How to value a pre revenue startup company?

An owner needs to evaluate the startup in the right way if they want to attract good investments.

Valuing a startup that is yet to bring in revenue is not an easy task. Since the company has no income, the traditional ways to measure the value will not work. Normally when valuing a company future projections, financial statements, and quantitative analysis are used, but these cannot be used for a company with no revenue. Pre-revenue startup valuation can be a complicated process that requires experience and a degree of subjectivity. You must have the required knowledge as it is not probable to get a pre-revenue startup’s exact value in its initial stages.

There are many reasons why you should get the valuation of your company done, some of them are:

- The value will play an important role in the negotiation process.

- Encourages the credibility and appeal of the company.

- The valuation can determine if your company is capable of acquisitions which affects expansion and profitability.

All this will have an impact on the business directly, paving the way to future profits and growth.

Startup Valuation

An owner needs to evaluate the startup in the right way if they want to attract good investments. Owners make a common mistake of guessing the amount and this could lead to undervaluation of the company resulting in huge losses. This is why the valuation of a pre-revenue startup is essential.

What is Pre Revenue Startup Valuation?

Startup Valuation is when you measure the net worth of the company in monetary terms. The valuation of pre-revenue startups is done like the seed funding round and investors invest funds in the startup in exchange for a part of the company (equity). By valuing the company, the investor will determine the percentage of equity they will receive for the funds invested. A business valuation is never simple. This process becomes a bit tricky, especially when valuing a startup with no revenue.

Valuing a mature, publicly listed company with revenue is easier than a new startup with no sales. In a company with sales, the valuation is generally based on specific industry multiples or the EBITDA, unlike pre-revenue startups.

Market trends play a crucial role in determining the valuation of pre-revenue startups. Here’s a table summarizing the key aspects:

| Aspect | Role in Pre -Revenue Startup Valuation |

|---|---|

| Market Size and Growth Potential | Startups operating in large, rapidly growing markets with high demand are valued higher than those in niche or stagnant markets. |

| Competition and Competitive Landscape | Startups with a unique value proposition in an untapped or underserved market segment can command premium valuations. Intense competition can negatively impact perceived growth potential |

| Industry Trends and Disruptions | Startups aligned with emerging industry trends (e.g., AI, blockchain) or disrupting traditional industries are seen as having higher growth prospects and valuations. |

| Regulatory Environment | Regulatory changes creating new opportunities can positively impact valuation, while heavily regulated industries may face valuation discounts due to compliance costs and risks |

| Technological Advancements | Startups leveraging cutting-edge technologies or developing innovative solutions are valued higher due to their growth potential. Rapid tech shifts can make offerings obsolete, negatively impacting valuation . |

Why is valuation important for a pre-revenue startup?

An experienced founder will tell you not to concentrate on the business’s valuation if you are going to invest because that is not the only factor that determines if the startup will perform well or not. The value of the business during the seed funding round can affect how much of the company you give up for the incoming capital. In the scenario of an exit strategy, the startup’s value will have a direct impact on the amount you leave with.

A part of this method is to understand how to value a pre-revenue startup. You must keep in mind that such valuations can impact the terms and ability to acquire other businesses. It may be crucial to profitability and overall growth. It may seem cosmetic, but the valuation has an impact on the company’s credibility and appeal. This will impact the hiring process, potential investors, recruiting advisors, and customers.

Factors Influencing Pre- Revenue Valuation

While evaluating a startup with no revenue, it is important to keep certain factors in mind as they directly affect the valuation.

Founding team

When an investor looks to invest in a pre-revenue startup, they consider the founding team or the management team. They do so because they want to back a team that will lead the company to success. Some of the points they will consider are:

- Commitment: Having a good team is not sufficient to succeed. Each individual in the team should have the dedication and time to ensure that the company runs well. A team that consists of part-time employees will not be attractive to investors as they are not putting all their efforts into the company.

- Skills and Diversity: The ideal team in a startup will consist of a mix of people who have skills that complement each other. A great programmer can’t individually do everything. If she has a marketing expert in her team, her application will succeed, and the startup will be valued higher.

- Experience: The startup will be valued higher if the team consists of people who have achieved success with other ventures before this. An investor will choose to invest in a company with an experienced team rather than a startup with first-timers.

Industry and Market demand

If your company operates in an industry where the number of business owners is drastically higher than the number of investors, it will significantly impact your startup. When the number of owners dwarfs the numbers of investors, founders get desperate. They might even choose to sell a significant amount of the company for a lower price. If your company has a unique idea and is in a booming industry that consists of many investors, the demand drive could lead to a higher value for your startup.

MVP or Prototype

Irrespective of the pre-money formula you utilize, having a prototype is a game-changer. Having a working model ready for the investors to see can significantly improve the product and bring visions and ideas into reality. This will also prepone the launch date as the product will be ready earlier.

