IRS Form 3921: Everything you need to know

Out of the many IRS tax forms, one of the main filings a company has to take care of is the filing of form 3921. This tax form is about employees who have exercised incentive stock options (ISOs) in the previous tax year. And form 3921 has to be filed for each of your employees. It comes with unique deadlines and consequences if you fail to file it on time.

Form 3921

There are a lot of tax filing requirements from the IRS for a lot of different things that happen in a company. And when you give your employees stock options as compensation, these requirements increase. Filing form 3921 is one such requirement. So what is this form about? And when is form 3921 due date?

What is form 3921?

Form 3921 is a form that companies have to file with the IRS when a shareholder exercises their incentive stock option (ISO). The form has to be filed in the year in which the ISO is exercised, and before the deadline mentioned for that calendar year. Once the form has been filed, it has to be distributed to the applicable shareholder.

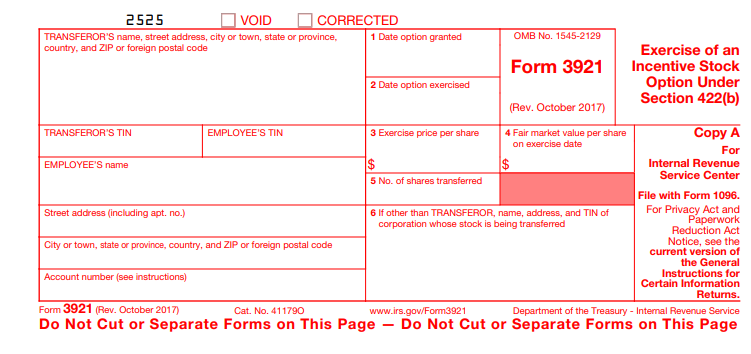

- File form 3921 copy A with the IRS, by mail or electronically

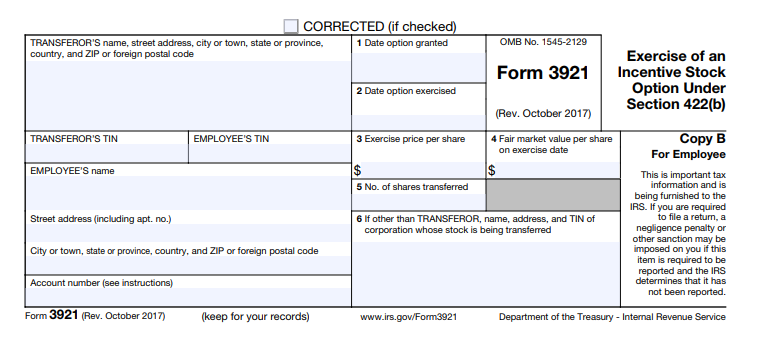

- Give form 3921 copy B to the employee who exercised their options

- Keeps form 3921 copy C for your company’s records

Here is what Copy A looks like:

Here is what Copy B looks like:

Copy C would be the one that you scan or photocopy and keep in the company records.

Who needs to file form 3921?

Companies with shareholders who have exercised their ISOs in the last calendar year have to file form 3921. For instance, let us assume that you issued ISOs to an employee (named David) in your company in 2016. And in 2020, David exercised some or all of his options. This would mean that this year in 2021, you will have to file form 3921 before the deadline (which would be shared below). This form would let the IRS know about the amount of stock transferred to David as a result of the exercise.

Filing Form 3921

ISOs trigger a taxable event in the following situations:

- When they are first exercised; and

- When the exercised options are sold.

And when employees exercise their ISOs, they pay the strike price and obtain company’s shares. Usually when the employee exercises their ISOs, the share price would have increased as compared to the strike price (the price of the shares when the ISOs were given). This difference between the stock’s fair market value on the exercise date and the strike price is added to the person’s income when calculating the Alternative Minimum Tax (AMT). But this is not counted as the taxable income in the standard income tax calculation.

To report the difference between the strike price and stock price at the time the options were exercised, form 3921 is filed.

How do I file form 3921?

Form 3921 can be filed online or via mail. If you need to file more than 250 of 3921 forms, you will need to do this online. For filing the form, you will need the following things:

- List of the employees who exercised their ISOs last year

- Your company’s transmitter control code (TCC)

- The employees’ tax ID numbers

- If you are filing online, you will need an account on the IRS Filing Information Returns Electronically (FIRE) system

Additionally, these are the things that you will have to fill in form 3921:

- The name, address, and employer identification number of the company transferring the stock

- The name, address, and social security number of the employee to whom the shares are being transferred to, for the exercise of the options

- The exercise price per share

- The date the ISO was granted to the employee

- The date the ISO was exercised by the employee

- The FMV (fair market value) of the share on the date the ISO was exercised

- The number of shares transferred due to the exercise of the ISO

- An account number (optional, and only needed if the company has multiple accounts for an employee, requiring multiple forms 3921 to be filed)

In case this is your first time filing online and you are not sure what to do, then you will need to also file Form 4419 electronically. This form would let the IRS know that you need help with filing online, and they will assign you a TCC. And you will then get help in setting up your FIRE account. Note that this process does take a few weeks.

