Extended Cap Table Report on Eqvista

There are some instances where you might need your basic company report to share while making a deal as a founder. Keeping this in mind, Eqvista decided to help you with this so that you can easily get all the information you need with just a few clicks. If you have your company profile created on Eqvista, extracting the basic company report is easy. Here is how you do it.

EXTENDED CAP TABLE REPORT

But before we can talk about how to get your extended captable report from Eqvista, let us understand what a extended captable report is and where you will need it.

WHAT IS AN EXTENDED CAPTABLE REPORT?

An extended captable report is a report that includes all the primary issuances of the company. The report does not just show the main cap table and overview of things but also provides in-depth details of all the issuances that have taken place in the company. You will be able to see all the shareholders in the company, the common equities, the preferred equities, options, warrants, and convertible notes.

CREATE AN EXTENDED CAPTABLE REPORT ON EQVISTA

To generate the basic company report on Eqvista is quite easy. Here is the step-by-step process to get it:

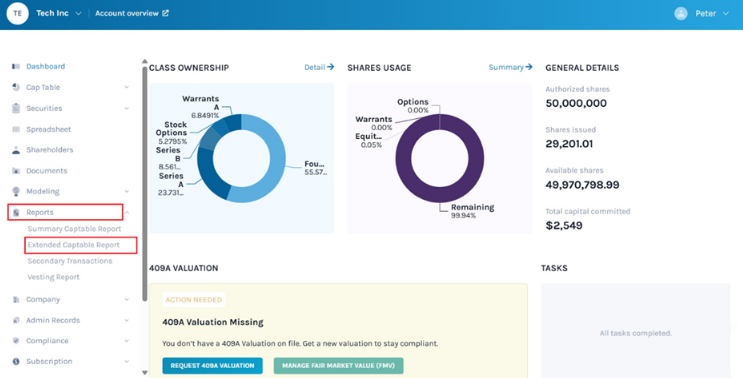

Step 1: Log into the application and select your company profile.

When you get to the dashboard, click on “Reports” from the left-side menu and select “Extended Captable Report”.

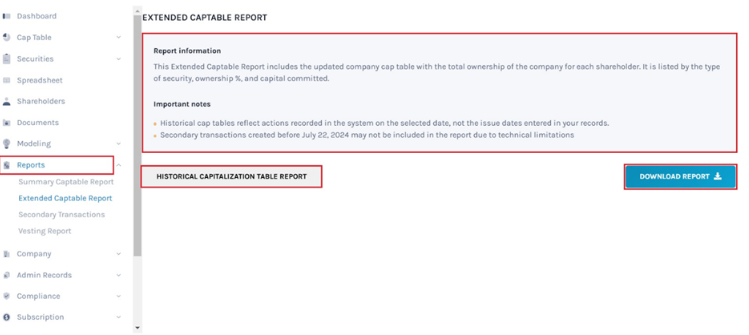

Step 2: Once you do this, you will see the report information shows up which says “This Extended Captable Report includes the updated company cap table with the total ownership of the company for each shareholder. It is listed by the type of security, ownership %, and capital committed.” with a button below it that says, “Download Report”.

Suppose you want to download past cap table reports, click on “Historical Capitalization Table Report” and select the date.

Then, click “Download Report” on the right-hand side of the page to download the report.

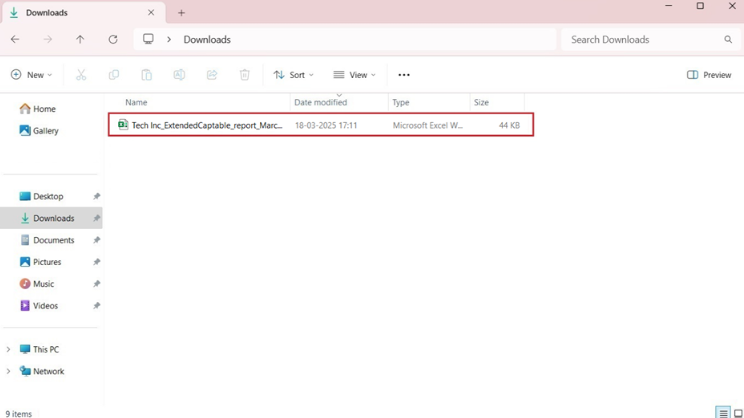

Step 3: Once you click, the report gets downloaded as an Excel sheet in your Downloads.

