Managing Cap Tables in Climate Tech Startups

In this article, we will go over the structure of cap tables in climate tech startups and how cap tables influence decision-making in climate tech startups.

Managing your climate tech startup’s cap table is crucial for effectively managing equity ownership and financial structure. The dynamic nature of the climate tech industry introduces unique challenges among a diverse set of stakeholders. Effective cap table management for climate tech startups is essential for ensuring transparency.

Climate tech startups are projected to expand to $25.32 billion in 2024, with a remarkable forecast of reaching $149.27 billion by 2032, showcasing a compound annual growth rate (CAGR) of 24.8%.

In this article, we will go over the structure of cap tables in climate tech startups, how cap tables influence decision-making in climate tech startups, and the major red flags found commonly in climate tech cap tables. Read on to know more!

Structure of cap table in climate tech startups

When you are looking at the cap table of a climate tech startup, you can expect the following elements to be present:

- Founders’ Equity – Founders of any startup will start with all the equity unless the startup has been onboarding investors from day one. Typically, a founder’s equity gets diluted as the startup goes through funding rounds. In some cases, founders may adopt a multi-class share structure like Facebook where Class B shares have 10 times the voting power of Class A shares.

- Employee option pool – Investors can assess the amount of dilution they may experience by looking at this cap table element. You must maintain an employee option pool such that your employees are motivated and your investors are not overly concerned with dilution.

- Investor protections – Preference shareholders may have rights that other shareholders do not get.In a cap table for climate tech startups or any startup for that matter, these rights will either be written in full or there will be a link to a document explaining such rights.

- Preferred stock – Cap tables typically group investors based on the type of stocks they own. So, employee stock options will be one group, founders’ equity will be another, common shareholders will be another, and preference shareholders will be another. In this line, you will also see the investor protection rights offered to preference shareholders.

- Alternative funding – Since climate tech startups contribute to social good, they can raise funding in ways other startups cannot. The alternative funding sources for climate tech startups include grants, subsidies, impact investors, crowdfunding, corporate partnerships, and accelerator and incubator programs.

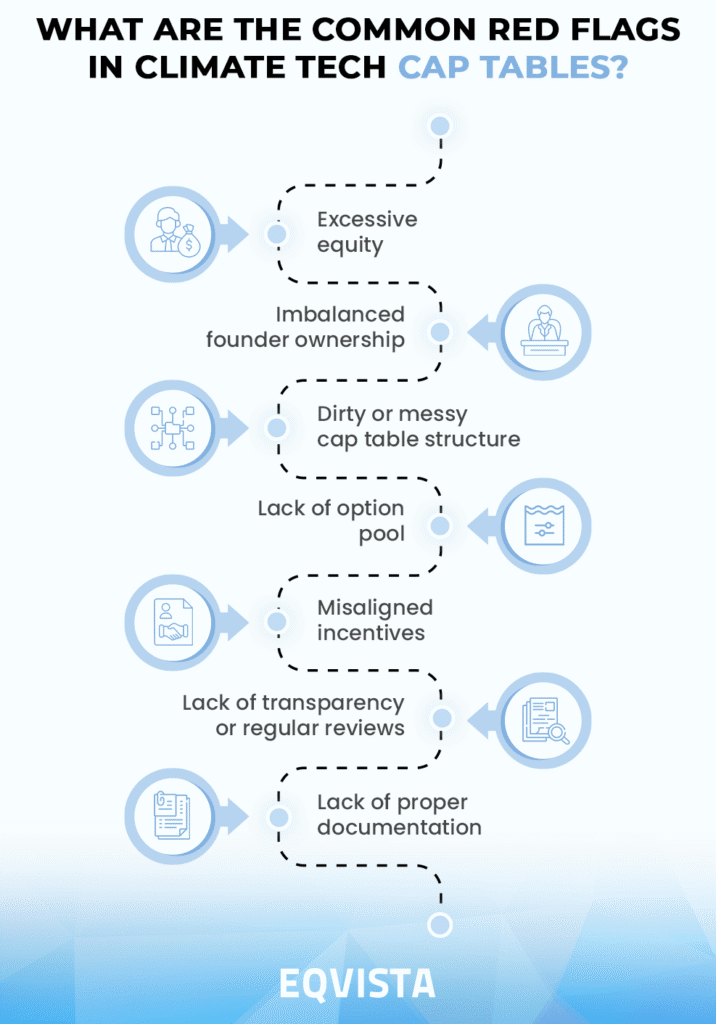

What are the common red flags in climate tech cap tables?

A well-structured cap table in the climate tech sector is essential for attracting investment and ensuring sustainable growth. However, certain red flags can indicate potential issues that may deter investors.

Excessive equity for non-operational founders or academic entities

Climate tech is an area where a lot of research and development (R&D) is required. It is common practice to invite academics for research projects. Some climate tech startups may invite well-known scientists as independent directors.

