Best Cap Table Management Software for Startups (2026)

This article explores the important role of cap table management in a business and presents a comparative study of the best cap table management software in the market.

Startup cap table management is a crucial function for every new business. Founders are in the dark without cap tables guiding their company’s equity distribution, a concept that comes into being right from the time two or more founders come together to form a company. However, managing cap tables becomes complex as the company grows. In such situations, cap table software helps manage these complexities with ease.

This article overviews how startup founders select the most suitable cap table management software for their business needs, including their strengths, pricing models, and user experiences.

What is Cap Table Management Software?

Cap table management software is basically an automated cap table that enables complete equity management of a business. Unlike cap tables maintained manually on spreadsheets, cap table management software is hosted online on secure servers. These cannot be accessed without proper authorization. Besides, this software is designed to handle multiple cap table functions in real-time irrespective of the events that trigger equity distribution.

Why is Cap table Management Important?

A Cap table or a capitalization table is a record of company ownership. Thus right from the incorporation of a company, startup cap table management is crucial to know the exact ownership structure involving various stakeholders primarily founders, investors, and employees. The most important role of cap table management is as follows:

- Investor negotiations – A well-organized and updated cap table is a powerful tool during funding rounds. Since the company has been monitoring all stock-related grants, vesting, and exit activities on the cap table, negotiations with investors become smoother as both parties understand the effect of incoming funds on the company’s ownership structure.

- Manage equity distribution complexities – Cap table contains details of all equity-related activities. With every funding round, or merger, or corporate restructuring, these stock-related details undergo several changes. Cap table management enables working through complex calculations in such situations that can complicate stock agreements.

- Ensure data accuracy – This is the fundamental role of startup cap table management. Multiple classes of shares are issued to diverse stakeholders in a company’s lifetime. Unless every move is documented with care, the company will land in legal disputes with stakeholders.

Thus, cap table management is an important function of startup business strategies. Owing to data sensitivity and the need for accuracy, it is best to automate this process. This can be done easily by using a cap table software like Eqvista. With state-of-the-art technologies like Eqvista, startup founders don’t have to worry about cumbersome paperwork or manual errors in data management. The entire process is automated, simple to use, and accessible with a few clicks.

Benefits of Using Cap Table Software

As we see, cap table management as an operation is quite intricate. Lapses in management of this process can land a company into legal trouble with investors and other stakeholders. Most often errors in cap table management attract heavy penalties as well. Here are some of the outstanding benefits of the best cap table management software in the market:

- Streamline workflows on grants, approvals, and monitoring all forms of equity such as options, stocks, warrants, convertible notes

- Manage financing rounds, employee equity incentive plans, and options pool

- Facilitate finance modelings such as waterfall analysis and round modeling

- Create audit ready reports anytime, saving company cost on bookkeeping

- Facilitate easy 409A valuations of the company. For mergers and acquisitions, integrate with business models of external valuation firms

- Integrate multiple functions such as payroll systems, accounting records, collection and distribution of stock purchase payments, and relevant legal documents

To truly appreciate the benefits of cap table management software, it is important to understand the disadvantages of the existing process on excel sheets. Let’s take a look:

- In a growing company with multiple stakeholders with varying equity holdings and vesting periods, manual tracking, maintaining, and updating cap tables on an excel sheet is a cumbersome process and often needs expensive man-hours and the process is still prone to errors.

- Errors in cap table management in turn affect the company’s chances during investment rounds. If equity distribution is not properly tracked, it impacts business valuation, and that, in turn, affects investments.

- Cap tables on excel sheets do not accommodate scale-ups. With expanding business, complex calculations such as estimating the fair value of share-based compensation based on diverse assumptions such as volatility, discount rates, equity value, etc cannot be handled by excel sheets.

- Cap tables on excel sheets do not allow customized access to stakeholders. Besides, stakeholder communication has to be handled on a one-on-one basis, creating possibilities for lapses.

Keeping these challenges in mind, let’s take a look at how cap table management software is beneficial in actual business scenarios like:

- Mergers – During a merger, the business structures of two or more companies must find a way to co-exist as per the agreed terms. Now imagine merging multiple cap tables on excel sheets. Different cap table structures with several variables are a cumbersome task to consolidate. But if the companies are already using cap table management software, where all data is digitized, then mergers become very simple.

