How to Calculate Tangible Assets

In this guide, we explain what tangible assets are, how they are calculated, and how you can effectively manage your company’s assets.

Everything a business owns are called assets. Assets can show a business’s net worth, but managing them can get quite complicated if there is no asset management system in place. Assets can be categorized as tangible or intangible. Tangible assets are physical things, while intangible assets do not exist in physical forms.

Tangible assets

A tangible asset of a company is one that has finite monetary value and is usually in a physical form. Although the liquidity of different markets varies, tangible assets may usually always be traded for some monetary worth. On the other hand, intangible assets are not physical in form and do not exist. Assets act as an imperative part for the company’s net value. One of the main reasons why firms have a balance sheet is to manage assets and their implications.

What are Tangible Assets?

Cash, inventory, vehicles, equipment, buildings, and investments are examples of tangible assets. These are assets that have a physical manifestation on a company’s books and balance sheet. They consist of a company’s fixed assets, such as machinery, office equipment, and buildings, as well as the materials utilized in product production (current assets). They are the non-physical assets on a company’s balance sheet, such as intellectual property or licenses, that are the polar opposite of intangible assets. Accounting will treat various forms of tangible assets differently. Current assets are frequently converted to cash in the short term and then reported as revenue in the earnings report.

What are current and long-term tangible assets?

- Current Assets – Current assets may or may not have a physical presence on site, but they will all have a transaction value. Cash, cash equivalents, marketable securities, and accounts receivable are among a company’s most liquid, tangible current assets. The fast ratio of a corporation is calculated using all of these physical assets. Other current assets are factored into a company’s current ratio computation. The current ratio indicates how well a company’s current liabilities can be covered by its current assets. Inventory, which is not as liquid as cash equivalents but has a finite market value and might be liquidated for cash if needed in liquidation, is included in current ratio assets.

- Long-term Assets – Long-term assets, often known as fixed assets, make up the second component of the balance sheet’s asset section. Real estate, manufacturing plants, manufacturing equipment, vehicles, office furniture, computers, and office supplies are examples of these assets. These assets’ expenses may or may not be included in a company’s cost of goods sold, but they are assets with genuine transactional value for the business.

Tangible assets example

Cash, inventory, vehicles, equipment, buildings, and investments are examples of tangible assets. Accounts receivable, prepaid expenses, patents, and goodwill are examples of intangible assets that do not have a physical form.

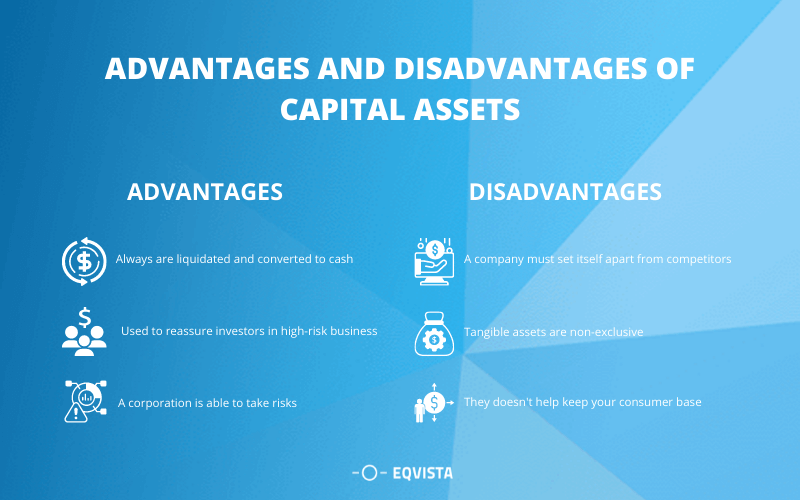

Advantage and Disadvantages of Tangible Assets

Consider the benefits and drawbacks of both types of assets when determining a company’s worth. Tangible assets provide security to a corporation, but intangible assets provide more opportunities for growth.

Advantages of Tangible Assets

- A corporation with a high tangible asset worth can always be liquidated and converted to cash.

- In higher-risk businesses like banking and finance, these assets are used to reassure investors.

