Benefits of Using Tax and Equity consultation for Equity Investments

In this article, we will dive a little deeper into such benefits of seeking help from advisors when making equity investments.

To navigate the complex world of equity investment taxation, you need more than just a basic understanding of financial markets. You will need the support of a tax consultant who combines finance-savvy with expertise.

Professional tax consultant can help you comply with evolving regulations and capitalize on opportunities for savings. A professional tax and equity consultant will ensure you do not miss out on any opportunities for loss harvesting, and utilizing credits. Such expertise is especially important when dealing with complex equity investments like non-qualified deferred compensations (NQDCs) and international investments.

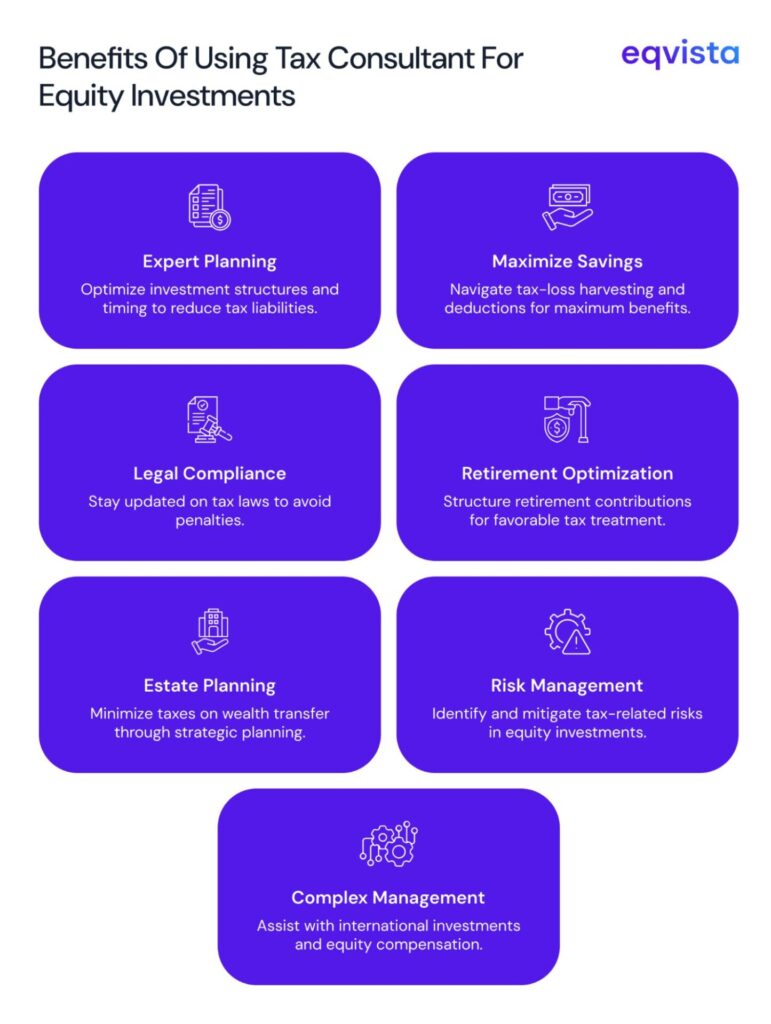

Key Benefits of Hiring a Tax and Equity Consultation for Equity Investments

Some of the key benefits of hiring a consultant for equity investments are as follows:

Expert Planning and Strategy

Your tax liabilities can change drastically depending on the equity investment structures, timing, and whether you are an individual or a corporation. An advisor will understand these nuances and will ensure that you structure and time your equity investment to optimize outcomes.

Whether you are a corporation contemplating an acquisition or an employee trying to minimize taxes on your stock options, an experienced advisor can identify efficient equity investment opportunities for you.

Maximizing Savings

You may be aware that you can reduce your taxable income by reporting your loss. This practice is known as tax-loss harvesting. However, there are various caveats relating to the type of loss that can be harvested and the extent to which a certain loss can be harvested.

Similarly, with deductions and credits, there are various terms and conditions you must be careful about.

To ensure that you take maximum advantage of loss harvesting, deductions and credits, you need the help of someone with in-depth knowledge. Employees can also get valuable insights from advisors about equity investment structuring cases like the early exercise of stock options and 83(b) elections.

Compliance with Laws and Regulations

Tax laws and regulations can change over time because equity investments have evolved, for political reasons, or because of serious offenders. For instance, Section 409A was introduced because Enron’s executives were found abusing equity compensation plans as the company was headed toward bankruptcy.

It can be incredibly difficult to keep track of tax law changes and revisions in how authorities interpret them. Even the smallest misinterpretation can result in hefty penalties or audits.

Optimizing Retirement Accounts and Tax-Deferred Investments

Tax consultants can help companies structure contributions to retirement accounts like Individual Retirement Accounts (IRAs) and 401(k)s in a way that secures favorable treatment. If you are considering equity investments, they can help you with strategies that secure exemption or deferral. Thus, advisors can help companies as well as employees minimize their liabilities.

Additionally, advisors can also recommend tax-efficient withdrawals from retirement accounts suitable to your financial situation and lifestyle needs.

