Differences Between American and European Equity Waterfalls

This article will help you with that by explaining the advantages of American equity waterfalls and the advantages in European waterfalls.

In the world of private equity, terminology like “waterfalls”, “clawback”, and “catch-ups” is used to describe the structure of the manager’s performance fee and the manner in which distributions from the investment are made to the partners. Investors in a waterfall structure might provide financial incentives to the sponsor in the form of higher returns. Distribution waterfalls often take one of two forms: the American Waterfall or the European Waterfall.

American and European equity waterfalls

Commonly used in equity investing, the phrase “distribution waterfall” describes the order in which the limited or restricted partners (LPs) and general partners (GPs) get their share of a fund’s capital gains. The two most frequent waterfall arrangements are the European distribution waterfall and the American distribution waterfall, with the former favoring investors and the latter favoring managers. Let’s learn more about each of them.

What is American Equity Waterfall?

The American Waterfall approach is more advantageous to General Partners. Instead of only being used at the fund level, the model is applied to each and every trade. Sponsors are guaranteed to get their money back before limited partners (LPs) get theirs back, and the risk is spread out across all the investments. Carried interest is paid to the General Partner in the American model even if the restricted Partners have not yet seen a return on their investment. The term “deal by deal” is used to describe this kind of agreement.

This schedule is preferable for the fund’s general partners since it distributes the overall risk across all agreements. While investors are still entitled to their initial investment and any desired returns, the structure enables managers to be compensated before they get those funds. To entice investors, the equity fund can incorporate a “clawback” language in the deal.

- Advantages of American equity waterfalls – The American waterfall structure’s advantage for the Limited Partner is that the General Partner is compensated sooner, allowing them to think about the property’s business strategy in the long run. This is especially crucial in the commercial real estate industry because adopting a new operating strategy might take months or even years.

- Challenges in American equity waterfalls – The most significant disadvantage associated with the American waterfall includes the possibility that the GP will not put in as much effort to reach the highest return tier since they will get their money back early.

