What Are the Risks of Delaying Stock Option Plans Until Later Startup Stages?

Here’s a scenario: your star employee, who joined your startup when it was at its nascent stage, receives a life-altering tax bill exceeding $100,000. Why? Because they simply exercised their stock options after your valuation skyrocketed. This isn’t fiction – it’s the direct consequence of delaying your stock option plan. Founders who obsess over product and funding often overlook the risks of postponing equity compensation. This can create a cascade of hidden risks that hamper talent acquisition, financially devastate early believers, and seriously erode founder ownership.

This article breaks down the tangible dangers of postponing your equity plan. You’ll understand how delay impacts your talent pipeline, employees’ financial security and your ownership stake. Learn why timing isn’t just paperwork—it’s critical to your startup’s survival and fairness.

High Cost of Delaying Stock Options

Startups often deprioritize creating a formal stock option plan, calling it “administrative noise” best tackled later. However, this delay can be a strategic self-sabotage.

- Talent Exodus Risk: Startups granting options within their first year witness a considerably higher early-employee retention rate. Without equity, cash-strapped startups struggle to compete.

- Employee Tax Risk: Delaying grants means higher exercise prices. When employees exercise, the spread between the exercise price and Fair Market Value (FMV) triggers Alternative Minimum Tax (AMT). AMT liabilities routinely reach over thousands of dollars at growing startups. It often forces employees to forfeit options as they cannot afford to exercise.

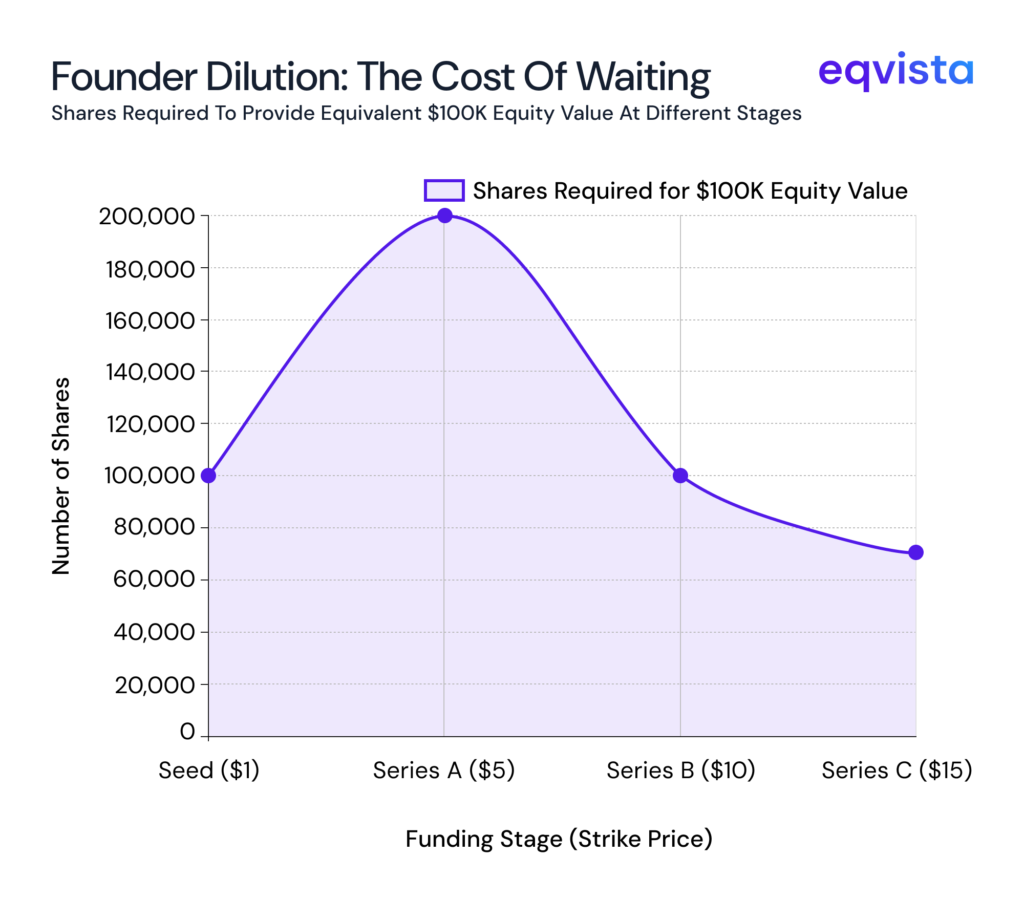

- The Founder Dilution Penalty: Waiting isn’t cheaper. Granting options after key valuation jumps can force you to hand out far more shares to deliver equivalent value, leading to founder dilution.

Thus, delaying your ESOP isn’t just an administrative oversight. It’s a critical financial, cultural, and strategic mistake with potentially dire consequences for founders, employees, and the company’s very foundation.

