409a valuation for Hong Kong

In this article, we will explain what a 409A valuation is, when it is needed, and where you can get a 409A valuation in Hong Kong.

Hong Kong is known to be the financial hub of Asia, and it’s no surprise that it’s the first place that many business owners think of when they want to expand their business. With most companies, there is certain paperwork that needs to be done in order to have a business in Hong Kong, especially if the business has any connection to the U.S.

Hong Kong Companies in the US

Hong Kong is a self-governing region of the People’s Republic of China located in East Asia’s Pearl River Delta. Hong Kong is one of the world’s most important financial centers, with the highest Financial Development Index score and a reputation for being the most competitive and free economic entity in the world. Official data suggest that the US has a $30 billion yearly trade surplus with the HKSAR. US direct investment in the city is close to $100 billion. Over 1,300 US corporations have opened offices in Hong Kong.

Overview of the Hong Kong companies and business with the US

Hong Kong and the United States share strong economic and social links. In Hong Kong, there are around 85,000 American citizens and 1,300 American companies, including 726 regional operations. In 2006, US exports to Hong Kong were $17.8 billion, according to US government statistics.

There is no tax treaty between the United States and Hong Kong. Even though the United States and Hong Kong do not have a bilateral tax treaty, a U.S. person (citizen, legal permanent resident, or foreigner who fulfils the Substantial Presence Test) with Hong Kong assets and/or income may be required to report to the IRS. The United States adopts a global income tax approach. That is, Americans are taxed on their worldwide earnings. Unless a limitation, exception, or exclusion exists, all income generated or derived in Hong Kong is taxed in the United States.

Important US tax issues to know

- 83(b) election – The Internal Revenue Code’s (IRC) 83(b) election allows an employee or startup founder to pay taxes on the complete fair market value of restricted shares at the time of grant. The 83(b) election is for equities that have a vesting period. The 83(b) election instructs the IRS to tax the elector for stock ownership at the time of gift rather than when the stock vests.

- ASC 718 – Employee stock-based compensation is expensed on an income statement in accordance with ASC 718. Equity awards are a type of compensation that is subject to a set of accounting regulations known as ASC 718 that corporations must adhere to. Expense accounting was previously known as FAS 123(r), but it is now governed by ASC 718.

- ISO 100k – In contrast to Non-qualified Stock Options (NSOs or NQSOs), Incentive Stock Options (ISOs) receive preferential IRS treatment. The key advantage is that when the option is exercised, the spread between the fair market value (FMV) and the initial exercise strike price is not subject to ordinary income tax. Ordinary income tax is withheld on the spread by NSOs at the time of exercise. ISOs, on the other hand, are nevertheless subject to the Alternative Minimum Tax (AMT) in order to prevent affluent persons from hiding all of their income in this method. Another IRS rule designed to prevent the ISO program from being utilized as a tax shelter is the $100K Limit (100K ISO Limit).

- Form 3921 & 3922 – The IRS has issued two forms (and instructions) for reporting ISO workouts and ESPP share purchases: Form 3921 for ISO exercises and Form 3922 for ESPP share purchases. For each workout or purchase made during the calendar year, a new form must be completed and filed. As an example, if an employee used many ISO awards over the course of a year, in a calendar year, the employee must receive a copy of Form 3921 for each exercise, and the corporation must receive a copy of Form 3921 for each exercise, will be required to file numerous tax returns with the IRS.

- Internal Revenue Code Section 409A – A 409A is an impartial evaluation of a private company’s common stock, or equity reserved for founders and workers, at fair market value (FMV). It is used to calculate the fair market value (FMV) of your company’s common stock which a third-party valuation firm usually does. The cost of purchasing a share is determined by this valuation.

409a Valuation & Hong Kong Companies

The 409a valuation is required for getting compensation on the fair market value and understanding the various other categories of finance and thereby giving share based compensation to the employees. It ensures that no penalties are paid by the company if the 409a valuation is not complete. Sometimes it can be a complex process for structuring the capital. Hong Kong is a hub for various businesses so the companies must get a 409a valuation for their companies to avoid paying any excise taxes to the government. A 409a valuation of the companies of Hong Kong includes a set of instructions that have to be followed by the companies, there might be some set of rules for them primarily.

