Transferring Shares in a Corporation

Here’s everything you need to know about transferring shares in a corporation.

The capital in a company or corporation is divided into small equal units, finite in number as defined in the total authorized shares. Each of these units are known as shares in a corporation. In layman’s terms, a share is the percentage of ownership that a shareholder in a corporation holds.

Here’s everything you need to know about transferring shares in a corporation.

What Is A Corporation?

A corporation is a separate legal entity that’s distinct from the owners. However, it has most of the rights and responsibilities that an individual possesses: it can enter into agreements, borrow and loan money, own assets, sue others, pay taxes, and file or face a legal lawsuit.

The development of a corporation entails a legal procedure called incorporation where the drafting of legal documents comprising the major purpose of the business, location, name, stock types, and the number of shares taking place.

The procedure of incorporation gives the business entity a unique feature that protects the owners from being personally responsible in case of a legal claim or lawsuit.

How a Corporation Works

A corporation is supposed to name its board of directors before it can begin operations. Shareholders in corporations elect the members of the board during the AGM or annual general meeting. All shareholders are entitled to a vote as they cannot participate in the daily operation of the corporation.

The directors stand for elections as executive officers or members of the board of directors of the corporation. The elected board of directors owe a duty of care to the shareholders in a corporation and should act in their best interest as well as that of the corporation.

Types of Corporations

A corporation is created by single or numerous shareholders who collaborate to seek a common goal. A corporation can be formed either as a ‘not-for-profit’ or ‘for-profit’ entity. Not-for-profit entities work as charitable organizations, which are committed to a specific social cause, for instance religious, research, or educational purposes.

Instead of distributing revenue to shareholders, they use their revenues to advance their objectives. Most corporations are for-profit entities formed to generate revenues and offer a return to the shareholders in a corporation, according to their ownership.

C Corporation

This incorporation is the most common among businesses and comprises nearly all of a corporation’s attributes. Owners obtain profits and are taxed individually while the corporation pays taxes as a business entity.

A Non-profit corporation

Educational, charitable, and religious organizations work as non-profit corporations, Since they are run without generating profits, they are exempt from paying taxes. Any donations or revenue obtained are retained in the entity to spend on expansion, operations, or future plans.

S Corporation

An S Corporation bears resemblance to a C Corporation but differs in tax purposes and owner limitation. The corporation comprises up to 100 shareholders and the taxation isn’t separate. Instead, the shareholders bear the profits and losses on their revenue tax returns.

How Shares are Recorded in a Corporation

The recording of issued shares occurs on a balance sheet as owner’s equity or capital stock. You’ll find outstanding shares listed on every corporation’s quarterly filings with the SEC. The outstanding shares are also available in the capital segment of a corporation’s annual report.

If it’s a publicly-traded company, then the transfer of shares in the corporation is recorded on an electronic ledger, and changes when their shares are traded in the open market.

Shareholders in a Corporation

The shareholders in a corporation are what makes up the ownership, and how the company manages these shareholders is important. This not only involves how many shares each shareholder owns, but the different types of corporate shareholders.

Definition of Shareholder

A shareholder can be a company, person, or organization that holds shares in a corporation. A shareholder in a corporation should own at least one share in a company’s mutual fund or stock to give them partial ownership. Shareholders usually obtain declared dividends if the company performs well in a financial year.

Also known as stockholders, they can vote on particular issues regarding the company and can also be elected to the board of directors. If the company is undergoing liquidation and its assets are sold, the shareholder in the corporation might obtain a share of the proceeds after all creditors of the company are paid off.

Types of Shareholders

Two kinds of shareholders exist common and preferred shareholders. Common shareholders own common shares in a corporation. They’re the more prevalent type with voting rights on matters regarding the company. Since they have control over the company’s management, they can file a class-action lawsuit against the organization for any wrongdoing.

On the other hand, preferred shareholders are less common. They own shares of the company’s preferred stock but lack voting rights and have no say in a company’s management. Rather, they have the right to a fixed annual dividend, which they receive before common shareholders.

While both preferred and common stocks experience a value increase with a company’s positive performance, the former experience higher capital losses or gains.

The Functions of a Shareholder in Corporation

A shareholder doesn’t merely receive profits. They perform other responsibilities, including:

- Determining the amount of salary that directors obtain. This decision is usually tricky since stockholders should ensure that the amount they’ll give will compensate for the living costs and expenses incurred by the director without compromising the corporation’s coffers.