Managing Complex Investment Scenarios

Tax consulting can help you expertly navigate the implications of international investments where you must consider the regulations and best practices in multiple jurisdictions. They can also help you structure private equity and venture capital investments to maximize efficiency.

When you receive equity-based compensations like stock options and restricted stock units (RSUs), you will have opportunities to lower your taxable income through the timing of investments and by avoiding double risks.

Estate Planning and Wealth Transfer

Consultants can suggest strategies for a tax-efficient wealth transfer. They can ensure that the beneficiaries have to bear the minimal burden. They can help you set up trusts and structure the wealth transfer to maximize the benefits from exemptions and deductions.

You can use their assistance in choosing from the numerous wealth transfer vehicles like revocable and irrevocable trusts, family limited partnerships (FLPs), and charitable remainder trusts (CRTs) so that the wealth transfer meets the financial needs of the beneficiary. Such alignment of vehicle structure and financial needs will help you minimize estate and gift taxes when you transfer equity investments.

Risk Management

You must carefully sidestep various tax-related risks while making equity investments. For instance, you should always check if you can qualify for long-term capital gains treatment by holding your equity investments for a little longer. If you want to harvest losses from an equity investment, you should wait until the wash sale rule is not applicable anymore to make a similar equity investment.

If you are receiving incentive stock options (ISOs), you must be careful not to trigger alternative minimum tax (AMT) since that can lead to unexpected liabilities.

How to Choose a Tax and Equity Consultant?

Choosing the right tax and equity consultant requires careful consideration of your specific needs, the consultant’s qualifications, and the services they offer.

Qualifications and Experience

Look for consultants with relevant certifications such as Chartered Financial Analyst (CFA) or Certified Valuation Analyst (CVA), especially if your equity investments involve complex instruments or private equity.

Ensure the consultant has demonstrable experience in equity investment taxation and has helped clients with similar profiles or industries.

Services Offered

Verify that the consultant offers services aligned with your needs, whether it’s comprehensive tax planning, equity valuation, 83(b) filings, QSBS guidance, or compliance support. Some firms provide end-to-end solutions including filing and business valuations, while others may focus solely on consultation or advisory.

Fee Structure

Understand the fee models—hourly rates, flat fees, or percentage-based fees—and compare them relative to the value and scope of services offered. Perform a cost-benefit analysis to ensure the consultant’s fees are justified by the potential tax savings and compliance benefits.

Use of Technology and Tools

Consultants who leverage advanced financial tools and technology can provide more accurate valuations, real-time reporting, and audit-ready documentation, enhancing transparency and efficiency.

Why Choose Eqvista’s Tax Consultation and Equity Service?

Eqvista’s tax consultation service is designed to provide expert guidance and support for equity-related tax matters, helping companies reduce risks and optimize tax outcomes.

- Expertise and Experience – In the six years since Eqvista’s inception, our team of accredited tax advisors has minimized the liabilities of more than 15,000 companies.

- Eqvista’s team consists of accredited and NACVA-certified valuation and tax professionals with extensive experience in helping over 19,000 companies minimize liabilities and comply with laws.

- Our services are specialized in equity investments and stock-based compensation, covering areas such as 409A valuations, ASC 718 compliance, and year-end reporting.

- Eqvista integrates advanced financial tools and technology to provide audit-ready, GAAP-compliant reporting and real-time valuation insights, which support informed decision-making.

- Eqvista offers a client-centric approach, tailoring consultation to each company’s unique needs without imposing preconceived solutions.

- Eqvista’s consultation helps companies manage tax compliance and optimize savings related to equity without providing direct advisory or decision-making services, which aligns with the distinction you noted between consultation and advisory.

Frequently Asked Questions (FAQs)

Some questions people frequently ask about Eqvista’s tax and equity services are as follows:

What makes Eqvista different from other tax consultation services?

Eqvista’s tax and equity consultation services are not limited to just recommending the right course of action. We also provide filing services and business valuations for equity income calculations. Additionally, we have partnered with various law firms to provide value-added services like drafting and filing of paperwork, and risk evaluations.

How does Eqvista help with equity investments and tax consultation?

At Eqvista, we help startups and employees reduce their taxable income and maximize their gains through prudent, research-backed, and tested solutions.

What is the process for getting started with Eqvista?

To get started with Eqvista’s tax and equity consultation services, you can simply set a calendar meeting with our sales team via this link.

What kind of clients does Eqvista typically work with?

Eqvista provides tax and equity consultation to startup founders, early employers, investors, entrepreneurs, and startups from various stages.

Maximize Equity Gains and Minimize Tax Liabilities with Eqvista!

Involving a tax consultant in your equity investment decisions has various benefits, including expert planning, maximizing savings, ensuring compliance with evolving tax laws, and optimizing retirement accounts.

Complex taxation scenarios like international equity investments and equity compensations can be simplified by consultants. Employees can benefit from professionally optimized retirement plans, estate plans, and gifts by getting tax and equity consultation.

If you are someone who needs assistance in maintaining compliance and minimizing tax liabilities, consider choosing Eqvista. Contact us today to explore the benefits of our tax and equity consultation services.

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!