Burn Rate: Everything You Need to Know

Startups face many challenges during the first couple of years. The issues they face range from raising capital to maintaining the burn rate. This is especially true during times like these, where the pandemic has caused many countries to be locked down, and others struggle to keep their economies afloat. It has become more difficult for small companies and startups to keep running without burning through cash before becoming profitable.

What is a Burn Rate?

Burn rate is the rate at which a business consumes cash in a scenario where they generate a loss. In other words, it is the rate at which companies spend their capital to finance overheads before the operations can generate a positive cash flow. Companies & start-ups use it as a standard metric to check their performance. Burn rate calculates the negative cash flow.

Startups are mostly focused on improving their products and growing their customer base in their early stages; this makes them unable to produce a positive net income. Usually, the burn rate is measured in terms of cash flow per month. For example, if a startup has a burn rate of $10,000, it means that they are spending $10,000 monthly.

How does a Burn rate work?

The net burn rate’s fundamental analysis lets you know if the business is self-sustaining or not. A positive net burn rate means that the company is spending more money than they are taking in, and this needs to be looked at. The company has a basic choice to make here, either they increase their revenue or cut costs to make the burn rate negative.

You can also check the amount of excess runway you have if you compare your company’s total funds to the burn rate. In case you are unable to lower the burn rate before exhausting your funds, you will be forced to shut down operations and look for different sources of funds like outside investments or loans. Additionally, investors look at the company’s burn rate and compare it to the business plan before investing. They will only invest in companies in which they believe to have a realistic chance of making a profit. Investors continue to calculate the burn rate in order to track the company’s progress after they have invested in it. If the burn rate continues to increase, the investors will want to know why the business is going the wrong way.

Let’s take an example of a gross burn rate of $45,000 for a company, although the net burn rate will be different if this same company is producing revenue. Let’s say the revenue and cost of goods sold looks like this:

- Revenue = $25,000

- Cost of goods sold = $15,000

And the company’s expenses:

- Rent= $10,000

- Server costs (monthly) = $15,000

- Salary= $20,000

In this case the net burn rate will be:

$25,000 – $15,000 – $10,000 – $15,000 – $20,000 = $35,000

Income is an essential distinction factor as it directly affects the money in the bank. But when the generated revenue is not meeting expectations or the burn rate exceeds the forecasts, the only option is to re-examine the costs so that the burn rate drops. This should happen regardless of the cash the company has.

Burn Rate Types

There are two types of burn rates:

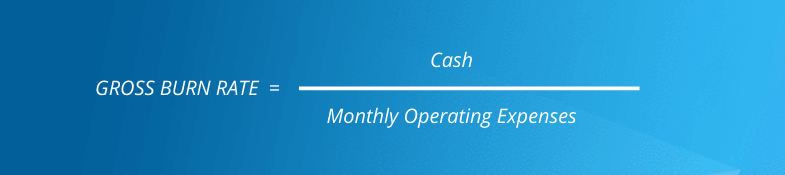

Gross Burn Rate – Simply put, the company’s operating expenses are the gross burn rate. To calculate it, you need to add all of the company’s operating expenses such as salaries, overheads, and rent. The rate is often calculated monthly. Regardless of the revenue, this provides a look at the company’s efficiency and the cost drivers. The formula for the gross burn rate calculation is:

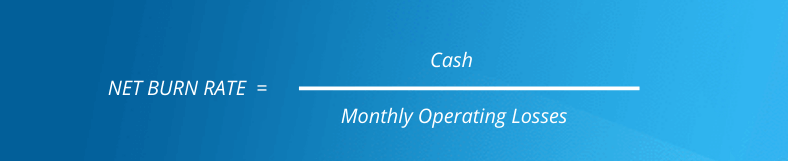

Net Burn Rate – The Net Burn Rate of a company is the rate at which they lose money, it is calculated by subtracting the operating expenses from the revenue. It is the most commonly calculated on a monthly basis. This shows the amount of cash the company needs so that they can continue operations for a certain period of time. But, the variability in revenue is one factor that needs to be controlled. A higher burn rate can also occur when there is no change in costs, but there is a fall in revenue. The formula for the net burn rate calculation is:

What is the right burn rate for a startup?

Nevertheless, considering the situation of the company, a minimum cash runway of six months should be maintained for the burn rate. If a company maintains a burn rate with a runway of less than six months, they will not be ready for the unpredictable changes in revenue or spending. Simply put, a company’s monthly spending should not dive into the minimum capital, exposing it and affecting the needed capital to continue the operations of the business for the next six months.

But every company is different; just because a financial strategy works for one company does not mean it will work for others. In fact, following the same strategy as another company might be a huge misstep. So, in terms of the growth of your company, frame your burn rate and increase your understanding by learning the metrics as burn per department or burn per new hire. If your company has the means to take off on a period of growth, then you can consider increasing your gross burn rate for a certain period of time to grow the business.

