Form 8283: The Essential Guide for Filing Noncash Charitable Contributions

In this article, we will walk through the Requirements for Filing Form 8283, Rules and Limitations for form 8283, and Filing and Deadlines for form 8283.

The Internal Revenue Service (IRS) of the United States requires Form 8283 to be used for reporting non-cash charitable contributions. When the aggregate deduction for all non-cash gifts is greater than $500, individuals, partnerships, and corporations must file this form.

Noncash contributions are donations of property or assets other than cash, such as stocks, real estate, vehicles, artwork, or collectibles.

Form 8283 and Non cash Charitable Contribution

If you make noncash charitable contributions totaling more than $500, you must report them using Form 8283. Individuals, partnerships, and corporations use this form. It helps the IRS keep track of these contributions.

By filling out this form, you can ensure you get the tax deductions you are entitled to. Donations of non-cash items like stocks, real estate, vehicles, works of art, or collectibles are examples of non-cash donations. Non-cash contributions also include gifts of money.

Form gives the IRS facts about the donated item, it’s worth, and other pertinent information. Taxpayers may be eligible to claim tax deductions for their non-cash charitable gifts by submitting Form 8283. The fair market value of the donated item serves as the basis for most non-cash deductions.

It is a critical documentation tool for noncash donations, assuring accurate records of the beneficiary organization, property description, fair market value, and compliance with IRS laws.

Purpose and requirements of Form 8283

Let’s discuss the purpose and requirements of Form 8283

Purpose of Form 8283

- The aim of Form 8283 is to provide precise information to the Internal Revenue Service (IRS) about noncash contributions for tax reporting reasons.

- It is used to report non-cash gifts to qualified charity organizations, such as automobiles, real estate, securities, and tangible things such as household goods and apparel.

Requirements of Form 8283

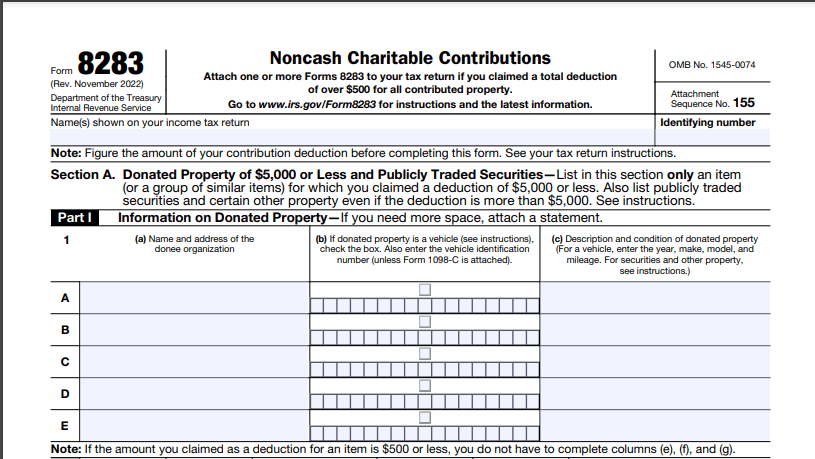

There are two sections on Form 8283. They are Section A and Section B.

- When claiming a deduction of $5,000 or less for gifts or groups of gifts, including publicly traded stocks of any value, you must itemize them in Section A.

- For contributions worth more than $5,000, view Section B. It necessitates extra information regarding the donated property, such as descriptions, conditions, and fair market values.

Understanding Non cash Charitable Contributions

Non-cash charitable contributions are gifts of property or other assets, as opposed to cash, donated to eligible charitable organizations. These contributions may come in the form of securities, automobiles, memorabilia, works of art, and real estate. Understanding Non-Cash Charitable Contributions entails understanding the regulations and standards established by IRS for the accounting and reporting of non-Cash Donations made to Qualified Charitable Organizations. Non-monetary contributions are gifts of goods or resources other than cash.

Non-cash charitable contributions are gifts of property or other assets, in contrast to cash, donated to eligible charitable organizations. These contributions may come in the form of securities, automobiles, memorabilia, works of art, and real estate.

Benefits of Making Non cash Charitable Contributions

The advantages of making non-cash charitable contributions include:

- Tax Deductions – Tax deductions for non-cash donations to charities are possible if they are categorized under Schedule A and adhere to IRS regulations. Fair market value deductions from taxable income can reduce tax obligations and result in tax savings.

- Defending Causes – Non-cash donations help organizations and causes by contributing assets, advancing their missions, supporting initiatives, and offering resources.

- Eliminating Clutter – Donating unused things, fostering organization and satisfaction, and minimizing waste are all benefits of giving non-cash assets to charity organizations, which may help simplify living spaces.

