Stock Option Agreement

Whenever a company offers its workers with employee stock options, they do it through a unique contract known as a stock option agreement.

A stock option is a form of compensation giving employees an incentive to join an organization or stay at a company for a particular period. However, the way you execute your stock option agreement is a massive determinant of how it pays off employees and the company. It doesn’t matter whether a fresh startup offers its employees with stock options, but more so how it drafts the stock option agreement before issuing employee stock options.

Stock Option Agreement

Many online resources have definitions for stock option agreements. However what goes into an agreement and the small details is really what’s important on how the agreement is defined. Let’s take a look.

What is a Stock Option Agreement?

Also referred to as stock options, many organizations use stock option agreements to attract and retain high performing and reliable talent, making sure they remain invested in the organization for a long time. As mentioned earlier, companies give stock option agreements to key employees while hiring them or giving them greater responsibilities in the organization. Whenever a company offers its workers with employee stock options, they do it through a unique contract known as a stock option agreement.

An option like this, once given to the employee, offers them the chance to take advantage of increases in the organization’s share value by offering the right to purchase shares down the line. They can buy these shares at prices equal to or lower than the fair market value at the time when they received the grant.

Furthermore, the option agreement details every term present on the offer, which also includes time limits (to exercise any special conditions), and vesting schedule. There are several essential provisions and documents when it comes to offering stock options. Let us take a close look at four of the most important ones.

- Stock Option Grant Notice – Although the stock option notice is not always present in stock option agreements, it tends to be there in most cases. This document provides a short summary of the grant’s material terms, and generally this document is there to fulfill the requirements present on the SEC notice. In addition, the document may contain disclosures in some cases.

- Individual Stock Option Agreement – As the name implies, an individual stock option agreement is a customized contract offered by the organization and any specific optionee. It specifies the amount of options an employee can rightfully exercise, the vesting schedule, the different forms of options granted, and various other employee specific issuance terms.

- Exercise Agreement – The exercise agreement document essentially defines the terms employees have to abide by when they decide to exercise their options.

- Stock Option Plans – Stock option plans are essentially the document that governs the organization’s stock options issuance. This plan usually consists of the terms and conditions to be granted, which also includes the limitations and purchase price. Traditionally, stock option plans are a standard document for the options offered to workers at the same time.

Key Terms in Stock Option

Just like warrant agreements, stock options also have a variety of essential terms you should familiarize yourself with. These terms are essential when drafting a stock option agreement and should be known in negotiation. They are as follows:

- Vesting Period – In most cases, an employee cannot exercise their stock options immediately. Instead, they have to abide by a vesting schedule, according to which a stock option vests over time (it usually takes a few years).

- Cliff – The term “cliff” represents a particular time in the vesting period before shares become available. For instance, a pattern that most individuals see is that shares do not vest in the first year after an option grant. Once the cliff period is over, a part of the option generally vests on a quarterly or monthly basis.

- Strike Price or Exercise Price – The rate at which employees can purchase stock in the exercise period is the “exercise price” or “strike price”. It is worth remembering that the price should be fair market value, however, some people tend to calculate the range price by looking at the closing stock price (this is for public companies). However, when it comes to privately held companies, they look at formal valuations, like a 409a valuation.

- Exercise Date – The exercise date signifies when an employee receives the stock in accordance with the stock option agreement.

- Expiration Date – As the name suggests, this is the period where the exercise period comes to an end. After this, the option will no longer be available to the employee.

- Grant Date – This is the date during which the company offers an employee the opportunity to purchase a set amount of shares at a particular exercise price.

- Clawback Provisions – The clawback provisions are a list of conditions, which give employers the right to take back the portion of the option not exercised during a triggering event. Traditionally, this provision consists of corporate events, for instance, employee related events, bankruptcy, termination etc.

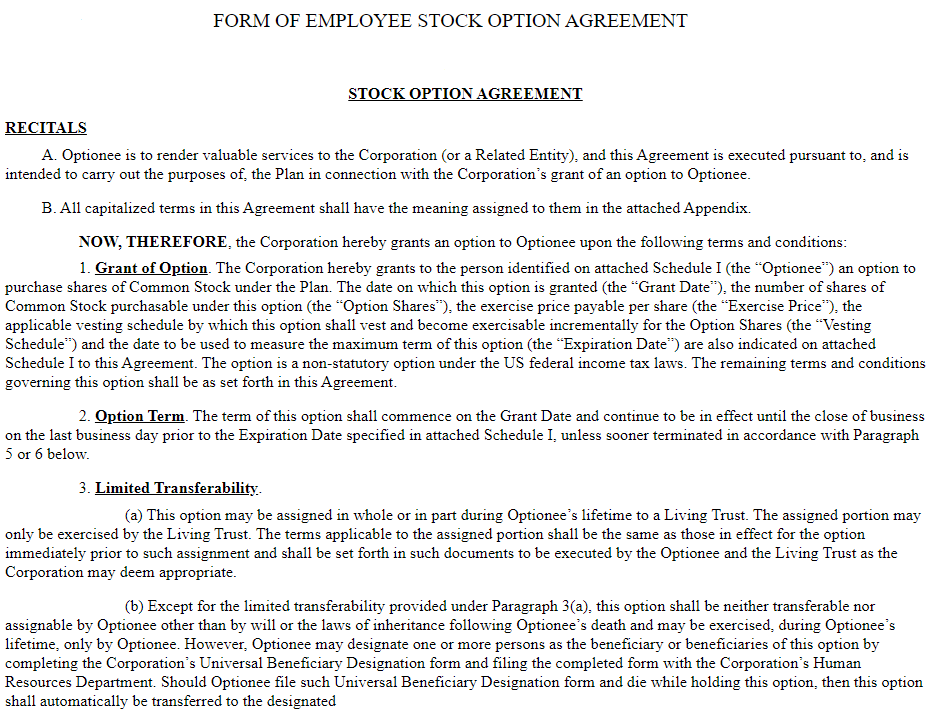

Stock Option Agreement Template

Many people wonder what a stock option agreement startup template looks like and what are the stock option terms used in it.

