Guide to Distribution Waterfalls – Everything you need to know

This article will offer you insights into all of these and the best practices for distribution waterfalls.

The mechanism of distributing gains on capital or investment dividends across all participants is known as a waterfall in the private equity industry. Investors, limited partners, property managers, real estate companies, and business sponsors are all on the receiving end of equity waterfalls. The phrase “waterfall” is used to describe the distribution of earnings from a business enterprise.

The primary goal of implementing a distribution waterfall structure is to delay the allocation of earnings to the management until all of the partners have received their agreed-upon ROI. To implement this structure to benefit from your business, you must understand the types of distribution waterfalls, and the various factors affecting distribution waterfalls.

Understanding Distribution Waterfalls

A distribution waterfall approach is a framework for allocating profits in a manner that benefits both general partners and limited partners. It is possible to alter the waterfall model’s progression to better suit the needs of all parties involved. A perfect waterfall model would distribute rewards fairly.

Whether setting up an equity fund or investing in real estate, all parties involved in the transaction should have access to the governing agreements that detail the parameters of the distribution waterfall model. The deal’s limits, including any clawback clauses and carry interest, should be laid out in detail and made plain to all parties in the corresponding paperwork.

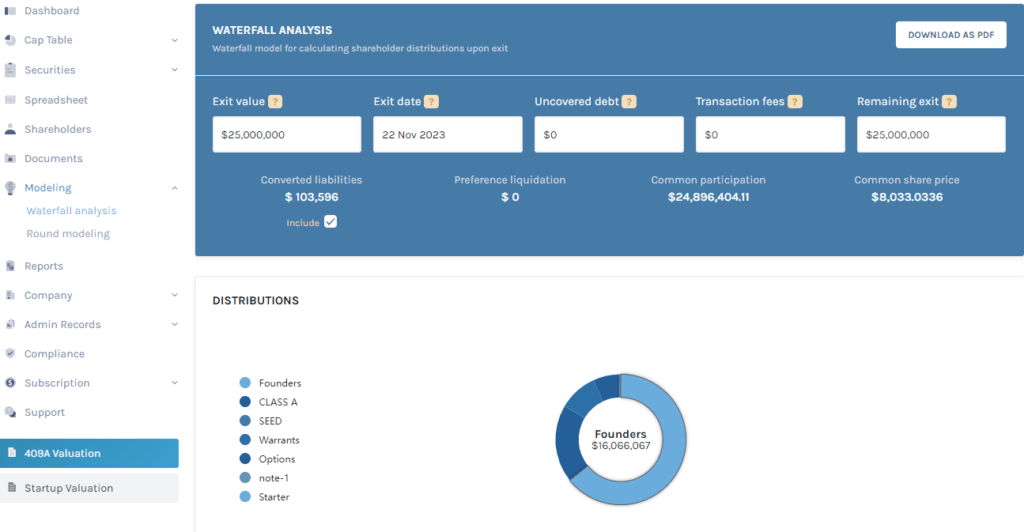

Here is a sample waterfall analysis of Eqvista

Investors in a waterfall structure might provide financial incentives to the sponsor in the form of higher returns. If returns are lower than anticipated, however, the sponsor’s portion of the profits will be reduced under the distribution waterfall model.

Case Study: Project DeltaSoft – Delta Pvt. Ltd’s Software Development Project

1. Project Overview

Delta Pvt. Ltd aimed to develop DeltaSoft, an innovative software solution to streamline their internal processes. The project involved several phases, including planning, design, development, testing, and deployment.

2. Project Timeline

The project was planned to span over six months, starting from January 1, 2023, to June 30, 2023.

| Phase | Planned Start | Planned End | Duration (Days) |

|---|---|---|---|

| Planning | 01-Jan-2023 | 15-Jan-2023 | 15 |

| Design | 16-Jan-2023 | 28-Feb-2023 | 45 |

| Development | 01-Mar-2023 | 30-Apr-2023 | 61 |

| Testing | 01-May-2023 | 15-June-2023 | 46 |

| Deployment | 16-June-2023 | 30-June-2023 | 15 |

3. Resource Allocation

Delta Pvt. Ltd allocated a team of 20 developers, 8 designers, and 5 QA specialists for Project DeltaSoft. The development team worked in an agile environment, allowing for flexibility in task assignments.

4. Budget Allocation

The budget for Project DeltaSoft was set at $3 million, covering personnel costs, software and hardware expenses, testing tools, and contingency.