What exactly is 409a valuation/regulation?

A 409A is used to calculate the fair market value (FMV) of your company’s common stock, which a third-party valuation firm usually does. The strike price for options granted to employees, contractors, advisors, and anyone else who receives common stock is determined by 409As.

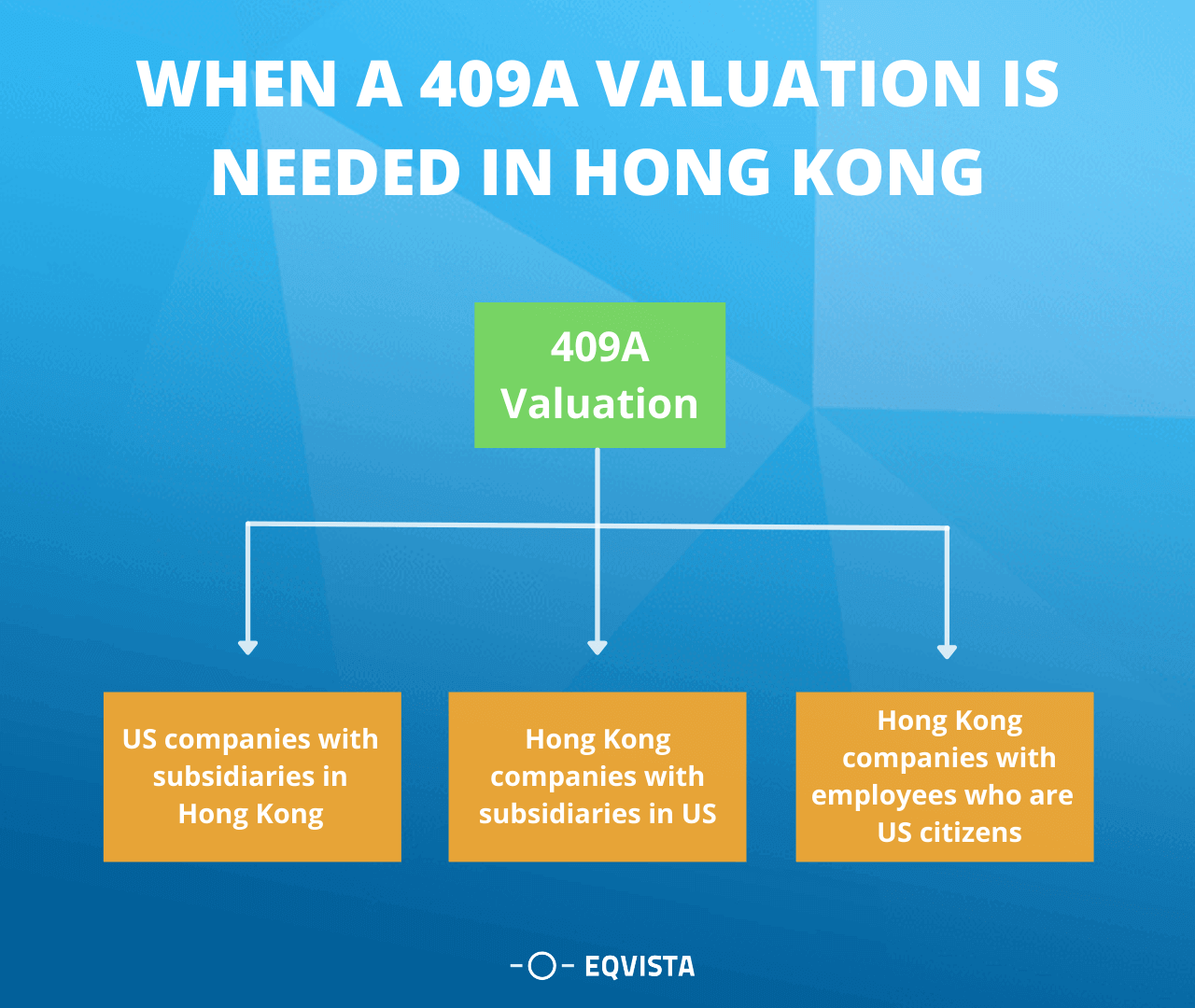

When a 409a valuation is required for a Hong Kong company?

