Transferring stock between founders

This article will help you understand how does the transfer of founder stock work and how to split equity among founders.

Selling shares of a private company is one thing, but adding a founder into the company after the company is another. When you want to add a founder to the company, this means that you will need to issue them what is traditionally referred to as founder’s stock. Splitting equity among founders has always been a big question. Lots of people find it tough to decide on the split when they issue stocks to founders.

This article will help you understand how does the transfer of founder stock work and how to split equity among founders.

What is Founder Stock?

Founder stock is the equity interest issued to the founders in a company. This stock is issued at the time the company is formed. At this time, since the company has no value, it would be at a nominal cash payment. The rate of the share at this time is normally $0.0001 per share. Along with this, the founders who are given stock in the company do not get the shares immediately due to the founder stock vesting. This means that the stocks are subject to a vesting schedule.

Moreover, the rights of the founder stock usually depend on the agreement created at the start of the company. If the rights are different from the other equity interest, it should be noted in the agreement either when the stock is issued or later. Some of these rights might include:

- Co-sale provision

- Lock-up agreement – A lock-up agreement prevents the sale of stock for a period of time following an IPO.

- Super-voting rights – Supervoting stock is a separate class of stock that may have 10 or more votes per share.

- Right to the first refusal

- Accelerated vesting upon the sale of the company – This is when the vesting schedule is fast-forwarded when there is the sale of the company taking place.

- Vesting provisions – vesting schedule added to the stocks issued

Since startups have a dynamic nature, as people keep coming and going, the responsibilities of each founder would keep changing. So, it is always better to note these things at the initial stage and mention them in the agreement created before you issue stock to founders in the company.

Splitting Equity Among Co-Founders

When it comes to splitting equity among founders, many end up making the situation worse for them. The best way to split equity is by splitting the equity equally among the founders. Reason is, these are the people who are going to work with you for a long time and going into a war with them means winning in your business or losing it. In fact, the co-founders tend to spend more time with each other than they spend with their family members. Therefore, it’s important to get the split done right!

How to Split equity among Co Founders Fairly?

Moreover, the co-founders are the ones who will help you decide on the most important things for your business. And when things go well and the company succeeds, these are the people you will be celebrating with. So, the best way for splitting equity among founders is by offering all equal or close to equal ownership. If you are not ready to give your partners an equal share, then you might be choosing the wrong partner.

Furthermore, if you feel that you might end up breaking up with a co-founder or you are afraid this might happen, the best way to avoid it is by imposing a vesting schedule on the shares issued.

Let us take an example to explain this. You have a company and you have three more people who can help build your business. Together, you decide to split the equity evenly, and split the equity by offering each founder a 25% ownership stake. Let us say that the total number of shares in the founder stock is 1,000,000, meaning each founder would get 250,000 shares.

The equity split would look like:

| Founder | Percentage of Ownership | Number of Shares |

|---|---|---|

| Founder A | 25% | 250,000 |

| Founder B | 25% | 250,000 |

| Founder C | 25% | 250,000 |

| Founder D | 25% | 250,000 |

Now, to make things safe for you in case one tries to backout, you can add a vesting schedule to everyone’s portion. The most common kind of vesting schedule is 4 years with a one-year cliff. So, this would mean that if one of the founders tried to walk away before a year, they would not get anything before the first cliff.

After the first year, 25% of the total stock of that founder would be vested, which means that this founder would own 25% of their total stock. After this, every month the founder would get an additional 1/48th of the total stock. The founder would earn all the stock at the end of four years and would own 25% of the company.

This plan makes sure that a founder is a good fit for the company and sticks for a long time.

Here is how the shares would be vested:

| Year | Percentage of total Shares Vested | Number of Shares Vested |

|---|---|---|

| 1 (Cliff Period) | 25% | 62,500 |

| 2 | 25% (2.083% each month) | 62,500 (approx 5,208 shares would be vested each month) |

| 3 | 25% (2.083% each month) | 62,500 (approx 5,208 shares would be vested each month) |

| 4 | 25% (2.083% each month) | 62,500 (approx 5,208 shares would be vested each month) |

Transfer of Founder Stock

Once the founders start gaining shares in the company and the company starts to grow, there may be various reasons for transferring stock between founders. This could be due to a founder leaving the company for personal reasons, or a founder trying to gain more control of the company due to their higher personal investment in the business. Whatever the reason may be, the next step would be to transfer this founder stock.