5. Waterfall Analysis

a. Planning Phase

During the planning phase, the team identified potential risks and estimated the project’s costs and timeline. They allocated 5% of the budget for planning.

| Activity | Cost ($) | Percentage of Budget |

|---|---|---|

| Risk Identification | 20,000 | 0.67% |

| Cost and Timeline Estimation | 60,000 | 2% |

| Contingency | 120,000 | 4% |

| Total | 200,000 | 6.67% |

b. Design Phase

In the design phase, the team focused on creating a detailed blueprint for DeltaSoft. They allocated 10% of the budget for design.

| Activity | Cost ($) | Percentage of Budget |

|---|---|---|

| UI/UX Design | 300,000 | 10% |

| Architecture Design | 200,000 | 6.67% |

| Design Reviews | 70,000 | 2.33% |

| Contingency | 150,000 | 5% |

| Total | 720,000 | 24% |

Types of Distribution Waterfalls

To manage risk away from investors, it may be helpful to explore the idea around a distribution waterfall model. The profitability of waterfall models may be determined in many ways. There are two types of waterfall analysis: ”American “ and “European”.

Comparison Between Equity Waterfalls

| EUROPEAN | AMERICAN |

|---|---|

| Prioritize investors, ensuring that they receive their share of profits before the manager receives any. | Favors Sponsors ,and they rewarded with large equity due to higher returns generated for investors. |

| The manager will only participate in profits after the investors have received their invested funds and preferred return in full. | Managers will receive a disproportionate share of distributions . |

| Management may not see a significant return on their investment for many years. | appealing to investors if it has a "clawback" mechanism in the agreement. |

| Easier on the wallets of potential backers. | General Partner must wait a long period before receiving compensation |

Components of a Distribution Waterfall

Distribution waterfalls are utilized by equity and venture capitalists as a structure for allocating earnings to investors and fund management. According to predetermined standards, it lays down the sequence and precedence of handouts. The preferred return, the hurdle rate, and the carried interest are the three main parts of a distribution waterfall.

- Preferred return – Priority return or preferred return refers to the minimum rate of profit that investors obtain on their money before the fund management is entitled to a portion of the profits. Usually represented as a percentage, it limits the fund manager’s share of the earnings to a certain amount before the investors start seeing any returns.

- Hurdle rate – The term “hurdle rate” refers to the rate of return over which the fund manager will begin to receive compensation for managing the fund. It is a target return for the fund that must be exceeded in order for the management to share in the fund’s profits.

- Carried interest – The carried interest, is the percentage of a fund’s earnings that goes to the management after the expected yield and hurdle rate are achieved. attained. It is the proportion of earnings over the hurdle rate that goes to the fund manager, and it indicates the manager’s part of the profits. By compensating the fund manager with a carried interest based on their performance, the investors’ interests are aligned with those of the manager.

Factors Affecting Distribution Waterfalls

Multiple variables affect the timing and distribution of returns in the case of private equity and VC funds, each of which is known as a “waterfall”. Distribution schedules are influenced by the fund’s initial terms, investment returns, and investor contributions. Let’s understand these factors better here.

- Fund terms – The distribution waterfall is heavily influenced by the requirements and conditions set out in the fund’s governing documents. Profit allocation conditions may include a preferred return rate, a hurdle rate, an accrued interest percentage, and other provisions. The existence of distinct classes of investors or varying degrees of priority in the fund structure might also have an effect on the distribution waterfall.

- Investment performance – The distribution waterfall is very sensitive to the investment returns of the fund. If the fund earns profits and returns more than the hurdle rate, dividends will be made to investors and the fund management will be entitled to a carried interest payment. However, the fund manager’s share of the profit may be reduced or delayed if the fund’s investments underperform.

- Capital contributions – The investor’s capital contribution plays a role in the distribution hierarchy. Investors who put in more money to the pool may be entitled to a bigger dividend percentage than those who put in less. The time and size of capital contributions may also have an impact on the priority and sequence of distributions, particularly if the conditions of the fund include catch-up or equalizing funding clauses.

Distribution Waterfall Calculation Methods

In order to distribute returns depending on parameters like preferred yield, hurdle rate, retained interest, catch-up rules, and clawback provisions, a distribution waterfall calculation technique is used to define the sequence of computations needed.