- Proposing and determining the powers they’ll transfer to the company’s directors, including their appointment and removal from office

- Examining and approving the company’s statements

- Decision-making on occasions where the directors lack power, including making amendments to a company’s constitution

How Do You Transfer Shares in a Corporation

Understanding the transfer of shares in a corporation is significant for both the business owners and the shareholders. It’s also equally important to properly record this transfer of shares in the company’s cap table.

Here’s how the process of transfer of shares in a corporation works:

Stock Transfer

Transfer of shares occurs in all kinds of business entities, whether partnerships, corporations, or limited liability corporations. However, the share structure, maximum shareholder number, and share transfer process in every entity is different.

For the share transfer process to happen, a stock transfer form is necessary. The document comprises details of the buyer and seller of the shares, the number and type of shares being transferred, and the amount paid by the purchaser.

Most corporations have stock transfer agreements and procedures stipulating how to calculate the share value and who might or might not be a shareowner in that respective organization. While all corporations should have a stock transfer agreement, not all do. If such an agreement is unavailable, you must value the stock realistically before the transfer of shares takes place in order to comply with state corporation decrees and the IRS rules.

The creation of a purchase agreement is a mandatory step in order to transfer shares in a corporation. The document delineates all the details concerning the share transfer process. Once the signing of the document takes place, the share certificates must specify the name of the new owner.

Transfer of Shares in an S Corporation

When it comes to transferring shares in an S Corp. there are mandatory procedures that need to be followed so that the company continues to enjoy its advantageous tax benefits. These include:

1. Ensuring That the Purchaser Is Eligible

Tax code rules in an S corporation strictly limit the number and types of shareholders in a corporation. In order to maintain its S Corp. status, the company cannot have more than 100 shareholders who can be individuals and specified trusts and estates. Partnerships, other corporations and non-residents are not allowed to own S Corporation stock. If the company violates these statues, it stands to lose its preferential tax status. So, ensure that a proposed transfer complies with these restrictions.

2. Review the Shareholder Agreement

All restrictions pertaining to stock transfers can be found in the shareholders’ agreement or bylaws. Any proposed transfer may first need to be approved by the board or the management. The corporation may also have the first right of refusal which allows it to buy its stock back before you offer it to another purchaser.

3. Determine the Value of the Stock

Since S Corp. shares are not publicly traded, they do not have a current market value. It is therefore important to determine the right price of your stock. A selling price or the process to arrive at one might be specified in the shareholders’ agreement. In the absence of such information, the price can be determined by comparing the corporation to similar businesses that have an established market value on their shares. The best way to determine the fair market value of the corporation is to have a 409a valuation conducted by an independent appraisal firm. Checkout our 409a valuation prices at Eqvista.

4. Prepare the Stock Transfer Agreement

Once the value of the shares has been determined, a written stock transfer agreement needs to be prepared, setting out the terms and conditions of sale. Alternatively, the stock transfer form can also be filled. It will also include the quantity of stock purchased, the selling price and a commitment by the purchaser to abide by the bylaws of the corporation.

The stock transfer agreement needs to be signed by the seller and the purchaser who must also execute a declaration consenting the terms of the company. This declaration needs to be notarized by the purchaser and filed with the company.

5. Update the Stock Transfer Ledger

The new ownership needs to be entered into the corporation’s stock transfer ledger after which new stock certificates need to be prepared. The seller can also request the corporation to issue a final statement showing Share of Income, Deductions and Credits that reflects their share in the profits and losses during their time as a shareholder.

Let’s cover a simple example to understand how to transfer shares in a corporation better:

Say there’s a corporation, ABC Corp, which has a total of 4 founders each holding 25% of the company. With a total of 1,000,000 authorized shares, each founder would have 250,000 shares each with a share price of $0.10. Now let’s say that a founder, James Moore, has decided to resign from his position in the corporation, and the company finds another person, Amy Scott, to join the company and purchase James Moore’s shares. Therefore James Moore would sell his 250,000 shares to Amy Scott.

James Moore and Amy Scott will now have to determine the consideration that James Moore will receive for the stock transfer agreement. Since James Moore and Amy Scott go back a long way, James Moore agrees to transfer his shares at 10% less than the current market value. This means he will be transferring each share to Amy Scott at a value of $0.09 per share. (0.10-15%).

Amy Scott will therefore need to pay James Moore USD 22,500 ($0.09 x 250,000 shares) for the transfer of shares.

James Moore then needs to write a share transfer contract. The template would be available in the shareholders agreement. A written contract will prevent ambiguities and any future legal problems that may arise out of the transfer. The contract needs to mention the amount of stock given and the consideration for the stock, the names of both – the buyer and the seller and any other information that may be relevant to the transfer.

James Moore and Amy Scott also need to ensure that all relevant updates have been made in the stock transfer ledger and that updated stock certificates are prepared.