A 409a valuation is required by the company when it doesn’t know the value of the stock. For example, If you want to sell a table but don’t know how much it’s worth, you sell it to anyone. Using the same analogy, a 409a becomes vitally important if a firm intends to offer equity. It’s impossible to sell shares if you don’t know how much they’re worth. A 409a valuation is required if your company is:

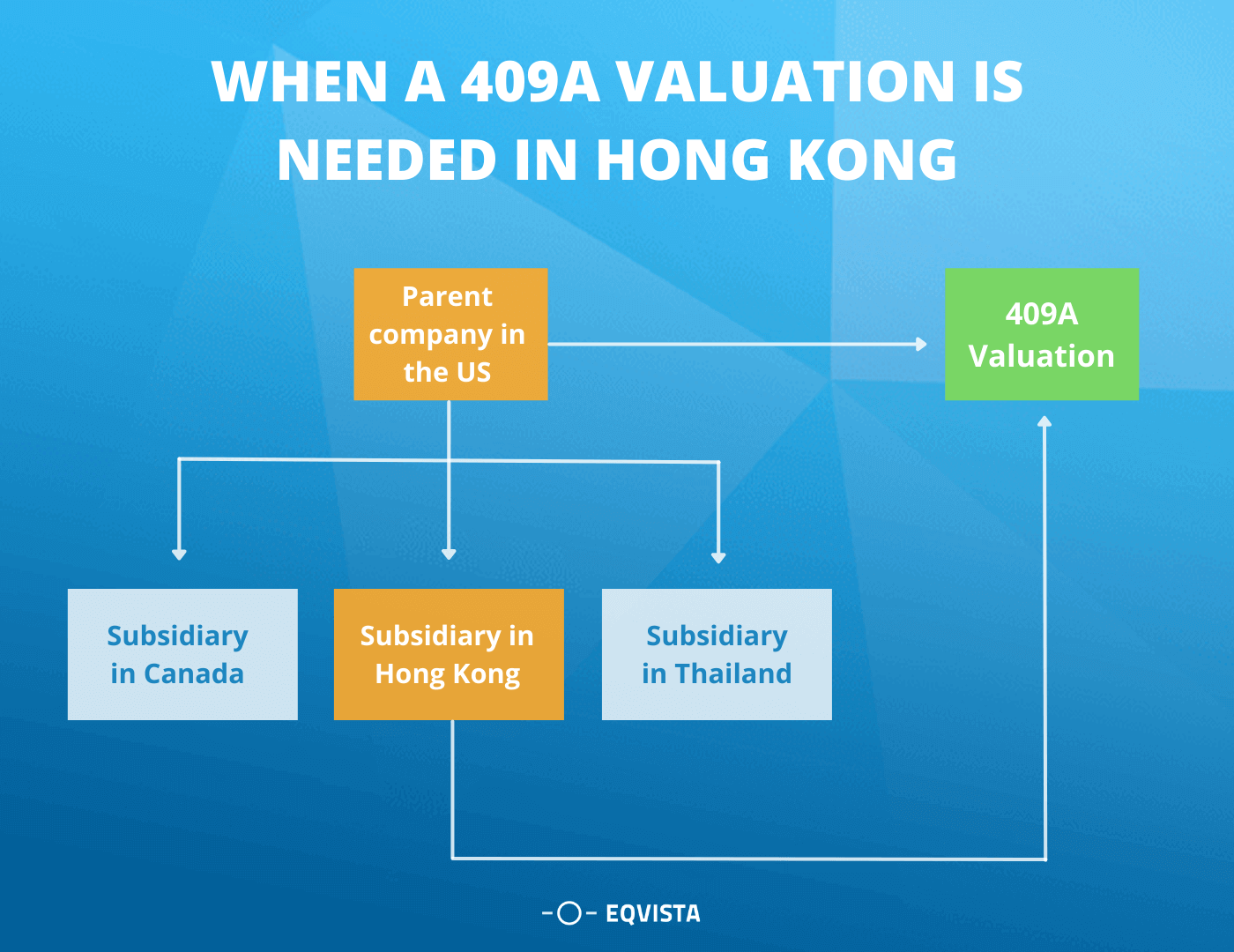

US Holding company with the Hong Kong subsidiaries

A holding company is a type of corporation formed to purchase and control the stock of other corporations. Investors interested in forming a company for this purpose will frequently hunt for a jurisdiction that will allow them to do so quickly and easily. Furthermore, if the chosen place of incorporation has a low taxation regime, it is a significant advantage. Hong Kong boasts pro-business regulations and is considered one of the world’s most important financial centres. Hong Kong has modernized and updated its Companies Law, making it one of the most up-to-date legal systems in the world.

