Early Exercise of Stock Options & 83(b) Filings: A Comprehensive Guide

Early exercise of stock options can potentially lead to significant tax advantages and increased capital gains.

You must understand the intricacies of stock options for effective tax planning, especially if you are a startup or fast-growing company employee. You can early exercise stock options to reduce your tax liabilities and improve your gains. 83(b) election forms are closely tied to this practice.

Early exercise of stock options can potentially lead to significant tax advantages and increased capital gains. However, this strategy also comes with its own set of risks and considerations.

This comprehensive 83(b) filings guide will explore the pros and cons of early exercising and filing 83(b) election forms, how to early exercise stock options and file 83(b) election forms, and how Eqvista can be of assistance to you here.

Early Exercise of Stock Options

When you exercise your stock options before they vest, you can get the benefit of long-term tax treatment and potentially improve your capital gains. Once you exercise your stock options and the holding period requirements are met, any potential gains will be taxed at the long-term capital gains tax rate which is typically lower than short-term capital gains tax rate.

When an employee exercises their stock options early, they will take greater responsibility for the company’s growth in comparison to when they exercise the stock options on vesting.

Private companies tend to exhibit exceptional growth in short periods. Your chances of capturing such high-growth periods are higher when you invest early or, in this case, exercise your stock options early.

83(b) Filings: A Brief Overview

When you file an 83(b) election form, you are letting the Internal Revenue Service (IRS) know that you did early exercise stock options. Once you file this form, you are choosing to include either the value or the difference between fair market value (FMV) and the strike price in your taxable income.

If you exercise stock options, you must file an 83(b) election form within 30 days, as simple as that. Let us use this chance to learn about situations that will be beneficial.

Considerations for Early Exercise and 83(b) Election

Before you early exercise stock options and file 83(b) election forms, you should consider the following things:

Tax implications

The tax implications differ depending on the type of stock option and the holding period. Let us examine both.

Do you own ISOs or NSOs?

Let us make it clear that there will be no immediate tax liability if the exercise price is lower than or equal to the FMV. So, we are only considering the case when the exercise price is higher than the FMV.

If you exercised your ISOs, you will have to pay an alternative minimum tax (AMT) on the gains and if you exercised your NSOs, you will have to pay ordinary income tax.

How long can you hold your stocks?

If your stock options were issued a long time ago and there is very little vesting period left, the difference between your exercise price and the FMV will be very high. Also, if the vesting period left is less than a year, you will not get the long-term capital gains tax treatment benefit. So, it doesn’t make sense in such a scenario.

After all, long-term capital gains tax ranges from 0% to 20%, and short-term capital gains tax ranges from 0% to 37%.

However, if you recently received your stock options, then the FMV will be very close to your exercise price. Also, you can start the clock early for long-term capital gains tax treatment. So, it makes sense in such a scenario.

Financial risk

Early exercising your stock options exposes you to greater financial risks. The stock price of your company might fall in the future. You are more likely to experience such losses the longer you hold.

Vesting schedules

Some companies repurchase your shares if you exercise stock options and leave before the vesting period. However, some companies only pay the exercise price and not the FMV, thus reducing your potential gain.

Some companies may even ask you to forfeit your shares and you will lose the money spent on exercise price.

So, if you plan on leaving the company before the vesting period ends, you should not exercise stock options.

Company Policies

Some company policies that you need to be aware of when you early exercise stock options are:

- Companies holding the right to repurchase, sometimes at exercise price and not the ongoing FMV

- Lock-up periods

- Company approval requirements for the sale of stocks

- Company-specific procedures and paperwork

- Some companies may not allow you to early exercise stock options in the first place

83(b) Filing Requirements

The filing requirements for 83(b) election forms are as follows:

| Timing of the filing | To be filed within 30 days of early exercise |

|---|---|

| Information required in the filing | |

| Consequences of not filing | You will lose the opportunity to elect to pay taxes at lower initial value |

How to early exercise stock options and file 83(b) election?

In this section, we will discuss the process of early exercising stock options and filing 83(b) election forms through a comprehensive list of steps which are as follows:

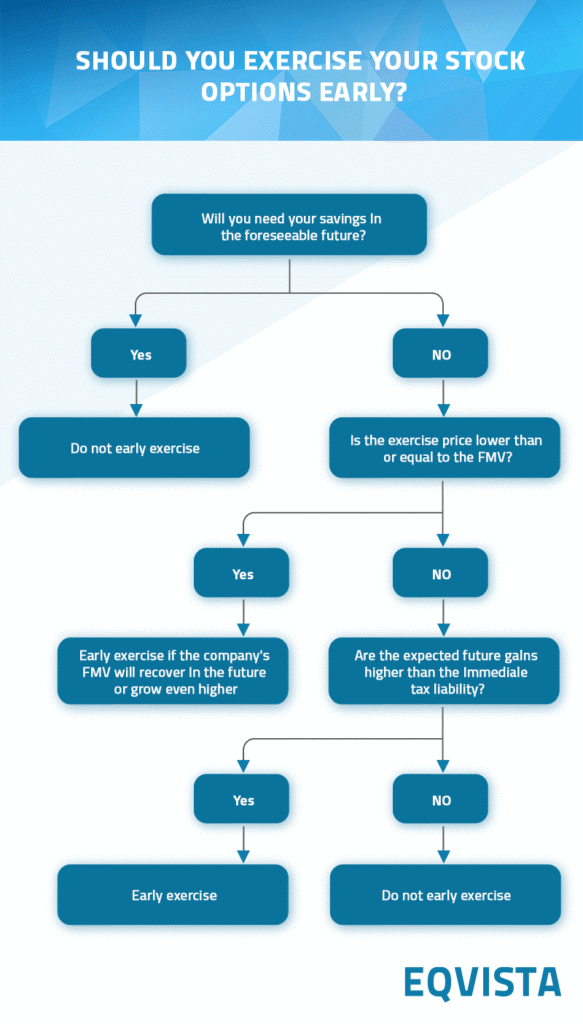

- Evaluate Financial Situation – Since early exercising stock options means you will use your savings, you should assess your own current financial situation. If your financial situation allows you to exercise early, you should assess if your company’s stock price will increase or not. You should move to the next step only if you think your company’s stock price will increase.

- Understand the Company’s Stock Plan – You should analyze your company’s stock plan and policies. Clauses and terms like repurchasing terms on termination, lock-up periods, and company-specific procedures and paperwork must be studied.

- Make a Decision on Early Exercise – Based on the information you have collected so far; you must decide on whether to exercise stock options or not and there is no turning back after you made a decision.

- Execute the Early Exercise – Fill out the necessary forms and pay the exercise price to early exercise stock options before the vesting period ends.

- Preparing the 83(b) Election Form – You must fill the 83(b) election form with information about yourself, your address and SSN, and details about the stock options.

- Filing the Form – Within 30 days of early exercise, you must submit the 83(b) election form to the Internal Revenue Service (IRS). You should also keep your employer in the loop.

- Maintaining Records – You should keep copies of the 83(b) election form, proof of filing, and any related correspondence for your records and future tax filings.

How can Eqvista help file 83(b) elections?

Early exercising your stock options can be an effective way to minimize your tax liabilities while improving your capital gains- killing two birds with one stone. However, making the smallest mistake will mean losing this opportunity.

Eqvista can help you make the most of this opportunity in the following manner:

- Expert Guidance and Advisory Services – Our team of accredited tax advisors and equity advisors will provide personalized advice to help you navigate the complexities of filing an 83(b) election effectively.

- Step-by-Step Filing Assistance – Eqvista will support you at each step of filing 83(b) election forms starting right from whether you should file 83(b) election forms or not.

- Timely Filing – Since the deadline for filing 83(b) election forms is just 30 days, we notify our cap table software clients to file these forms on time.

- Documentation and Record Keeping – On Eqvista’s platform, every one of your 83(b) election forms will be recorded so you can refer to them in the future at your convenience.

- Ongoing Support and Consultation – Eqvista provides continuous expert support and consultation to address any questions or issues that may arise pre-filing, post-filing, and while filing 83(b) election forms.

Frequently Asked Questions (FAQs)

Some of the commonly asked questions by people who need to file for 83(b) elections to early exercise stock options are as follows:

What is the early exercise of stock options?

Some companies allow their employees to exercise their stock options before they vest so that you could benefit from lower tax rates and increase your capital gains.

What are the benefits and risks of early exercise?

You will make better capital gains and benefit from lower tax rates under long-term capital gains treatment. On the other hand, when you exercise stock options early it exposes you to termination risk, company-specific risks, and a lack of liquidity.

How does a Section 83(b) election work?

You need to file an 83(b) election when you choose to exercise your stock options before they vest (early exercise). Within 30 days of exercising, you need to fill out this form and send it to the IRS.

When should I file an 83(b) election?

You should fill out and send the 83(b) election form within 30 days of exercise.

What are the tax implications of early exercising ISOs and NSOs?

You may have to pay the Alternative Minimum Tax (AMT), and when you exercise NSOs, you may have to pay ordinary income tax.

Minimize Your Tax with Eqvista’s 83(b) Filing Services

Early exercise of stock options can significantly reduce your tax liability. If you hold the stock for long enough, you will benefit from long-term capital gains tax treatment and there are chances that your immediate tax liability will be zero. However, filing an 83(b) election form is crucial for doing so.

Before you make this decision, you must also assess your financial situation and the company’s prospects, company policies, and tax implications.

Given these challenges, expert assistance can be invaluable. Eqvista offers comprehensive support for early exercises and 83(b) filings, combining technology with expert guidance. Our platform streamlines the process and provides ongoing support, helping you navigate complexities with confidence. Contact us to know more!

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!