Transfer shares on Eqvista

You can transfer shares in a corporation seamlessly on the Eqvista platform. The whole share transfer process can be completed all online through the equity software management through your account. Let’s take a look at how the transferring shares in a corporation would look on Eqvista.

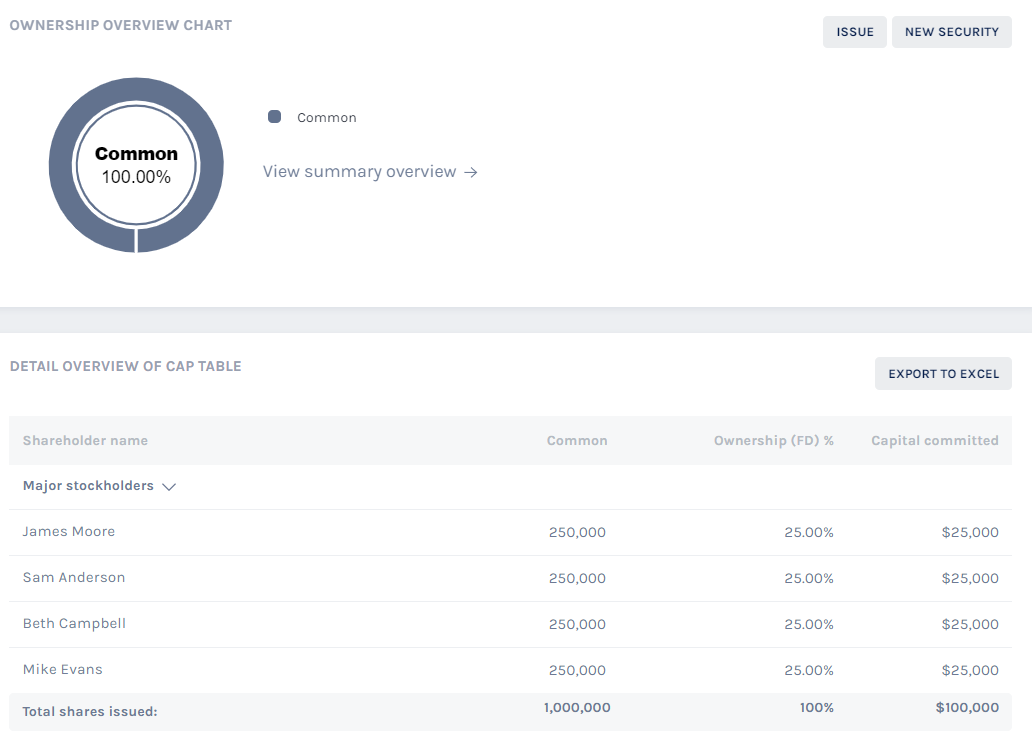

Here is the pre-transfer cap table of ABC Corporation.