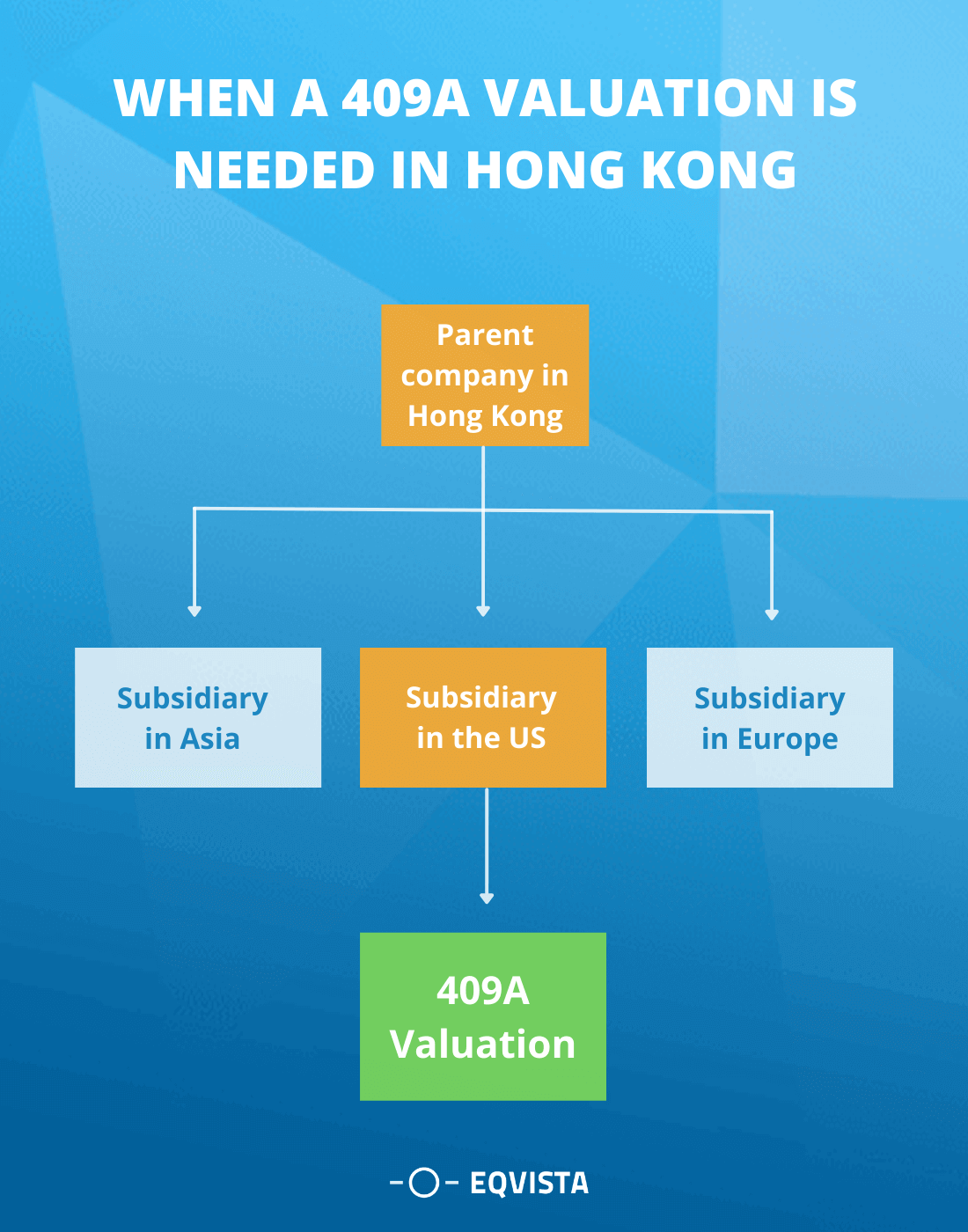

Hong Kong Holding company with US subsidiaries

A Hong Kong holding company can serve as a stable platform for investors looking for a way into US markets. Such a corporate structure, providing investors far greater flexibility in handling their finances in the US. For example, as a Wholly Foreign-Owned Enterprise, a US corporation that owns an entity in Hong Kong can profit from any US-based assets or entities that the Hong Kong company owns (WFOE). In the same scenario, the US business can sell any US-based entities through its Hong Kong entity, which administers these assets, using a variety of means, such as selling its shares through the Hong Kong company. Of course, the US has adopted severe restrictions in recent years to restrict indirect sales of taxable firms within the country. As a result, it’s critical to stay informed about any policies that apply.