In such cases, instead of offering a salary, startups may offer equity.

However, if non-operational founders or academics hold too much equity, then you might be overcompensating them. Investors are bound to see this as a red flag since it directly affects the value of their stake and the voting powers they hold. After all, academics and investors may not always have the same goals.

Imbalanced founder ownership

Climate tech is a sector that attracts a lot of attention and is rife with charismatic and visionary leaders. Startups regularly leverage the fame of their founders to raise funds, attract talent, and execute deals.

So, it is not surprising for climate tech startup founders to have higher ownership stakes than other founders. However, once again, you must be careful against over-compensation and over-centralization of power.

Dirty or messy cap table structure

A messy and unorganized cap table structure makes it difficult for anyone to interpret and understand the startup’s ownership structure. It can also lead to misunderstandings and poor decision-making. It also shows that the founders do not make the necessary efforts to address investor concerns. So, a dirty or messy cap table structure is not a good look.

Lack of option pool

As mentioned earlier, climate tech startups must have significant R&D capabilities. However, to build a viable product, you will also need an internal team of researchers and engineers. To attract such talent, one option is to offer employee stock ownership plans (ESOPs) or other forms of equity-linked incentives.

If ESOPs are necessary to attract the kind of talent you need, then a lack of employee option pool will be a major red flag. It sends the signal that you have no estimates about the type and number of employees you want to onboard in the foreseeable future.

Misaligned incentives

Performance-linked equity incentives should match the amount of effort required to achieve them. Equity-linked incentives must be offered only to employees who contributed heavily to the company’s growth.

Liquidation preference should match the risks taken by the investor. The extent of anti-dilution rights must match how crucial an investment was. For instance, if an investor showed belief when no one else would, it makes sense to reward them with better anti-dilution rights than other investors who came in when the company was attracting ample attention.

Lack of transparency or regular reviews

Cap tables are meant to provide transparency to your investors and help them explore concerns regarding changes in valuation, liquidation opportunities, and dilution risk. They are an important tool for investors in planning their exit. Investors also get the opportunity to check for any conflicts of interest by going through the names on your cap table.

So, if your cap table does not provide information about investor rights, names of investors, and other key details, it is not valuable to your investors. In fact, having such a cap table will make your investors suspicious. So, you must make an effort to have a detailed, transparent, and regularly updated cap table.

Lack of proper documentation

If your cap table consists of various types of equity interests including common stock, preferred stock, and ESOPs, then you must provide detailed documentation outlining the rights afforded by each category.

If you are offering performance-linked incentives, the documentation should clearly outline the conditions and must include a regularly updated report on the progress towards goals set for each equity interest holder. Without proper documentation, it is quite difficult for incoming shareholders to assess their dilution risk and their rights to liquidation in various scenarios.

How do cap tables influence the strategic decisions of climate tech startups?

Cap tables can assist in a climate tech startup’s strategic decisions about fundraising strategy, talent acquisition and retention, corporate governance, exit strategy, and risk management. Let us explore how cap tables influence various types of strategic decisions in the following sections:

- Decision-Making Power and Control – Cap tables provide insights into a company’s ownership structure. They can help you verify which investors hold how much decision-making power and control over the company.

- Fundraising Strategy – Your cap table will have information about which shareholders showed how much interest when they were onboarded based on the rights they asked for. This can help you identify shareholders who may want to invest again or could lead funding rounds in the future.

- Talent Acquisition and Retention – Your talent acquisition and retention plans will consist of the amount of equity-linked compensation you offer to your employees. Any equity option pools you may have created in the past for future employees can be seen in cap tables.

- Strategic Partnerships and Alliances – Potential partners need to see your startup’s equity landscape to assess the benefits of collaborating with you.

- Corporate Governance – If your startup’s cap table is clear and concise, it will facilitate effective corporate governance by aiding decision-making and improving accountability and compliance. A well-organized cap table ensures that governance structures are transparent and that all stakeholders understand their roles and responsibilities.

- Exit Strategy and Long-Term Vision – Your investors’ exit strategy and long-term vision are deeply connected to your cap table, as they show ownership distribution and potential payouts. Understanding this can help them plan exits that align with their financial goals and future aspirations.

- Risk Management – Managing risk effectively involves understanding your cap table, as equity distribution can impact financial stability and stakeholder interests. A transparent cap table helps you identify potential risks and prepare for various scenarios.

Your Cap Table Made Simple with Eqvista

By maintaining a clear, organized cap table, you ensure transparency and alignment among stakeholders, facilitating better decision-making and risk management. This can be quite valuable as well as challenging for climate tech startups because they tend to have a diverse set of stakeholders.

To streamline this process, consider Eqvista’s cap table management software. We provide real-time insights and simplify equity tracking, helping you focus on what matters most. Get a quote on our software here!

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!