Stock Warrant Agreement

Here we will discuss what goes into a stock warrant agreement and the terms you should know when drafting one for your company.

Companies without fixed share prices often take advantage of warrants to provide investors and founders with an incentive. Unlike public companies, warrants issued by private companies are not there to raise company funding. Instead, they are mainly used as an incentive to reward founders and investors for their contribution towards the company.

Stock Warrant

Most of you reading this may have heard about stock warrants but don’t know what they precisely are. If you are one of those people too, no need to worry, as we will discuss what stock warrants are all about and why companies issue them.

What are Stock Warrants?

Warrants are essentially a derivative issued by companies to investors and founders, giving them the right to buy or sell securities (also referred to as equity) for specific prices, prior to expiration. The rates at which people can buy or sell the underlying security are also known as the strike price or exercise price.

What’s more, warrants issued by private companies have longer times (could be multiple years instead of months) between the issuing date and expiration compared to options. Contrary to popular belief, stock warrants do not give investors or founders voting rights or dividends.

Why do Companies Issue Stock Warrants?

Companies mainly issue stock warrants for raising capital, hoping to encourage investors to purchase their stock. They obtain funds after selling the warrant and they receive them again when purchasing stock with the warrant. Typically, warrants tend to be inexpensive, especially when you compare them with the underlying stock. It is a major reason why investors find them to be so appealing, particularly if they are for a new or unproven organization.

Surprisingly, the company issuing the warrant purchase agreement never loses anything even if the receiver loses out on money (because of not utilizing it.) Several reports and studies suggest that you are more likely to come across warrants from newer companies compared to blue-chip organizations. There are very few cases where well-established firms give out warrants. Why? Because unproven or newly opened firms need more money than well-established organizations.

However, some investors may not find the risk to be appealing. Stock warrants are an excellent way to test stocks before diving in.

For private organizations these warrants are often used as an incentive or reward for founders or investors, without the hassle of creating a separate option pool. While less common than options, they are more like one-off equity awards, which could be worth something big if the company share price increases, and the difference between the strike price and share price is great.

How do Stock Warrants Work?

Stock warrants bear a lot of resemblance with call options in the sense that they offer holders the right to purchase a company’s shares at specific prices prior to the warrant’s expiry. Quite a lot of people are not aware of how a warrant purchase agreement works. If you are one of those people too, there is no need to worry, as we will discuss how stock warrants work.

First off, it’s worth keeping in mind that warrant holders can exercise their warrants with the present stock prices. Alternatively, they can sell their warrants too. If the present stock prices are lower than the strike price, exercising this would not be a feasible option as it is cheaper to purchase stocks from the stock market itself.

For instance, if the warrants strike is around $40, and the stock is trading around $30, exercising your right to purchase the stock for $40 when you can simply purchase it for $30 would not be prudent. That said, if the stock trades around $50 and the warrant’s strike is $40, exercising the warrant would be a wise choice. You don’t have to necessarily exercise your warrant just because the present stock price is over the strike price.

In case there is a fair bit of time left for the warrant to expire, holding them for an extra few weeks or months could result in more profits. For example, if the stock increases to $80 during the next year, the warrant will be more valuable. In addition, the warrant holder will be well within his or her rights to purchase the $80 stock for $40, and the best thing about it is that they can give away those shares for $80.

Note: For private companies without an established market price, the company would need to undergo a 409a valuation to find its fair market value.

Stock Warrant Agreement

A stock warrant agreement is essentially a statement that governs a warrant issuance. In case you do not know, warrants are documents that come with security, and they offer the holders the chance to purchase shares from those securities at specific prices on set dates. Not every warrant is the same, and the terms discussed on the warrant agreement are essential for finding out the warrant’s actual value.

What is a Stock Warrant Agreement?

A common stock purchase warrant agreement has a lot of moving components and features.

No matter which type of stock warrant deal is happening, the recipient will be well within their right to tell the company when they plan to exercise their purchasing rights for the underlying stock. As soon as the company that issued the stock warrant receives the purchase notice, it issues new stock shares allowing you to trade more shares from that stock.

This will eventually improve the company’s overall stock shares, leading to diluted stock prices, which always comes in handy. A warrant purchase agreement also has pricing mechanisms, which the issuing company declares after offering a new bond. Finally, as mentioned numerous times in this piece, stock warrants have expiration dates written on the contracts.

Key Terms in Stock Warrant

When discussing stock warrants, people use a variety of terms that can be difficult to understand for those who are new. However, knowing what they mean is essential, as it could help you utilize stock warrants the right way. Here are a few key terms that you will come across in almost every stock warrant agreement template.

