When does a company need a 409A valuation?

In this article, we will explore when exactly a 409A valuation is needed and how often you must get one.

Stock-based compensations are preferred by both companies as well as employees. By allowing your employees to take part in your company’s growth, you are raising their motivation to drive your company to new heights. At the same time, you can allocate cash for other important expenses. If your employees are investment-savvy, they will see it as a rare opportunity to enter the private equity market.

Before you set out to issue stock-based compensation, you must get a 409A valuation for tax purposes. In this article, we will explore when exactly a 409A valuation is needed and how often you must get one.

When to do a 409A valuation?

The 409A valuation establishes the “fair market value” of a company’s common stock, determining the strike price for stock options. The IRS requires these valuations to be “reasonable” and performed by qualified independent appraisers. Having an up-to-date 409A helps protect the company and option recipients from potential tax penalties associated with issuing options below fair market value.

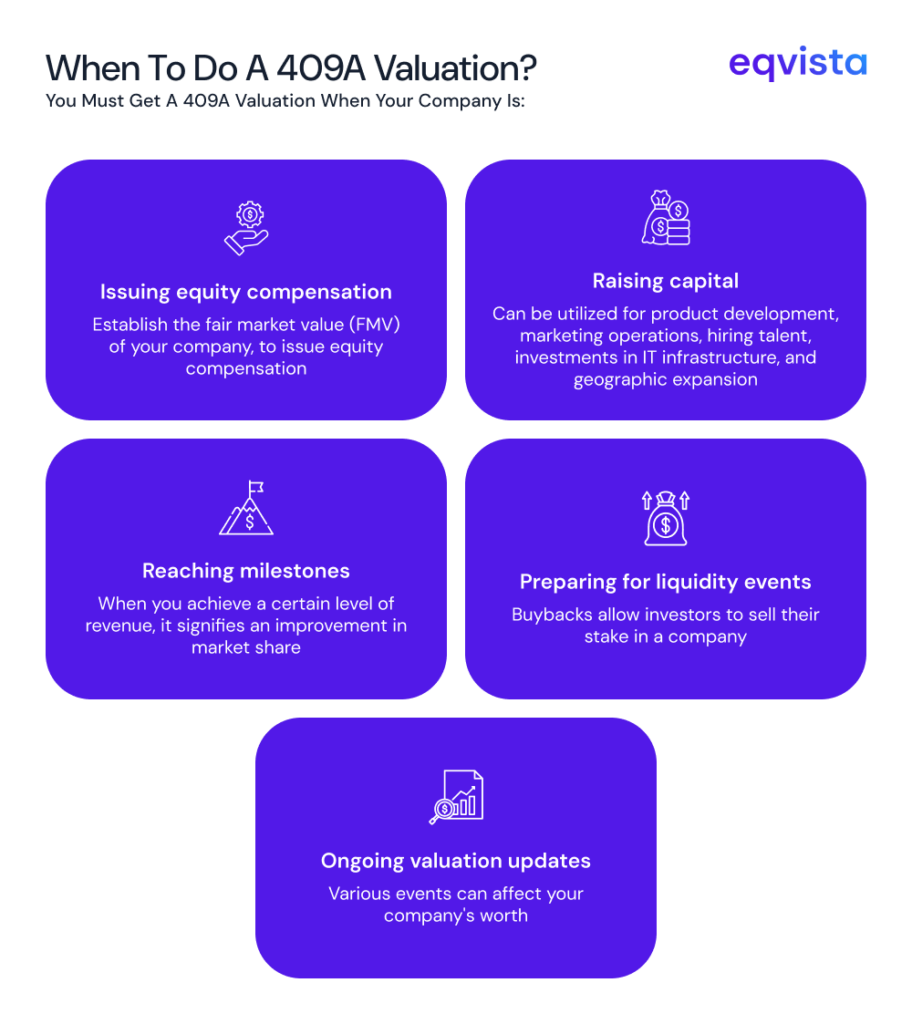

You must get a 409A valuation when your company is:

Issuing equity compensation

As per the Internal Revenue Code (IRC), you must get a 409A valuation to establish the fair market value (FMV) of your company if you want to issue equity compensation to your employees.

For example, a SaaS startup plans to implement an ESOP to attract and retain talent. Before issuing these options, they obtain a 409A valuation, establishing their FMV at $2.50 per share. This helps them to set the strike price at this level, and make sure employees receive options that comply with IRS regulations.

When you issue equity compensations, the purchase price offered determines your employees’ potential profits and tax liabilities. So, the IRS verifies whether the purchase price offered to your employees was based on the FMV.