- Acquisitions – Most startups aspire for a profitable acquisition. For this, startup cap table management using appropriate equity management software is important. Acquisitions are sensitive as it is due to the change in leadership. One of the defining aspects in such cases is clarity about exit scenarios for existing investors and employees. Thus the acquiring company must be presented with a reliable waterfall analysis, which is best done by cap table software. This automated reporting in a couple of clicks is not possible with excel sheets.

- Change in the corporate structure – Many times, after reaching a certain milestone, a company undergoes some structural changes. For example, a company initially incorporated as C-Corp may want to reduce heavy taxes and convert the business into two LLCs. This is a classic situation where apart from changing nature of stocks, mapping shares, and vesting cycles, all shareholders have to sign off on the changes. Cap table management software comes very handy in such a situation. With digitized data and customized access to shareholders, this process can be completed with ease with almost no human error.

Common Cap Table Mistakes

It is clear that cap tables offer a wide range of benefits. However, it is very easy to make mistakes in structuring a cap table. These strategic and pragmatic decisions regarding a cap table reside in the hands of a startup management team. If something goes wrong in planning, it sets in motion a series of catastrophes in equity management, like a domino effect. Here are some mistakes to avoid while designing a cap table for your company:

Strategic mistakes:

- Parting with too much equity in the early stages

- Not making vesting schedules mandatory, especially for founders

- Having a wide variety of investors owning different types of shares in the early stages of business

- Not seeking guidance/mentorship in visualizing the evolution of a business and its equity expenditure

- Not creating an options pool for employees in the early stages

- Not negotiating option pool post-money; getting talked into deciding this pre-money

Pragmatic mistakes:

- Not scaling up from excel sheets to equity management software at the right time

- Not recording the tiniest equity-related detail; moving on with hand-shake deals

- Committing to equity without paperwork

Eqvista – Leading Cap Table Management Software in the Market

Eqvista offers specialized cap table management software tailored for startups and growing businesses. It simplifies tracking equity ownership, shareholders, and securities like shares, options, and warrants.

Eqvista centralizes company equity and shareholder data for real-time updates and easy sharing while ensuring regulatory compliance. Users can issue shares, create certificates, model funding rounds, and analyze liquidation waterfalls, all within a user-friendly cloud platform.

Start by adding shareholders, equity classes, and issuances via manual entry or spreadsheet upload; the cap table auto-generates and updates dynamically. This beats Excel templates by enabling real-time collaboration and professional valuations like 409A.