How to Transfer a Founder’s Stock?

When a founder wants to transfer their stock to someone else, there is a restriction that comes up as mentioned in the founder’s agreement created when the company is formed. This means that the founder’s stock is usually subject to a “right of first refusal”, which gives the company and the other founders the chance to purchase shares that a founder proposes to sell to a third party. This rule is mentioned in the Company’s Bylaws and automatically applies to all shares issued after the Bylaws are adopted.

This right is perfect as it would help the founders keep control of the company. For instance, if Founder B wants to sell his shares off to a third party, Founder A has the right to deny it and buy it instead, if he doesn’t want another outsider to be the founder of the company. But if the founder is not able to purchase the shares of the company, he can agree to sell it to a third-party.

What is co-sale right?

A “co-sale” right offers the right to a person to be a seller. It gives the opportunity to participate in a sale by a third-party. The main idea behind this is that if one founder is able to get a buyer to a part of his shares, the same opportunity should be made available for other founders in the company. Although this right is not common, it is usually requested and added by many founders in the agreement. However, this right is more common with investors than with founders as it acts as a benefit for them.

Transferring Founder Stock on Eqvista

With this said, when you begin your company and issue stocks to the founders, it is always a good idea to keep a track of it. The best way is by using a cap table application to track and record all the shares of your company.

Eqvista is an advanced cap table application that can help you with it.

Here are the steps on how to issue shares to founders:

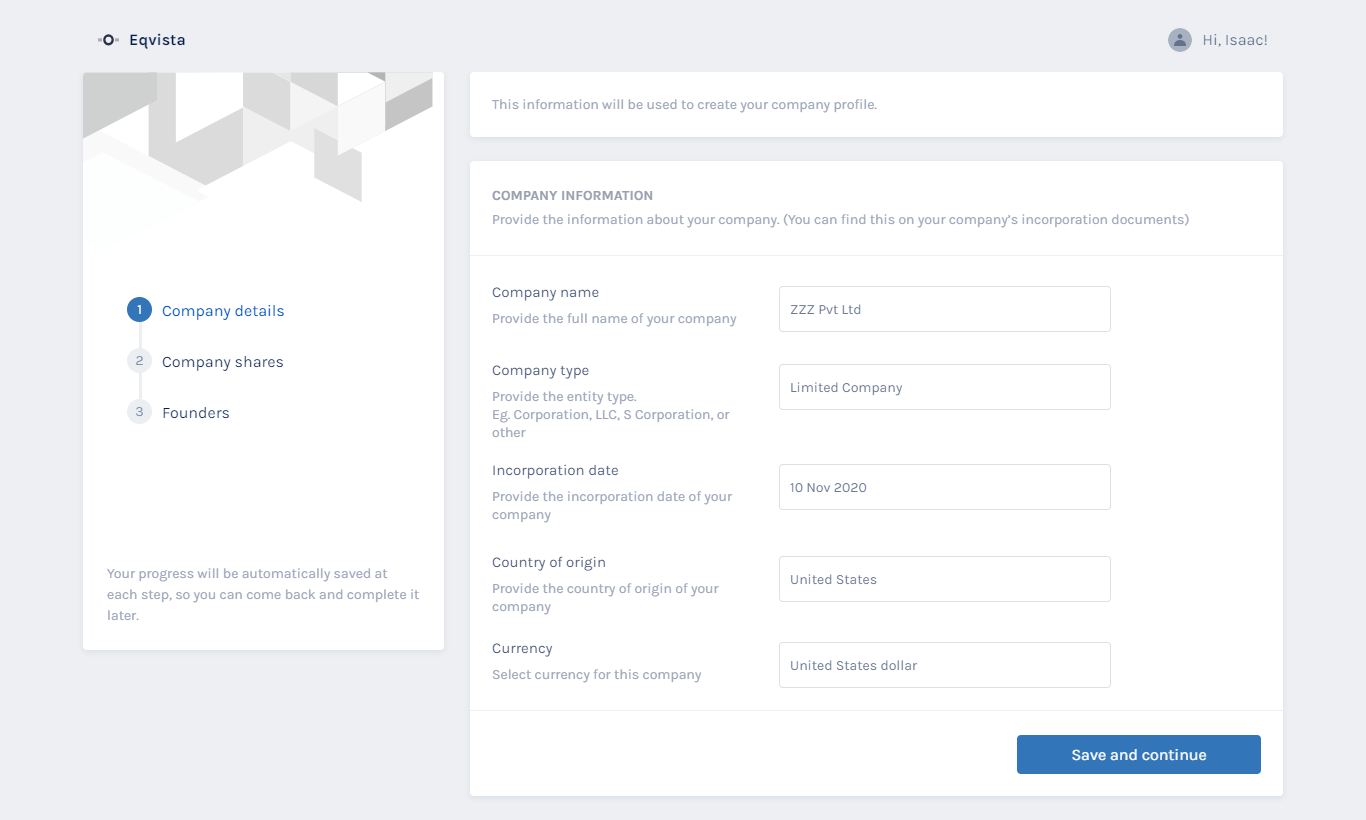

Step 1: Create an account on Eqvista and you will reach the main page where you get the option to create a company profile.

You will be directed to the page where you can begin forming your company profile.

Add in the details of the company such as the company name, the company type, the incorporation date, country of origin, and the currency. When done, click on “Save and Continue”.

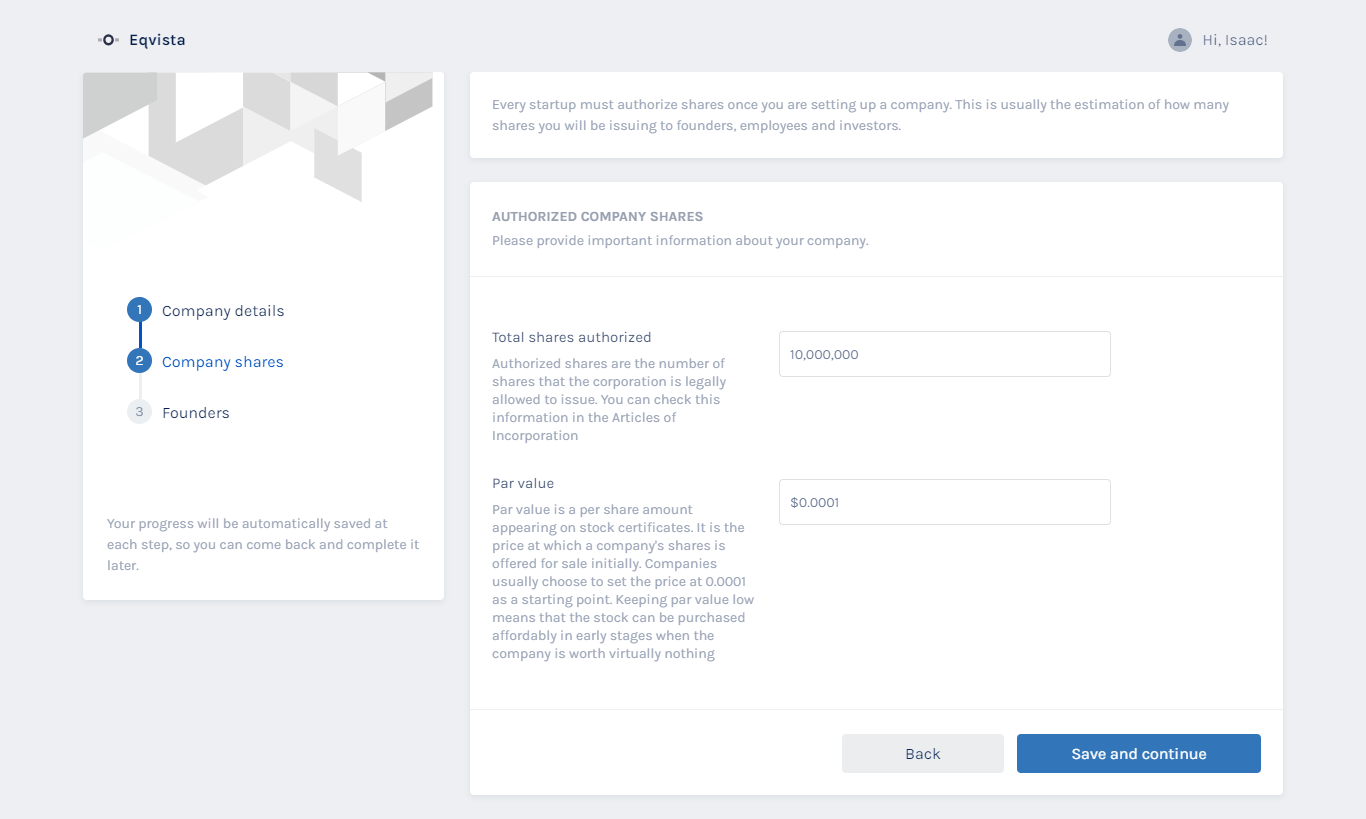

Step 2: You will reach the next step as shared below:

Here, you will have to add the total number of shares that have been authorized to your company (found in your company’s Article of Association), as well as the price per share.

