Patent Valuation – How to Value Patents?

Because patents are valuable assets to businesses, it’s critical for investors to understand how to value and account for them.

Innovation is the most crucial method for firms to stay competitive in the marketplace, and the only way to preserve that competitive advantage is to protect original ideas and prevent others from using them. Patents allow firms to protect their ideas from other users, at least for a limited time. Because patents are valuable assets to businesses, it’s critical for investors to understand how to value and account for them.

Patent valuation in business

The practice of calculating the real market worth of a patent or patent portfolio is known as patent valuation. This valuation is required when companies or inventors are discussing arrangements such as mergers, acquisitions, sales, or licensing of inventions. A patent is essential for intellectual property (IP) rights, intangible assets, and brands.

What is a patent?

A patent, in general, refers to an invention or technique that has been disclosed and registered with a governing body. In exchange for this information, the patent owner is granted an exclusive right to prevent others from utilizing or exploiting the invention in a given territory for a set number of years.

Why are patents important for a business?

A patent is necessary because it protects your invention. It has the power to protect any product, design, or method that meets certain criteria for originality, practicability, appropriateness, and utility. A patent can usually protect an invention for up to 20 years. The application process must be completed after you have published a description of your innovation, publicly disclosed the product, sold it or made your item available for commercial use.

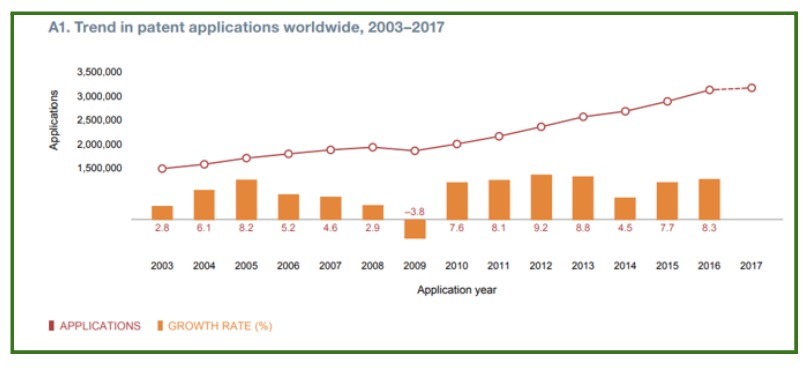

In 2022, a record 3.46 million patent applications were filed globally, up 1.7% from 2021. China, the US, South Korea, and Germany were the top countries for patent filings. China led with around 1.58 million applications. The US, Japan, South Korea, and Germany followed. India saw significant growth, with a 31.6% increase compared to 2021, despite ranking 7th in the number of applications filed.

*Number of Global Patent Filings

Fortunately, the one-year requirement allows the inventor to evaluate their product before investing in the application. Take extreme caution. If you have a foreign product, patent protection is not accessible for an innovation that has been made public before a formal application has been filed.

Types of patents

There are different kinds of patents that are used for businesses having different notations, which are explained below:

- Utility patent – Anyone who invents or discovers a new and useful process, the machine, article of manufacture, composition of matter, or any new beneficial improvement thereof, may be issued a utility patent. Utility patent applications account for the vast majority of applications filed at the (United States Patent and Trademark Office) USPTO.

- Design Patent – The visual decorative elements embodied in or applied to a product of manufacture are referred to as design. The subject matter of a design application can relate to the configuration or shape of an object, the surface ornamentation applied to an article or a combination of configuration and surface ornamentation. A surface decoration design is inextricably linked to the article to which it is applied and cannot exist alone. It has to be a distinct pattern of surface ornamentation added to a manufactured item.

- Plant Patent – Anyone who invents or discovers and asexually reproduces any different and new type of plant may be issued a plant patent. An inventor (or the inventor’s heirs or assigns) who has invented or discovered and asexually reproduced a different and novel variety of plant, other than a tuber propagated plant or a plant found in an uncultivated state, is issued a plant by the United States government.

What are some important patent applications?

Patent applications act as an important tool used to value and know the worth of a certain kind of business allocation and how it can be differentiated from other businesses. These patent applications are further explained below:

- Provisional patents – A provisional application, according to US patent law, is a legal document submitted with the US Patent and Trademark Office that establishes an early filing date but does not mature into an issued until the applicant submits a standard non-provisional patent application within one year.

- Complete patents – In the first instance, as a complete patent application with a thorough specification completely detailing the invention and how it is to be implemented, as well as illustrative drawings (where relevant) and claims identifying the subject matter for which protection is claimed.

