Down Round Financing: All You Need to Know

In the startup world, financing can happen by two methods; an up round or a down round. As entrepreneurs start learning the ropes of startup funding, they become familiar with these ideas very early in the process. But what exactly are these rounds? How do they impact the reputation and operations of a startup? Is down round financing always a bad idea for a company? In this article, we try to understand these aspects. Let’s begin.

Down Round Financing

Startup fundraising is a progressive process. A healthy growing business is one where investments increase with every round. However, there come situations when this is not the case. A scenario where a subsequent funding round is raised at a lower valuation is called a down round. Here is how this works.

What is down round?

A typical down round is one where a private company is compelled to sell additional shares at a price lower than the previous funding round. This happens when a startup realizes that the pre-money valuation of the present round is lesser than the post-money valuation of the previous round. Since raising capital is important to continue operations, companies go ahead with down round financing despite being well aware of the market implications.

Let’s say there is a company, ABC Corp, which after a round of funding has the following details:

- Founders: 6,000,000 shares (60% ownership)

- Investors: 4,000,000 shares (40% ownership)

- Company valuation: $15,000,000

- Price per shares: $1.5

The Company’s cap table would look like this:

After failing to attract investors with an overly optimistic view of their company valuation, ABC Corp ultimately chose to do a down round financing and undergo a round of funding at a lower price than their previous rounds. This was in order to gain more funds to keep expanding the business.

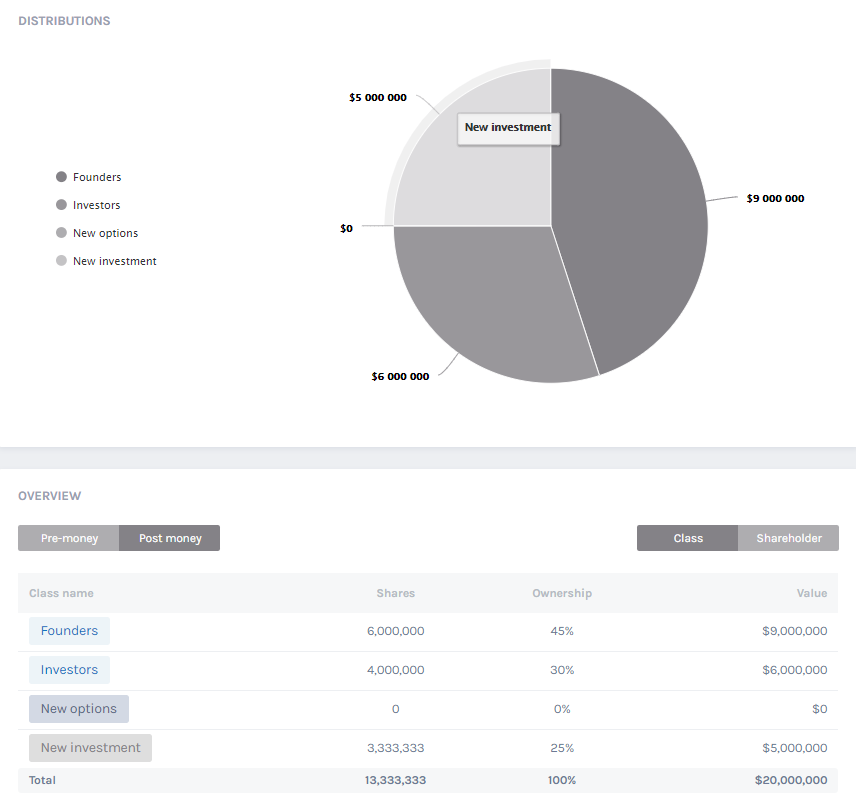

The new round saw the company offer 5,000,000 additional shares for $5,000,000, or $1 for each new share. With the new investment, the company’s cap table details would be:

- Founders: 6,000,000 shares (45% ownership)

- Investors: 4,000,000 shares (30% ownership)

- New Investors: 5,000,000 shares (25% ownership)

- Company valuation: $20,000,000

- Price per shares: $1.33

The new round of funding would look like this on the Eqvista app using our financial round model:

As you can see from the figures, having a down round financing can cause a company’s shares to become diluted and cause the existing shareholders to lose value with each new investment round. This has caused the original founders to lose 15% of total ownership ($1 million in value) and the old investors to lose 10% of their ownership ($666,666 in value) with the new investment.

As we know, startup financing is based on company valuations. In an ideal scenario, as the business grows, expands, and steadily achieves milestones, company valuations increase with every stage. But despite playing all cards right, sometimes company valuation is affected by market forces beyond the purview of an entrepreneur. We discuss this in detail in the next section.

When down rounds occur in a company?

Traditionally down round financing is used as a corrective measure. It is a way in which investors infuse the much-required funds into the business to stay afloat, no matter how unpredictable the circumstances are. It is better than falling short of funds and heading towards bankruptcy.

Here are some instances when a down round is the preferred mode of financing:

- Failing benchmarks – Startup funding is a high-risk venture. Investors who enter this are well aware of the risks. Hence they compensate for the risk factor by setting milestones for the founders to achieve. Investors also take a place on the Board, to ensure their active participation in the decision-making process of the business. When startup founders fail to achieve these milestones and become part of the management team, the investors are well aware of the circumstances of such failure, the subsequent funding round becomes a down round. Investors continue to have faith in the business and use down round financing to give the business another chance to correct its course.

- Restricted funding models – The investment market sometimes goes through a rough patch. Investors as a community might slow down in terms of high-risk investments. This may throw off plans for steady business expansion. In these situations, sustaining the business as it is, and not let the achievements slip away is more important than scaling new heights. Investors may thus opt for a down round financing in these situations to ensure that the entrepreneur’s efforts are sustained.

