Ultimate Guide to Calculate Business Valuation

In this article, we discuss what a business valuation is, why is it important, and how a business valuation is calculated.

Getting a business valuation might be a confusing process for some company owners. It’s important to know that a business valuation is a must in order to determine the value of your company. Usually, professional analysts conduct the business valuation.

Business Valuation

There could be several reasons to know the value of your business. Let’s say someone is interested in buying your business, but you don’t know how much to sell it for. This is where a business valuation is needed. A business valuation determines the price you can sell your business for. It also helps potential buyers make their decisions if they want to go ahead with the purchase or not.

What is Business Valuation?

Determining the economic value of a whole firm or company unit is known as business valuation. For various purposes, including sale value, establishing partner ownership, taxation, and even divorce proceedings, company valuation can be used to evaluate the fair value of a business.

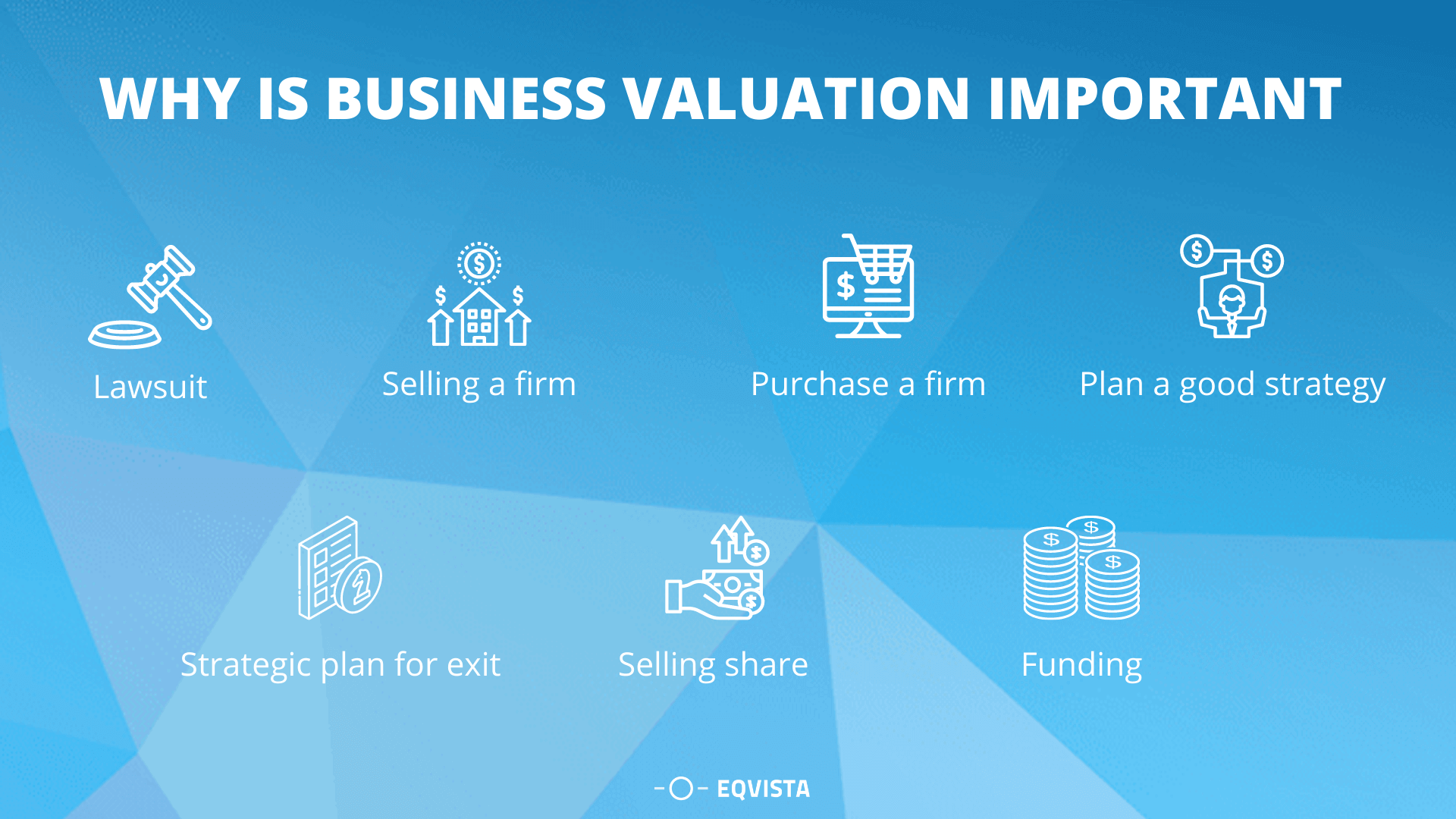

Why is Business Valuation Important?