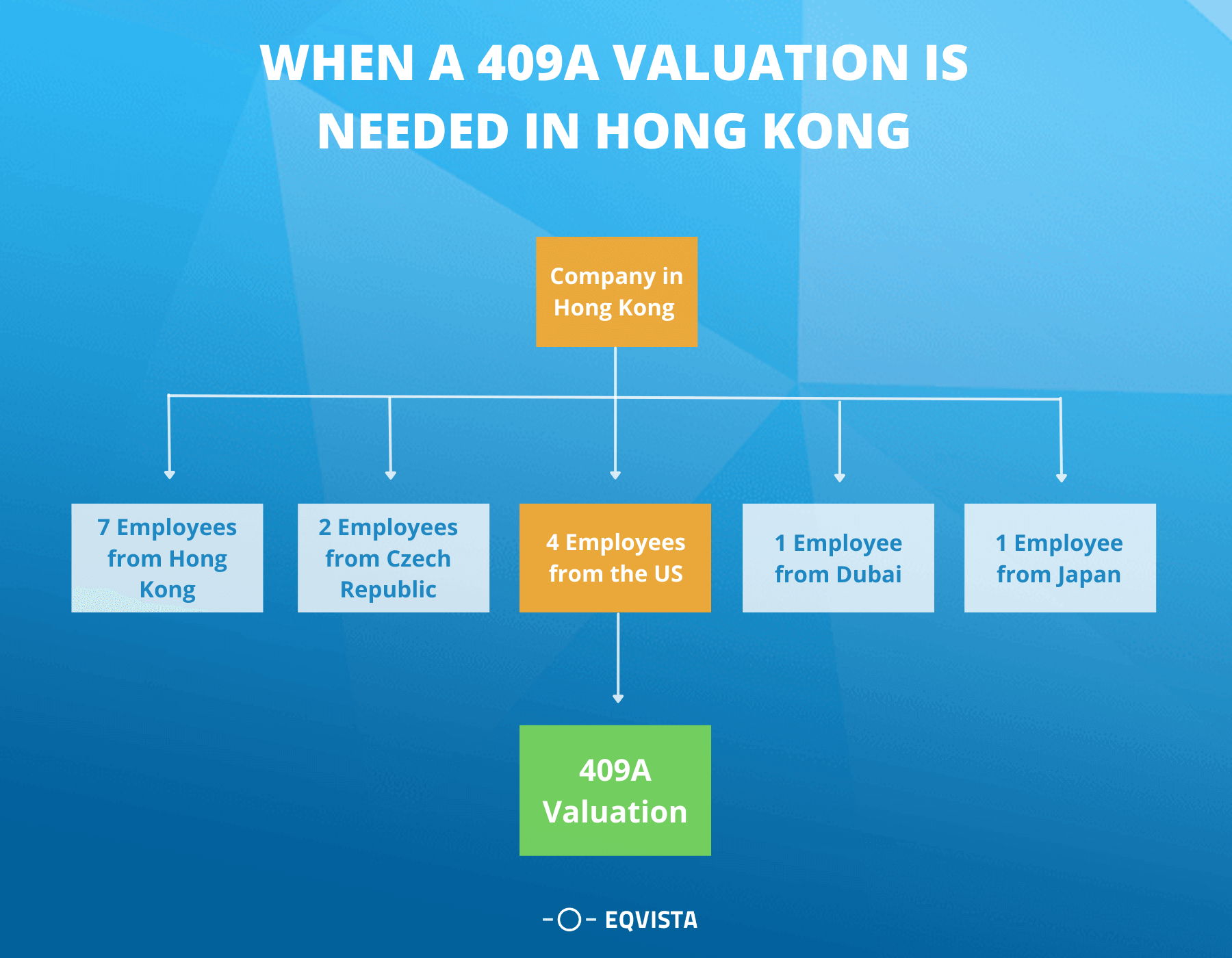

Hong Kong companies with US employees (Offering ESOPs/Other Incentive Programs)

Employee Share Option Plan (ESOP) is a mechanism by which a company (which can be private or publicly traded) grants one or more employees the right to purchase a specific number (or a specific percentage) of the company’s shares at a specific price (the exercise price) and for a specific period of time, usually within a few years (the exercise period). During this time, the employee has the choice to exercise or not exercise the option at a price set by the corporation at the time of the award. This is a choice made available to the employee, not a requirement. On the company’s side, it’s a valuable tool for rewarding and motivating critical and loyal people to stay with the company by giving them stock in future revenues. In addition to salary and other kinds of monetary remuneration, an ESOP is considered as an alternate tool to incentivize strong performers and talent (especially useful for start-ups or early-stage companies which have limited financial resources).

Other situations for 409a valuation

A third-party valuation provider is often employed to estimate the fair market value (FMV) of your company’s common shares under 409A. The strike price for options granted to employees, contractors, advisors, and anyone else who receives common stock is determined by 409As. When two countries do a stock exchange, there might be some situations that may occur.

- ESOP in Hong Kong? – In Hong Kong, an Employee Stock Option Plan (ESOP) is a successful retention technique for employees who desire to stay with the company. In Hong Kong, ESOP plans work by giving selected employees stock options in the company. This serves as a motivator for employees to commit to the organization for the long run. Employee stock option plans are beneficial because they allow employees to have a stake in the company’s success

- Is ESOP Regulated in Hong Kong? – Consultants, directors, and consultants can all be included in an Employee Stock Option Plan in Hong Kong. Because it is similar to dealing with the sale of securities, it is a practical strategy. The Companies (Winding-Up and Miscellaneous) Ordinance governs this type of business (Cap. 32) typically

