How to Use Market-Based Approaches in Patent Valuation

In this article, we will explore how to apply market-based approaches in patent valuation.

Design patents are a crucial weapon for safeguarding a product’s appealing designs and prohibiting competitors from copying them without permission. The valuation of patents is a crucial problem since it establishes a patent’s value and prospective financial success. There are various types of patents, including utility patents, design patents, and plant patents, that are used to protect new and original inventions. For a variety of reasons, including merger, acquisition, joint venture, negotiations to sell or license intellectual property rights, and disagreement or dispute over a patent, businesses may need to value patents.

In this article, we will explore how to apply market-based approaches in patent valuation, including the market capitalization method and market transaction method.

Patent valuation

The process of figuring out a patent’s monetary value is known as patent valuation. Accurately determining a patent’s value involves evaluating aspects like market demand, potential profitability, and competition. Market-based approaches, cost-based approaches, and income-based approaches are only a few of the techniques used for patent valuation. With market-based approaches, the value of the patent is estimated by examining market dynamics and trends. Market-based approaches are especially helpful when there is little information on the revenue or expense of a patent. Investors and inventors can estimate an invention’s potential value by knowing the market demand and level of competition.

What is a patent?

A patent is a legal document that gives the owner of an invention exclusive rights for a predetermined amount of time, usually 20 years from the date of filing. By giving inventors a way to safeguard their creations and stop others from using or benefitting from them without authorization, patents serve to promote innovation. An invention must satisfy a number of requirements, such as innovation, non-obviousness, and utility, in order to be given a patent. The holder of a patent may prohibit others from producing, utilizing, selling, or importing the innovation without their consent. As they can be licensed or sold to third parties for a profit, patents can be significant assets. Nonetheless, it can be difficult and expensive to enforce a patent.

How do patents work?

The owner of a patent has the legal authority to prevent anyone from producing, using, selling, or importing the protected innovation without their consent. Giving inventors a reason to develop new and useful procedures, promotes innovation.

In return for this exclusive privilege, innovators must make their creation public in order for others to improve them when the patent expires.

An inventor must submit a patent application to the relevant agency in order to receive a patent. After reviewing the application, the agency will decide if the invention satisfies the requirements for novelty, non-obviousness, and usefulness. A patent, which offers defence against the unauthorized use or sale of the innovation, is given to the creator if the application is accepted.

Patents give innovators a way to make money off of their ideas by allowing them to sell or license them to third parties. Yet, enforcing a patent can be difficult and costly, frequently necessitating taking legal action against infringing parties. Patents continue to be a crucial instrument for preserving intellectual property and promoting innovation despite these difficulties.

Types of Patents

Utility patents, design patents, and plant patents are the three different sorts of patents. While design patents protect brand-new, unique ornamental designs for manufactured goods, utility patents only cover novel and beneficial inventions. Unique and novel plant varieties are covered by plant patents.

- Utility Patent – The most prevalent kind of patent, known as utility patent, protect novel and practical innovations or discoveries, including methods, tools, manufactured goods, and material compositions. These creations ought to be original and valuable in some way. The government awards utility patents to inventors, which are valid for 20 years after the date of filing and during which the patent holder has the only authority to regulate the use and commercial exploitation of the innovation. Utility patents can be useful assets for inventors and businesses wishing to profit from their intellectual property. Utility patents are crucial for promoting and safeguarding innovation.

- Design patents – New and unique decorative designs manufactured, such as a product’s form or surface ornamentation, are protected by design patents. These patents offer protection from unauthorized duplication and use of the design for a period of 15 years after the date of issuance. The sole aspect of an innovation that is covered by a design patent is the aesthetically pleasing design. Companies wishing to protect their branding or product designs may find value in design patents, which can also be used to stop other companies from making goods with a similar appearance.

- Plant patents – Asexually reproducing plants, such as novel strains of fruit trees or flowers, are covered by plant patents, which are specific sorts of patents. A new plant variety must be distinct from all other varieties already in existence, have been developed asexually, and be stable and uniform in order to be eligible for a plant patent. For a period of 20 years from the date of filing, the patent grants the owner the only authority to grow and market the plant variety. For growers and horticulturists wishing to safeguard their distinctive plant kinds, plant patents might be useful.