Features & Benefits of Eqvista

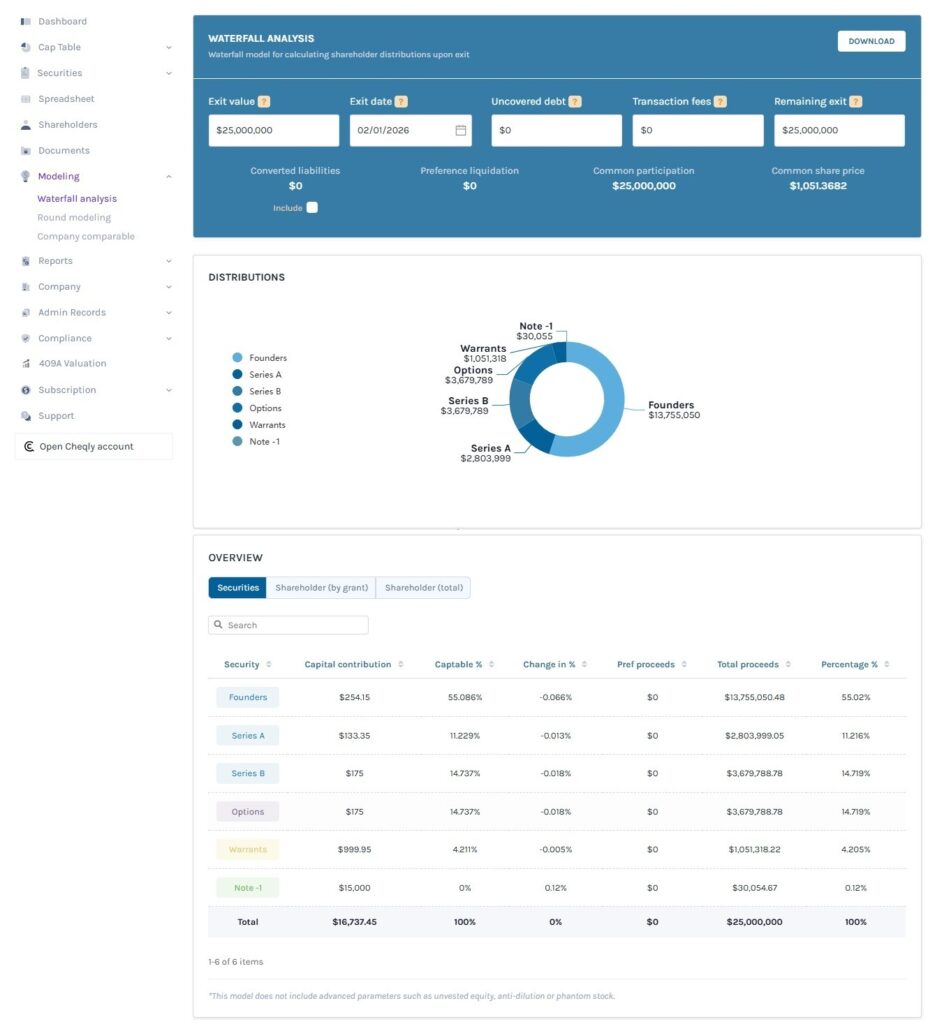

- Cloud-based Cap table management solution – Eqvista software is hosted online on secure servers. As a result, all information is updated and kept safe in real-time. Since every equity-related data is available on a unified platform, it becomes easier to create finance model worksheets and access complex reports like detailed waterfall payouts.

- Share the Cap Table with your client or partner and give them access rights – Eqvista is great for startup cap table management because it enables customized access to numerous stakeholders. Thus selective permissions can be granted to a legal team, investors, and diverse categories of shareholders including employees.

- Easy share management – Apart from sophisticated software Eqvista has a dedicated team of professionals who will efficiently help companies manage their equity needs. With Eqvista, founders not only have access to a state-of-the-art technology to issue or transfer shares but can also rely on a dedicated team of finance professionals who can guide them in the process.

- Issue electronic stocks and certificates – Eqvista cap table management software allows share issuance electronically to all stakeholders including founders and investors. Issuing and maintaining paper certificates are no longer required. Be it stock options, restricted stocks, warrants, convertible notes, SAFEs, or profit interests, all of these can be issued and managed on Eqvista platform in a couple of clicks.

- Offering personalized shareholder portals – Eqvista allows the user to grant selective access to stakeholders. Users can choose between enabling ‘view access’ or ‘complete access’. Based on the type of stakeholder (founders, employees, investors, board members, lawyers, accountants) Eqvista enables customized access.

- 409A Valuation & Reports – 409A valuation of a company are crucial for funding rounds. Eqvista is best suited for startup cap table management because all types of equity-related information required for investment rounds are readily available in real-time. Final versions of important documents, such as waterfall analysis, can be readily accessed anytime.

- Creating ESOP (Employees Stock Option Plan) supporting RSU & RSA – Employee stock option plans are integral to a startup recruitment process. Since a business typically struggles with cash flows in the initial stages, offering company equity along with a basic cash component as salary is a great way of hiring and retaining talent. With Eqvista, restricted stocks of ESOP plans can be easily issued, tracked, and managed.

- Creating, managing, and instantly applying your Vesting Plans to shareholders – Irrespective of the category of stocks, all equity grants are accompanied by vesting schedules. These vesting schedules vary from one stakeholder to another. Eqvista’s robust platform enables the application of varied vesting schedules based on the type of stocks held.

- Supporting all types of Convertible instruments as Convertible Notes, KISS, etc – Convertible instruments function differently than stock options. They work like loans that eventually convert into equity at a certain milestone. Since they do not need company valuation for grants, they form a major part of investments for startups in the early stages. Eqvista supports all types of convertible notes, thus enabling efficient startup cap table management.

- Creating, managing, and converting Stocks to Options and Warrants – With Eqvista, all equity data is available in real-time. This makes the process of creating, managing, and converting stocks to options and warrants very easy and streamlined. The user can pull out all the necessary information in a couple of clicks.

- Waterfall Analysis and Round Modeling – Waterfall analysis and round modeling are important tools used to analyze the effect of new funding rounds on the cap table in terms of share dilution and exit scenarios for stakeholders. Eqvista cap table management software offers one of the best waterfall analysis platforms which is user-friendly and provides the flexibility of trying out various options while calculating exit values.