Example of form 3921

Let us take an example to understand the form 3921 instructions and what you need to do if you are an employee. Assuming your employer sends you a form 3921 as you exercised your ISOs. The numbers that come in the form 3921 would help you calculate the additional income included when calculating your AMT tax liability.

A blank form 3921 and how you need to fill:

The most significant number that has to be reported on form 3921 is in box 4. This box would hold the FMV of the shares on the exercise date. It is important as the rest of the details can be found elsewhere or would already be known. For example, the day you exercised the shares (box 2), the price you paid to exercise each share (box 3), and the number of shares you exercised (box 5) are things you would already know.

But the fair market value of the shares on the exercise date is determined by the company’s 409A valuation (for private companies), and the exact amount would most probably be news to you (if you do not have an informant in the office). This form is what would help you determine the spread at the date you exercised your options (calculate by getting the difference between box 4 and box 3, and then multiplying by box 5). Then this amount is reported as income for the AMT calculations.

What are the due dates and deadlines for filing form 3921?

The deadlines for all copies of form 3921 are different. Below are the deadlines for each copy:

- Give Copy B to All Employees: January 31st – The company needs to give the Copy B of the form to all the applicable shareholders by January 31st.

- Paper File Copy A with the IRS: February 28th – The company has to paper file Copy A of the form with the IRS by February 28th. Note: Copy A is the one in red and needs to be postmarked by the 28th.

- Electronically File Copy A with the IRS: March 31st – You can choose to file the form with the IRS electronically. But this has to be done by March 31st, and it is usually more trouble than paper filing the form.

Here is why it is usually a huge trouble to file the form electronically: First of all, you (the company) would have to apply for a filer’s code from the IRS. As soon as you get this, you will have the government’s FIRE system, which has some strict requirements.

Also, you will need to do the filing yourself (by someone in the company) and cannot get someone (a non-employee) to file electronically on your behalf. To get a non-employee to file form 3921, you will need to get additional approval. The best way is to either get help to file form 3921 or just have it done using the special paper and mail it to the IRS.

Consequences if I Fail to File Form 3921

In case you do not file the right information by the due date, you would have to pay a penalty. And the penalties for non-compliance are surprisingly heavy. The amount you pay as the penalty depends on when you file the correct form. If you correctly file form 3921:

- Within 30 days after the due date, you will pay $50 per form (which is $50 per employee who exercised an ISO). So, if you had 40 exercises for the last year, your penalty would be $2,000 ($50 * 40). The penalty is capped at $547,000 per year or $191,000 for small businesses.

- More than 30 days after the due date, but by August 1st, you will have to pay $100 per form 3921. The penalty is capped at $1,641,000 per year or $547,000 for small businesses.

- After August 1st or if you never file correctly, you will have to pay $270 per form. The penalty is capped at $3,282,500 per year or $1,094,000 for small businesses.

If the IRS can prove that you intentionally ignored the rules around form 3921, the minimum penalty per failure would jump to $500 per form without any cap. So, if you had 40 ISO exercises in the last year and intentionally disregarded filing Form 3921, you would have to pay a minimum penalty of $20,000 each year.

Form 3921 vs Form 3922

Form 3921 is different from Form 3922. Form 3921 is used by companies to report that a shareholder has just exercised the ISO to the IRS. This form is filed in the year the ISO was exercised. Once the company files the form, a copy of it would be sent to the shareholder as well.

On the other hand, form 3922 is called the “Transfer of Stock Acquired Through an Employee Stock Purchase Plan Under Section 423(c)”. This is used for information purposes and is not entered into the tax return of an employee. So, form 3922 is also filled by the company and given to the employee when a share has been transferred. The information on the form would be used when the company sells the shares to an employee. It would also be needed by the employee when they want to sell the shares to another.

Need to file form 3921 for your company?

Have your employees just exercised their stock options? Then, do remember to file form 3921 on time. Also, be sure to accurately track your company shares and employee stock options on captable software. Eqvista is a cap table application that can help you keep track of all the shares in your company. It would also help you in filing forms and staying compliant. Check out our app here!