The Definitive Guide to M&A Deal Structure & Agreement

A merger and acquisition agreement is used when a company purchases another company or when a struggling company seeks help from a much more successful company.

A lot of companies get into a mergers and acquisitions agreement to grow stronger in the industry. However, there are many factors to consider before coming to an agreement, such as financial, intellectual property, human resources, business and key legal issues. We have prepared a definitive guide on how to prepare a mergers and acquisitions agreement and how to make the process go smoothly.

Mergers and Acquisitions

Mergers and acquisitions are most common in the business world, and especially for growing startups. However, there is often a misunderstanding between the two. A merger is when two companies join together to form a new company. Meanwhile, an acquisition is when one company takes over another company. When either a merger or acquisition happens, an M&A deal structure is created, and all the terms are set in an agreement.

What is a Merger and Acquisition (M&A) Agreement?

A merger and acquisition (M&A) agreement is used when a company purchases another company or when a struggling company seeks help from a much more successful company. The agreement sets the rules that the newly acquired company needs to follow until the convergence has been finalized. It also includes the accounting of all the assets and liabilities of both companies, and contains the details of how each company’s shares will be valued post the merger.

When there is a merger, two things take place. The first is that the two companies combine their assets and liabilities. The second is that the process impacts everyone in the companies, from the customers to the shareholders and employees. However, while the mergers and acquisitions process takes place, both the companies would still continue with their daily business operations.

The merger and acquisition agreement holds many documents that are important to finalize the transfer. One such document is also the share purchase agreement for the mergers and acquisitions process. If your company is about to acquire another company, you need a lawyer to prepare the documents for you. You can make use of any merger and acquisition agreement sample found online.