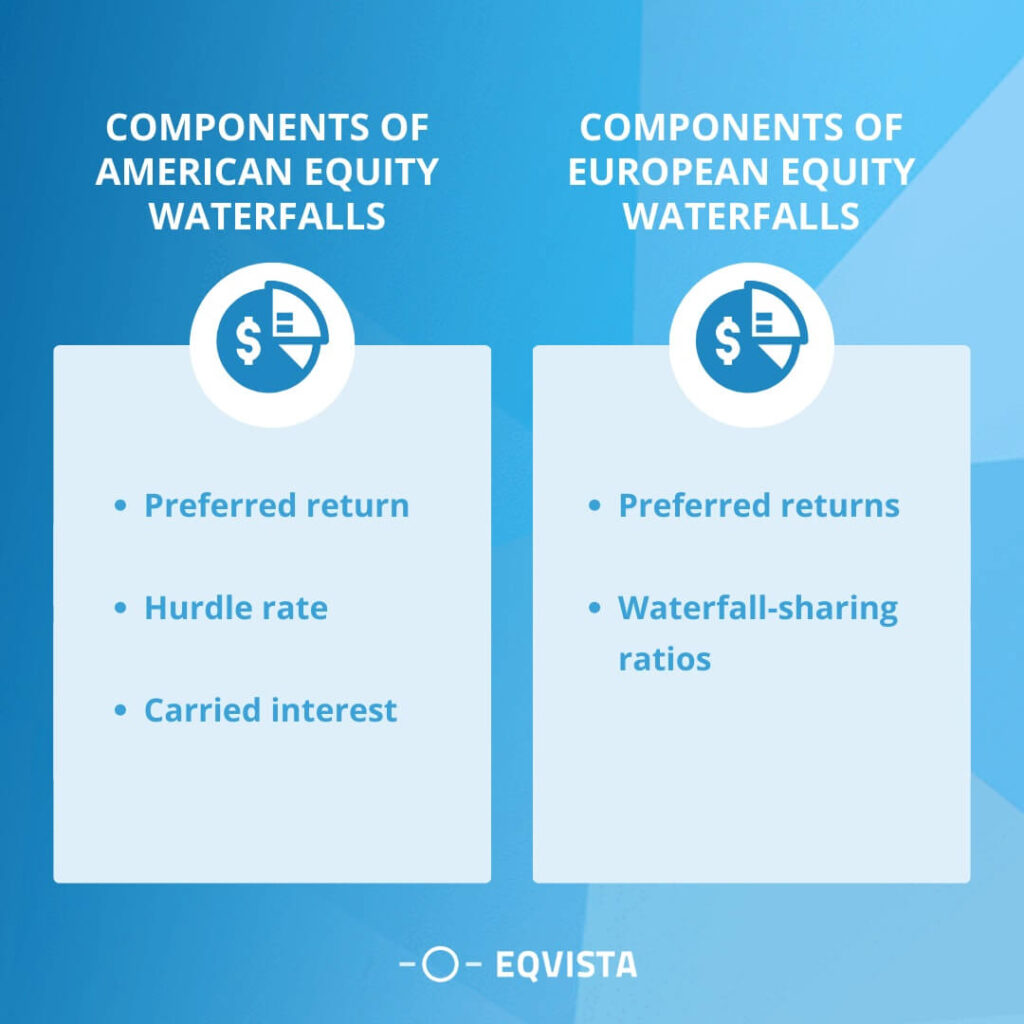

Components of American equity waterfalls

Most often, the preferred return, the hurdle rate, and the carried interest make up the components of American equity waterfalls. These phrases are often used in the fields of investing and finance, particularly in the areas of equity investing and real estate. A quick breakdown of the parts follows.

- Preferred return – Some investors are guaranteed a higher rate of return, sometimes known as a “preferred return” before any other investors earn their portion of the investment’s profits. It’s a mechanism for giving some investors, such as restricted partners or preferred stockholders, access to funds first. The ideal rate of return is sometimes stated as a percentage of the principal invested.

- Hurdle rate – The hurdle rate, or the “waterfall threshold” is the minimal rate of return required to trigger a change in the investors’ share of the profits. It’s a bar that has to be crossed before the earnings may be shared with higher-tier investors. The barrier rate may be a predetermined percentage or some other standard, such as a market index.

- Carried interest – General partners and investment managers earn a carried interest, sometimes known as “carry” from private equity and real estate investments. It’s the number of investment returns over the desired return and the hurdle rate. Investment managers are incentivized to do well by receiving carried interest, which is usually a part of the earnings. When the desired return and the hurdle rate are both achieved, the general partner or management will get carried interest.

Calculation Methods for American equity waterfalls

Profits are frequently calculated and distributed on a deal-by-deal basis under the American equity waterfall method. Here is a simplified overview of the processes involved:

- Determine the rate of return that will be most appealing to each investor or investor group.

- Determine the rate of return needed to advance to the next level of distribution.

- Figure out how much money was made from each individual investment.

- Pay out the proceeds to the investors according to their selected return percentages.

- Allocate the excess earnings as carried interest if they are higher than the desired return and the hurdle rate.

- The general partners or investment manager may be entitled to a carried interest payment equal to a predetermined proportion of the profits earned.

- For each separate contract or investment that will make up your fund or investment structure, repeat the preceding processes.

For example, if a private equity (PE) firm invests in 10 portfolio businesses and one of those companies is sold for $100 million, the PE fund will take a 20% carry on that profit. What this implies is that carried interest is determined after each contract closes. And it is preserved for the future even if it is lost. The American waterfall structure improves upon the main flaw of its European analog, namely the length of time it takes for the general partners to earn their payments. In the American model, the GP is paid whether or whether the investors get back their initial investment plus their chosen return.

What are European equity waterfalls?

A European waterfall structure provides that the General Partner will not get any of the retained interest layers before the Limited Partners receive their initial investment back plus their desired return. The General Partner will be allowed to share in the carried stake only if this condition is met. Based on this plan, investors will get their share of the money first, and the management will get nothing until the investors’ initial investment and desired return have been repaid in full. However, the manager’s share of the profit could not materialize for a long time, which is a potential downside. The European waterfall approach is more popular because it is more appealing to investors.