Laws associated with patents

The section of intellectual property law that deals with new innovations is known as patent law. Circuit boards, automobile engines, heating coils, and zippers are examples of actual scientific inventions that are protected by standard patents. Patents have, however, been used to protect a greater range of inventions over time, including coding systems, business processes, and genetically modified creatures.

Application: A set of paperwork must be submitted to the USPTO to receive a patent.

Agent: A person who is not a lawyer but is authorized to file patent applications on behalf of inventors but is not an attorney.

Claims: The section of the patent application defines the part of the invention that is new and nonobvious, as well as the part of the invention that can be protected later.

A patent application was filed with the USPTO for an innovation previously patented in another nation. The same person usually files both applications. Infringement is the act of producing or selling a patented device without first obtaining a license from the owner.

Prior Art: The state of the industry prior to the patent filing. Because they are not new, things that are considered previous art are not eligible for protection.

The process of applying for and getting a patent is known as patent prosecution.

The process of defending against infringement is known as patent litigation.

Patent Valuation

An organization or a business has both tangible and intangible assets in the form of intellectual property such as patents. A company or organization invests in research and development operations to get a patent. The economic assessment of a company’s intellectual property aids in making judgments not just about the company’s assets, but also about commercialization and transactions. The licensing and assignment of intellectual property are the most important transaction decisions made in the market.

When is a patent valuation required in a business?

A patent valuation has become extremely equivalent today in terms of business, and it helps to protect the brand from getting identical to the other brands. They are required when we do the following:

- M&A, joint venture, and bankruptcy – IP acquisition sometimes necessitates fewer resources than a traditional research and development cycle (time and money). Depending on the IP status and asset maturity, the possibility of the produced products or services becoming commercially viable increases in a merger or acquisition.

- When negotiating – Because patent acquisition is an expensive and time-consuming process, even before factoring in the R&D costs of designing a product or process, having a clear understanding of how you want to monetize your patent is critical. And in some circumstances, the earlier you begin the procedure, the better; in fact, it is recommended that you begin the process during the invention’s development stage.

- Patent conflict or dispute – Patent infringement lawsuits are not rare. The vast majority of patent disputes fall into one of two categories: those between market competitors and those brought by a third party in an attempt to monetize portfolio. Licensing agreement disagreements are also rather prevalent. According to most experts, litigation should only be used as a last resort when it comes to resolving patent issues. Because litigation can cause significant business disruption and expense, it’s important to consider all options before going to court.

- Fundraising – Fundraising, often known as fund-raising, is the process of obtaining voluntary financial donations from individuals, businesses, charity institutions, and government agencies. Although fundraising is most commonly associated with efforts to raise funds for non-profit organizations, it can also apply to the identification and solicitation of investors or other funding sources for for-profit businesses.

- Patent protection – The owner has the sole right to prevent or stop others from profiting from the protected invention. In other words, protection prevents others from commercializing, using, distributing, importing, or selling the innovation without the owner’s permission.

- Accounting and taxation – A tax patent describes and claims a system or technique for decreasing or delaying taxes. Tax patents are most commonly issued in the United States, but they can also be granted in other nations. When a firm purchases a patent from its inventory or from another company, the patent or intangible asset account is debited, and the cash account is credited. The patent is amortized at the end of the term by debiting amortization expenditure and crediting accrued amortization.

How to value patents?

Traditionally, three techniques for patent valuation have been used: the market approach, income approach, and cost approach. The current value of cash flow or cost savings that a patent will bring will be the value under the income approach.

Patent valuation methods

Patent valuation is an approach to calculating the real market value of the patent so that the patent owners can generate money from their intellectual property rights. Here are the patent valuation methods:

Cost-based method of Patent Valuation

According to this method, the value of a patent is the replacement cost, or the money required to replace the invention’s protection right. If an inventor has a patented item, the patent’s worth is equal to the amount of money required to replace the invention.

Pros and Cons of Cost-based method of patent valuation

The cost-based approach to patent valuation has both advantages and limitations. Here are the key pros and cons:

| Pros of Cost-based method of patent valuation | Cons of Cost-based method of patent valuation |

|---|---|

| Provides a tangible baseline value based on the actual costs incurred in acquiring, maintaining, and enforcing the patent. | Does not account for the patent's future earning potential, market demand, or income-generating capacity.Fails to consider factors that contribute to a patent's true worth. |

| The cost-based patent valuation method is built on objective and verifiable data, not subjective estimates or forecasts. | May overvalue patents with high development costs but limited commercial viability, or undervalue highly profitable patents with relatively low acquisition costs |

| Useful for valuing new or unique patents that lack comparable market transactions or income streams. | Challenging to accurately quantify indirect costs like opportunity costs and risk premiums |

Example for the cost-based approach to patent valuation

Consider a car company that invented a new car wheel design. Using the replacement cost method, let’s estimate the patent valuation:

- R&D Expertise: Highly specialized engineers might be needed, costing $200/hour. Estimating 200 hours of development effort translates to $40,000.