There are chances that you can attract investment up to $5 million if you have an MVP (Minimal Viable Product). If the valuation-by-stage method is used to derive the company’s value, a working prototype can positively impact the amount. Your company would be able to attract $2 to $5 million in investment.

Common Valuation Methods for Pre Revenue Startup

Investors regularly invest in different startups. To do so, they need to derive the value of the startups using various methods. Here are the most common startup valuation methods.

Scorecard method

The scorecard valuation method uses other companies in the same industry and region to compare and derive an estimation. If your startup is similar to another startup that was recently valued at $5 million, your startup should also be worth $5 million. The startup’s value is then adjusted based on the need for additional capital, competitive environment, size of the opportunity, the strength of the management team, the product/tech, sales and marketing, and other miscellaneous factors.

| Factor | Weight | |

|---|---|---|

| Size of opportunity | 25% | 0.25x |

| Team | 30% | 0.3x |

| Technology/Product | 15% | 0.15x |

| Competitiveness | 10% | 0.10x |

| Marketing/Sales | 10% | 0.10x |

| Financing need | 5% | 0.05x |

| Other | 5% | 0.05x |

Berkus method

The Berkus Method is a simple estimation of the company. This estimation is done by envisioning that the startup will earn $20 million in revenue by the fifth year. In order to calculate if this is possible they will assign an amount up to $500,0000 to different lines in the company such as:

- Management – $500,000

- Product – $400,000

- Technology – $500,000

- Basic Value – $500,000

- Strategic relationships – $200,000

This makes the pre-revenue startup’s value $2.1 million, with a forecast of 10 times the investors’ returns on investment. Amounts are allocated to the business idea, strategic relationships, prototype, management team, and a rolled out product. The investor will consider if all these lines could combine and make the company break $20 million in 5 years.

First Chicago method

The first Chicago method bases the forecasted value of the pre-revenue startup on the predicted cash flows. It takes into account the profit that could be earned by investments in the right places. Effectively it is a discounted cash flow model. Three financial projections are made; best case, base case, and worst-case scenario.

For example, ABC Ltd is to invest $100,000 in a small company. According to the first Chicago method, three different scenarios can emerge from this deal. The first is the best-case scenario where the deal goes through and ABC Ltd has 50% chances of a high-profit margin. The second scenario is the mid-case scenario where they have a 30% probability of profits. The third is when the company loses its investment, this is the worst-case scenario at 20%. Once this is assigned all the probabilities are added to derive a weighted sum average.

Venture capital

Venture capital is an essential method for valuing a pre-revenue startup. The method projects future revenue for five years, then based on the industry benchmarks, it assigns trading multiple net profits and then backs out the aspired investor’s return. For example, A company is expected to make $1.5 million in revenue with a sale multiple of 2. Using the formula:

The company’s expected exit value is $3 million, with a $300,000 post-money valuation. With a $50,000 investment, the pre-money valuation of the company is $300,000 so,

Risk factor summation

The risk factor summation studies 12 risk factors and subtracts or adds the monetary value on a scale ranging from very low risk to very high risk for each element. The main risk factors are the legislation, marketing and sales, funding, technology, potential exit, litigation, management, manufacturing, and the business stage.

| Risk Factor Approach | ||||

|---|---|---|---|---|

| No. | Risk | |||

| Initial value | - | - | $3,000,000 | |

| 1 | Management | Very Low | +$1,000,000 | $4,000,000 |

| 2 | Stage of Business | Normal | - | - |

| 3 | Manufacturing | Normal | - | - |

| 4 | Political/Legislation | Normal | - | - |

| 5 | Sales/Marketing | Normal | - | - |

| 6 | Funding | Normal | - | - |

| 7 | Competition | Very High | -$1,000,000 | $3,000,000 |

| 8 | Technology | Low | +$500,000 | $3,500,000 |

| 9 | Litigation | Very Low | +$1,000,000 | $4,500,000 |

| 10 | International Risk | Normal | - | - |

| 11 | Reputation | Very Low | +$1,000,000 | $5,500,000 |

| 12 | Potential Lucrative | Normal | - | - |

| Box Valuation | - | - | $5,500,000 |

Common Methods Pre-Revenue Valuation of Startup VS Traditional Valuation Approaches

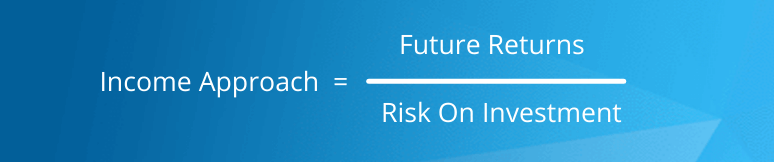

Many companies choose to use traditional methods to evaluate their startup because these methods are more direct and easier to calculate. There are three traditional methods used for valuing startups:

- Market Approach – In the market approach, by using the principle of substitution, a value is developed. The selling price of an asset or valuation multiple determines the value of a similar asset. For this method to work, there must be sufficient data of comparable startups within the same industry.

