Restricted Token Unit (RTU) – Everything you should know

In this article, we will discuss the concept of RTU and how it works.

In recent years, the interest in cryptocurrencies and the technology that drives them, blockchain, has exploded with the emergence of new coins and tokens. However, the area of the restricted token units, or RTU, and their usefulness have been largely overlooked. RTU refers to blockchain-based coins or tokens that are restricted and paid to workers or employees after the vesting period is over. Basically, it is an agreement wherein the company is contractually obligated to offer the employee these tokens after the vesting period. In this article, we will discuss the concept of RTU and how it works.

Restricted token units and token awards

RTU are similar to stock options; however, other than offering shares to employees of the company, tokens or digital units are given to the employees instead of shares. The tokens or digital units can either be in coins or tokens. These digital units are generally used by companies to attract talent and employees to their business. However, certain vesting conditions need to be met before an employee is given these digital units. Token awards can be offered for a number of reasons, such as recruiting new employees, retaining talent, and incentivizing employees to perform their duties well. But what are restricted token units?

What are restricted token units?

RTUs are a cryptocurrency or asset that is issued by companies as an incentive to employees in order to retain talent. RTUs can also be referred to as tokens or digital assets. Tokens and digital assets can be similar in function, but they are different in terms of their end users and the benefits they provide. A company will issue token awards to its employees as an incentive and make the token available to them after their vesting period. The RTU is intended to be a reward for employees and is given based on the number of coins or tokens the employee has collected.

How do RTUs work?

Usually, RTU is time-based and follows a predefined vesting period. The vesting period is the number of months or years an employee has to earn these restricted token units. It can be a one-time or repeat offering that is made on clear-cut dates and is more effective in retaining an organization’s talent. The tokens are only awarded and paid after the vesting period, and no units can be redeemed until the full period has been completed.

The restriction on these tokens gives the token its value and is an incentive for employees to work harder. To better understand, let us look at an example; for instance, the RTU plan will grant 10,000 RTUs to an employee who will fully vest after six years. The employee will be rewarded after six years based on the number of tokens that they have earned. However, if the vesting period is on a cliff basis, the distribution of tokens will vary.

Who can use RTUs as employee benefits or token awards?

Companies working on a crypto token project can create an RTU plan, and it can be used to attract customers, clients, or employees to a new business. It is an excellent way to retain talent and reward employees who have great performance. The RTU helps the company manage risks associated with the token offerings and allows them to accelerate its development process by raising capital for its enterprises.

Essentially, companies can provide themselves with more time to prepare for the future and invest in their businesses’ development. The RTU is a solution for those companies who need to implement time-based cryptocurrency without the high cost associated with issuing their own coin. Thus, RTU is a good option to use when it comes to hiring people and attracting talent.