- Emerging competition – Competitors impact company valuation. They eat into existing market shares and have a diluting effect on the investing community. In this case, existing startups adopt down round financing to ensure their continued association with the investor’s community and to remain steady in their growth trajectory. Also, venture capitalists are not just a source of funds. They bring along expansive business experience which is equally crucial for startups to tackle unpredictable markets.

Is down round financing bad for a company?

The consequence of a down round depends on the state of the business. If it is suffering setbacks and needs a down round to bail it out, the effect on the business reputation will be negative. But if the management strategically uses a down round to sustain its performance for a while before taking the next leap, the business has a winning chance to bounce back stronger and reach a much higher valuation in comparison to the previous funding round.

However, irrespective of the conditions, down round financing triggers what is known as the ‘anti-dilution’ mechanism. This clause protects the interests of existing investors. This is possible because investors hold a different class of shares when compared to founders and employees. In case of down rounds when shares are sold at an unusual discount, the anti-dilution clause prevents dilution of investor shares, but at the cost of founder holdings. Dilution is of two types:

- Full ratchet – Full ratchet anti-dilution protection allows preferred shares of investors to be converted into common stock in case of a down round.

For example, let’s assume an investor has purchased 2,000 preferred shares of a company for $40,000 at $20 per share. In the down round, share prices are dropped to $10. Thus as per the full ratchet anti-dilution protection, the investor is entitled to 4,000 common shares ($40,000 / $10).

- Weighted average – Weighted average anti-dilution protection also allows the conversion of preferred stock to common stock. But the risk is distributed evenly, unlike full ratchet which heavily reduces founder holdings. Sometimes it becomes difficult for businesses to bounce back from such blows. However, in the case of the broad-based weighted average anti-dilution protection, investors receive a much smaller adjustment and it depends on both the size and price of the down round relative to the company’s outstanding capital.

Both ways, down rounds impact a company in different aspects and entrepreneurs must understand the full consequences before considering it. The actual effects of a down round sustain well into the future operations of a business. Thus care must be taken to position down rounds in a positive light.

Here are some expected backlashes from down round financing:

- Market/investors/clients may perceive a down round as a sign of financial trouble in business. This may affect the possibilities of future collaborations.

- Founder’s shareholding may be diluted to an extent that they no longer feel motivated to contribute to the business.

- The founding team may lose confidence in the business and quit. This is a catastrophe, especially for startups as most often founders are the key players in the business.

- Existing investors/partners may become restless and insecure about the company’s chance at profitability. They may either plan an untimely exit adding on to the burden or might become overtly active in the decision-making process bordering on overreach.

- The consequences of a down round are worst felt by employees. In startups, employees hold common stock. Most often their compensation structure includes a wider berth of equity. When share prices fall in a down round, employees are the worst hit. By this time, additionally, they would have already incurred tax cuts.

Up Round vs Down Round

Both up round financing and down rounds are valid ways of startup fundraising. It all boils down to the pre-money valuation of the business. If the pre-money valuation is higher than the previous round, up round is opted for. But if the pre-money valuation is lower, the subsequent round automatically becomes a down round. Here are some basic differences between the two:

| UP ROUND | DOWN ROUND |

|---|---|

| Pre-money valuation higher than the previous round | Pre-money valuation lower than the previous round |

| Indicates positive growth of a business | Indicates trouble in business |

| Profitable for founders and investors | Profitable comparatively for investors at the cost of the founder’s shareholdings |

| Increases confidence and faith of market/investors/clients/employees | Stakeholders lose confidence in business |

| Visible actual growth | No growth. Negative or stagnant business |

Alternatives to Down round

By now we know that if possible, a down round is something a startup is better off avoiding. But how is it possible? When a business gets into a tough spot staring right at a down round, is there a way to skip it? Here are some alternative methods that can be used to steer past down round financing:

- Postpone external funding – A growing startup requires diligent financial planning to avoid unprecedented roadblocks. This is the only way to avoid a down round. If the company management is adept in planning and forecast, while sensing a fund shortage or a down round scenario, cost cuts can be planned well in advance. It can be ensured that sufficient cash remains in the company so that external fundraising activities can be shifted to a later date, buying more time.

- Bridge Financing – Another alternative is to inject funds using debt instruments such as convertible notes. These are available for small amounts and are hassle-free and immediate to obtain. Instead of selling out shares at a discounted rate as a dire consequence of a down round, it is better to obtain such short-term funds that will act as a bridge between consecutive equity rounds.

- Mitigate anti-dilution protection – The anti-dilution clause in down-round financing, though in favor of investors, has the potential to damage the founder’s interests is a way that may be irreparable. Thus if a down round is inevitable, founders must try to mitigate this clause. Investors, who are genuinely interested to help the company flourish, will cooperate.

- Start over – In the worst-case scenario, when investor negotiations do not go as planned and the founders might be bleeding more in a down round, it might be worth a try to wipe the slate clean and start over.

Manage your company funding & equity operations on Eqvista

From the beginning of a startup, equity management has become an integral part of every business. Investors, top management, and employees alike become shareholders in the company. Tracking and managing equity is thus an important process for a startup. When the company holds a handful of resources, equity calculations can be managed manually on an excel sheet. However, as the business grows and enters up rounds and down round financing, equity calculations become complicated and cumbersome.

Our expert team at Eqvista specialize in this process. Issuing, tracking, and managing company shares using Eqvista software is a breeze. Here are some articles that discuss the whole spectrum of our services. To know more, reach us today.