Raising capital

When startups succeed in raising capital through funding rounds, they typically scale up their operations which increases their value. These funds can be utilized for company development and expansion. Startups are also known to raise capital at lower valuations in difficult times.

Suppose a company closed its Series B funding round of $8 million at a $40 million pre-money valuation. This represents an increase from their previous valuation of $15 million. Before issuing new stock options to recently hired employees, they obtain a fresh 409A valuation to reflect their new financial position, ensuring compliance with IRS regulations for subsequent equity grants.

So, you must get a 409A valuation after raising capital since valuations could move in either direction after such an event.

Reaching milestones

When your company reaches a new milestone, its valuation can change. When you launch your first product, it signifies the end of the ideation phase. When you achieve a certain level of revenue, it signifies an improvement in market share.

Take the case of a medical device startup that receives FDA approval for its flagship product after three years of development. This milestone reduces company risk and opens up the market. Their previous 409A valuation no longer reflects their current business prospects, so they commissioned a new valuation before issuing additional equity compensation.

So, when your company achieves a new milestone, its perceived risk and expected future cash flows improve and you must get a 409A valuation.

Preparing for liquidity events

Liquidity events like mergers and acquisitions, initial public offerings (IPOs), and buybacks allow investors to sell their stake in a company. In such events, company valuations change, usually for the better.

For example, a company preparing for an acquisition needs to obtain a fresh 409A valuation to establish an updated FMV for its common stock. This helps them determine equity compensation during this transition period and ensures compliance with the terms of the acquisition agreement.

So, when your company is preparing for a liquidity event or has just completed one, you must get a 409A valuation.

Ongoing valuation updates

Various events like changes in the regulatory environment, corporate restructuring, key personnel changes, entry into new markets, and changes in the competitive landscape can affect your company’s worth.

Suppose a firm experiences these changes within 10 months, but its annual 409A valuation isn’t due for another two months.

In that case, they commission an early update to reflect these material changes before issuing additional stock options, protecting the company and employees from potential tax issues. Hence, you must get a 409A valuation after such events.

What triggers a 409A valuation?

Some examples of 409A valuation-triggering events are as follows:

- Changes in ownership structure – Ownership structures change when the company onboards new investors, issues stocks to its employees, buys back shares from its investors, and when investors sell their shares to a third party. The selling price of stocks in all these events is decided when both parties reach a consensus about the company’s worth. This consensus about the company’s worth must be considered to calculate the valuation at which stock options are offered to employees.

- Stock option grants to employees – 409A valuations are a requirement for granting stock options to employees. In fact, they are also required to grant other kinds of stock-based compensations like phantom stocks and stock appreciation rights (SARs). If you do not comply with this requirement and if the IRS deems your valuation as unreasonable, your employees will face expensive tax penalties.

- Significant events – Companies experience various significant events like mergers, acquisitions, funding rounds, achievement of milestones, and significant improvements in financial performance. After such events, you must re-evaluate how risky your company is and the cash flows you can expect in the future. So, a company’s valuation changes after such events.

Is a 409A Valuation Right for Your Startup?