In every stock option agreement template, you will find a notice of the stock option grant. In this portion of the template, you will find things like the optionee’s name, total amount of shares granted, grant date, exercise price for every share, grant date, vesting schedule, termination period, expiration date/term of award.

The second portion of the agreement discusses the terms regarding the option grant and when and how you can exercise those options. It is important to abide by these terms, as not doing so could lead to problems down the road. It would also help if you went through the “methods of exercise” part of the template, as it details how you can exercise your stock options the right way.

SEC Guidelines and Form S-8 Filing

There have been a lot of questions about SEC guidelines and Form S-8 filing, mainly because of how confusing they can be to understand. Let us take a close look at both and discuss them in the simplest way possible.

Stock Option Contracts and SEC Guidelines

As you would expect, every contract issuing stock options should comply with the regulations of SEC securities. Therefore, every option agreement’s provision should be compliant, and the security issued should be properly registered.

Moreover, employees issued stock should have the same notices and disclosures available to every other investor. Therefore, consulting a lawyer with experience prior to issuing stock options would be a wise choice.

What is Form S-8 Filing?

S-8 filings are essentially SEC filings needed for companies that wish to offer their employees equity. The S-8 form provides the details of internal options to employees, which bears a lot of resemblance to filing prospectus. An organization gives an S-8 filing for programs intended to benefit personnel, which includes trustees, directors, workers, general partners, consultants, the company’s officers, advisors, and consultants.

In most cases, their schemes would include people who worked as a consultant for an organization, even though they did not have any experience offering such services. The individual may even act to promote stocks for giving its market price a massive boost. Doing so, would help them obtain a high amount of shares from an internal program. You would have to register this program through S-8 filing, after which it instantly sells all shares in the public market.

After sometime, there were massive changes made to the registration requirements people had to follow for S-8 filings.

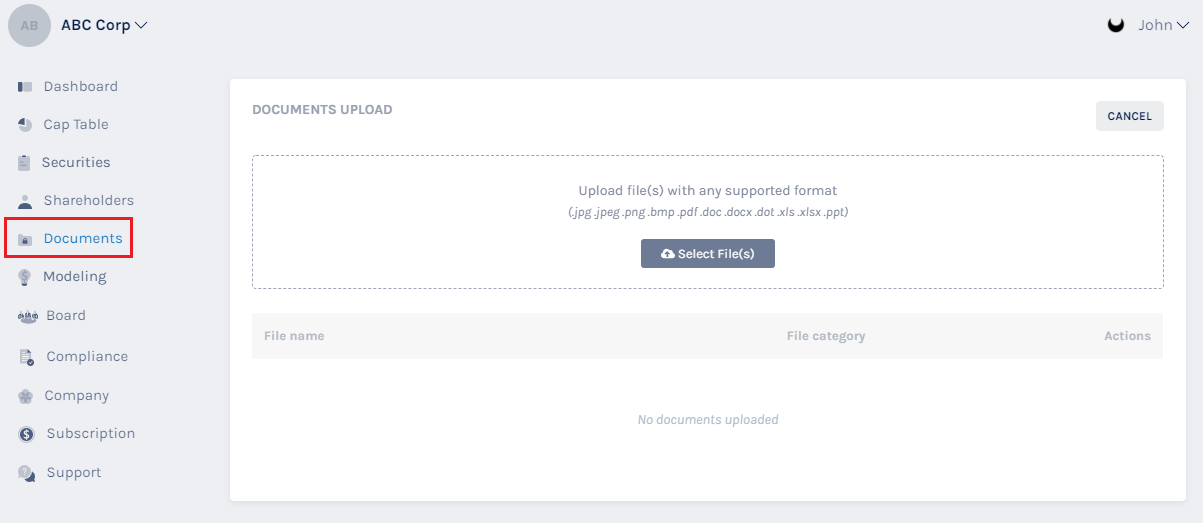

Store your Stock Option Agreement on Eqvista

The Eqvista App allows companies to store their important company documents and share it with the founders, employees or investors. Once you have your Stock Option Agreement ready and drafted for your company, you can store this document right on the app.

From the Dashboard, go to the “Documents” section on the side bar, and add a new document from your computer.

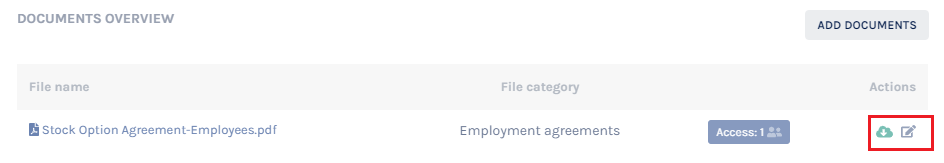

Once the document has been uploaded to the App, you can use various functions such as download, edit, and share access to other users.

Once you click on the Access button, you can go through your shareholder/admin list, and easily add users to access the document with the click of a button.

Once these users have access to the document, it will appear in their individual accounts, and they can view it on the app. If they also have admin functions, they can edit the document as well, like changing the name, file category, or add more documents as well.

Conclusion

Stock options can be quite complicated when you do not know the fundamentals. However, with the information discussed in this piece, understanding it will be a walk in the park, making sure that you know how and when to exercise them and make the most out of it.

Eqvista is a user friendly equity management software that can manage and store all your stock options agreements. Our software also helps companies issue and track their company share grants and organize different types of shareholders.

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!