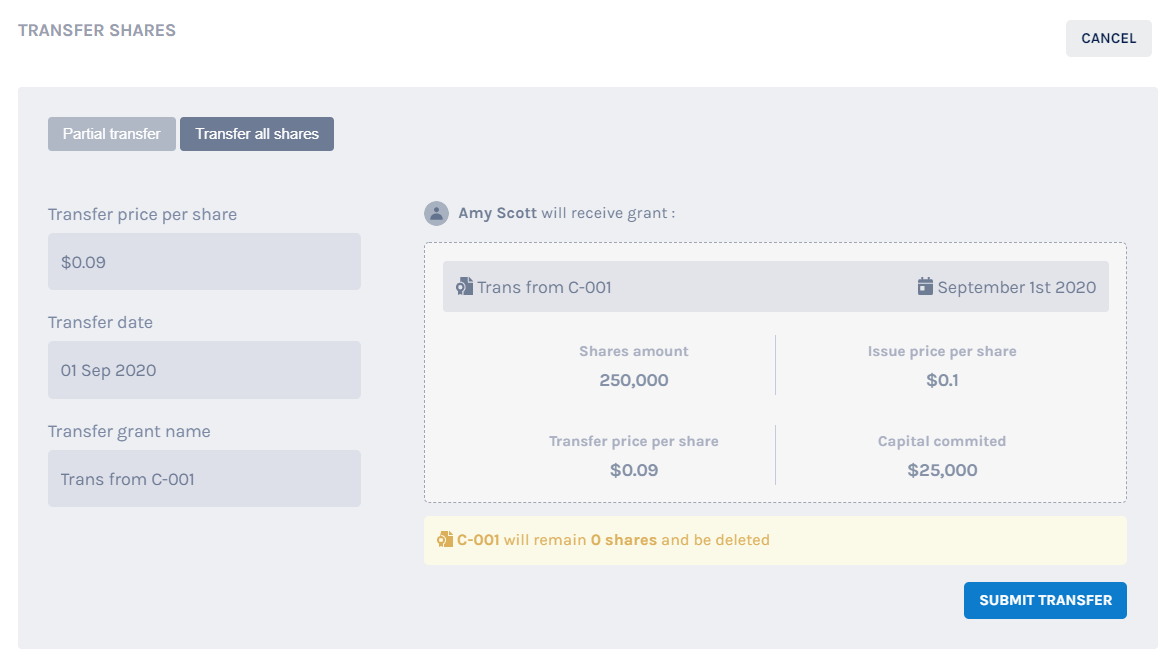

Once you are ready to transfer the shares, you can click in to the share grant and go the transfer shares page, which will show up on the platform as below:

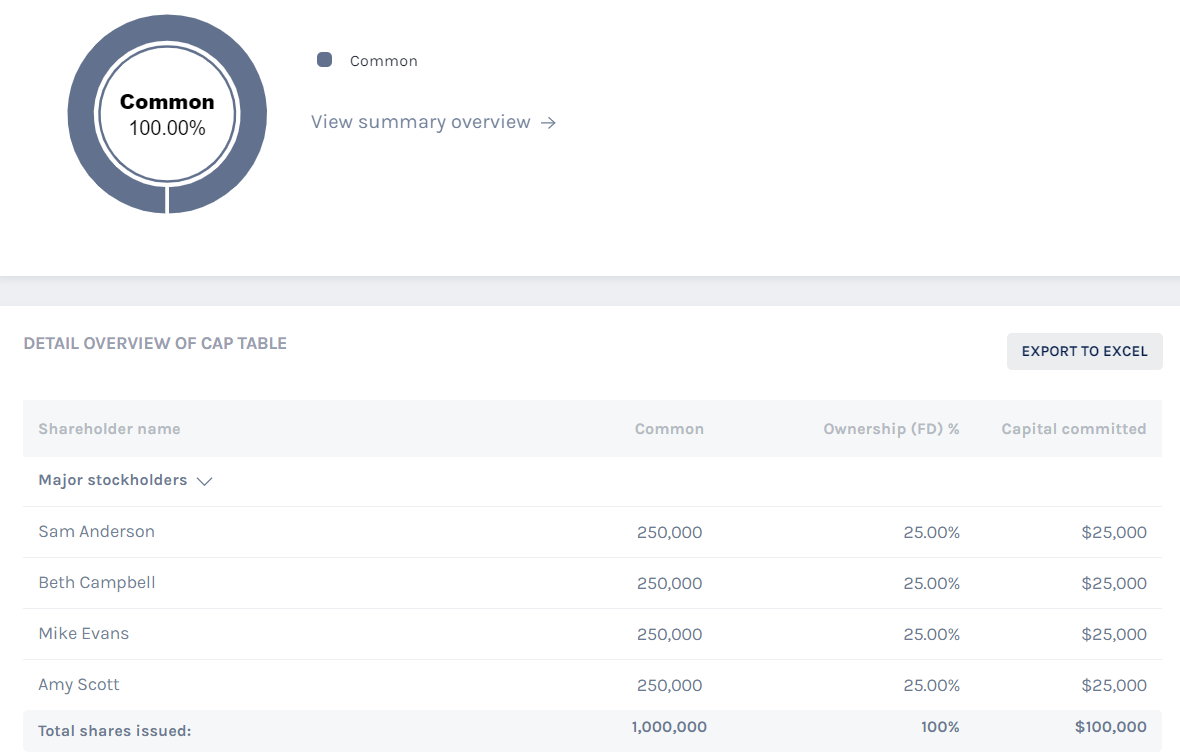

After you have entered in all the information for the share transfer, the company’s cap table would be updated with the new shareholder.

Now this is a simple example to illustrate how transferring shares in a corporation works, but no matter how complex your cap table may be, transferring your shares on the Eqvista platform can be easy and straightforward.

Transfer shares in your Corporation on Eqvista

Managing over a large corporation can be tricky, especially when it comes to the company shares. Corporations with as few as 20 shareholders to hundreds of owners often find it hard to manage their cap table and all the information needed to be recorded when they transfer their shares.

Eqvista is a sophisticated cap table software that can handle this. Authorize, issue, transfer, redeem, and perform all your share transactions on the Eqvista app.

If you have questions on the share transfer process or wondering how to initiate the transfer of shares in a corporation, you can reach out to us Eqvista and explore how our software can help you manage your shares!

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!