What is IRC 170? A Guide to the Tax Code Section on Charitable Giving

This article will look into the Types of Charitable Organizations, Noncash Contributions under IRC 170, IRS Compliance, and Audits for IRC 170.

The United States Internal Revenue Code’s IRC 170 is the section that deals with charitable contributions and deductions. It details the policies and procedures governing tax deductions for people and organizations who give to charities in further detail.

IRC 170 allows taxpayers to potentially deduct a portion of their taxable income for charitable contributions, lowering their overall tax burden. This clause offers tax advantages to people who support charitable organizations and causes in order to reward and promote philanthropy.

This article will look into the Types of Charitable Organizations, Noncash Contributions under IRC 170, IRS Compliance, and Audits for IRC 170.

IRC 170 and charitable giving

Section 170(f)(2) provides a charitable contribution deduction in the case of property transferred in trust by the donor if the trust is a charitable remainder annuity trust, a charitable remainder unitrust, or a pooled income fund.

Understand IRC 170 and its purpose

The primary purpose of IRC 170 is to encourage charitable contributions by offering tax breaks to individuals and businesses who make donations to qualified charity organizations. IRC 170 is critical in promoting philanthropic contributions by offering tax breaks to individuals and businesses. It promotes philanthropy and supports charitable organizations’ efforts to address diverse social, cultural, and environmental needs by providing tax benefits and deductions.

In the US, the IRS is in charge of regulating and imposing restrictions on the deductibility of charitable contributions. Contributions made by individual taxpayers to eligible organizations can be written off on their federal income tax return. IRC 170 lays forth the rules and specifications for people and businesses looking to claim tax deductions for contributions made to approved charity organizations. It was created with the intention of promoting donations to charity by offering tax benefits.

The value of a taxpayer’s qualifying charitable gifts can be deducted from their taxable income, lowering their overall tax obligation.

A Case Study For IRC170

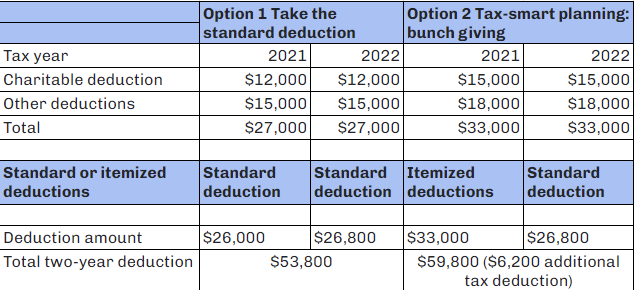

This table compares two tax-filing options for the years 2021 and 2022, presenting the financial implications of choosing between the standard deduction and tax-smart planning, specifically “bunch giving”.

In Option 1, individuals take the standard deduction, while Option 2 involves strategic planning for charitable contributions to maximize tax benefits.

For both years, charitable deductions under Option 2 are higher than the standard deduction, with $15,000 in 2021 and $15,000 in 2022. Other deductions remain constant at $18,000 each year. The total deductions for Option 2 are $33,000 for both 2021 and 2022, compared to the standard deduction of $26,000 and $26,800 for the respective years.

The table highlights the potential tax advantage of Option 2, showcasing a total two-year deduction of $59,800, which includes a $6,200 additional tax deduction compared to the standard deduction over the same period. This comparison aims to help individuals make an informed decision based on their financial situation and tax-planning goals.

Types of Charitable Organizations

Charitable organizations, often known as nonprofits or non-governmental organizations (NGOs), are entities formed to solve various social, humanitarian, and environmental challenges.

There are many different kinds of charity organizations, such as

- Public Charities – Engage in community-based initiatives, relying on public support and contributions to address societal needs and promote the common good.

- Private Foundations – Operate with funds from a single source, usually a family or corporation, and provide grants to other charitable entities.

- Advocacy Groups – Strive to influence policies and decisions by raising awareness and championing specific causes or issues.

- Relief and Development Organizations – Offer aid during crises and work on sustainable development projects to address long-term challenges.

- Environmental Nonprofits – Dedicate efforts to conservation, sustainability, and addressing environmental issues for a healthier planet.

- Health Organizations – Focus on promoting well-being, preventing diseases, and addressing health-related challenges through research, education, and advocacy.

- Educational Nonprofits – Channel efforts into educational initiatives, scholarships, and skill development programs to enhance learning opportunities and empower individuals.