Equity Management Software Comparison: Best Platforms Reviewed (2026)

| Platform | Best for | Entry level Pricing | Free Trial | G2 Rating |

|---|---|---|---|---|

| Eqvista | Fast-growing startups to late-stage companies, even unicorns | $2/month per shareholder | Yes - Freemium plan, No credit card required | 4.9/5 |

| Carta | Series‑A+ startups | $1,000–$2,500/year | Limited - Free for up to 25 stakeholders and $1M raised | 4.4/5 |

| Pulley | Small Businesses | Starting at $1,200/year (25 stakeholders) | No | 4.7/5 |

| Cake Equity | Mid-Market company | $40 for 30 stakeholders per Month | Yes - 5 Stakeholders Per Month | 4.8/5 |

| Ledgy | Mid-Stage startups | Starting at €75 per month | Yes - For startups with up to 3 collaborators | 4.7/5 |

Top Cap Table software for startups

Selecting the right cap table software is essential for maintaining accurate records, facilitating informed decision-making, and ensuring compliance with regulatory requirements. Here are some of the top cap table software options for startups:

Eqvista

Eqvista’s unique blend of affordability, customization, and comprehensive equity management services makes it a preferred choice for many businesses. Currently, Eqvista serves over 23,000 companies, reflecting a significant presence in the cap table management industry.

Eqvista ranks as the #1 equity management platform on G2’s highest-rated list, based on verified user reviews from founders and finance professionals.

- Usability: Users consistently praise Eqvista for its ease of use, seamless cap table management, and integrated 409A valuations, which streamline fundraising and ESOP issuance. Founders highlight real-time dashboards, responsive support, and compliance features that replace messy spreadsheets, with many noting faster seed rounds and investor confidence.

- Cost: Eqvista offers a tiered pricing plan starting with a free Freemium option for basic cap table needs.

- Freemium Plan: Free for up to 20 shareholders, covering core features like equity tracking and basic reports. Ideal for early-stage startups with simple structures

- Premium Plan: Costs $2 per shareholder per month (prorated) for companies with more than 20 shareholders. Includes advanced tools like e-signing, funding modeling, waterfall analysis, and spreadsheet imports.

- 409A Valuation Plans: Starting at $990 per year, depending on the company’s stage. Cap table access is bundled at no extra cost.

- Enterprise Plan: This plan comes with premium cap table features and contains Unlimited 409A Renewals, QSBS Attestation, Premium Cap Table 83(b) Election (mail-in to IRS) and ASC 718 . It starts at $1,990/year.

- Suitable for: Eqvista is suitable for businesses of all sizes and all industries:

- Startups: Offers affordable cap table management solutions, essential for early-stage companies with limited resources.

- Growth-Stage Companies: Provides advanced features and unlimited 409A valuations, which are crucial for strategic planning and fundraising.

- Established Companies: Supports complex equity management needs with customizable services and comprehensive reporting

