Simple Employee Equity Development or SEED by Eqvista

SEED by Eqvista is an employee compensation plan that helps companies across diverse industries to design their employee equity offerings.

Employee equity is the foundation of every growing business. It is a well-known fact that all startups typically face difficulties in cash allocation. All activities being important in the initial phases of a business, prioritizing is always a challenge. Specifically, a startup has to balance between cash spent for recruiting the quality talent and finding optimum avenues to invest in operational processes that will maximize profits. Of the two, thankfully employee compensation can be handled without diluting immediate cash reserves.

Employee Equity Compensation

A startup must hire the best-skilled people in the industry to drive growth. Needless to say, this is never cheap. The best talent is usually engaged in companies paying their worth. A startup can never compete with established companies in terms of cash-based salary packages. Thus employee equity becomes an important currency to design competitive compensation schemes that will attract talented and experienced resources and retain them in the company for a long time. Let’s take a closer look.

What is equity compensation for employees?

Equity compensation is a method of granting employee compensation using company shares. It is a non-cash method of payment usually offered in combination with a below-market salary. Equity to employees can be granted in the form of stocks, stock options, warrants, and bonds. Based on the type of grant, they incur varying tax implications. But on the whole, by extending equity to employees, a company extends a share in business profits and ownership.

When a startup is incorporated, all shares are owned by the founders. To design employee compensation packages using equity, founders must collectively set aside a certain percentage of their equity stakes. This is known as the ‘option pool’. All further share distribution for employees and investors is done from this pool. A startup must have a clear vision about the option pool early in their operations. This is a preference by investors as well. Deciding on the size of an option pool is strategically important. Too much will send founders into losses and too little won’t meet company needs.

Advantages of offering equity compensation to employees

The option pool created for employee equity eats into founder shares. In many ways, it could also become a liability in the long-term because as per the National Centre for Employee Ownership, close to 76% of employees eligible for equity rewards programs choose to receive it. Despite these factors, the two most important benefits of offering equity as compensation are:

- Managing human resources: A startup functions in a high-energy, stressful environment. Employees might come on board impressed by the idea, but it takes adamant optimism, unwavering hard work, and commitment to turn a brilliant idea into a profitable company. Employee compensation in the form of equity contributes to this aspect. It instills in employees a sense of ownership in the business and employees perceive themselves as drivers of the business as opposed to being just spokes in a wheel. Their financial goals are aligned with that of the company. Equity rewards thus help to increase employee retention.

- Managing cash flow: Paying monthly salaries in cash is a drain on cash reserves. For a startup’s financial structure, this is quite a liability. Employee equity helps ease this burden. Employees are sufficiently compensated with share ownership and the company does not have to worry about diminishing cash reserves just to ensure employee retention.

What are the different types of employee compensation?

The bottom line of granting employee equity is extending part ownership in the company. However, not all employees receive the same privilege. As profitable as share ownership is, it is also an important responsibility and needs to be extended after sufficient vetting. Some of the common types of equity rewards are:

Stock Options

Employee compensation in the form of stock options is the right to purchase company shares on a later date at a pre-fixed price (exercise price). This type of equity reward is reserved mostly for employees, but can be extended to other external stakeholders as well. However, stock option holders are not the same as shareholders and do not enjoy the same rights. But a stock option holder may eventually become a shareholder once options are exercised. The two types of stock options are:

- NSO: Non-qualified Stock Options or NSOs do not meet all the requirements of the Internal Revenue Code. NSOs benefit the company as it involves tax deductions at grant as well as at exercise. But this becomes an expensive option for employees as tax is deducted twice. There is no limit to NSO grants.

- ISO: Incentive Stock Options or ISO on the other hand are granted only to employees. These are not extended to any stakeholders like consultants, advisors, or external directors. However, ISOs are limited to a grant of 100K per year. This option works out to be beneficial for employees as they are taxed only at a sale.

Restricted Stock (RSU & RSA)

Restricted stocks are otherwise known as ‘letter stocks’ or ‘section 1244 stocks’. They are a form of employee compensation reserved for senior positions such as executives and directors. These stocks are typically unregistered at the time of grant, subject to graded vesting schedules, non-transferable, and must be traded in compliance with SEC regulations. Since these grants are sizable and granted to senior, experienced members, they are subject to restrictions that deter the premature sale of stocks. Though the chances of foul play are minimal, restricted stocks prevent a hit-and-run scenario. The two types of restricted stocks are:

- RSU: Restricted Stock Units or RSUs are not actual stocks. It is a promise to receive company stocks at a fixed price at a later date. Until that time, employees do not have voting rights either. Employees must exercise their options to receive actual stock ownership.

- RSA: Restricted Stock Awards or RSAs on the other hand are actual stocks. The employee receives complete ownership of them from the grant date. However, these cannot be redeemed for cash.

