Vesting – Definition & Meaning

Vesting is a legal term used in companies to earn or offer the rights for a future or present payment, benefit or asset over a specific period of time.

Vesting is often used for retirement plans, in real estate and also when offering shares as a form of employee compensation. Vesting of shares is a common tool used by startup companies.

In this article we will discuss the meaning and definition of vesting, types of vesting schedules and challenges and considerations.

What is Vesting?

Let us take an example to understand Vesting. In case you are an employee in a company and get a bonus of 1,000 shares, these shares would vest over a period of 5 years. With this plan, you can vest about 200 shares on the first anniversary, with the other 800 shares remaining unavailable until you work longer for the company.

Such plans of vesting shares are offered by startup companies to employees, vendors, contractors and others working with the company. This is normally done to keep these people dedicated and focus on the company’s success. Anyone who leaves before the vesting period would not enjoy the benefits of owning the shares.

Vesting Definition in Employment Agreements

A vesting defined is agreement between an employer and an employee that sets the terms and conditions for shares and share options to vest. Vesting shares are shares held by an employee that were granted either through employee stock options (ESOs) or restricted stock units (RSUs) that still need to be earned.

Example for Vesting

Let’s take the example of John who worked as a software engineer at Marriott Tech Solutions. He was hired in January 2022. He has a vesting period of 4 years, and has total stock options granted as 4000 with 25 % of vesting schedule over 4 years at 20$ exercise price per share.

Vesting Definition Schedule

| Vesting Year | Cumulative Vesting (%) | Vested Options | Unvested Options | Stock Price at Vesting | Total Vested Value |

|---|---|---|---|---|---|

| Year 1 | 0% | 0 | 4,000 | - | - |

| Year 2 | 25% | 1,000 | 3,000 | $25 | $25,000 |

| Year 3 | 50% | 2,000 | 2,000 | $30 | $60,000 |

| Year 4 | 75% | 3,000 | 1,000 | $35 | $105,000 |

| Year 5 | 100% | 4,000 | 0 | $40 | $160,000 |

Vesting Calculation

| Year 1 (cliff period) | No vesting during the first year. John Doe has 0 vested options and 4,000 unvested options. |

| Year2 | 25% of the stock options vest. 25%×4,000=1,000 25%×4,000=1,000 options vest. John Doe has 1,000 vested options and 3,000 unvested options The stock price at vesting is $25 per share, resulting in a total vested value of $25,000. |

| Year 3 | Another 25% vesting. 25%×4,000=1,000 25%×4,000=1,000 options vest. John Doe has 2,000 vested options and 2,000 unvested options. The stock price at vesting is $30 per share, resulting in a total vested value of $60,000. |

| Year 4 | 25% vesting. 25%×4,000=1,000 25%×4,000=1,000 options vest. John Doe has 3,000 vested options and 1,000 unvested options. The stock price at vesting is $35 per share, resulting in a total vested value of $105,000. |

| Year 5 | Final 25% vesting. 25%×4,000=1,000 25%×4,000=1,000 options vest. John Doe has 4,000 vested options, and no options remain unvested. The stock price at vesting is $40 per share, resulting in a total vested value of $160,000. |

How is vesting Defined To Employee Benefits?

As part of employee benefits, vesting allows employees to gain entitlement to employer-provided assets gradually. This incentivizes employees to perform better and stay with the company longer. The vesting schedule established by the company specifies the point at which employees gain complete ownership of the asset.

The term “vested benefit” refers to retirement savings that employees can access upon retirement age. This includes,

- Health Insurance

- Employee Stock Options

- Retirement plans

- Pensions

Types of Vesting Meaning And Definition

A vesting schedule is a plan that specifies the timeline for earning your options or shares. It helps you understand when and how your equity will be available. This information is usually included in your option grant, which specifies the number of shares or votes you’ll receive over a certain period.

There are three types of vesting : time-based and performance-based and Hybrid Vesting. Let’s get into details.

Time Based Vesting Definition

Time-based vesting is defined as when employees earn their stock options gradually over time, following a predetermined schedule and a cliff. The cliff refers to the point in time when the employee’s initial option is granted and becomes exercisable.

Companies typically offer vesting contracts with a one-year cliff. This means an employee must remain with the company for at least one year to earn a vested interest.

Example: Let us understand Time-based vesting definition with the help of an example.

Smith, an employee of Gaze Inc., is granted 10,000 stock options with a one-year cliff vesting period and monthly vesting afterward. This means the employee cannot exercise any of his options until he has been with the company for one year.

- Grant Date: January 1, 2023

- Number of Options Granted: 10,000

- Vesting Schedule: 4-year vesting with a one-year cliff

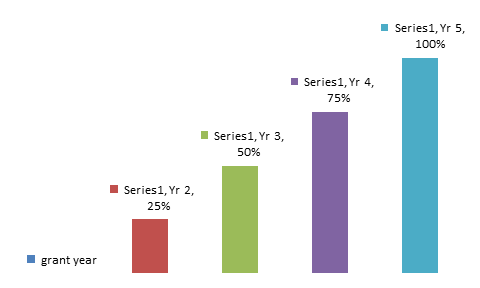

Vesting Percentages

| Year 1(Cliff) | 0% |

| Year 2 | 25% |

| Year 3 | 50% |

| Year 4 | 75% |

| Year 5 | 100% |

Under this vesting schedule, John would not earn any options until he had been with the company for one year. After one year, he would earn 25% of his options (2,500). After two years, he would earn 50% of his options (5,000 options), and so on. By the end of the four-year vesting period, John would have earned all 10,000 options.