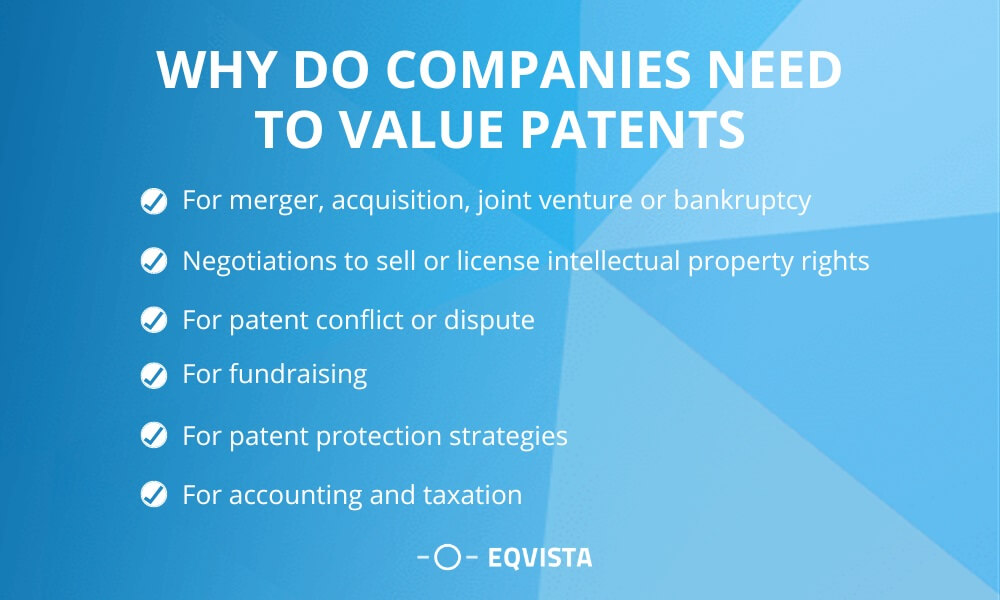

Why do companies need to value patents?

Patents are important to businesses for a number of reasons. First of all, patents are frequently valuable assets that can be licensed, sold, or used to raise money. Companies can estimate the value of their patents and strike reasonable arrangements by valuing them. Second, patents can be utilized to stop rivals from making use of or cashing in on the invention. Putting a value on patents can help businesses determine if the expense of enforcing their rights is worthwhile. Lastly, by pricing patents, businesses may decide which patents to file and which to discard as part of their intellectual property strategy. In conclusion, patent valuation enables businesses to make knowledgeable choices about their intellectual property that may affect their ability to compete and financial success.

- For merger, acquisition, joint venture or bankruptcy – In the case of a merger, acquisition, joint venture, or bankruptcy, patent valuation is crucial. Patents may be important assets or liabilities in these situations, and determining their value and negotiating fair terms may be made possible with the aid of precise patent valuation. Companies can detect possible risks of patent infringement as well as opportunities to license or sell patents with the aid of patent valuation. In these situations, patent valuation ultimately plays a significant role because it can affect the parties’ financial success.

- Negotiations to sell or license intellectual property rights – Valuing the IP is essential when negotiating the sale or licensing of intellectual property rights, such as patents. Both the seller and the buyer can reach an equitable agreement on the price and other conditions of the sale or license arrangement by appropriately valuing the IP. The market’s demand for the invention, potential revenue or cost savings, and the quality and scope of the patent claims are only a few of the variables taken into account throughout the valuation process. In addition to identifying potential infringement issues, proper patent valuation can also assist in the identification of negotiation strategies to reduce such risks. The negotiation process when selling or licensing intellectual property rights must ultimately include a patent valuation.

- For patent conflict or dispute – Accurate patent valuation is essential when there is a disagreement or dispute regarding a patent, such as a legal claim for infringement or a licensing agreement. An accurate patent valuation can aid parties in negotiating a reasonable settlement or licensing contract. The strength and extent of the patent claims, the potential revenue or cost savings that the invention could produce, and the market demand for the technology are some of the considerations taken into account throughout the valuation process. Parties are better able to resolve conflicts or disputes if they have a clear knowledge of the patent’s worth.