The types of organizations eligible for deductible contributions under IRC 170

IRC 170 permits tax deductions for donations made to churches and other religious institutions as long as they are only used for religious activities. As long as they adhere to the guidelines established in IRC 170, governmental organizations, war veterans’ groups, fraternal societies, and nonprofit cemeteries may also qualify for deductions. Additionally, donations to nonprofit cemeteries, fraternal clubs, and groups for veterans may all be tax deductible.

Here is an example of 501(c) (3) Organizations:

- Religious

- Educational

- Scientific

- Literary organizations

Public charities or private foundations are two different types of tax-exempt organizations recognized in the US under section 501(c)(3) of the Internal Revenue Code (IRC). The organization’s financial sources, activities, and governance structure all play a role in determining its classification.

Requirements for organizations to maintain tax-exempt status

A tax-exempt organization must have a recognized purpose, such as charitable, educational, religious, scientific, or literary, and must serve its activities and resources. It must function as a nonprofit and refrain from paying out earnings or profits to shareholders. The organization’s operations should assist the general public or a particular philanthropic class, and it must not provide undue benefits or private advantages.

Tax-exempt organizations are expected to abide by local, state, and federal legislation, file the necessary tax returns, and make disclosures. They may be taxed on income derived from unrelated commercial activity. Any substantial changes to an organization’s structure, governance, operations, or activities must be reported to the IRS.

Cash Contributions under IRC 170

Cash contributions are defined as monetary donations made to qualifying charity organizations by individuals or businesses under Internal Revenue Code (IRC) Section 170. These contributions are tax-deductible if donated to qualifying organizations recognized by the IRS as tax-exempt under Section 501(c)(3).

These organizations include those that adhere to religious, educational, scientific, charitable, and other standards established by the IRS.

Guidelines for deducting cash contributions under IRC 170

To claim a deduction, cash contributions must be given to qualifying charitable organizations. Keep documentation of your donations, including a canceled check, bank or credit card statement, or a letter from the charity, to support your deduction.

A letter of acknowledgment from the charity is necessary for donations above $250. Cash donations must be made within the tax year for which you are claiming the deduction. There are several restrictions on the amount that can be written off as a cash donation deduction in a given tax year; for public charities, the maximum deduction is 60% of AGI.

Cash gifts are monetary contributions made to a nonprofit or charity organization by individuals or groups. These contributions may take the form of cheques, money orders, cash, or electronic payments. To accurately track cash donations, precise financial documents, such as bank statements, deposit slips, and accounting records, are required. These documents support transparency and aid in the creation of annual and financial reports.

Tax forms and reporting duties might differ based on the jurisdiction and the specific circumstances of an individual or organization. Cash donations and their interactions with other tax forms and reporting requirements are governed by a number of laws and regulations. It’s important to be aware of any state or local tax laws and reporting requirements for cash gifts in addition to federal tax laws.

Noncash Contributions under IRC 170

IRC Section 170 defines noncash contributions as gifts of property or assets, such as clothing, furniture, household goods, automobiles, stocks, bonds, and real estate.

Inclusive Examples Of Non Cash Contributions

- Clothing – Donated apparel falls under noncash contributions.

- Furniture and Household Goods – Contributions of items furnishing homes are considered noncash.

- Automobiles – Vehicles donated for charitable purposes are recognized as noncash gifts.

- Stocks and Bonds – Transferring financial instruments like stocks and bonds qualifies as noncash contributions.

- Real Estate – Donations of property, including land and buildings, are acknowledged as non cash gifts.

Tax Implications

Understanding IRC Section 170 is crucial for taxpayers, as it governs the eligibility for deductions and establishes valuation methods for these diverse forms of noncash contributions. This framework encourages philanthropy and ensures clarity in the treatment of such donations for tax purposes. A tax deduction based on the fair market value of donated goods may be available to qualified people or organizations.

Deductibility rules for noncash charitable contributions under IRC 170

Cash and non-cash charity deductions combined cannot exceed a certain percentage of your adjusted gross income (AGI). The precise restrictions vary according to the type of donated property and the entity receiving it.

Valuation requirements and guidelines for noncash donations

The fundamental concept is that the value of the donated object should reflect its fair market worth at the time of giving. Fair market value is the sum that a willing buyer and a willing seller would exchange in an open market, taking into account the item’s state and other pertinent elements.