Performance Shares

As the name suggests, employee equity in the form of performance shares is subject to reaching performance benchmarks. The company sets certain measures which when achieved by the employee, qualifies them for the actual stocks. Vesting schedules for performance shares are designed in a way that giving equity is staggered over many years. Metrics such as EPS, Return on Equity, the total return on company stocks, etc. are used to determine the worth and credit of the employee’s contribution before granting performance shares.

Vesting Schedules for Employee Equity

With these many ways available for granting employee equity, one common factor underlying all of them is the conditional nature of the process. Whether actual stocks or the right to purchase stocks, a condition is known as ‘vesting’ is applied to all equity schemes. Let’s see why.

Why is vesting important for equity compensation?

Vesting is a process by which a company grants non-forfeitable rights to employees over company stocks. This process is either time-based or performance-based. Certain timelines and benchmarks are set, on completion of which employees earn complete ownership over the assigned stocks. The three basic types of vesting are:

- Immediate vesting: When employee equity is granted all at once and the employee owns these shares immediately, it is known as immediate vesting. This is a rare case and might be used as a sign-up bonus for executives and directors. It is quite a risky affair in case the executive chooses to immediately sell their shares and exit the company soon after. These cases are rare, but cannot be ruled out.

- Cliff vesting: ‘Cliff’ is the time an employee needs to wait before they become eligible to receive stocks. For example, if a company grants 50 shares as employee compensation with a cliff of 1 year, this means that the employee will be eligible to receive those 50 shares only after working for the company for one whole year. After this one year, the employee receives ownership of all 50 shares at once.

- Graded vesting: This is the most common type of vesting. Stocks are granted in a staggered manner spaced over a certain period. Most often this type of vesting schedule is accompanied by a cliff. For instance, if a company grants 100 shares to an employee using a 4 year graded schedule and a 1-year cliff, this implies that after the one-year cliff, the employee will receive 25 shares every year amounting to a total of 100 by the end of 4 years.

What are the advantages of using a vesting schedule for equity compensation?

Company stock is an invaluable asset. Employee equity aims to ultimately benefit employees, but if in irresponsible hands, has the potential to cause irreparable damage to the business. Vesting schedules help to stall such unfavorable events. The two biggest advantages of using vesting schedules are:

- Employee retention: Employee equity granted especially using graded vesting schedules is a reliable method of long-term employee engagement. The more time an employee spends working for a company, the higher the chances of accelerated share prices that typically correspond to company growth. An employee thus sees value in continuing with the firm as at the end of the vesting schedule of 3 or 4 years, share prices would have increased since the grant date and the employee stands to profit while exercising all options.

- Safeguarding company interests: No matter how impressive a resume is, an employee’s true potential can be judged only in work. Thus vesting schedules provide the much-needed safety advantage to the company where they take time to test the recruit’s potential before beginning to part with company stocks. If an employee leaves before completion of the cliff, they forfeit all their rights over promised shares. Similarly, if the employee leaves midway through a vesting schedule, they will exit with only their portion of the vested shares and forfeit the rest. Thus the company does not put itself at risk issuing employee equity.

SEED by Eqvista

As we see, employee equity is a crucial component of a business, especially startups. To determine the size of the option pool is the first step, yet a lot of considerations go into this before arriving at a consensus as all founders must agree to it. Also, not all startup founders have the foresight required for this or are adept at handling equity distribution early on in the business lifecycle. SEED is a perfect solution to this.

What is SEED by Eqvista?

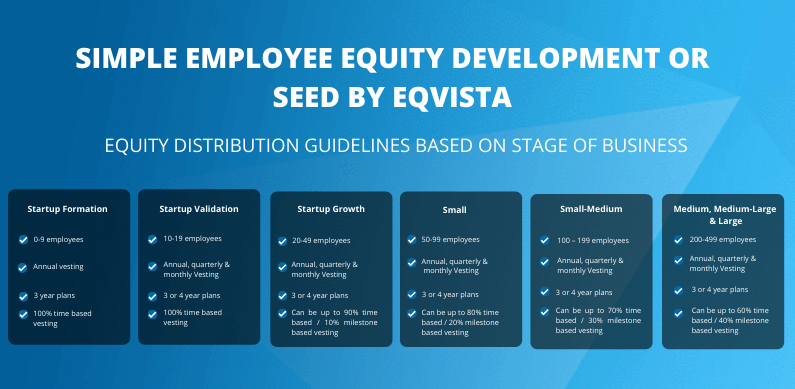

Simple Employee Equity Development or SEED is a vesting template designed by Eqvista targeted towards the equity distribution needs of various companies. Eqvista is a pioneer equity management software with years of experience in handling employee equity in diverse industries. SEED is a unique solution created by Eqvista that assimilates these experiences into creating an optimal equity rewards plan for employees. Before delving further, let’s understand some basic terminologies used in the SEED template:

SEED terms

Our SEED plans incorporate different aspects of a company in determining how the vesting schedules will play out. Therefore, it’s good to know all the terms involved and what factors play a part in determining how the equity awards will vest. They are:

- Employee Size: Number of employees in a company

- Staff Position: Position of the staff in the company, being Entry Level, Mid Level or Senior Level.