Objective data is used in the best business valuations, and evidence-based valuations are especially critical at trial. Every data piece must withstand analysis, which is typically done in an adversarial context when the opposite side is looking for methods to dispute and impeach credibility.

- Lawsuit – The process of determining a company’s economic value or worth is known as business valuation. This specific knowledge is frequently necessary in court. The valuation process is used to drive discovery, settlement discussions, trial strategy, testimony, and cross-examination during the course of a case.

- Selling a firm – Selling a business isn’t easy; it’s a complicated and time-consuming process. While each business sale is different, the foundations remain the same, and there are well-established methods you may follow to obtain the best bargain. You’re more likely to maximize revenues if you’re well-prepared. It’s best to start getting your firm ready for sale a year or two before the actual sale. This will help you to organize your affairs and command the highest possible price. The quality of the broker you select, the timing of the deal, and the reason you’re selling will all influence how much money you get for your firm.

- Purchase a firm – Buying an existing company is less hazardous than creating one from the ground up. When you purchase a firm, you are taking over an already profitable operation. You have a solid client base, a good reputation, and well-versed workers in all facets of the company.

- Plan a good strategy – Strategic planning is a process by which leaders of organizations decide their long-term vision as well as their organization’s goals and objectives. The method also includes determining how those goals should be achieved to achieve its stated vision.

- Strategic plan for exit – An entrepreneur’s business exit strategy is a strategic plan to sell its ownership to investors or another company. An exit strategy allows a business owner to reduce or liquidate his company ownership while still making a significant profit if the company is successful.

- Selling share – In a share sale, the firm’s stockholders sell the shares that give the buyer control of the company. The shareholders determine the sale price. All rights and responsibilities associated with share ownership, such as debts and liabilities, are transferred to the buyer as part of the transaction.

- Funding – The act of providing resources to finance a need, initiative, or project is known as funding. While this is generally in the form of money, it can also be in the form of an organization’s or company’s work or time. This term is most commonly used when a company leverages its internal reserves to meet its cash needs.

Multiplier in business valuation

A multiplier is a metric for determining the relative importance of one industry to other industries in a given region. For example, if one sector has a multiplier of 2.5, the total effect on the area economy will be 2.5 times the original change for any positive or negative change in that industry.

What is an industry multiplier?

Multipliers (also known as “earnings multipliers”) are used in business valuations to multiply a company’s earnings to reflect its actual value. For small to midsize businesses, the multiplier will typically be between one and three, implying that the earnings before interest and taxes (EBIT) will be multiplied by 1x, 2x or 3x. The multiplier for larger, more established businesses might be as high as four.

Importance of industry multiplier

Input-Output (IO) multipliers help assess the income-generating potential of economic strategies that target specific industries. Multipliers track variations in economic activity throughout an economy’s initiatives due to changes in final demand for a given industry. Through the multiplier process, an increase in investment creates a cumulative rise in income and employment, and vice versa. The multiplier theory explains how income spreads due to increased investment, but it also aids in bringing savings and investment into balance.

How to determine industry multipliers?

This method, which is one of the most generally used valuation benchmarks, calculates the value of a corporation by multiplying its sales or earnings by an industry average “multiplier”. This multiplier is multiplied by either the company’s profits or gross sales based on industry average sales numbers. The gross sales and inventory of retail enterprises are then multiplied by the industry average amount. When utilizing the gross sales number, the conventional multiplier is normally in the range of 0.25 to 1.0 or higher. Multipliers can be 1, 2, 3, 4, or 5, depending on whether pretax earnings are utilized instead of sales.

Who decides the industry multiplier?

The banks and higher authorities always monitor industry multipliers. The multiplier’s value is determined by the marginal propensity to consume as well as the marginal propensity to save.

How to calculate business valuation

As an entrepreneur, you’ve most likely invested a lot of time, money, and sweat equity into starting and expanding your company. As a proportion of your initial investment, the return of investment (ROI) is a measure of how much value or additional money you have earned – your return or net profit after paying all of your business expenses. A potential buyer may additionally wish to see evidence of the following features of your firm to assist decrease the danger of future business failure:

- Critical drivers of new sales that can be predicted

- Business expansion/growth potential

- Well-established supplier partnerships

- Employees that are loyal, dynamic, and motivated

- Repeat purchases and customers at a high rate

- There are no pending or prior lawsuits or tax issues.

- Well-established branding, with an explicit trademark, copyright, and legal history.

- For efficient business operations, documented systems and processes are required

Clauses are used to determine business valuation

A value clause is a section of an insurance policy that specifies the maximum amount a policyholder can receive in the event of a claim. In some insurance contracts, the valuation clause specifies the amount of money the policyholder will receive from the insurance provider if a covered hazard event occurs. In the case of a loss for an insured property, this provision specifies a predetermined amount to be paid. A valuation clause might use a variety of approaches, such as agreed value, replacement cost, or stated amount. The most generally used language is actual cash value, which means that the amount paid for a claim is equivalent to the insured’s pre-loss worth.