The “means” in the above case are the tangible resources in your company, such as:

- Venture capital

- Strong credit line

- Growing revenue sources

- Ample cash in the bank

If you can’t afford the luxury of having these “means”, you should re-examine the company’s growth plan and maintain a stable burn rate. This is regardless of the risk that you are willing to take or the potential of the company. You can also use intangible means to influence your burn rate calculation as these can be appealing to investors. But before you allow it to affect the burn rate, think twice. Some of the intangible means are:

- Trade secrets

- Reputation

- Productivity of workforce

- Relationships with clients

- Third -party valuations

- Industry growth

- Team skills and expertise

Calculator Burn Rate

Now that you are clear regarding what the burn rate is about, let us talk about how to calculate it for a company.

How do you calculate the burn rate?

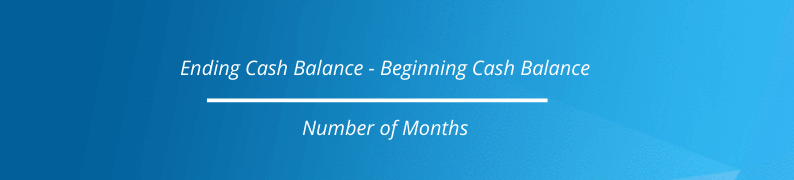

To calculate the burn rate, it is essential that you choose a time period that you want the rate to express. For example, on a monthly basis. The burn rate formula is not complex. To calculate it, subtract the current cash in the company by the money you had at the beginning of the year. Then divide that amount by 12.

Let’s take an example: XYZ Co. is a small startup in the online food industry. They are considering the option to raise capital from angel investors. The burn rate of XYZ Co. is calculated on a monthly basis. As they have no revenue, the gross burn rate calculation will be:

- Cash in January = $1 million

- Cash on December 31st = $400,000

Burn rate formula:

= ($1,000,000 – $400,000) ÷ 12

Burn Rate= $50,000/month

Additional note: You can calculate the burn rate with or without income. A calculation that factors in the income will help you see the company’s habits and their impact on the long-term viability and is the net burn rate.

The other scenario is without income; this is a worst-case scenario. This scenario indicates the amount of time your company will survive if all income streams were suddenly cut off. This is also known as gross burn rate.

How to reduce the burn rate?

There are different ways to reduce the burn rate of a company:

- Growth – Companies can project growth, which will boost their economies of scale. This permits the business to cover all fixed expenses and enhance its financial situation. For example, there are many startups in the food-delivery market that are facing a loss-generating scenario. But the forecasts for this market are promising to show a boost in its economies of scale. This further motivates investors to invest additional funds in such companies with the hope of future profits.

- Pay Cuts & Layoffs – Generally, in companies with a high burn rate, the investors negotiate a clause in the financing deal to decrease the number of employees or remuneration. In startups that start to follow a rather slender strategy, layoffs are imminent. Also, when companies sign new financing deals, the same thing happens as the investors are looking for the company to be profitable & not for them to drown in losses. One major example here is Tesla, during its initial stages a new CEO was hired in 2008, and Tesla laid off 10% of its workforce due to high burn rates.

- Marketing – The most common way to reduce the burn rate is by increasing the customer base. The best way to reach a wide audience is by marketing. But small startups do not have the luxury to spend that much on advertising as they have tight constraints on their cash. A new way of marketing has been coming up that does not rely on your pocket, and it is called “growth hacking”. This is a way to advertise your products on other platforms for free, leading them to your website. One real-life example is Airbnb, they got their engineers to configure Craigslist so that clicking on their information would redirect you to their website.

Cash Runway

Let us begin by understanding what a cash runway is. The amount of time available before the company runs out of money is called a cash runway. This is a projection made by calculating the average monthly burn rate and the amount of cash available in the company.

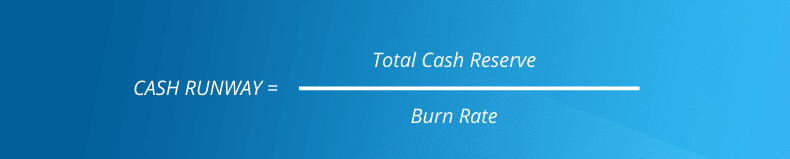

To derive the cash runway, divide the cash available by the burn rate:

Using the above example, the company XYZ has a burn rate of $50,000, and the cash in the bank is $400,000. Using the given formula:

= $400,000 ÷ $50,000

Cash runway = 8 months

Additional Note: This formula assumes that there will not be any major change in the financial status of the company and the company will not raise more money. This shows the “bare minimum” time the company can survive with no income.

What is the burn rate for your company?

From this article, we can see how vital the burn rate is in a startup. We also learned about the types of burn rates and how to calculate them. If your company has high burn rates, you can try to get it to an acceptable low. Having a low burn rate can help startups in the long run as they will have enough cash to deal with any other uncertainties.

One of the tools that can help you is Eqvista, an online cap table to help you track the ownership in the company. Our online equity management tools help your investors and shareholders track the important information in the company’s ownership, and also has advanced features like financial modeling tools that help you make smarter decisions. To know more, reach out to us today!