- Income Approach – By estimating the present value of the expected returns, you can derive the value of an asset. While using the income approach, factors considered here are risks associated with the investment, growth of expected income, timing of projected income, and the revenue generated by the investment. In short, this method is just a basic fraction, with the numerator being the future returns of an investor and the denominator being the risk regarding the investment.

- Asset Approach – The asset approach is a general way to estimate the value of a company. This is done by subtracting the total liabilities from the total assets. All values used in this calculation are derived from the company books. This method ascertains a value based on the assets of the company. Presenting you with a fair value of the assets of the company.

The common valuation method focuses on the combination of short & long-term and predicted data. This helps to value the startup regarding the short and long run while assuming certain figures. On the other hand, traditional valuation methods focus on the financial value of the company. The value of the startup is determined based on available data such as similar companies’ valuation information, the business’s income, and asset value.

Here is an example of the asset approach from a company’s Balance Sheet.

| Assets | Amount ($) | Liabilities | - |

|---|---|---|---|

| Non-Current Asset | $280 million | Non-current Liabilities | $95 million |

| Current Asset | $2.5 million | - | - |

| Total | $282.5 million | - | $95 million |

The company’s value according to the asset approach is $282.5 million – $95 million = $187.5 million. i.e. The equity value of the company is $187.5 million.

How to Build the value of your pre-revenue startup faster?

In order to build the value of your company faster there are many things you need to do, some of them are:

- Begin Sales: To increase the value of the startup, you need to start generating revenue. Put your product out there and start selling.

- Get Your MVP: Having a minimum viable product will help you raise more funds, show the investors more of your company, and also create a faster road to sales.

- Positioning: Make sure that your company is positioned in the right market.

- Hiring process: When you are hiring individuals for any job in your company, hiring experienced people will contribute to the success of the product and will lead the company to a higher value.

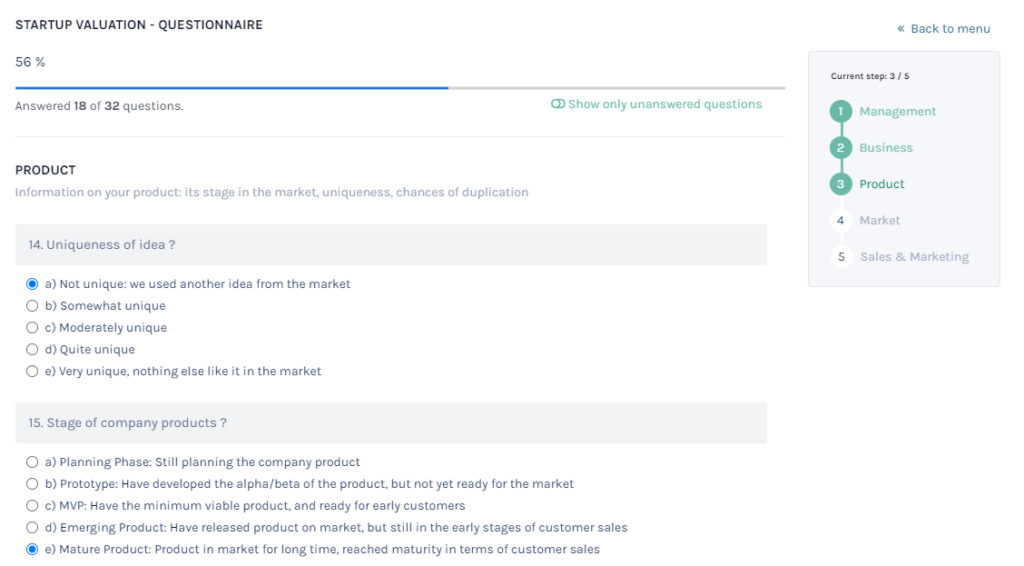

Get your accurate pre-revenue startup valuation in minutes with Eqvista

Getting a pre-revenue startup valuation has been made easier with Eqvista’s latest feature. We use the most accurate and trusted valuation methods such as Berkus Method, Scorecard Method, Risk Factor Method and VC Method to value your business. Just answer a questionnaire and you can get a valuation report in 20 minutes. Check out our startup valuation software here.

Why Eqvista is a reliable source to choose for your startup valuation?

All factors must be taken into consideration while estimating the value of a pre-revenue startup. Experimenting with different methods of valuation can help add value to a startup. Using the right methods for the valuation of a pre-revenue startup can give more accurate value to the company.

Investors often use tools to help them in the valuation of a company or startup. Eqvista is a tool that assists in valuing a company without the risk of errors. The tool also provides cap table management enabling you to see a summary of the owners at a glance. Eqvista provides you with a platform with tools backed by a professional team. Check out our Startup Valuation for your pre-revenue company! Get a comprehensive startup valuation for $89, with 5% off on 409A valuations.

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!