- Vesting Length: Waiting period that employees need to surpass before receiving stocks

- Vesting Schedule: A timeline that determines stock vesting

- Time Based (TB) & Milestone (performance) based (MB) vesting: Vesting schedules subject to completion of a certain period or pre-set performance milestones

- Employee Pool: Number of shares set aside by the company founders to be used for employee compensation. This is usually set as 10%, 15% or 20% (or anywhere in between).

SEED Vesting Schedules

In our SEED plans, we have selected the vesting terms of the equity awards based on company size, staff position and what vesting plan you select. Here is how the vesting terms look for each staff position of the different sizes of companies:

| Staff | Startup Formation | Startup Validation | Startup Growth | Small | Small-Medium | Medium/Medium Large/Large |

|---|---|---|---|---|---|---|

| Entry Level Staff | 100% TB | 100% TB | 100% TB | 100% TB | 100% TB | 100% TB |

| Mid Level Staff | 100% TB | 100% TB | 100% TB | 90% TB/10% MB | 80% TB/20% MB | 70% TB/30% MB |

| Senior Level Staff | 100% TB | 100% TB | 90% TB/10% MB | 80% TB/20% MB | 70% TB/30% MB | 60% TB/40% MB |

After selecting your vesting terms, you can select the vesting length and schedule for each of your employees. Here is a list of our recommended vesting schedules based on our SEED plans:

| Startup Formation | Startup Validation | Startup Growth | Small | Small-Medium | Medium/Medium Large/Large |

|---|---|---|---|---|---|

| 3 Years, Annual | 3 Years, Annual | 3 Years, Annual | 3 Years, Annual | 3 Years, Annual | 3 Years, Annual |

| - | 3 Years, Cliff + Quarterly | 3 Years, Cliff + Quarterly | 3 Years, Cliff + Quarterly | 3 Years, Cliff + Quarterly | 3 Years, Cliff + Quarterly |

| - | 3 Years, Cliff + Monthly | 3 Years, Cliff + Monthly | 3 Years, Cliff + Monthly | 3 Years, Cliff + Monthly | 3 Years, Cliff + Monthly |

| - | - | 4 Years, Annual | 4 Years, Annual | 4 Years, Annual | 4 Years, Annual |

| - | - | 4 Years, Cliff + Quarterly | 4 Years, Cliff + Quarterly | 4 Years, Cliff + Quarterly | 4 Years, Cliff + Quarterly |

| - | - | 4 Years, Cliff + Monthly | 4 Years, Cliff + Monthly | 4 Years, Cliff + Monthly | 4 Years, Cliff + Monthly |

Once you have an idea of the type of vesting plan you want, in case your employees have Milestone Based (MB) vesting, you can also select the number of milestones for each. In our SEED plans we recommend:

- 3 Year Vesting: 6 Milestones (semi annual vesting). These should be performance based milestones which can be achieved around every 6 months from the employee.

- 4 Year Vesting: 8 Milestones (semi annual vesting). These should be performance based milestones which can be achieved around every 6 months from the employee.

Now let’s look at how these SEED vesting plans can help you based on the size of your company.

How SEED by Eqvista template helps business founders?

Employee compensation in the form of equity is inevitable in today’s business environment. However, what makes it tricky is that not all employees can be handed out the same benefits. Various parameters must be considered before deciding on a fair employee equity scheme. SEED by Eqvista is a comprehensive guideline that accounts for a company’s diverse equity distribution needs. SEED helps business founders carefully account for these three important parameters:

Stage of business

Since employee equity is typically all about owning shares in a company, the stage of the company in a business lifecycle plays an important role. Early employees in a startup are usually offered a higher percentage of equity which diminishes in the later stages. However, owning a small percentage of equity in the later stages amounts to a huge sum as the business is quite established and generating substantial revenues. SEED provides equity distribution guidelines for companies in the following 8 stages:

- Startup formation (0-9 employees): For the startup formation stage (0-9 employees), as your company is still starting off and developing your business, our SEED plans outline a 100% time based vesting schedule for all staff positions over 3 years. As many small companies and Startups fail within the first 2-3 years of business, we suggest a 3 year time frame to motivate staff to help grow the company. The recommended vesting terms are on an annual basis to simplify recording shares, focus on the business, and compel staff to stay for 1 year periods. Recommended employee pool would be 10%.