- Transfer of Shares involving US shareholders – The intentional transfer of title of the shares between the transferor (one who transfers) and the transferee (one who receives) is referred to as a transfer of shares. A private limited company’s shares are not transferable, with a few exceptions. For the transfer of shares, a transfer deed is used. In the USA, a private business cannot transfer shares to an individual directly, although an existing shareholder can. The paperwork will be signed by both the transferor and the transferee once the form has been completed. Alternatively, the document could be signed by either two directors or one director and one secretary.

Why is a 409a valuation important?

A 409A is used to calculate the fair market value (FMV) of your company’s common stock, which a third-party valuation firm usually does. The strike price for options granted to employees, contractors, advisors, and anyone else who receives common stock is determined by 409As.

A company’s post-money valuation, which is based on how much investors paid for their position after fundraising, is often (but not always) different from its 409A valuation. Because preferred stock is given to investors, a post-money valuation is based on preferred stock price, but a 409A is based on the cost of common stock. Preferred stock is frequently more valuable than regular stock because of certain characteristics.

Defining the fair market value of shares

A company’s post-money valuation, which is based on how much investors paid for their own position after fundraising, is often (but not always) different from its 409A valuation. Because preferred stock is given to investors, a post-money valuation is based on preferred stock price, but a 409A is based on the common stock price. Preferred stock is frequently more valuable than regular stock due to particular characteristics.

The fair value of the company

A 409A is used to calculate the fair market value (FMV) of your company’s common stock, which a third-party valuation firm usually does. The strike price for options granted to employees, contractors, advisors, and anyone else who receives common stock is determined by 409As.

Safe harbor status

While companies frequently conduct their financial analysis to estimate FMV early in its lifespan, valuations grow more complicated as time goes on, requiring more knowledge and taking longer. Eqvista helps you in filing a 409a valuation offer safe harbor status.