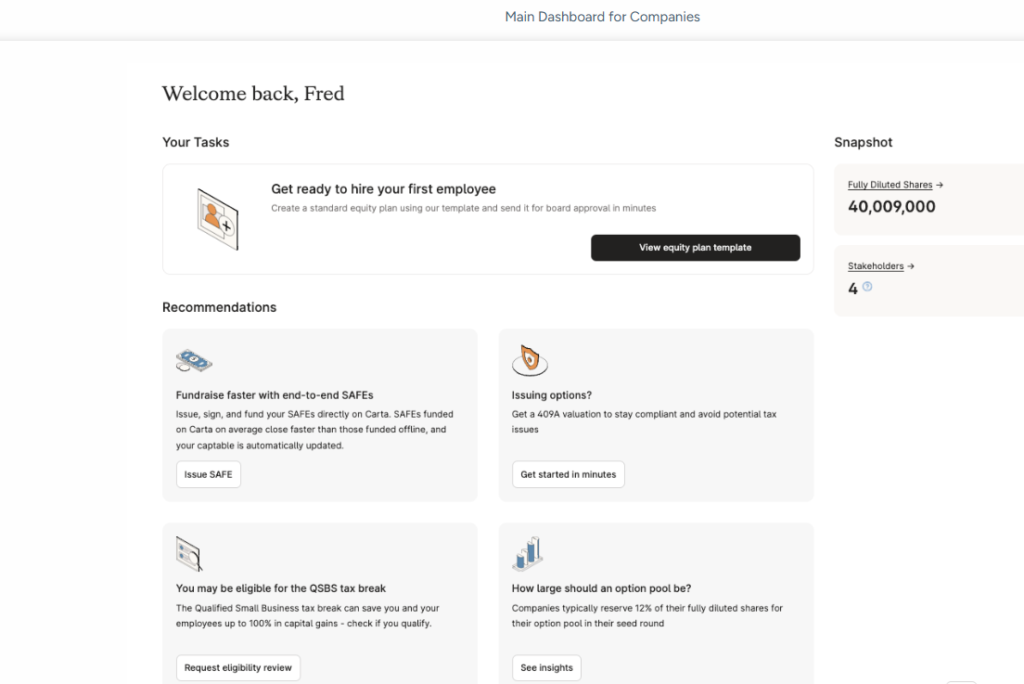

Carta

- Usability: The interface is not user-friendly and time-consuming.

- Cost: Pricing can range from $6,000 to $77,000 annually.

- Suitable for: Ideal for large enterprises but not for small businesses with simple equity structures and limited budgets.

Like Eqvista, Carta is a leading cap‑table and equity‑management platform widely trusted by startups, investors, and employees. However, it also comes with trade‑offs in complexity, cost, and workflow friction as you scale. Very early‑stage or geographically distributed companies that prioritize low cost, simple UX, or specialized regional compliance tools may find Carta expensive or too complex, and may prefer lighter or more niche alternatives.

According to G2, Carta is a comprehensive solution widely trusted across private capital markets, but it can be expensive and has mixed reviews for onboarding and support.

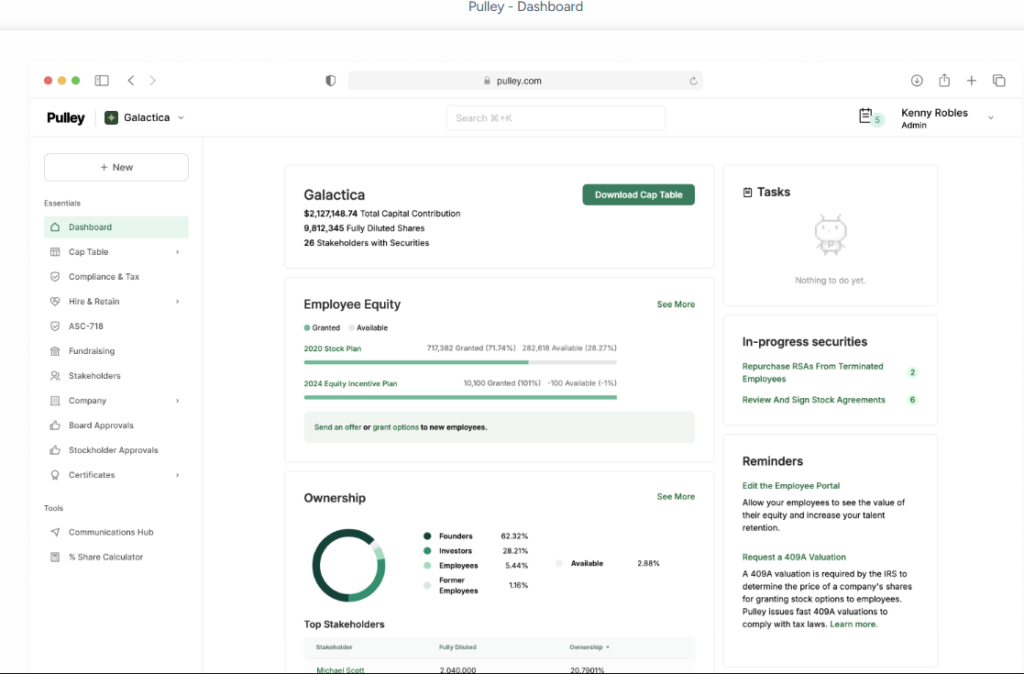

Pulley

- Usability: Easy to use

- Cost: Pulley doesn’t offer a free plan; their pricing starts at $1,200 per year.

- Suitable for: Ideal for startups and growing companies that may not be the best fit for single founders or small founding teams.