Risk #1 Talent Acquisition and Retention Craters

Your first hires bet their careers on your vision. Without meaningful equity granted early, you remove the primary tool for compensating for below-market salaries and high risk. The consequences can be severe and immediate:

- Recruiting roadblocks: Top talent expects considerable equity for joining pre-product/market-fit. Delaying plans means you undervalue their risk, making you uncompetitive against others with clear ownership stakes.

- Retention Crisis: High early churn devastates momentum. Your key players who joined on promises of “future equity” will lose faith as milestones pass without grants. They’ll leave for competitors offering concrete compensation.

- Cultural Erosion: Early teams build the culture. Perceived inequity poisons morale. If your employees feel like hired help rather than owners, it can spread disengagement.

Equity compensation is your most potent currency for creating a loyal, mission-driven core team. Delay devalues it.

Risk #2: The AMT Tax Bomb

This stage inflicts the most visceral financial pain. As you raise capital and hit milestones, your company’s 409A Fair Market Value (FMV) soars. Delaying stock options until after these jumps can create huge tax liabilities via the Alternative Minimum Tax (AMT).

- Stock options offered later have a higher exercise price (strike price) tied to the current elevated FMV.

- When your employee exercises an Incentive Stock Option (ISO), they owe AMT on the difference between the strike price and the FMV at the time of exercising. That’s even before selling the shares. This “spread” is taxed as ordinary income under AMT rules.

- These AMT liabilities routinely reach thousands of dollars. For instance, an early employee was granted options at $1/share after a seed round. If they exercise post-Series A when the FMV is $5.00/share, they owe AMT on $4/share per share exercised. For a 20,000-share grant, that’s a $80,000 income on illiquid stock for AMT calculation. Many simply cannot pay such hefty amounts and forfeit their hard-earned equity.

- The higher the exercise price, the smaller the potential profit for employees before sale. Delay directly cuts down their ultimate reward.

A simple example of early vs late option planning

| Stage | Valuation | Option Strike Price | Perceived Employee Value |

|---|---|---|---|

| Seed Stage | $10M | $1/share | High upside potential |

| Series C Stage | $150M | $15/share | Reduced upside, higher risk |

An employee who joins at Series C now faces a steeper price for potentially less reward.

Thus, postponing employee stock option plans can punish your most loyal pioneers with possibly huge tax bills and reduced financial upside.

Risk #3: Strategic and Investor Minefields

Delaying stock options also creates operational chaos and erodes stakeholder trust as you scale.

- Introducing a large stock option pool after a significant valuation increase means a vast and sudden dilution for existing shareholders (both founders and early investors). This can spark contentious negotiations and resentment.

- Sophisticated VCs see a delayed employee stock option plan as a major governance failure. They perceive it as poor planning, potential fairness issues with early contributors, and future dilution debates. Investors look for clean and early alignment.

- Moreover, setting up a legally sound plan with proper board approval, shareholder consent, and other documentation is far more expensive and complex mid-growth amidst other scaling pressures.

A delayed stock option plan can lead to the risk of investor distrust and cap table issues. For VCs looking from the outside, it may signal organizational dysfunction.

Risk #4 The Founder Dilution Double Whammy

Founders often postpone equity option plans to “preserve” their ownership. It is a critical miscalculation.

- Equity granted at a low FMV gives considerable perceived value with fewer shares. Granting the same value of equity later, when FMV is high, requires issuing far more shares.

- Founders who delay creating option pools until funding rounds suffer significantly higher dilution than those who establish plans early. You don’t save equity by waiting. You’re forced to give away more of the company later to match the motivational impact of early grants. Waiting will force you to dilute more aggressively to attract talent later.

Implement Early, Reap the Rewards

The antidote is clear: Establish a formal stock option plan with your first key hires, ideally post-incorporation and pre/following your first significant funding (e.g., pre-Seed/Seed). But, the optimal timing may vary based on your company’s specific circumstances, hiring needs, and growth milestones.

It will help in:

- Lock in Low Strike Prices: Minimize future employee AMT nightmares.

- Secure Vital Talent: Attract and retain mission-critical builders with meaningful, early ownership.

- Build Ownership Culture: Foster alignment and long-term commitment from day one.

- Clean Cap Table: Manage dilution predictably and avoid investor friction.

- Founder Protection: Preserve more ownership by granting equity efficiently at low valuations.

Eqvista Helps You Tackle Risks Comfortably!

Procrastination isn’t just inefficient; it’s actively harmful. Delaying your stock option plan isn’t just poor planning — it’s a strategic risk. It weakens your ability to attract talent. It complicates your fundraising. It frustrates your employees. The most innovative founders treat stock options as part of their growth strategy, not an afterthought.

Eqvista provides the expert guidance and robust platform you need to implement your equity plan correctly and early. Avoid the hidden costs of waiting. Contact Eqvista to build a fair, motivating, and strategically sound equity foundation.