- Prototyping Costs: Advanced materials and fabrication techniques might push prototyping costs to $10,000.

- Patent Filing and Legal Fees: Similar to the original scenario, assume $5,000.

Replacement Cost Estimate: $40,000 (R&D) + $10,000 (Prototyping) + $5,000 (Legal) = $55,000

As we’ve seen, the cost approach provides an initial valuation. However, it’s important to note that this is just a starting point, not the ultimate assessment.

Market-based method of Patent Valuation

This strategy entails figuring out how much a prospective buyer would pay for a similar property. In other words, the patent’s value is roughly comparable to the value of identical patents or patented products that have already been sold and purchased.

Pros of Market-based method of patent valuation

The market-based approach to patent valuation has several pros and cons:

| Pros of Market-based method of patent valuation | Cons of Market-based method of patent valuation |

|---|---|

| Reflects the actual market value of a patent based on comparable transactions or licensing deals for similar patents. | Challenging to find truly comparable patents due to differences in scope, technology, geographic coverage, and other factors. |

| Provides an objective and unbiased valuation by relying on real-world market data rather than subjective estimates or projections | Fails to account for the patent owner's specific circumstances, such as their ability to commercialize or enforce the patent effectively. |

| Useful for valuing patents with limited income potential or cost data, where other valuation methods may not be applicable | It is time-consuming and expensive to gather and analyze relevant market data, especially for large patent portfolios. |

Example for Market-based method of patent valuation

Identify similar patents that have been sold recently. These patents should be comparable regarding technology, market, and other relevant factors.

Collect information about the sale prices of these comparable patents. For example:

- Patent X sold for $160,000.

- Patent Y sold for $150,000.

- Patent Z sold for $140,000.

Add up the sale prices of the comparable patents and divide by the number of transactions to find the average:

- ($160,000 + $150,000 + $140,000) / 3 = $150,000

In this case, the estimated value is $150,000. For the final valuation, adjust the estimated value based on the patent’s uniqueness, market demand, and competitive advantages.

Income-based method of Patent Valuation

When determining valuation, this method considers future cash flows. It asserts that the present value of the increased cash flows or cost savings that a patent will assist generate is the worth of the invention. When a corporation or individual develops a product with the potential to be patented, the goal is that the patented product would enhance sales or, at the very least, save money for the company.

Pros and Cons of Income-based method of patent valuation

Here are the key pros and cons of income-based method of patent valuation:

| Pros of Income-based method of patent valuation: | Cons of Income-based method of patent valuation: |

|---|---|

| When applied consistently across a patent portfolio, it facilitates meaningful comparisons and portfolio management decisions. | All changes in input variables like discount rates or growth assumptions can significantly impact the valuation outcome, leading to potential over- or undervaluation |

| It allows for the incorporation of various assumptions and scenarios, enabling a more comprehensive analysis. | Obtaining accurate and reliable data for cash flow projections and risk assessments can be challenging, particularly for new or emerging technologies. |

| By discounting future cash flows to their present value, it incorporates the principle that money received today is worth more than the same amount in the future. | Accounting for various risk factors can be complex and time-consuming, especially for early-stage or unproven technologies. |

Example for Income-based method of patent valuation

Lumi Inc., a startup with a patented smartwatch strap design incorporating health sensors, expects $300,000 annual income from royalties on projected sales of 200,000 straps at $50 each with a 3% royalty rate. To determine the present value of this future income stream considering the patent’s 5-year lifespan and risk, they will perform a Discounted Cash Flow (DCF) analysis using an 8% discount rate.

Discounted Cash Flows:

- PV1 = $300,000 / (1 + 0.08)^1 = $277,778

- PV2 = $300,000 / (1 + 0.08)^2 = $257,202

- PV3 = $300,000 / (1 + 0.08)^3 = $238,150

- PV4 = $300,000 / (1 + 0.08)^4 = $220,509

- PV5 = $300,000 / (1 + 0.08)^5 = $204,175

Total Present Value (PV):

PV = PV1 + PV2 + PV3 + PV4 + PV5

PV = $1,197,813

Estimated Patent Value:

The present value of all future royalty income represents the estimated patent value using the income approach, which is approximately $1,197,813.