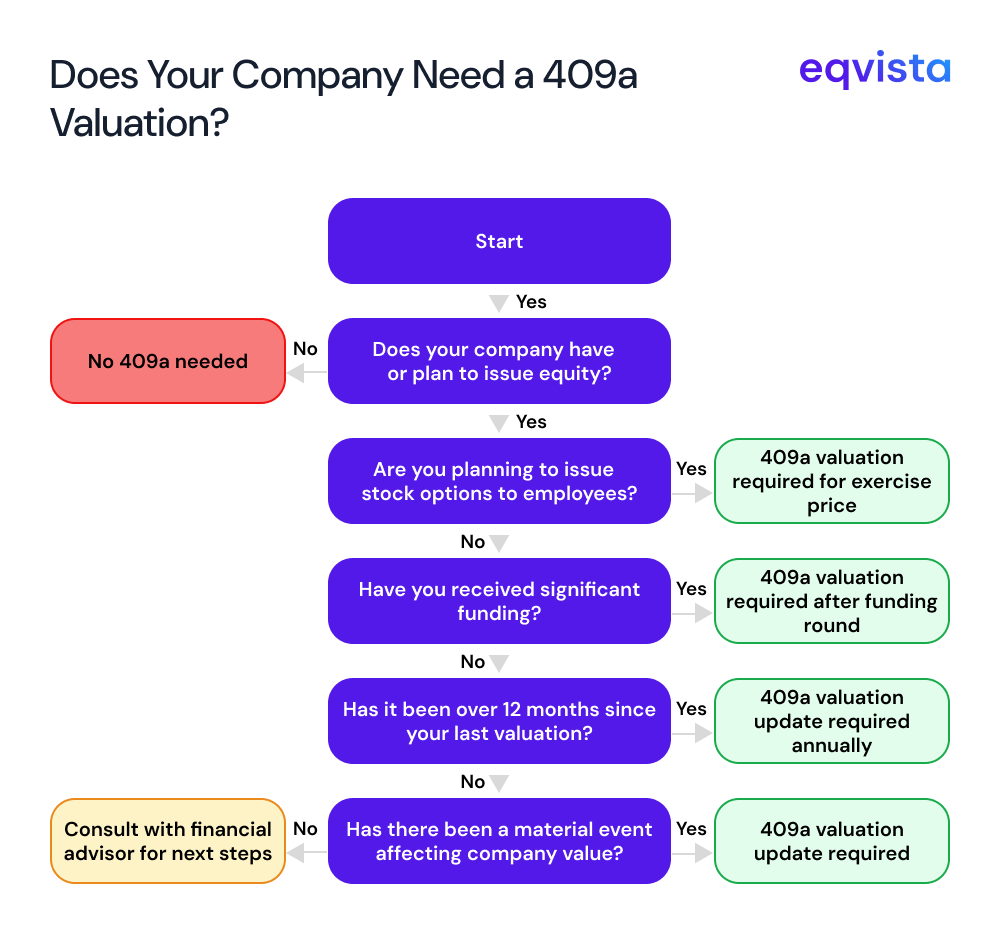

A 409A valuation is essential for privately held companies issuing stock options, as it determines the fair market value of the common stock. The IRS requires this valuation to ensure stock options are priced at or above fair market value to avoid potential tax penalties.

With the help of a decision tree, we explain the key factors that trigger the need for a 409A valuation, such as issuing equity, granting stock options to employees, receiving significant funding, the time elapsed since the last valuation, and material events affecting the company’s value.

This decision tree flowchart guides you through key questions to determine if their company needs a 409A valuation. It addresses the main scenarios where a 409A valuation would be required.

The flowchart uses color-coding to indicate outcomes clearly:

- Green boxes indicate situations where a 409A valuation is required

- Red box indicates when it’s not needed

- Yellow box suggests consultation with a financial advisor

By following the chart, companies can assess their specific circumstances and determine whether a 409A valuation is needed to comply with IRS regulations and avoid tax implications.

Benefits of engaging a valuation expert

Establishing the valuation of a private company can be a complex process. You do not have a lot of data to work with, so you must rely on qualitative factors.

Precision in valuation

Valuation experts provide precise and unbiased value assessments, leveraging their qualifications, experience, and industry knowledge. This accuracy is important for making informed decisions and ensuring fair transactions.

Informed decision-making

Professional valuations provide crucial insights for strategic decision-making, such as mergers, acquisitions, or divestitures. This data-driven approach enables stakeholders to negotiate from a position of strength and make well-informed investment decisions.

Through Eqvista’s detailed valuation reports, in addition to learning your company’s valuation, you get an unbiased and transparent assessment of your company’s operations and assets.

Funding and investment leverage

Valuation reports prepared by experts serve as credible documents that facilitate negotiations during property transactions, business sales, or mergers. These reports help ensure fair transactions and can be critical in securing financing or investment.

Eqvista’s valuation expertise goes beyond just 409A valuations. We also provide investment valuations or VC valuations. You can attach these valuations and the findings from our valuation reports to your pitch decks to provide your potential investors with an unbiased assessment of your business.

Taxation and compliance

Accurate valuations are critical for ensuring compliance with tax regulations and financial reporting standards, helping to avoid costly penalties and disputes, and ensuring that financial statements accurately reflect the value of assets and liabilities.

At Eqvista, NACVA-certified valuation analysts collaborate with taxation professionals to provide valuations that are audit-ready. Furthermore, since we are an independent appraiser, our 409A valuations can help you attain a safe harbor status.

Exit strategy optimization

Expert valuation significantly enhances the exit planning process by providing crucial insights and strategic guidance. It helps business owners maximize value and achieve their personal and financial goals upon exit.

To further assist your investors in exit strategy optimization, you can utilize Eqvista’s cap table management services. By doing so, you will be enabling your investors to instantly understand the shareholding pattern, the amount of SAFE notes, and the rights of various shareholders.

Litigation support

Engaging a valuation expert in litigation support delivers critical financial expertise that clarifies complex issues, ensures defensible and credible valuations, aids in damage quantification, and strengthens legal strategies through expert testimony and compliance with legal standards. This collaboration ultimately enhances the chances of achieving fair and equitable outcomes in legal disputes involving financial valuation.