Pulley is a cap table management platform tailored for startups and finance teams, offering tools for equity tracking, 409A valuations, and investor management. Some reviews note that it may require onboarding time for complex scenarios such as advanced modeling or IFRS reporting. It’s optimized for growth-stage needs, so very early-stage teams might find simpler free tools sufficient initially.

According to G2, Pulley focuses on startup and growth-stage companies with transparent pricing and specialized support, but offers fewer broad financial integrations.

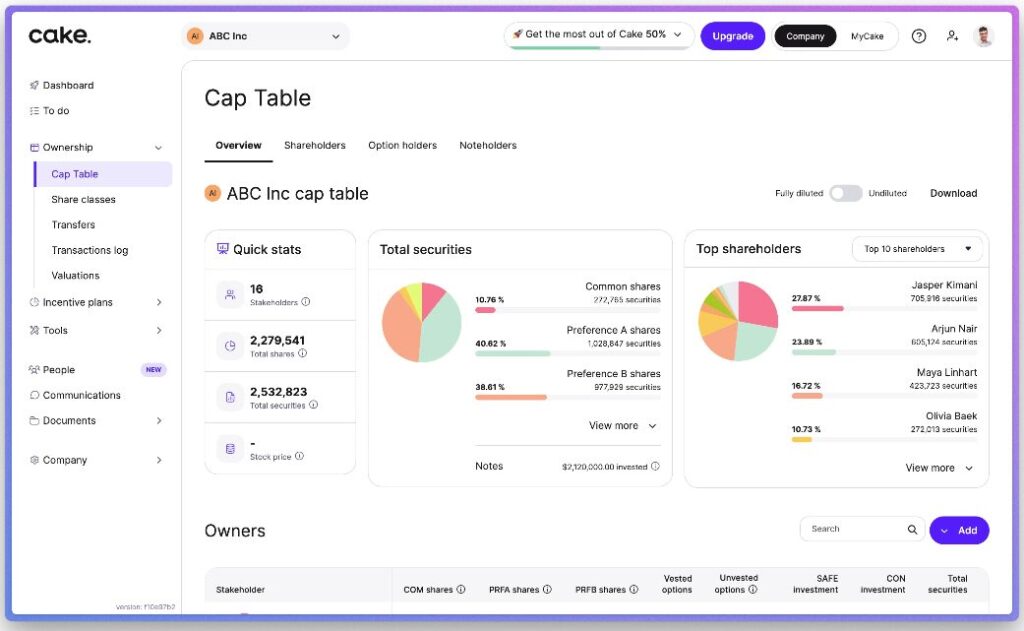

Cake Equity

- Usability: Easy to use and automates tasks.

- Cost: Typically around $43 per month for the Starter Plan.

- Suitable for: Ideal for startups and companies with global operations.

Cake Equity is a Cap table and equity management software focused on startup founders, emphasizing team motivation through equity ownership. Simplifies complex cap table modeling with scenario planning and automated calculations, ideal for early-stage founders. Some reviews note limitations in advanced reporting or handling very large cap tables for later-stage companies.

According to G2, Cake Equity prioritizes team motivation through equity, offering an intuitive platform tailored for startups, transparent pricing, and strong support. Some users note limited features and difficulty with setup.