- Warrant Price/Exercise Price/Strike Price – As the name implies, warrant price is essentially the current price of your warrant and the rate at which you can sell it. Some people also refer to this as strike price and exercise price and use this term interchangeably.

- Number of Stock Warrants – The term “number of stock warrants” simply refers to the amount of stocks you possess. Some investors tend to have multiple stock warrants, which significantly increases their chances for profitability.

- Issue Date – Issue date is the term used to describe the exact date when the company issued the stock warrant agreement. It is essentially the initial date when the recipient got their warrant.

- Expiration Date – The term “expiration date” is quite self-explanatory, especially when it comes to stock warrants. It simply refers to the last day you can use your warrant. Exercising your warrant after the expiration day is not possible and will not yield any profits whatsoever.

Stock warrant agreements, if utilized the right way, could lead to massive profits down the line. Therefore, it would be best to hold onto yours instead of rushing things, and preferably choose a reputable broker to exercise the warrant on your behalf in case of public companies, or deal with the company directly for private firms.

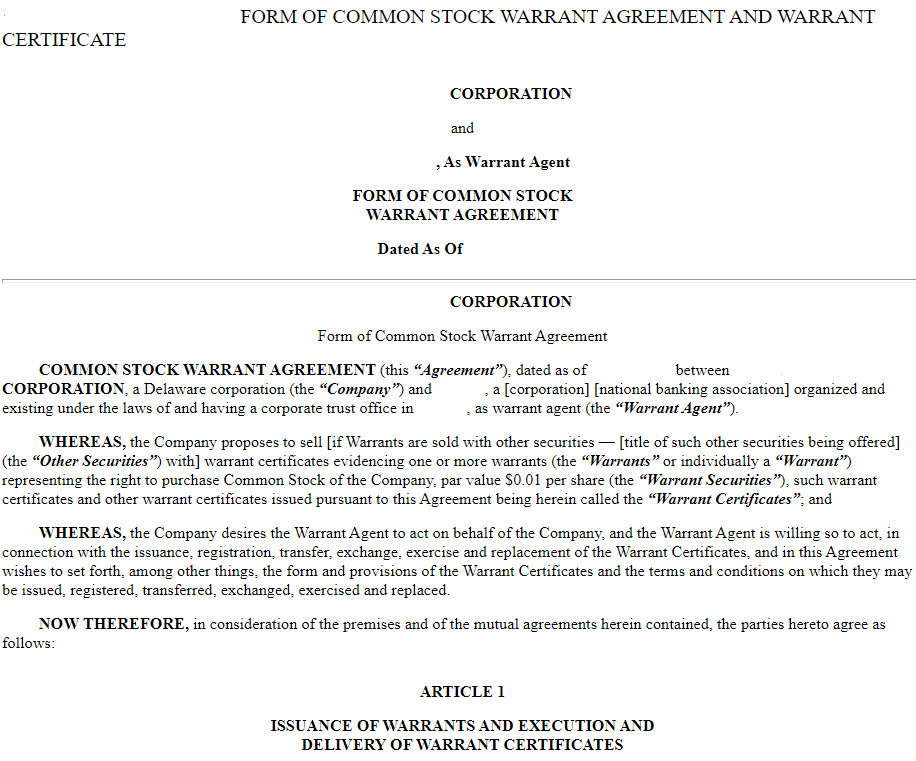

Sample Stock Warrant Agreement & Certificate

Similar to the more common form of stock options, there are also sample stock warrant template agreements online, usually from larger firms. Upon viewing, you can see how they outline their terms from the number of company warrants, exercise price, issue date, and expiration date.

While some of the terms used and more minute details may differ from stock option agreement, the overall outline is generally the same.