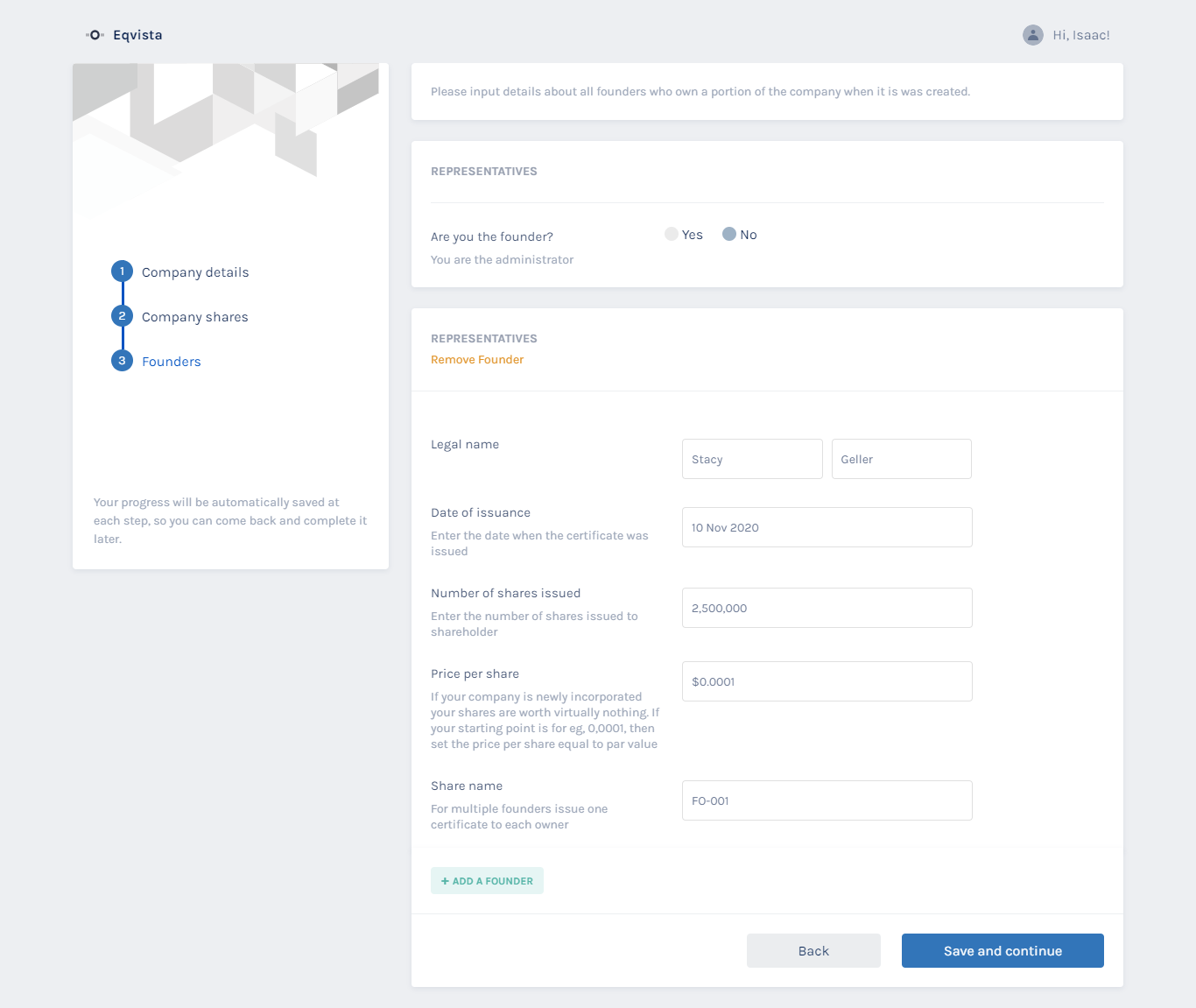

Step 3: You will reach the final step of forming the company profile where you need to issue shares to the founders.