- Advantages of European waterfalls – The main advantage of the European waterfall arrangement for the limited partnership is that they are paid before the General Partners. The General Partner has an additional financial incentive to generate a high rate of return in order to advance toward the carried interest level. The General Partner usually reaps the most benefits by obtaining a sizable carrying interest in the business.

- Challenges in European Waterfalls – The fact that Limited Partners in European structures are paid after General Partners is a huge drawback for them. Therefore, the General Partner has a financial incentive to return the funds as soon as possible so that they may share in the profits. Therefore, they may focus on the short term and take additional risks in order to reach the next level of carried interest.

Components of European equity waterfalls

Common elements of stock waterfalls in Europe include higher-tiered preferred returns and higher-tiered waterfall share ratios. These phrases are often used in investing and finance, notably in the real estate and private equity industries. A quick breakdown of the parts follows:

- Preferred returns – Like American equity waterfalls, European equity waterfalls have preferred returns. It refers to a certain rate of interest that select investors obtain before other investors receive their fair share of profits. Preferred returns are usually represented as a percentage of the investor’s original investment. Limited partners and preferred equity holders get priority distributions from the preferred return.

- Waterfall-sharing ratios – Waterfall-sharing ratios divide investment earnings and revenues among investors. It establishes the distribution ladder and the percentage of earnings that each group of investors gets after favored returns. Waterfall share ratios determine the sequence and proportion of profit distribution among investors, namely the general partners or investment administrators.

Calculation method for European equity waterfalls

European equity waterfalls may be calculated in a number of different ways, each of which is determined by the investment’s own terms and conditions. The following is a summary of the many approaches used to determine the variables:

- Preferred Return Calculation – The preferred return computation is used to ascertain the preferred return owing to individual investors. The following are the typical stages involved:

- Find the optimal rate of return. In accordance with the terms of the investment, these investors will earn a higher rate of return. It is most often reported as a percentage per year.

- Determine the most desirable rate of return. An investor’s preferred return is calculated by multiplying their original investment by the desired return rate.

- Profit-Sharing Calculation – After the desired returns have been met, the profit-sharing formula establishes how the remaining returns or profits from the investment will be allocated among the participants. Different investment agreements and waterfall share percentages will result in a range of possible computation methods.

- Waterfall Sharing Ratio Calculation – Calculating the waterfall share ratio assigns a fixed proportion of earnings to each investment tier. Set the percentage breakdown for the waterfall. Profits will be divided up amongst various types of investors according to the ratios specified in the waterfall-sharing structure. Depending on the investor’s position in the waterfall structure, these ratios may change.

Key Differences Between American and European Equity Waterfalls

There are a number of important distinctions that can be made between the equity waterfalls of the United States and Europe. The following is a table that provides a summary of them.

| Features | American Waterfall Model | European Waterfall Model |

|---|---|---|

| Law and Regulation | Compliance with applicable laws and rules in the US | Influenced by European Laws and Requirements |

| Ratios for Profit and Waterfall Distribution | Multi-tiered, multi-year structures with catch-up provisions and carried interest. | Regional methods provide varying priority allocations and processes |

| Structures of Carried Interest | Calculated deal-by-deal or across the fund's investments. | Depending on investor preferences and regional customs. |

| Catch-up Provisions | Regularly included | Not as prevalent |

| High-Water Mark | Used to guarantee that the GP or fund manager only receives carried interest on new earnings surpassing earlier losses. | May have different ways to handle losses and calculate carried interest. |

| Management Fees | The general partners or investing manager charges for operating expenditures. | Region-specific structure and computation. |

Get expert help with your waterfall analysis with Eqvista!

The distribution of money is the primary focus of both American and European equity waterfalls, which may either bring parties’ interests into alignment or misalign them. A simple method for mitigating risk is to make certain that you are engaging in the appropriate pricing structure. Because waterfall structures have the potential to influence investment behavior, it is important to verify that the sponsor is driven by the potential return on investment.

The secret to profitable investment is to find a framework in which everyone’s interests are aligned from the very beginning of the venture. Utilizing the Eqvista platform will make it much easier to communicate with your distribution systems and other private equity arrangements. Get in touch with us right away and we’ll show you what it can do for your finances.

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!