Store your Stock Warrant Agreement on Eqvista

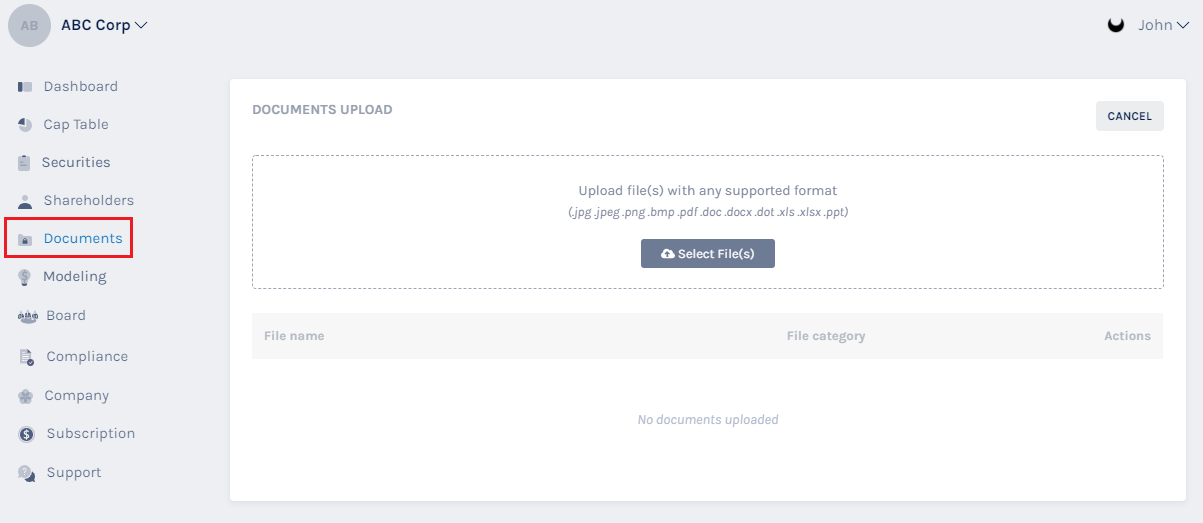

The Eqvista App allows companies to store their important documents and share it with users seamlessly online. Once you have your Stock Warrant Agreement ready for your company, you can store this document right on the app.

From the Dashboard, go to the “Documents” section on the left-hand side, and add a new document from your computer.

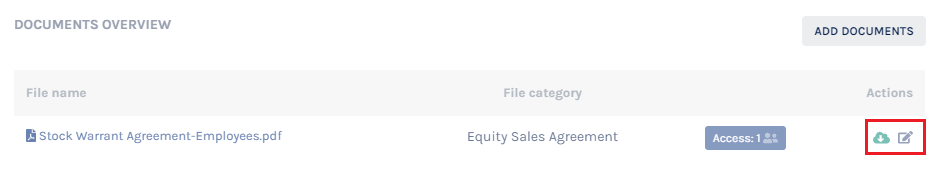

Once the Warrant Agreement has been uploaded to the software, you can use different functions such as download, edit, and share access to other users.

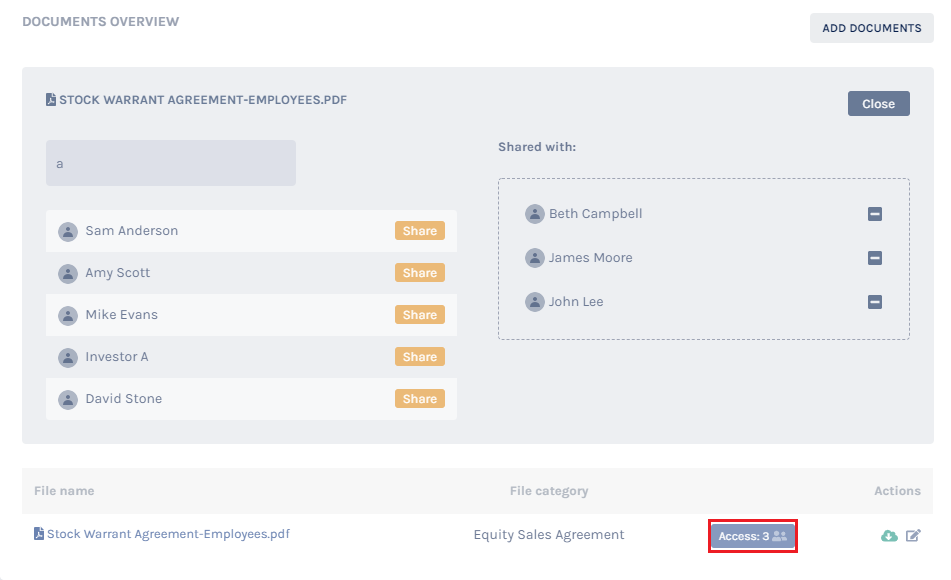

Once you click on the Access button, you can go through your user list, and easily add more people to access the document with the click of a button.

Once users have access to the document, it will appear in their personal shareholder accounts, and they can view it on the app. If they have admin functions as well, they can edit it or add more documents to share with more users all online.

Conclusion

Stock warrants can be quite confusing when you do not know the fundamentals. However, with the information and terms covered in this article, understanding it will be a breeze, making sure that you know how and when to exercise them. Also how to adequately store the warrant agreement documents for later use.

Eqvista is a user equity management software that can manage and store all your stock warrant agreements. Our online software also helps companies issue their company shares and manage different types of shareholders.

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!