Here, you will have to add the founder’s details. You can select to be the company founder, or if you are setting up the company for another, enter in the founder’s details as well.

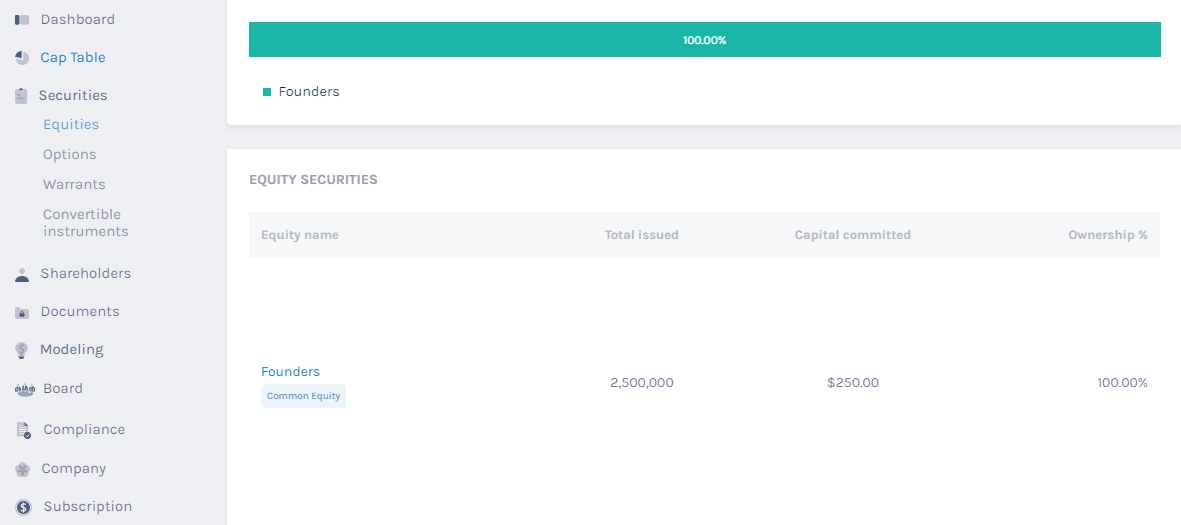

Step 4: You will reach the dashboard of the company profile. Now, let us say that you want to add another two founders into the company and issue shares to the founders. For this, click on “Securities” on the left side menu. A small drop-down menu will appear. Click on “Equity” here. You will be directed to the following page.

Here, click on the equity class from where the share transfer is about to take place. In this case, we select the option “Founders”, since we are talking about issuing shares to founders here.

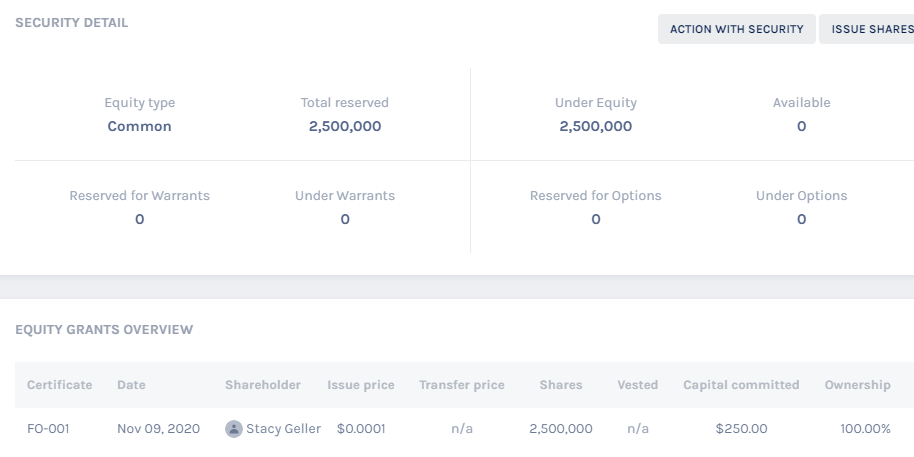

Step 5: Once you do this, you will reach the next page, as shared below.

From here, select the certificate number of the shareholder whose shares are being transferred.