- Possibility of Appreciation – Non-cash assets, such as stocks or securities, may have increased in value since their purchase. These assets can have a greater impact if they are directly donated to an eligible organization because capital gains taxes can be avoided.

- Respect and Legacy – Cash and non-cash donations to charities enhance reputation and satisfaction. Supporting charities has a good impact on the community and serves as an inspiration to others. Programs for donor recognition may assist in establishing a lasting legacy.

Requirements for Filing Form 8283

Form 8283 is used to report noncash charitable gifts for tax reasons. The requirements for submitting Form 8283 are listed below.Form 8283 should be submitted along with your tax return for the fiscal year in which the donation was made. It also has an extended due date if you request for an extension to file your tax return.

Thresholds for reporting contributions based on their value

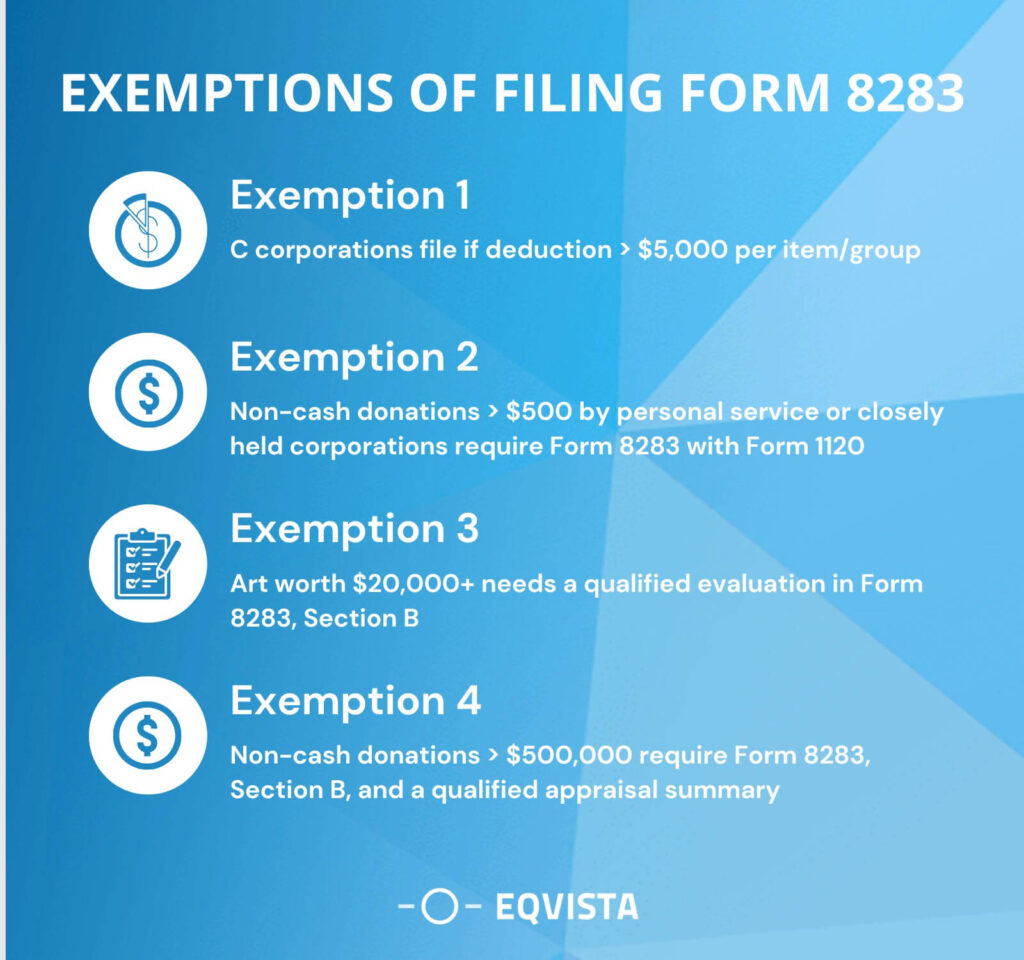

- If the deduction for each non-cash donation is greater than $500, individuals, partnerships, and corporations must file Form 8283.

- It is also necessary if a group of similar items with a total deduction of more than $500 is claimed.

- C corporations are required to file Form 8283 if the claimed deduction exceeds $5,000 per item or set of related items

- Personal service corporations and closely held corporations that wish to deduct non-cash gifts in excess of $500 must file Form 8283 along with Form 1120 or the equivalent special return.

- Partnerships and S corporations that wish to deduct noncash donations in excess of $500 must file Form 8283 (Section A or Section B) along with Form 1065 or 1120-S.

Form 8283 Sections and Instructions

Form 8283 consists of various sections, which range from Section A to Section F. It assists taxpayers in providing comprehensive facts about the given property, its fair market value, and other pertinent information.