- For Fundraising – In fundraising initiatives, such as when looking for financing from venture capitalists or other investors, patent valuation is also crucial. Patents can be important assets that aid in raising capital and luring investors; nevertheless, a correct valuation of the patent is essential to ensure that investors are making wise choices. The strength and scope of the patent claims, the market demand for the invention, and the potential revenue or cost savings that the invention could produce are all taken into account throughout the valuation process. An accurate patent value can help to improve the chances of successfully raising capital and expanding the company

- For patent protection strategies – A key element of patent protection tactics is patent value. An accurate patent valuation can assist businesses in making defensible choices regarding which patents to file, which to drop, and how to enforce them. Companies can prioritize their patent filings and manage their resources efficiently by knowing the worth of their inventions. Companies can decide how best to safeguard their intellectual property by identifying potential infringement risks with the use of patent value. In general, successful patent protection plans are developed and implemented by businesses with the assistance of patent valuation.

- For accounting and taxation – Patent Valuation is important for accounting and taxation considerations. It’s critical to appropriately value patents in order to reflect their worth on financial statements like balance sheets and income statements. Likewise, a company’s tax liability may be affected by the value of its patents. Tax obligations for the business, such as tax deductions for costs associated with research and development or tax credits for particular forms of intellectual property, may be impacted by the value of patents. In order to appropriately disclose the value of their intellectual property for accounting and taxation purposes, businesses can help assure this through effective patent valuation.

Patent valuation approaches

The cost-based approach, the income-based approach, and the market-based approach are the three primary methods for valuing patents. Invention reproduction costs are estimated using the cost technique, potential earnings are taken into account using the income approach, and patent prices are examined using the market approach.

- Income-based approach – The income approach is a technique for valuing patents that predicts the potential earnings the invention might produce. With this approach, projected future cash flows from the invention are estimated and discounted to their current value. This strategy necessitates a study of the market’s demand, the competition, potential licensing or sales prospects, and other variables that can affect the patent’s potential future earnings.

- Cost based approach – The cost approach is a technique for valuing patents that calculates the price to replicate the invention. This approach entails estimating the cost of producing a similar invention using comparable materials and methods, accounting for any necessary research and development expenses. By deducting the anticipated expenses of replication from the invention’s initial development cost, the patent’s value is calculated.

- Market-based approach – The market-based approach is a technique for valuing patents that takes into account the costs of similar inventions on the market. This strategy entails comparing the patent under consideration to similar inventions that have previously been sold or licensed, taking into account elements including technology, industry, and geography. The price of the related patents is then modified to reflect any variations between them and the patent being appraised in order to ascertain the patent’s worth.

Two types of market-based methods used in patent valuation

The market capitalization method and the market transaction method are the two categories of market-based techniques used to value patents:

- Market Capitalization Method – A particular kind of market-based strategy for valuing patents is the market capitalization method. Based on the value of the firm’s outstanding shares and current market conditions, this method is used to estimate the overall value of a company. Market capitalization is calculated by multiplying the total number of outstanding shares by the share’s current market value. According to the market capitalization technique, a company’s market value represents the value of its patents and other intellectual property. This method does not take into account the unique qualities and properties of each patent, hence it might not be appropriate for valuing individual patents. It is typically employed to value the business overall.

- Market Transaction Method – One such market-based strategy for valuing patents is the market transaction approach. The fair market value of the patent being appraised is ascertained using this procedure, which entails examining the prices paid for comparable patents on the market. This approach is predicated on the idea that prices paid for comparable patents in the same or related markets indicate the market worth of a patent. Access to information on real transactions involving equivalent patents is necessary for the market transaction technique. When comparable data is available, this method offers a trustworthy estimation of the fair market value of a patent. When there aren’t any comparable data, this strategy might not be appropriate.

Get in touch to have a patent valuation report from experts!

For businesses trying to preserve and capitalize on their intellectual property assets, patent value is a critical component. The fair market value of a patent can be determined with accuracy by market-based methodologies like the transactional approach and the market transaction method. Businesses looking for expert patent valuation services may rely on the team of experts at Eqvista to produce thorough and precise patent valuations.

Eqvista provides a full range of services to assist businesses in managing their equity and intellectual property, and its valuation specialists can assist clients in making defensible choices regarding their patent portfolios. Contact Eqvista for professional services in patent value!

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!