Managers, investors, and anybody else having a stake in how investment funds disperse their earnings should familiarize themselves with these “distribution waterfall calculation methods.”

Waterfall Calculation Methods

| Preferred Return Calculation | The minimal return an investor must obtain is calculated by multiplying their initial investment by the chosen return percentage. | Preferred Return= Anticipated return percentage × Investment amount |

| Catch-Up Provision Calculation | This clause guarantees that the fund manager will get a growing part of the earnings until they have gotten their fair share. | Catch-Up Provision = (Total yield- Expected return - Hurdle rate) × Catch-up percentage |

| Clawback Provision Calculation | During the computation of the clawback provision, the overpayment is compared to the dividends being made now to ensure that any extra money gets accounted for and repaid to investors. | Clawback Provision = Excess Distributions - (Current Distributions - Clawback Amount) |

| Hurdle Rate Calculation | To determine the amount, the hurdle rate is multiplied by the sum of all investor contributions. | Hurdle Rate = Risk percentage × Sum of Capital contributions |

| Carried Interest Calculation | Profits in excess of a certain threshold are used as the basis for the computation. | Carried Interest = Profits - Hurdle rate × Percentage of carried interest |

Detailed explanation of this table:

- Preferred Return Calculation – The desired rate of return is often expressed as a share of the investor’s initial investment. It’s the return threshold at which the fund management is entitled to a cut of the profits earned by the investors. The minimal return an investor must obtain is calculated by multiplying their initial investment by the chosen return percentage.

- Hurdle Rate Calculation – Fund managers are only eligible to receive compensation after the fund’s overall rate of return exceeds the hurdle rate. To determine the amount, the hurdle rate is multiplied by the sum of all investor contributions. If the fund’s investments provide returns in excess of the target rate, the surplus might be distributed to investors.

- Carried Interest Calculation – Carried interest is the percentage of net earnings allocated to the fund management after the desired return and hurdle ratio have been achieved. Profits in excess of a certain threshold are used as the basis for the computation. To calculate the fund manager’s portion of the earnings, the carried interest rate is applied to the total amount of profits earned.

- Catch-Up Provision Calculation – Fund managers may “catch up” upon their profit distribution after the chosen yield and hurdle rate are both achieved, thanks to a catch-up clause that permits them to receive their profit distribution at a later date. This clause guarantees that the fund manager will get a growing part of the earnings until they have gotten their fair share. After fulfilling the chosen return and hurdle rate, the catch-up provision calculates the fund manager’s share by dispersing the leftover profits with regard to the catch-up percentage.

- Clawback Provision Calculation – To account for any overpayments paid to the fund management in past distributions, a clawback provision may be included in the distribution waterfall. A clawback clause permits the repayment of excess dividends previously obtained by the fund management if future investment performance falls short of expectations. During the computation of the clawback provision, the overpayment is compared to the dividends being made now to ensure that any extra money gets accounted for and repaid to investors.