Consequences for not complying with 409a while issuing equity

An independent company valuation is necessary for nonqualified deferred compensation (NQDC) plans that contain stock options and/or stock appreciation rights (SARs). The valuation determines the strike price at which the opportunities and SARs can be exercised.

The penalties of not complying with 409a can be severe for the company and the employees too. The sanctions will ruin your staff before they ruin your firm, but you can bet the two will happen in quick succession.

Tax penalties

Noncompliance with section 409A can result in the following tax penalties for employees:

- Even if payment is made in the following years, employees must pay income tax and a 20% penalty on any deferred vested amounts under the NQDC plan as of the last day of the vesting year.

- Employees must pay a premium interest tax of 1% above the federal underpayment penalty rate on failed compensation from the vesting date forward. Employees may be required to pay additional penalties as a result of understating their income. Employees may also be subject to penalties imposed by the state.

Common Valuation Methods

The common valuation methods are those that their companies use to calculate and check the stored stock. Three differences have been used to analyze the value of the stock and follow the instructions mentioned in the 409a section.

- Asset approach – A company’s net asset value is the emphasis of an asset-based approach to business valuation. Total liabilities are subtracted from total assets to arrive at the net asset value. There is some space for interpretation when determining which of the company’s assets and liabilities to include in the assessment and how to measure their worth. Financial executives have a significant duty in determining and keeping awareness of a company’s value.

- Market approach – The market approach is a method for calculating an asset’s worth based on the selling price of similar assets. Along with the cost technique and discounted cash-flow analysis, it is one of three main valuation methodologies. In circumstances where there is a lot of data on similar transactions, the market method shines. Alternative procedures may be required if that data is not available.

- Income approach – The income technique estimates fair value based on the income generated by the property. The capitalization rate is divided by the net operating income to arrive at this figure. When it comes to business valuation, the income method reigns supreme. The majority of people start a business to make money. As a result, if someone is buying a firm, the amount of money they will generate in the future is the most important consideration in determining the purchase price. In simple terms, the income strategy is analyzing a company’s financial history in order to forecast future earnings.

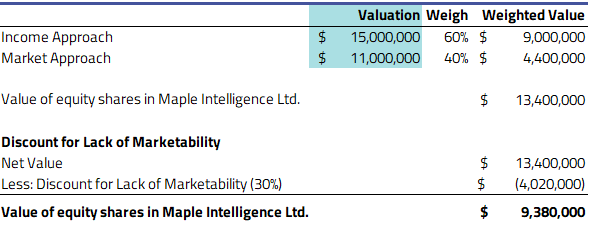

Calculations for 409A Valuation in Hong Kong

Let’s say there is a company, Maple Intelligence Ltd, which provides artificial intelligence software for security purposes. This company has some senior managers and executives who are expats and US citizens, who need to declare tax back in the US for their stock options they plan to exercise in the future. In order to determine the strike price on these options, Maple Intelligence Ltd decides to undergo a 409a valuation to find the value, and exercise price, for their ESOPs.

Here is a basic look at their Cap table:

| Security Name | Shares | FD% |

|---|---|---|

| Common Stock | 8,000,000 | 38.10% |

| Preferred Stock | 10,500,000 | 50.00% |

| ESOP | 2,500,000 | 11.90% |

| Total | 21,500,000 |

After having their 409a valuation processed, the resulting value was calculated as:

With the total valuation of the company at $9,380,000 after the DLOM, and capital structure with 21,500,000 shares, after processing the value through a waterfall analysis, the final share price was calculated as:

$0.31 price per share

With this, Maple Intelligence Ltd. was able to issue its stock options according to its ESOP plan at a strike price of $0.31 to its US staff.

Get a certified 409a Valuation Report for Your Company.

We at Eqvista are providing a valuation report for companies, and our experts will guide you on the entire process. We also provide consultations for the management of your shares, accounts, and growth of the business strategies. The software that we provide is highly transparent and user-friendly, which helps our clients to get the most out of our services.

If you are not sure where you can get your 409a valuation, we are here to help you. Book a free consultation today, and we will explain the entire procedure for the certificate.

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!