- The corporation will be safe as long as the value of its tangible assets exceeds the amount it is risking. The more money you have, the more risk you can take.

Disadvantages of Tangible Assets

- In a free market, a company must set itself apart from its competitors. To accomplish so, it must concentrate on what it does best and what it has that no one else in its field does.

- The disadvantage of tangible assets over intangible assets is that they are non-exclusive.

- Any business can have the same physical assets as another. In and of themselves, these assets don’t do much to keep your consumer base.

Calculate tangible assets

The formula for calculating the tangible assets is given below:

Understand Net Tangible Assets

Net tangible assets (NTA) are the worth of a company’s physical (“tangible”) assets minus its liabilities. NTA is the sum of a company’s total assets, intangible assets, and liabilities. The “book value” or “net asset value” of a firm refers to the total value of its net tangible assets.

Total Assets

The sum of the book values of all assets owned by an individual, firm, or organization is referred to as total assets. It’s a metric that’s frequently employed in debt covenants based on net worth. The worth of a company’s total assets is determined after depreciation has been taken into account.

Intangible Assets

A non-physical asset is referred to as an intangible asset. Intangible assets include goodwill, brand awareness, and intellectual property like patents, trademarks, and copyrights. Tangible assets, like land, vehicles, equipment, and inventories, compete with intangible assets.

Total Liabilities

Total liabilities are a company’s total debt and financial commitments to individuals and organizations at any one point in time.

Total liabilities are a component of the general accounting equation:

Example of Calculating Tangible Assets

Tangible assets are calculated by examining its balance sheet. Here is an example of calculating tangible assets.

Asset Calculation

The first step is appropriately assessing an asset’s worth. Start with the one that is the most liquid. Cash and cash equivalents are included, the next, go to investing and ascertain the current market worth. These are some of them:

- Pension

- Bond

- Cash value of life insurance

- Investing in a mutual fund

- System of severance pay – IRA, 401(k), 403(b) (b)

- Real estate and movables. Keep in mind that real estate encompasses both land and everything permanently attached to it, such as houses.

Debt Calculation

Debt is straightforward to calculate because it represents all outstanding debt. Monthly statements and reminders may also be sent to you. These statements are based on actual statistics rather than projections, and they reveal just how much money you’re borrowing.

Begin with the secured debt commitments listed below:

- Loan for a car

- Taking out a home equity loan

- Loan with a margin

- Mortgage

- Mortgage on a rental property

- Second loan

- Second mortgage/vacation

Net Worth Spreadsheet

Calculating the tangible net worth using the formula:

Use of Net Tangible Assets

On a balance sheet, net tangible assets denote a company’s book value, which is calculated by subtracting total assets from all liabilities and intangible assets. Analysts can isolate a company’s physical assets using net tangible assets.

Net Tangible Asset Per Share

The net tangible asset number of a corporation is divided by the total number of shares outstanding to determine net tangible assets per share. A company’s net tangible assets per share is $2 if it has $1 million in net tangible assets and 500,000 shares outstanding.

Net Tangible Asset Formula and Example

When determining the value of tangible assets, you must consider how they are recorded on the balance sheet as well as the income statement. On the balance sheet, most will be reported at their original, or book value.

Where:

- Total assets, which can be found on a company’s balance sheet, contains both tangible and intangible assets.

- Intangible assets are those that do not have a physical existence. Goodwill, trademarks, and copyrights are examples of intangible assets.

- Total liabilities, which can be found on a company’s balance sheet, include both current and non-current obligations.

The following approaches are used to transfer them to the income statement, Liquidity should be used to organize current assets. The most liquid assets will be at the top of the list.

Example of Net Tangible Asset Formula

If a firm has $1 million in total assets, $100,000 in total liabilities, and $100,000 in intangible goodwill, its net tangible asset amount is $800,000.

The calculation would be as follows = $1,000,000 – $100,000 – $100,000 = $800,000

Get experts to help to value your tangible assets with Eqvista!

Sometimes it becomes difficult to manage tangible assets and know the worth of your own company assets. We at Eqvista are here to help you. Contact us to get a free consultation from us. Our expert team will help you in managing your tangible assets and determine their value.

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!