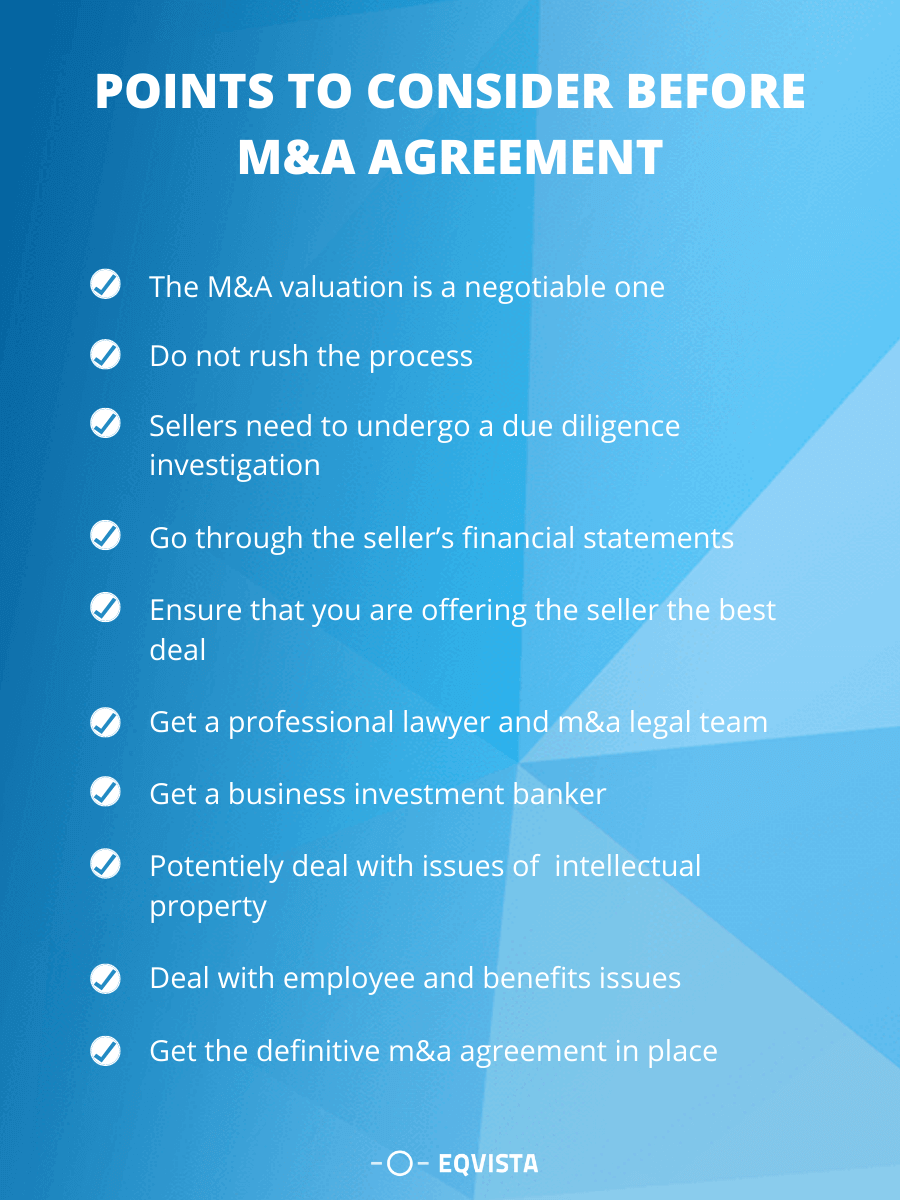

Points to consider before M&A Agreement

Before entering into an M&A agreement, there are many factors to consider. The process can be complicated, and it is advised to have a business attorney to help. It is important to keep in contact with the owner of the company and discuss all aspects of the process to ensure transparency between both parties. Here are some points to consider before entering into an M&A agreement.

Here are some points that you need to keep in mind:

- The M&A valuation is a negotiable one.

- Do not rush the process, as it can take longer to market, negotiate, and close the deal itself.

- Sellers need to undergo a due diligence investigation by the buyer.

- The buyer (you) needs to go through the seller’s financial statements and projections thoroughly.

- Ensure that you are offering the seller the best deal.

- Get a professional lawyer and M&A legal team to help you through the process, or things can go wrong.

- It is advised to get a business investment banker as well.

- There will be issues with the intellectual property that has to be dealt with patiently and professionally.

- Employee and benefits issues will also arise that need to be dealt with calmly.

- It is crucial to get the definitive M&A agreement in place.

If you want to have a better understanding of the company you are about to purchase, you can enter a joint venture agreement. When the company is ready to sell, prepare a non-disclosure agreement to ensure the confidentiality of all business documents to be given by the seller to the buyer. Afterwards, a letter of intent is prepared. The letter acts as a non-binding agreement that outlines the intent of both parties, including the selling price and the exchange information. It can also include a timeframe in which the seller cannot sell the business to other buyers.

Uses of Non-Binding Offer in an M&A Agreement

With an M&A agreement comes a non-binding offer. The non-binding offer, which is also called the indicative offer, lists all the terms and conditions of a potential buyer in an M&A transaction. It is a simple written offer letter that is signed by authorized staff of those in the deal.

The non-binding offer is not a legally binding one. Therefore, the seller cannot rely on the terms in it for the process. However, this is used in transactions to get a first glimpse of the way the parties value the business and what terms and conditions they will have in the offer. Only the purchase agreements are the ones that allow the parties to buy and sell. The seller uses the information on the non-binding offer to analyze, compare and review the bids. It is used as a draft to help with the M&A deal.

Different ways of Structuring an M&A Agreement

There are three ways in preparing an M&A deal structure. In fact, a lot of companies have begun to use more flexible and creative deal structuring methods. The three M&A deal structure methods are the following:

Asset Acquisition

In the asset acquisition method, the buyer buys all the assets of the selling company. This method is considered the best deal structure used to sell a company if the buyer wants to get cash in exchange for the deal. With this, the buyer also chooses the assets that they wish to purchase.