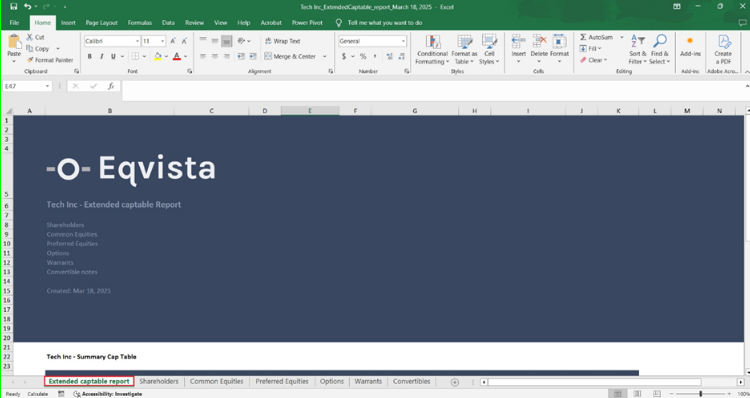

Step 4: Double-click the Excel sheet to open the downloaded report from the download folder in your system.

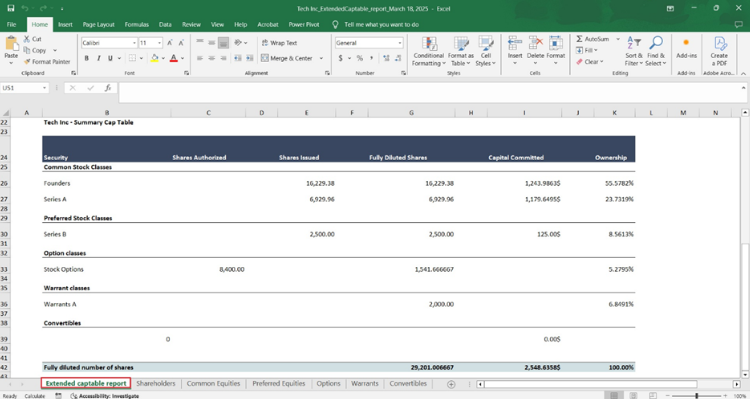

The report will have seven sheets with details. The first sheet is like a cover that tells what the report is about with the company name.

It also holds updated information on the company’s cap table. Listing all kinds of securities in the company, share authorized, shares issued, fully diluted shares, capital committed, and ownership percentage.

The remaining six sheets include details about:

A. SHAREHOLDERS

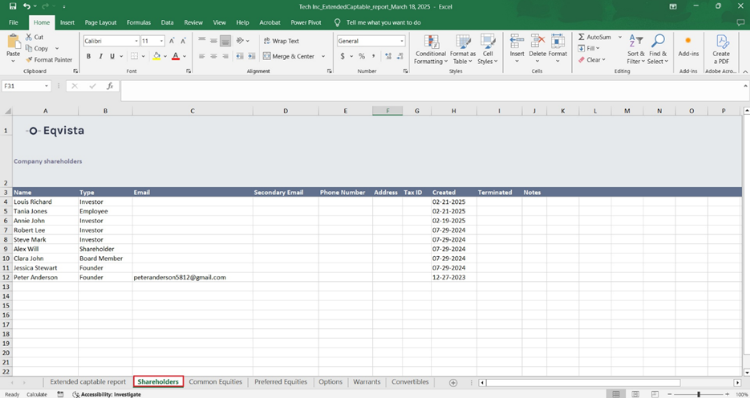

To view the sheet, click on the “Shareholders” tab, and the sheet will open up showing you all the shareholders in the company.

The role each shareholder plays in the company along with the shareholder details (Email, Phone Number, and Address), when they were created, terminated, and notes (if any).