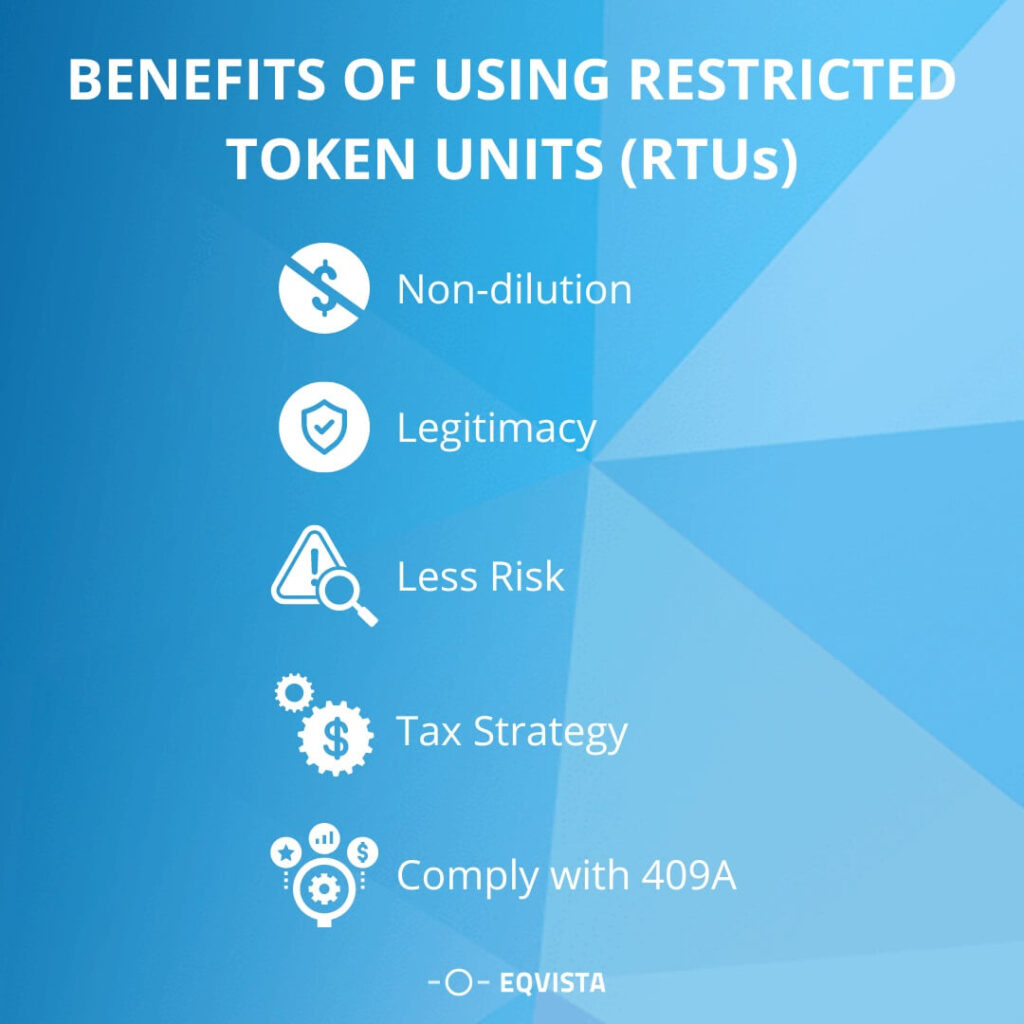

Benefits of using Restricted Token Units (RTUs)

An RTU and its tokens or digital assets allow employees to earn cryptocurrency without actually having to buy it. The RTUs are also an excellent way to attract talent as well as speed up the capital-raising process. Following are some of the benefits of using RTUs:

- Non-dilution – Non-dilution refers to the fact that the company is not “diluting” its shares. Traditionally, companies are required to issue a certain percentage of their shares to third parties in the issuance of stock. An RTU is a tool that can be used to grant tokens without diluting the company’s equity. This is an excellent way to create and issue digital tokens that can be used to retain the talent of employees.

- Legitimacy – Legitimacy is another advantage of using RTUs. There has been a lot of controversy regarding the legitimacy and legalities associated with blockchain-based tokens. The fact that the company has an agreement with the employees that provides a legal framework for the token issuance is a way to show legality. It also helps companies and organizations gain a competitive edge.

- Less Risk – Employees are not required to pay any amount in order to obtain the tokens, thereby eliminating the potential for losses. This means there is no risk of the employee losing any money when they participate in the offering. As a result, it is a win-win for both the employer and the employee.

- Tax Strategy – The fact that tokens are treated as property for tax purposes is a great way to utilize RTUs. RTUs can be customized in such a way that they can be given different distributions. This can be used to gain tax advantages and reduce tax liabilities for the employer.

- Comply with 409A – Unlike stock options, which are subject to a stricter rule under 409A, RTUs are not bound by these rules. However, it is still unclear whether the tokens are subject to such laws. It is not yet clear which rules apply, and it is recommended that they be used in a compliant manner and with caution. This will ensure compliance with the law and ensure legal benefits for the employer.

Increasing attraction for RTUs

More and more companies are beginning to see the benefits of using RTUs in their business operations. Employee retention is a major concern for many companies, especially when it comes to the focus on attracting talent in specific industries. While other methods, such as incentive bonuses, are used to retain talent, they are still not very effective. RTUs have become a cost-effective way to attract individuals and retain them by rewarding them with tokens that they can use when they need financial assistance.

- Company’s perspective – RTUs are seen as an efficient way of attracting talent. They can be used to attract employees by giving them crypto tokens that they can use when needed. In this competitive job market, companies want to find innovative ways of attracting talent, and RTUs are an excellent way to hold onto an organization’s talent. It also provides companies with a solid foundation for the development of their business.