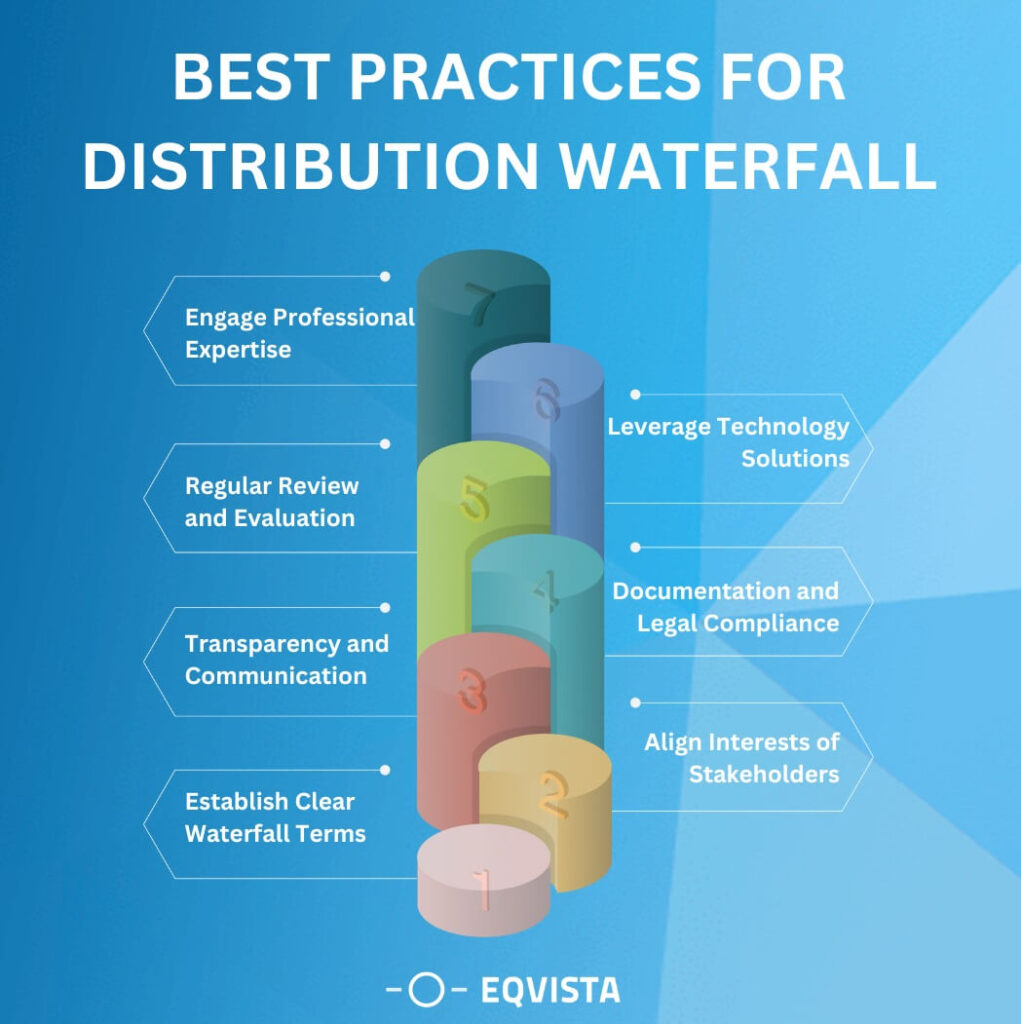

Best Practices for Distribution Waterfalls

The secret to creating a distribution waterfall that will impress your stakeholders is simple! With the following best practices, you’ll be able to establish an efficient system that not only promotes fairness but also aligns interests and builds unbreakable trust between investors and fund managers.

- Establish Clear Waterfall Terms – Defining the terms of the distribution waterfall up front is crucial. This includes mentioning the desired return, hurdle percentage, carried interest, catch-up clauses, clawback rules, and any other relevant conditions. Using precise language may help prevent future disagreements.

- Align Interests of Stakeholders – Investors’ and fund managers’ goals should coincide with the distribution waterfall. Fund managers should be incentivized to produce greater investment performance, and investors should be guaranteed a decent return on their investment, thus the conditions should be drafted with these goals in mind.

- Transparency and Communication – Throughout the distribution process, be as open and communicative as possible with investors and fund managers by providing them with frequent updates. Open lines of communication and reporting help establish mutual trust and improve working relationships.

- Documentation and Legal Compliance – Ensure that the conditions of the distribution waterfall are adequately recorded in legally enforceable agreements. Comply with all relevant laws, restrictions, and industry norms to safeguard the best interests of all parties involved.

- Regular Review and Evaluation – The distribution waterfall should be evaluated on a regular basis to see how well it is working and if any changes need to be made. Considerations such as market trends and investor expectations must be included in this process.

- Leverage Technology Solutions – Make use of tech tools and specialist applications to accelerate the distribution waterfall procedure. Distributions may be computed and tracked with increased efficiency, precision, and openness with the use of automation and digital platforms.

- Engage Professional Expertise – To get the best results, it’s best to enlist the help of lawyers and accountants who are familiar with different types of fund structures and different types of distribution waterfalls. Their knowledge and experience may be used to guarantee conformity with rules, improve distribution terms, and direct you toward best practices.

Need expert help for your waterfall analysis?

Private equity and VC firms rely heavily upon the distribution waterfall approach to structure how earnings are dispersed across investors. The distribution waterfall is strengthened by consistent evaluation, adherence to regulations, and the use of expert knowledge.

Eqvista’s sophisticated tools and knowledge of various fund structures allow for precise and transparent distribution calculations, benefiting both investors and fund administrators. Businesses may improve efficiency and confidence in profit allocation by using Eqvista to optimize distribution waterfall procedures and comply with regulatory regulations. Have queries? Contact us now!

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!