B. COMMON EQUITIES

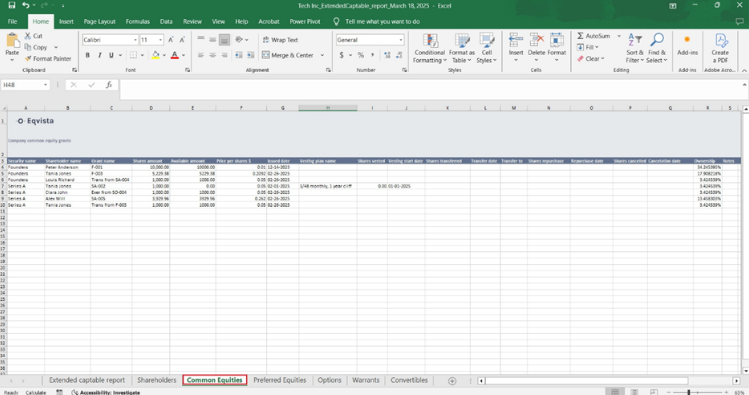

To view the next sheet, click on the tab with the name “Common Equities” at the bottom of the sheet. The next sheet will show up where you can see all the kinds of common equities that the company has.

Here, you can see:

- The common shares that have been given from which equity class, the shareholder’s name, the grant name, the number of shares, the outstanding shares available for transfer or repurchase, the price per share, the date it was issued, the vesting plan name, the vested shares, the vesting start date.

- Number of shares transferred, the transfer date, the name of transferred shares, the number of shares repurchased, the repurchase date, the number of shares canceled, the cancelation date, the ownership percentage of each shareholder, and notes (if any).

C. PREFERRED EQUITIES

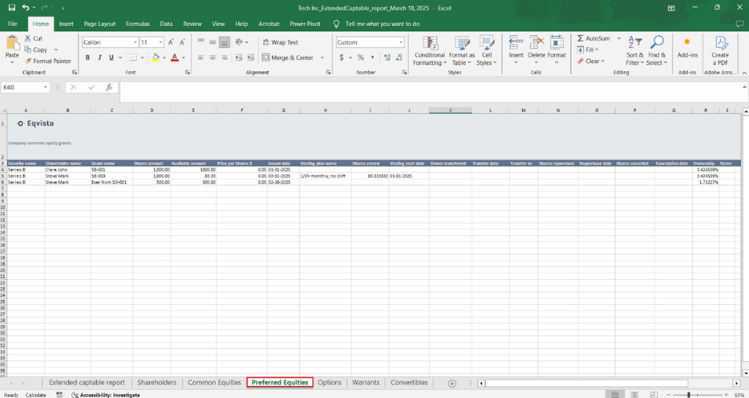

The next sheet shows all the preferred shares in the company. To view this, click on the “Preferred Equities” tab at the bottom of the sheet.

It holds details of:

- The preferred shares that have been given from which equity class, the shareholder’s name, the grant name, the number of shares, the outstanding shares available for transfer or repurchase, the price per share, the date it was issued, the vesting plan name, the vested shares, the vesting start date.

- Number of shares transferred, the transfer date, the name of transferred shares, the number of shares repurchased, the repurchase date, the number of shares canceled, the cancelation date, the ownership percentage of each shareholder, and notes (if any).

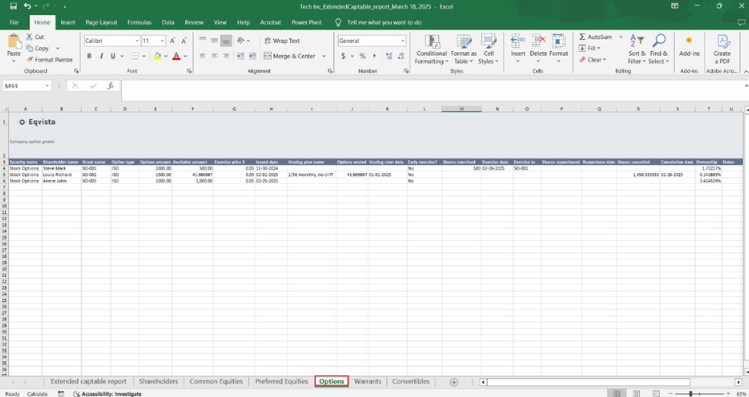

D. OPTIONS

The sheet also holds all the options that have been given out in the company. The next tab in the sheet would have the details of all the options given out in the company. To view this, click on “Options” from the bottom of the sheet.