- Employee’s perspective – Employees feel more valued at a company where they are rewarded with RTUs. Tokens allow employees to enjoy the benefits of being a part of a company that utilizes blockchain technology in its day-to-day operations. Thus, employees feel that they are being recognized for their commitment to the organization, which can increase employee morale.

Valuation mechanism for RTUs

Ideally, the share price from the most recently raised capital (IPO, VC round A, or B) should be used as the base valuation in the calculation. The number of RTUs or tokens that have been issued to existing employees and the number of remaining RTUs or tokens available for future issuance should be analyzed and considered.

Additionally, the current market price of the tokens should be used to determine the asset value. As a result, the RTU provides a more efficient way of creating and using tokens among the employees of an organization.

While for startups wherein no funding has been raised, the fair value of the token is calculated using all available data and assumptions. Independent valuation can be performed by third-party valuation experts. However, many owners are unsure of the accuracy of the valuation they have received, while others struggle to wrap their heads around the statistics. That’s why they bring in business valuation specialists to provide a judgment on the company’s fair market value after considering a variety of aspects using various valuation approaches.

Implementation consideration for RTUs

A written token option agreement between the employer and the employee is extremely important. This agreement helps determine the value of the tokens and their distribution among employees. It ensures that employees are aware of their rights and obligations with regard to RTUs.

Without such an agreement, there is a greater risk of errors or disputes regarding the token value, distribution, and any other issues that may arise during the process. Furthermore, the rules and regulations must be followed, and it is important that they are written clearly and concisely to avoid legal complications. Rule 701 of the 1934 Securities Act is one of the rules that must be followed when issuing RTUs.

How should founders offer RTUs at the different stages of a company?

Prior to the initial coin offering (ICO), strategizing can help determine the best time to utilize the RTUs. Here are stages wise considerations for RTUs:

- Early stage – This is the stage in which an organization is just starting up to create hype and grab the attention of early adopters. It is at this stage that an organization uses RTUs for token issuance to attract talent. It encourages employees to join and helps them create a crypto project that can be profitable for everyone involved. This is also the stage in which employees will get the opportunity to learn about blockchain and other new technologies, leading to a lower chance of a negative experience.

- Mid-stage – RTUs are most commonly used in mid-stage companies, where they are considered a means of rewarding their employees with tokens that they can then use when needed. These tokens are given to a project manager and representative of the company as compensation for their efforts in getting the project started. It serves as a motivational factor that can increase their productivity and efficiency. These tokens also serve as an excellent incentive for employee retention at the company.

- Late-stage – At this stage, an organization uses RTUs in a more tactical way. By utilizing RTUs, the company can keep its employees loyal to their company and project throughout the completion of their project. This is accomplished by incentivizing their employees through their RTUs and giving them tokens that they can use to improve their productivity and further the growth of the organization. Basically, these tokens act as a means to motivate employees to work hard.

Why should companies have an RTU plan/agreement?

To ensure that everything is legal and to avoid any complications, it is important for employers to provide a certain level of clarity about their RTU plan. Employers should explain why they are using RTUs, how they will be used, what the terms and conditions are (including information such as the value of tokens and how they will be distributed), and more. Through this written document, an employer can clearly explain its intentions related to RTUs. Hence, it ensures that the plan will be carried out in an efficient manner and everyone is on the same page.

Do RTU plans fit with smart contracts?

Yes, RTU plans can be used in conjunction with smart contracts. However, it can be prone to major bugs and exploits because they are flexible, which is not desirable in smart contracts. Additionally, smart contracts are written by developers and are immutable and thus cannot be changed. Using RTU plans makes it possible to adapt and make changes to an agreement if necessary or appropriate. Therefore, it is possible to use smart contracts with RTU plans as long as such flexibility can be handled.

Get experts’ help in valuing RTUs with Eqvista!

RTUs can be a great idea for companies to use to reward their employees. This allows them to attract and retain talent and motivates them to work hard and develop a successful crypto project. Employee token option plans are legal and can be used by companies at any stage. Eqvista is here to help companies value RTU plans and implement them in a reliable manner before launching their ICO or other token offerings. At Eqvista, we are committed to delivering valuable solutions that will address your needs, maintaining the highest level of customer service, and ensuring your success. Contact us now to get a valuation!

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!