- Startup validation (10-19 employees): For the startup validation stage (10-19 employees), the company has already hired more staff to operate the business and the company is seeing a bigger team and growth in operations. For this stage our SEED plans also outline a 100% time based vesting schedule for all staff over a 3 year period. However as there are more staff and different positions in the company, we recommend an expanded vesting schedule of 3 years on annual vesting, cliff + quarterly vesting and cliff + monthly vesting. This gives the company more flexibility when it comes to how to vest their equity. Recommended employee pool would be 10%.

- Startup growth (20-49 employees): For the startup growth stage (20-49 employees), the company has surpassed the critical stage of company failure, and is starting to significantly grow its operations and personnel to expand the business. And because of this, we suggest a 100% time based vesting schedule for entry level and mid level staff, and a 90% time based / 10% milestone based vesting for senior level staff. The 10% MB vesting will motivate senior staff to achieve performance targets to grow the company. Also as the company is operating for the long term, our SEED plans recommend both 3 year and 4 year vesting schedules, on annual vesting, cliff + quarterly vesting and cliff + monthly vesting. Recommended employee pool would be 10%.

- Small (50-99 employees): For the small stage (50-99 employee), the company is further expanding its operations ,hiring of staff, and beginning to take up more market share within the segment. Thus for this company size, we recommend mid level staff to also have a 10% milestone based vesting and increase of senior level staff to 20% milestone based vesting. This would encourage staff to continually meet performance targets to keep growing the company. The recommended vesting length remains the same at 3 and 4 year terms. Recommended employee pool would increase to 15% for the higher number of employees.

- Small-medium (100-199 employees): For the small-medium stage (100-199 employee), the company has a significant size of operations and maturing its operations within its industry. The company would be expanding its amount of funds, investors, and operations within its segment. Thus our SEED plans recommend an increase in the weighting of mid level positions to 20% MB and senior level staff to 30% MB, as to emphasize more of their equity awards on their performance in the company and less on tenure. The recommended vesting length remains the same at 3 and 4 year terms. Recommended employee pool would be 15%.

- Medium(200-299 employees), MediumLarge(300-399 employees) & Large (400-499 employees): For the Medium stage (200-299 employees), Medium-Large Stage (300-399 employees) & Large Stage (400-499 employees), the companies have developed into large corporations with expansive services and size in the market. And because of this, the vesting schedules of these companies would vary greatly depending on the company culture and how best to fit the needs of the goals of management together with their staff. Our SEED plans recommend a further adjustment to 30% MB for mid level employees and 40% MB to senior executives, to focus on performance within the company. However this would depend on the needs of the company, and some companies may favor more time based vesting, and other more on performance. The recommended vesting length remains the same at 3 and 4 year terms, with a 15-20% employee pool for the company.

Employment levels

An important factor that affects employee equity is their seniority in the company. SEED categorizes staff into 3 sections: Entry-level, Medium level, and Senior level. These categories are important because, unless recruiting for executive positions, an entry-level staff needs to be assessed for their performance and commitment to the company before giving away large chunks of equity. Similarly, senior-level staff must be sufficiently rewarded for their consistent contributions.

Employee pool

This is the third most important factor to be considered while designing employee equity schemes. SEED proposes to start small at 10% for formative startups and expands up to 20% based on the size of the company. It is better to have a small option pool at the beginning so that founders do not have to part with a large portion of their shares.

SEED by Eqvista per industry

We have compiled an in-depth analysis of how our equity compensation plans can benefit you depending on your industry. Taking into consideration your industry, size of company, staff position and annual salary, you can develop the best equity plan for your employees to drive growth for your company:

Checkout our industry reports on equity compensation below:

- Finance and Insurance

- IT and Technology

- Retail Trade

- Utilities

- Construction

- Manufacturing

- Wholesale Trade

- Transportation and Warehousing

- Mining, Quarrying, and Oil and Gas Extraction

- Agriculture, Forestry, Fishing and Hunting

Ready to Start using Eqvista’s SEED plans for your Employees?

Equity compensation when done right can be a powerful recruitment and retention tool. Good practices in equity distribution also play an important role in attracting high-profile investors. Equity management begins as a simple, manual process and quickly accelerates to quite a cumbersome activity requiring dedicated personnel to monitor it at all times. This is why using state-of-the-art equity management software like Eqvista can be beneficial.

Eqvista consolidates all equity needs of a company right from issuance to dividend payouts and provides personalized access to all stakeholders. Managing equity has never been easier. Explore more about all our services: including Cap Table management, 409a valuations, and financial modeling such as Waterfall Analysis and Round Modeling. To know more about how our SEED plans can benefit your company, or more customized vesting plans for your shareholders, reach us today!

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!