A detailed breakdown of the different sections of Form 8283

| Section | Consists | Instructions |

|---|---|---|

| Section A | Comprises Donor Information | Donors must include their name, address, taxpayer identification number, and the date of their contribution in Section A. |

| Section B | Covers information on Donees. | Donors must fill out Section B with the name, address, and, if applicable, employer identification number, of the non-cash charity organization receiving their gift. |

| Section C | Contains the Property Description. | Section C specifies the donated property's type, quantity, and identifying details, such as the artist's name, the component's medium, and its dimensions to ensure accurate and thorough documentation. |

| Section D | Provides an extract of the Property Appraisal Summary. | Section D should contain a summary of the appraiser's name, credentials, date, and the appraised value in order to acquire a competent appraisal for a donated item with a fair market worth over $5,000. |

| Section E | Includes a Declaration of Appraiser. | If an appraisal is necessary, the appraiser must complete section E, certifying that the required appraisal requirements have been met, and provide their certification. |

| Section F | Outlines the Donor Declaration. | Section F requires you to sign and date as the donor in order to confirm that the data is true and accurate to the best of your knowledge. |

Common mistakes to avoid when filling out the form

Form 8283, which is used to report non-cash charitable contributions, must be filled out accurately. There are certain frequent errors that should be avoided.

- It is intended for reporting noncash charitable contributions, such as gifts of property or money, and should not be utilized for volunteer costs or monetary contributions paid with a check or credit card.

- Fill out Form 8283 if your noncash contributions exceed $500 and your total deduction from a group of similar goods exceeds $500. Ascertain whether you fulfill these standards, and file appropriately.

- Ensure you complete the part that applies to your unique case and double-check all the information you supply to prevent mistakes.

- Make sure you adhere to the IRS’s requirements for requesting appraisals and that you give all necessary information truthfully.

- Make sure to carefully read the precise requirements listed in the Form 8283 instructions and include any required supporting paperwork.

Penalties and Compliance for Form 8283

Failure to complete or file an incomplete Form 8283 will result in the donor’s charitable donation deduction being denied. It is crucial to guarantee compliance with IRS requirements because there are penalties for missing or incomplete paperwork.

Penalties for substantial valuation misstatements

According to IRS regulations, there are material valuation errors when the assessed value of a property is 15% or higher than the actual value, which results in a 20% accuracy fine. Penalties may also apply to overstatements that are false or fraudulent.

Consequences of noncompliance or inaccurate reporting on Form 8283:

- Penalties under section 6721 may be assessed for incorrect information returns or for omitting information from Form 8283. The fine could be up to $550 per return and could change depending on when the return is filed. Even minor errors on Form 8283 might result in a deduction of $0.

- The IRS considers any mistake or omission in connection with this form extremely serious. Inaccurate reporting may result in audits, penalties, and possibly legal action. Due to the overvaluation of easements and technical irregularities in submitting forms such as Form 8283, the IRS has started investigating partnerships that contribute to conservation easements.

- Donors must make sure they comply with the guidelines standards and submit the required public Deed of Conservation Easement and Baseline Report.

Frequently Asked Questions Of Form 8283

Here we listed out some frequently asked questions of Form 8283:

What are the Filing and Deadlines for form 8283?

The taxpayer’s filing status determines Form 8283’s due date. Individual taxpayers who submit their tax returns on a calendar year basis (January 1 – December 31) must generally file Form 8283 with their tax return by the due date, which is often April 15th. The deadline for submitting Form 8283 is, however, also extended if a person asks for a delay in filing their tax return. Depending on their tax year, other entities like corporations and partnerships could have various filing deadlines.

Where and how to file Form 8283?

Visit the Internal Revenue Service’s (IRS) official website and search Form 8283 in the search bar. Download the instructions and the application form. Submit your tax return by the due date.

What are the Important deadlines for filing the form?

The due date for Form 8283 for taxpayers filing on a calendar year is normally April 15. The deadline for corporations and partnerships is the 15th day of the third month following the end of the tax year. The cutoff date for businesses is the 15th day of the fourth month following the end of the tax year.

Form 8283 has Options for filing electronically or by mail?

You can file electronically using tax software or by mailing a paper return to the correct IRS address depending on your preferences and the options that are readily accessible at the time.

Connect Eqvista for a seamless filing and a clear path to financial compliance

Ultimately, Form 8283 is required when claiming a deduction of more than $500 for noncash charitable gifts. To ensure compliance with IRS rules and optimize your tax benefits, it is essential to submit this form accurately and by the deadlines stated.

Get form 8283 filing assistance from professionals at Eqvista! For further details about our services feel free to contact us anytime. Signup and make use of our application which is absolutely free!

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!