Here, you can see:

- The options issued from which option class, the shareholder’s name, the grant name, the option type, the number of options, the outstanding options available for exercise or repurchase, exercise price, the date it was issued, the vesting plan name, the vested options, the vesting start date.

- The options can be early-exercised or not, the number of options exercised, the exercise date, and the name of exercised options.

- Number of options repurchased, the repurchase date, the number of options canceled, the cancelation date, the ownership percentage of each shareholder, and notes (if any).

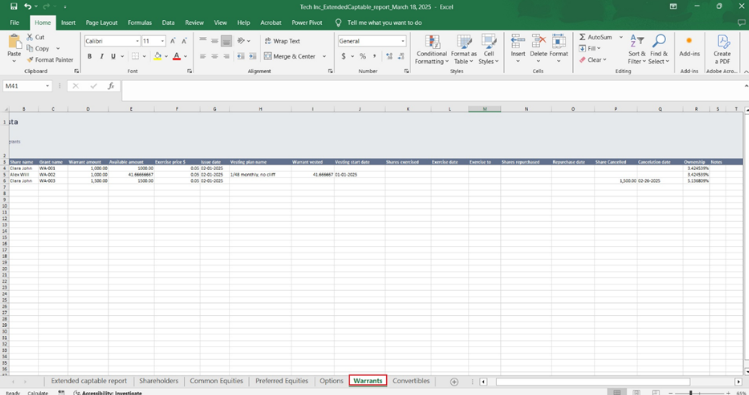

E. WARRANTS

The next sheet will let you know all about the warrants of the company. To view this, click on the “Warrants” tab at the bottom of the sheet.

It holds details of:

- The warrants issued from which warrant class, the shareholder’s name, the grant name, the number of warrants, the outstanding warrants available for exercise or repurchase, exercise price, the date it was issued, the vesting plan name, the vested warrants, the vesting start date.

- The number of warrants exercised, the exercise date, and the name of exercised warrants.

- Number of warrants repurchased, the repurchase date, the number of warrants canceled, the cancelation date, the ownership percentage of each shareholder, and notes (if any).

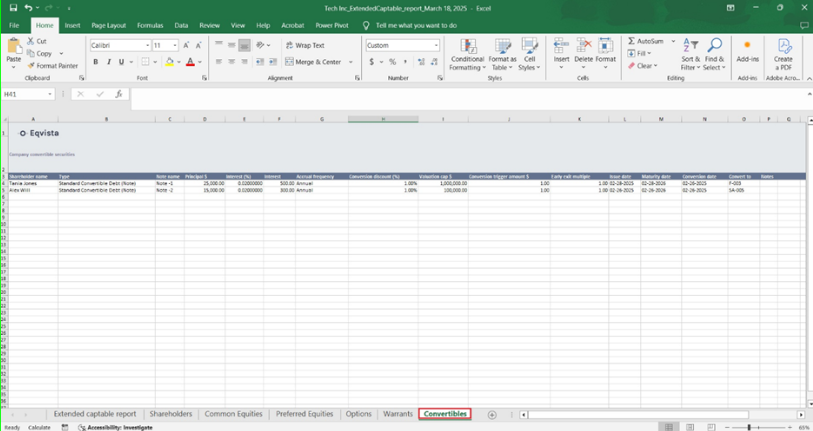

F. CONVERTIBLE NOTES

The last sheet in the report would be the convertible notes. To view this sheet, you will have to click on the “Convertibles” tab at the bottom of the sheet.

The details in the sheet include the shareholder’s name, the convertible note type, the note name, the principal amount, interest percentage, accrual frequency, conversion discount percentage, valuation cap, conversion trigger amount, early exit multiple, the maturity date, conversion date, the name of converted shares and notes (if any).

Just like this, you can now use Eqvista to get your company’s basic company report. To know more, contact us today or just check out our support articles here!