Financial records

Documents that offer evidence of or summarise company transactions are referred to as financial records. Invoices and receipts are examples of financial records at the most precise level. Financial records at a higher level include subsidiary ledgers, the general ledger, and the trial balance.

Management experience

Managerial experience can be classified in two ways: where you are in charge of people or projects and where you are not in charge of people or projects. You may, for example, have team members who report to you. Alternatively, you may be in charge of specific efforts directly or indirectly: managing your company’s social media campaigns, for example, or managing your pricing strategy, etc.

Market conditions

Market circumstances refer to the elements that influence a given area’s housing market, such as cost of living, demography, supply, demand, mortgage rates, etc.

Intangible assets

Intangible assets are those assets that are not physical in nature. They include goodwill, brand awareness, and intellectual property like patents, trademarks, and copyrights. Tangible assets, like land, vehicles, equipment, and inventories, compete with intangible assets.

Tangible assets

Physical assets or property possessed by a corporation, such as equipment, buildings, and inventories, are examples of tangible assets. Tangible assets are the most common sort of assets used by businesses to create their products and services. On the other hand, patents, copyrights, and a company’s brand are examples of intangible assets.

Company size

The average number of employees, turnover, and balance sheet total (the total of fixed and current assets) are used to define the size of a company. Additionally, qualitative characteristics are taken into account.

Competitive advantage

Competitive advantages are factors that enable a corporation to produce goods or services better or more cheaply than its competitors. These elements enable the producing unit to earn higher sales or higher margins than its competitors.

6 Main Business Valuation Methods

Various valuation methods have been used to determine the value of the business. Company experts and big owners use these methods. Often they take help from valuation guiding experts. Here are the six main methods for business valuation:

- Market Capitalization – The most basic approach to valuing a company is to use market capitalization. It’s computed by dividing the company’s share price by the total number of outstanding shares.

- Times Revenue Method – The multiple of earnings valuation approach also considers a company’s future profits potential when determining its worth. This small business valuation approach, commonly known as the time revenue method, assesses a business’s maximum worth by multiplying current revenue by a multiplier. Multipliers differ depending on the industry, the economy, and other factors.

- Earnings Multiplier – The earnings multiplier, rather than the time revenue technique, can be used to acquire a more accurate representation of a company’s real value because profits are a more reliable predictor of financial performance than sales revenue. The earnings multiplier compares future profits to cash flow that might be invested at the present interest rate over the same period. In other words, it adjusts the current P/E ratio to take current interest rates into account.

- Discounted Cash Flow (DCF) Method – The DCF method of business valuation is comparable to the earnings multiplier. This strategy is based on future cash flow estimates that are updated to determine the company’s current market value. The fundamental difference between the discounted cash flow approach and the profit multiplier method is that the discounted cash flow method calculates the present value after taking inflation into account.

- Book Value – In the book value approach, the firm’s balance sheet is used to determine the value of the company at any given time. In using this approach, the value of your equity—or total assets minus total liabilities—is computed, and this amount represents the value of your company. The book value technique may be beneficial if your company has moderate profits but substantial assets.

- Liquidation Value – The liquidation value asset-based method assumes that the company is closed and its assets will be liquidated. In this example, the value is determined by the amount of net cash available if the business was complete and the assets were sold. Because liquidation value is generally substantially less than fair market value, the value of a company’s assets will likely be lower than usual.

Business valuation formula and example

Business value equals assets minus liabilities. Your business assets include anything that has value that can be converted to cash, like real estate, equipment, or inventory.

Example: Consider a company with a market value of $500,000 and $100,000 in debt. Valuation works on the assumption that there is no surplus or debt. The actual selling price is then modified to take them into account. The buyer may offer $400,000 for the company in exchange for the $100,000 debt.

What is a rule of thumb for a business valuation?

The most typical rule of thumb is a percentage of annual sales or sales/revenues for the previous 12 months. For example, if total sales in the prior year were $100,000 and the multiple for the particular business is 40% of annual sales, the price would be $40,000 based on the rule of thumb. A multiplier of earnings is another rule of thumb that can be used. It’s usually based on a multiple (usually between 0 and 4), multiplied by the company’s earnings. The multiple is applied to what is known as Seller’s Discretionary Earnings in small enterprises (SDE).

Get your effective business valuation done with Eqvista!

A business valuation is a complicated process, especially when you examine the various approaches for evaluating your company and determining its economic worth. It is highly advised that business owners seek the help of professionals to get a valuation for their company. The Eqvista valuation team is highly trained with more than 10 years of experience in business valuations. To know more about our valuation service, contact us today!

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!