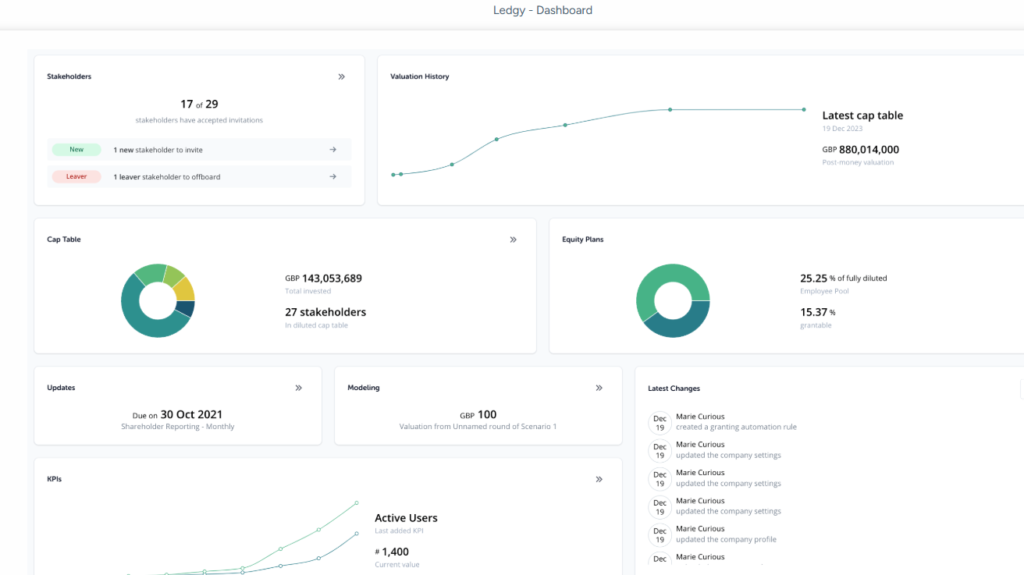

Ledgy

- Usability: Simple to use. The initial stage is typically quick and straightforward.

- Cost: Average annual costs for Ledgy range between $1,631 and $6,215.

- Suitable for: Those with complex equity structures or international operations.

Ledgy is a modern equity management platform automating processes for compliance, risk management, and stakeholder engagement. Supports cap table, equity plans, dashboards, document workflows, extensive integrations, and powerful compliance features. If the client is an early‑stage startup prioritizing cost, speed to implementation, and basic ESOP adoption, Cake is often the pragmatic, low‑friction choice.

According to G2, Ledgy is suitable for complex equity plans but may pose challenges for users due to its technical complexity and setup.

How to create a cap table using Eqvista

Creating a cap table is an important step for a new startup or growing business. It represents the company’s ownership structure and equity distribution.

Eqvista, a leading cap table management platform, offers a streamlined process for creating and managing cap tables. Using Eqvista’s tools and features, businesses can efficiently set up and maintain cap tables, ensuring accuracy and compliance with regulatory requirements. Learn how to create a cap table using Eqvista step by step, highlighting its user-friendly interface and advanced features that simplify equity management.

FAQs

Here we added a list of commonly asked questions for cap table management software for startups.

What features should I look for in cap table management software?

The most important features to look for include:

- A user-friendly interface that is intuitive and easy to navigate

- Ability to model different funding scenarios and their impact on ownership

- Automated updates when changes occur to the equity structure

- Tools for issuing and managing employee stock options

- Compliance features to ensure regulatory requirements are met

- Reporting and analytics capabilities

- Secure access controls and permissions management

- Support for different types of equity instruments

How does cap table software differ from equity management software?

While there is some overlap, cap table software focuses primarily on tracking ownership structure and capitalization. Equity management software has a broader scope, handling stock-based compensation plans and providing more detailed views of employee stock options.

What are common mistakes to avoid when using cap table software?

Key mistakes to avoid include:

- Not updating the cap table regularly

- Failing to understand the terms of different securities issued

- Not planning for future financing rounds

- Allowing rounding errors (especially if using spreadsheets

What are the main cost factors when choosing cap table software?

The main cost factors include:

- Company size and complexity

- Number of users/stakeholders

- Features and Functionality

- Pricing model

- Support and services

- Free trials/tiers

- Setup and onboarding fees

- Compliance and reporting features

What are the benefits of using cap table software for fundraising?

- Improved accuracy and reliability

- Scenario modeling

- Easy sharing of up-to-date information

- Waterfall analysis

- Comprehensive reporting

- Efficient management of complex securities

- Time-saving & Enhanced credibility

Why do companies need cap table software?

Companies use cap table software to:

- Keep track of investments and ownership percentages

- Manage equity dilution

- Provide up-to-date information for investors and stakeholders

- Automate complex calculations and reporting

- Ensure accuracy and compliance

Eqvista – Trusted By Over 23,000+ Companies

Over the years, Eqvista has grown to become the most sought-after cap table management software. The comprehensive yet easy access nature of the platforms empowers startup founders and seasoned entrepreneurs alike to feel comfortable understanding and managing their company equity.

Our services streamline your equity management, making Eqvista a necessary tool for businesses seeking to optimize their financial resources and attract investors. Get started today!

We also specialize in company valuations, including 409A valuations, providing accurate, audit-ready, and defensible private company valuations. Our team of experts ensures that every valuation is conducted using widely accepted practices, guaranteeing compliance with safe harbor standards. Contact us today to learn more about our service!

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!