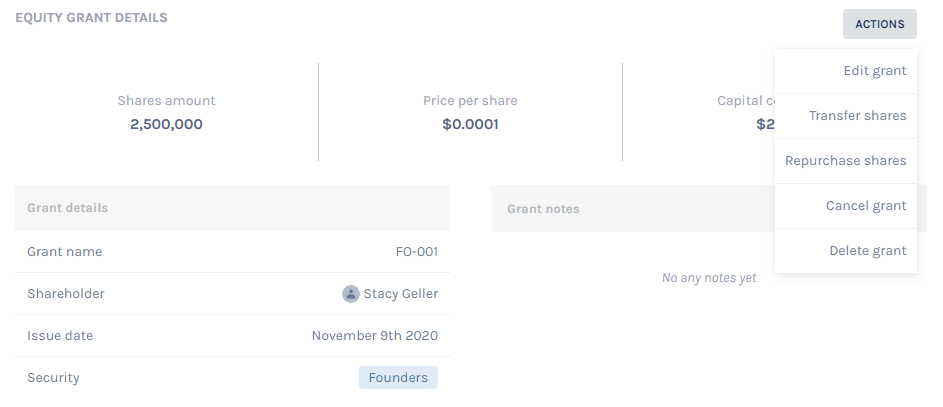

Step 6: This will take you to the page where you can see the details of this transaction. Click on “Actions” on the right hand side, and choose “Transfer Shares”.

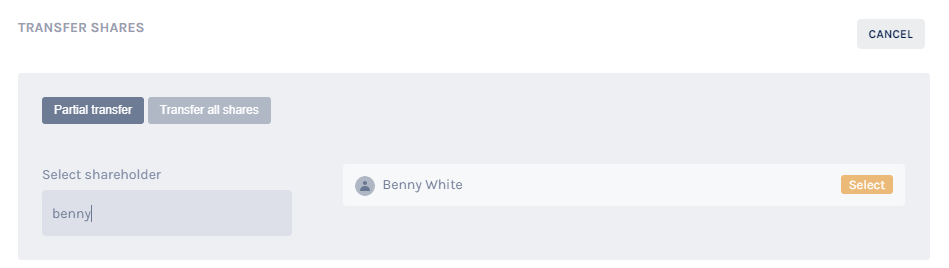

Step 7: When you do this, you reach the following page.

There are two kinds of transfers that you can make. One is the partial transfer and one is the transfer of all shares.

Since you are the founder of the company and you want to split the shares with two more founders, based on your percentage split, you will have to transfer a part of the shares you own to them.

So, select the option of the partial transfer and add the shareholder’s name in the field below then select the name that comes up.

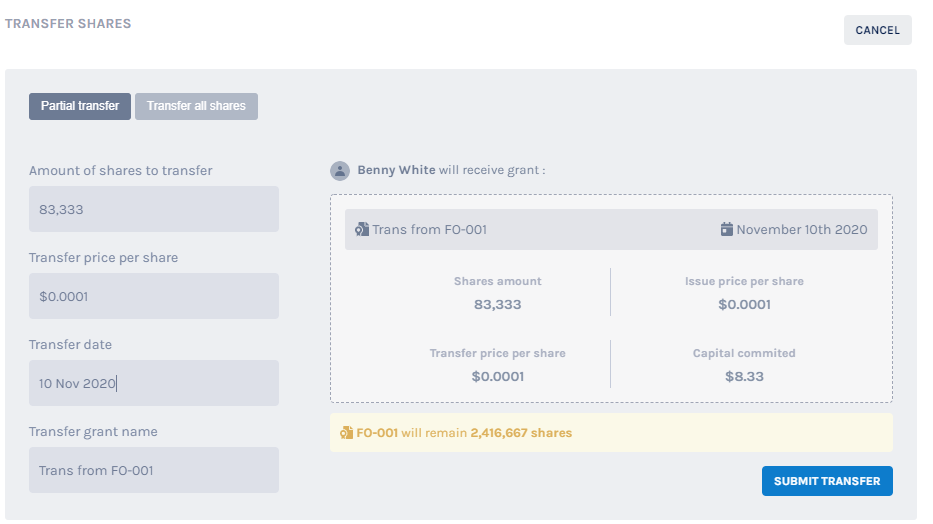

Step 8: You will reach the next step where you need to add the price of the share at the time of the transfer. Fill in the transfer date and if you want, change the transfer grant name.

With this, the transaction would be complete, and you will be redirected to the page of the transferor shareholder. Like this, you can transfer the founder stock in your company.

And just like this, you can easily issue shares to founders and transfer shares to founders as well through Eqvista. To know more about the application and how to use it, check out our knowledge center here or contact us today for a demo!

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!