Milestone Based Vesting Definition

Equity awards tied to performance-based vesting have been a part of growth company capital structures for a long time. These structures are also now employed in US middle-market buyouts to supplement time-based vesting. The fundamental idea behind performance vesting is that management should perform better as investors perform better.

Example: Gaze Inc. grants employee Smith stock options with a milestone-based vesting schedule, and the grant date is January 1, 2023:

| Milestones | Vesting Percentage | Condition |

|---|---|---|

| Product Launch | 25% | Vesting occurs when the company successfully launches a new product. |

| Revenue Growth | 25% | Vesting occurs when the company achieves $10 million in cumulative revenue. |

| User Base Expansion | 25% | Vesting occurs when the company reaches 1 million active users. |

| Acquisition or IPO | 25% | Vesting occurs upon the successful acquisition of the company or an initial public offering (IPO). |

In this example:

If the product is launched successfully by January 1, 2024, Bob vests 25% of his stock options, and if the company achieves $10 million in cumulative revenue by January 1, 2025, an additional 25% vests, and so on.

Hybrid Vesting Definition

Hybrid vesting is defined as a combination of time- and milestone-based requirements for stock option vesting. Under this method, employees must remain with the company for a specific period and accomplish certain milestones to become eligible for exercisable stock options.

Definition And Meaning Of Vesting Schedule

A vesting schedule outlines the benefits an employee will receive after a certain period. It determines when the employee will have full ownership of their shares. Any money that the employee contributes is vested immediately, and vesting schedules only apply to the contributions made by the company.

A standard graded vesting schedule for stock options looks like this:

A vesting schedule is the blueprint of an employee’s incentive plan offered in the form of company shares. Broadly, the 3 popular vesting schedules are:

Cliff Vesting

Cliff vesting ,defined as a retirement plan where employees become fully entitled to the benefits provided by their employer’s qualified retirement plans and pension policies on a specific date rather than gradually over time. This is different from other retirement plans where employees’ ownership of the funds vests gradually.

Companies typically design their vesting schedule based on goals and competition. There is no fixed vesting schedule for any companies.

Benefits of Cliff Vesting

- Cliff vesting enables startup companies to offer vested benefits while allowing time to vet employees before committing them to the system.

- A fair agreement fosters loyalty from employees and strengthens the employer-employee relationship. This creates a win-win situation for both parties involved.

- The employee is promised incentives after a certain period, and the employer’s targets are quantifiable and can be met.

- To achieve these high standards, employees must show genuine commitment, and in return, the company must constantly support its employees.

Acceleration of Vesting

Accelerated vesting allows employees to access restricted company stock or stock options faster than the standard vesting schedule, resulting in earlier monetary benefits.

Situations where an employee’s employment is terminated, particularly in scenarios such as layoffs or company acquisitions, accelerated vesting provisions are often employed to provide financial protection or compensation to the departing individual.

Benefits of accelerated vesting are follows

- Accelerated vesting may be used by startups to attract talent or for personal situations such as divorce settlements or estate planning.

- Valuable employees are often retained, exceptional performance is rewarded, and interests are aligned with company strategy.

- Smoothing transitions and incentivizing support can ease mergers, IPOs, and ownership transitions.

Immediate Vesting

Immediate vesting schedule will provide your employees immediate access to their assets. There is no waiting period. This is usually offered to highly valued employees as a spot incentive. Immediate vesting incentivizes employees and investors by providing quick access to financial benefits, improving retention, commitment, and aligning interests.

Advantages of Immediate vesting are as follows

- Immediate vesting of employee stock options incentivizes employees to stay.

- Employers can retain top talent by offering immediate vesting stock options during critical periods or transitions.

Vesting Challenges and Considerations

By implementing vesting schedules, companies can provide their employees with enticing perks while safeguarding against potential financial losses. At the same time, designing a vesting contract requires thought, caution, and investment to avoid losing high-caliber employees due to harsh vesting terms.

Advantages of Vesting

Vesting provides several benefits to employers, particularly if the company is new;

- Stock options can be a valuable part of an employee’s compensation package and are often used to attract new talent.

- The company can retain cash for debt repayment, emergencies, or business expansion.

- Employees are encouraged to stay with the company for a set number of years, which can reduce turnover.

Disadvantages of Vesting

Vesting is not free from risk, let’s see the disadvantages of vesting,

- Complex vesting schedules can demotivate employees and result in higher turnover.

- The vesting definition terms may not be suitable for the employee’s requirements.

- Although vesting is an important part of employee compensation, it cannot replace the need for a regular paycheck. Therefore, workers should still receive their salaries to meet their financial needs.

Create your Vesting Plans with Eqvista!

In short, vesting is essential for a company to preserve cash flow and employee retention and increase employee productivity. A clear vesting plan path to your wealth creation and financial planning journey.

Eqvista allows you to create a vesting plan much easier than you think. To know more about vesting, Eqvista can help you. Check out the application & contact us today! With the Eqvista application, you would be able to easily create vesting periods for the shares you offer your employees.

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!