Advantages of this method:

- The selling company will still continue to operate as a corporate entity even after the sale has been made, with its unsold liabilities and assets.

- The buyer has the choice to choose the assets they get to buy from the seller and which ones they do not want to purchase.

Disadvantages of this method:

- The deal might take a long time to close as compared to the other M&A deal structure methods.

- This process can lead to high-impact tax costs for both parties.

- The buyer will not have the choice to acquire any non-transferable assets, such as goodwill.

Stock Purchase

Unlike the asset method, the stock purchase method does not have the assets transacted directly. In this method, the major amount of the voting stock of the seller is acquired by the buyer. In other words, this means that the control of the seller’s assets and liabilities are transferred to the buyer.

Advantages of this method:

- It is a less expensive method.

- Closing this deal will take less time as it is simpler and requires less negotiations.

- The taxes on this deal are low, especially for the seller.

Disadvantages of this method:

- Uncooperative minority shareholders might have an issue with this.

- Financial and legal liabilities can come with the stock purchase acquisition.

Merger

Even though a merger is used a lot with the acquisition, and sometimes interchangeably, a merger is a result of an agreement between two companies that want to come together and create a new company. This process is normally a less complicated one as compared to the other two as the companies come together to become a new one. It is also why this method is the one mostly used.

Mergers and Acquisitions Agreements

An M&A deal structure is a binding agreement that two parties make in a merger or acquisition. This agreement outlines the rights and obligations of both parties. It states what each party gets and what each is obligated to do as per the agreement. The mergers and acquisitions agreements can be called the terms and conditions of the merger and acquisition.

It helps prioritize the aims of the M&A and make sure that both parties’ goals are satisfied. The deal structure is prepared by also considering the risk weightage of both parties. For starting the deal, it needs both the parties to state the following things:

- How much risk can they take

- Observable latent risks and how they can be managed

- Their stance on the negotiation

- Conditions under which the negotiations can be canceled

Preparing the M&A deal structure can be very challenging and complicated as there are a lot of factors to be considered. These factors include accounting policies, antitrust laws, market conditions, business plans, corporate control, financing means, and many more. It is important to employ the right legal, investment, and financial advice to get everything right. It will also make the process less complicated.

Drafting the Purchase Agreement

The first step is to select the acquisition method that will display the intent of how the buyer is purchasing the company. Is it going to be an entity purchase or an asset one? An entity purchase means a majority of the company’s stock, along with the debts and obligations, will go to the new owner. With an asset purchase, the buyer will get all the assets – all the real property like the real estate, office equipment, and even the intellectual property, including the copyrights, trademarks, and patents. The new buyer has the right to start depreciating the new assets instantly as it gives a tax benefit.

Steps for M&A Agreement

To prepare a M&A deal structure, aim for a win-win situation. Keep in mind the interests of both parties when making the deal and reduce the risks as much as possible. By focusing on such a deal, you will be able to finalize the deal faster. When doing this, there are two main documents that you need to delineate with the process. They are:

- Term Sheet – A term sheet is a document that states the terms and conditions of the mergers and acquisitions’ financial investment. These are normally considered to be legally binding unless both parties have stated it.

- Letter of Intent (LOI) – This outlines the understanding between the parties and their intent in a legally binding agreement. Just like the term sheet, the LOI is not normally considered a legally binding document, except for the binding provisions that have been added to it.

If you are looking into forming an M&A agreement, there are many templates that can be found online. It is best to get help from a legal advisor, but you can look for templates for your own reference.

Manage your M&A Agreement with Eqvista

Managing an M&A agreement can be a complicated task with the many documents you have to prepare and keep track of. With Eqvista, you can easily upload all of your company’s documents and store them safely in one place. If you happen to have an M&A agreement to prepare, you can easily retrieve the necessary documents from your Eqvista account. You can even share these documents with your respective shareholders. We also provide private company valuations with our team of certified professionals. Want to learn more? Try out Eqvista now!

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!