When filing your taxes, you may be required to submit a specific form or schedule to declare noncash donations. For example, in the US, taxpayers often report non-cash charitable contributions using Form 8283.

Reporting and documentation obligations for noncash contributions

In the US, Form 8283 (Noncash Charitable Contributions) must be filled out and attached to a tax return if the amount of the noncash donation exceeds $500. The donation must be described in detail on this form, together with how the property was acquired and its appraised worth.

Maintain detailed records of noncash contributions, including receipts, acknowledgments, appraisals, and any supporting paperwork. These records must be preserved for a set amount of time (e.g., three to seven years) in order to support the deductions claimed on your tax return.

Tax Planning Strategies for IRC 170

IRC 170 tax planning techniques can assist individuals and corporations in maximizing their tax advantages while contributing to charitable causes. Additional tax advantages may be available if appreciated assets are donated, including stocks, bonds, and real estate.

Strategies for optimizing tax benefits under IRC 170

Consider contributing valued assets such as stocks, bonds, or real estate rather than cash. This will enable you to deduct the asset’s fair market value at the donation time while avoiding capital gains tax on the appreciation.

An eligible charity may receive direct transfers from your conventional IRA if you are 70.5 years of age or older. Even if you don’t itemize deductions, the distribution is excluded from your taxable income, giving you a tax benefit.

Timing of contributions to maximize deductions

The timing of your contributions may affect your ability to take advantage of deductions under IRC Section 170, which deals with charitable donations. If you’re an individual taxpayer, you can typically deduct charitable contributions from your income in the tax year you make them.

Make your donations by December 31st of the relevant tax year in order to maximize your deductions.

Considerations for donor-advised funds, charitable remainder trusts, etc.

Charitable remainder trusts (CRTs) and donor-advised funds (DAFs) can offer significant tax benefits. DAFs enable contributors to continue to suggest offerings to charity organizations over time. As a result, the time and volume of donations are flexible and within your control. Although DAFs and CRTs facilitate charitable giving, their timing and types of charitable impact vary.

DAFs give you the chance to participate continuously in grant recommendations, giving you the chance to address new priorities and needs as they arise. Contrarily, CRTs offer a predictable income stream during the donor’s lifetime, with the charitable remainder going to the donor’s preferred charities after death.

IRS Compliance and Audits for IRC 170

The IRS has the authority to audit tax returns in order to ensure the accuracy of claimed deductions, including charitable contributions. In the event of an audit, you will be required to produce proof of the claimed deductions.

The audit procedure must be complied with, and you must do everything you can to provide the necessary data.

IRS compliance and enforcement related to charitable contributions

The IRS launches compliance efforts on a regular basis to target certain potential areas. Examining tax returns tied to charitable contributions to identify anomalies or patterns of abuse could be part of this. These programs aim to encourage adherence to tax regulations and uphold the integrity and fairness of the tax system.

Potential audit risks and common areas of Scrutiny

Non-cash gifts including clothing, furniture, appliances, cars, stocks, bonds, and real estate may be tax deductible for both individuals and organizations. Auditors verify the timing of expense recognition, evaluate asset valuation, check for adherence to accounting standards, and complete financial statement disclosures.

Regulatory rules, specific conditions, and industry influence the audit risks and areas that will be examined. The processes used by auditors are customized to address these risks and requirements.

Importance of accurate record-keeping and adherence to IRS guidelines

Accurate record-keeping and adherence to IRS requirements are critical for tax compliance, audit readiness, optimizing deductions and credits, financial planning, legal compliance, efficient operations, and historical analysis.

Individuals and corporations can successfully negotiate the complexities of financial problems and reduce the chance of errors, penalties, or conflicts by maintaining accurate records.

Streamline your work with Eqvista’s expert solutions

IRC Section 170 is an effective instrument for enticing people and companies to donate to charitable purposes. The tax legislation recognizes the significance of philanthropy in meeting social needs and promoting community well-being by offering tax advantages.

Taxpayers must itemize their deductions rather than use the standard deduction in order to benefit from the tax breaks provided by IRC Section 170. This necessitates maintaining accurate records and proof of philanthropic contributions. Eqvista lets you manage your company’s equity! To learn more, get in touch with us. Signup to our freemium account to receive updates.

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!