Option-based method of Patent Valuation

The key similarity is that a patent gives its owner the right to prevent others from using the underlying invention, so patents and stock options both represent the ability to utilize an asset in the future while preventing others from doing so.

Pros and cons of Option-based method of patent valuation

The option-based approach, which applies principles from financial option pricing models to value the flexibility and uncertainties associated with patents, has several pros and cons:

| Pros of Option-based method of patent valuation: | Cons of Option-based method of patent valuation: |

|---|---|

| It recognizes the various decision paths and options available to the patent owner. | Complex, requiring specialized knowledge and expertise, especially for patents with multiple decision points |

| This is useful for early-stage or unproven technologies. | Can be challenging and may require subjective assumptions |

| The option-based method reflects the actual decision-making process of patent owners. | The option-based approach may be less suitable for valuing patents with relatively low uncertainty |

Example for Option-based method of patent valuation

A patent can be valued as a call option, where the patent owner has the right but not the obligation to commercialize the patented invention in the future. Let’s say Biotech Corp has a patent on a new cancer drug with promising results, but market adoption is uncertain. Here’s a simplified option-based valuation:

- Underlying Asset & Strike Price: The underlying asset is the drug’s future success, with a market potential of $1 billion (optimistic scenario). The strike price is the R&D cost, estimated at $200 million.

- Option Factors: Volatility (uncertainty) of market adoption is high (50%). The time to expiry is the patent life, assumed to be ten years. The risk-free interest rate is 5%.

- Options Model: Using a simplified option pricing model, such as the Black-Scholes option pricing model, we calculate the option value (patent value) at, for instance, $350 million.

So, this patent could be valued at $76.1M using an option-based approach, capturing the value of the right to commercialize the invention in the future if conditions are favorable

Factors Influencing Patent Value

It’s important to note that the factors influencing the value of a patent can be complex and vary. The specific factors and their relative importance can change based on the industry, technology field, and intended use of the patented invention.

Here we classified these factors into four categories:

| Technical Factors | Patents in rapidly growing or commercially important fields tend to be more valuable. |

| Market Factors | |

| Legal Factors | |

| Commercial Factors |

Why are claims required while performing patent valuation?

The boundaries of an invention are defined by a patent claim, which establishes what the patent does and does not cover. A patent claim is the most significant part of a patent application since it defines the protected subject matter. The claims in application define the extent, or scope, of the protection provided by a patent or sought in a application in technical terms. In other words, the claims’ objective is to specify which subject matter is covered by the patent (or sought to be protected by the application). A patent claim’s “notice function” is to notify others of what they must not do if they violate the claim.

How can Eqvista help with business patent valuation?

Valuing a patent is a challenging process involving technology, finance, economics, and law expertise. Eqvista’s patent valuation services can help businesses appropriately disclose the value of their intellectual property for accounting and taxation purposes, ensuring compliance with financial reporting and tax obligations.

Eqvista can help with business patent valuation in the following ways:

- Eqvista has a team of experts who can assist businesses with patent valuation. They offer professional services to accurately determine the fair market value of patents or patent portfolios.

- Eqvista employs various patent valuation methods, including cost-based, market-based, income-based, and option-based approaches. These methods are meticulously applied to ensure a reliable and accurate valuation.

- For market-based approaches, Eqvista utilizes techniques like the market transaction method, which involves analyzing prices paid for comparable patents in the same or related markets to estimate the value of the patent being valued

- Eqvista can assist businesses in identifying potential infringement risks and negotiation strategies through proper patent valuation, which is crucial for resolving patent conflicts, disputes, or licensing agreements.

- Accurate patent valuation by Eqvista can aid businesses in fundraising initiatives by helping them clearly understand the value of their patents, which can be important assets for attracting investors.

PATENT VALUATION WITH EQVISTA

Valuing a patent is a complicated process that involves expertise in technology, finance, economics, and law. Professionals use different approaches and consider specific circumstances to arrive at a reasonable estimate of a patent’s value.

Eqvista follows a comprehensive patent valuation process involving various methodologies and expert analysis. Throughout the process, Eqvista’s team of experts leverages their extensive experience, industry knowledge, and access to proprietary databases to ensure a reliable and accurate patent valuation.

The patent valuation report includes an overview of the valuation process, different valuation methods used, graphs, and a well-reasoned estimate of the patent’s fair market value. Eqvista’s patent valuation services ensure that the report is conducted professionally, objectively, and in compliance with international valuation standards.

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!