Hence, engaging a qualified and experienced valuation expert like Eqvista can be the right move. You can also rely on Eqvista for tax filing services and tax planning consultations.

Considerations for Planning 409A valuation throughout the Year

When planning your company’s financial roadmap, it’s important to budget and schedule it appropriately for 409A valuations. Here’s a practical guide:

| Standard Timeline | Additional Valuation Triggers | Cash Flow Management | Cost Saving Approaches |

|---|---|---|---|

| Budget for at least one annual valuation | After each funding round (add 30-45 days post-close) | Consider signing annual contracts with valuation providers for predictable costs | Coordinate option grants to follow scheduled valuations rather than requiring special updates |

| Allow 2-4 weeks for completion (longer for complex businesses) | Before issuing significant option grants | Some providers offer startup-friendly payment plans or discounts for long-term commitments | Communicate upcoming material events to your valuation provider to potentially combine multiple triggers into one valuation |

| Plan valuations to be completed before option grant meetings | After reaching major milestones (allow budget flexibility) | Factor in potential emergency valuations for unexpected events (add 10-15% contingency) | Consider providers who offer flat-fee structures to avoid scope creep |

Proactively monitor for material events, maintain organized financial records, and schedule regular check-ins with your 409A provider to ensure ongoing compliance and readiness for equity grants or company milestones. Eqvista offers some of the most competitive and transparent pricing of 409A in the industry, with unlimited 409A valuations for 12 months starting at $990 per year for startups.

How often should a company obtain a 409A valuation?

Three things that influence how often your company should obtain a 409A valuation are:

How long has it been since the last 409A valuation?

A company’s performance can change wildly in a year. A well-known example of this would be the growth experienced by Zoom Video Communications because of the COVID-19 pandemic. In the year ended on 31st January 2021, its revenue increased by 325.81% to $2.65 billion and its net income increased by 2,556.85% to $672 million.

Similar stories do unfold with private companies as well. In fact, since startups are less mature than listed companies, they have a higher growth potential and at the same time, they face a greater risk to survival.

So, unsurprisingly, the IRS does not presume a valuation as reasonable if it was calculated at least 12 months ago.

Did any material events occur since the last 409A valuation?

Events that can significantly impact the value of owning a company are called material events. Some examples of material events are mergers and acquisitions, significant regulatory changes, changes in corporate structure, and losing or winning contracts. By definition, these events change the valuation of companies. Hence, you must get a 409A valuation after a material event to issue stock-based compensation.

Are you issuing stock-based compensation to employees for the first time?

If you are issuing stock-based compensation to employees for the first time, you must get a 409A valuation. This would be the first time your company’s stock’s fair market value (FMV) will be determined.

FAQs

Some common queries of people learning about 409A valuations are:

What triggers a 409A valuation?

409A valuations are triggered when it has been 12 months since the last 409A valuation or if a material event occurred after the last 409A valuation.

What happens if you don’t get a 409A valuation?

When a business does not get a 409A valuation before issuing stock-based compensation, it risks extended audits and tax liabilities for its employees. In such cases, the IRS will investigate if the stock-based compensation was issued based on the business’s fair market value (FMV) instead of presuming this.

Can you issue options without 409A?

409A valuations are mandatory and non-compliance can lead to tax liabilities like a 20% tax penalty and an increased taxable income.

What is the difference between 409A and actual valuation?

A 409A valuation aims to find the fair market value (FMV) of a company’s stock while a company’s growth potential can sway a valuation in a funding round and hence can be speculative.

How much does a 409A valuation cost?

409A valuation prices typically start from $2,000. However, Eqvista offers unlimited 409A valuations for as low as an annual fee of $990. If you urgently require a 409A valuation, we can deliver one for $490 in 3 to 5 working days.

Do All Private Companies require a 409A Valuation?

A 409A valuation is required for private corporations to grant ownership to employees (often a key recruiting tool). Since the value of a private company’s common stock isn’t readily available as it isn’t listed on a public stock exchange, a 409A valuation is required.

Ensure tax compliance with Eqvista’s 409A valuation plans!

Since private companies can experience multiple material events in a year, getting a 409A valuation once every 12 months is not sufficient. If you do not establish your company’s fair market value, it can prove expensive for your employees. However, tax compliance does not need to be expensive or even time-consuming.

With Eqvista’s annual plans, startups from various stages can get unlimited 409A valuations at affordable annual fees. Need a 409A valuation? Contact us now for a detailed price estimate.

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!