Shareholder Register

A shareholder register is a list of all the active equity owners in the company.

A competitive market often encourages companies to expand and grow. One of the most compelling ways of raising funds is through angel investors or by issuing shares. When a company decides that they want to issue shares, there are many things that they have to go through to make sure everything goes smoothly. It is important that they keep track of everything related to their shares. One way of keeping track of it is by maintaining a shareholder register.

Shareholder Register

In simple terms, a shareholder register is a list of all the active equity owners in the company. This register contains all the key data about owners like their contact information, number of shares owned, ownership percentage, and others.

What is a shareholder register?

A register that contains a list of all of the current owners of the company’s shares is called a shareholder register. This list is updated regularly to ensure that all the data in it is current. Each and every shareholder is recorded in this list. The data includes the shareholders’ name, number, address, and no. of shares owned. Additionally, they also include the current occupation of the shareholder and the price they paid for the shares. To examine the ownership of a business, the shareholder register is key as it contains all the essential data. Generally, the term shareholder register is used in Europe and other countries globally, but in the U.S., it is referred to as the shareholder list.

All the shares issued by the company should be noted in the shareholder register. Also, if there are any restrictions on transferable shares or citations, it should be mentioned in the register. The list in the register should contain the names of the company shareholders in alphabetical order with their last known address. Some shareholder registers contain every detail about the shares, such as the date of transferable shares and all the shares issued to each individual over the previous ten years. Additionally, they also include the name of the individuals who received the transferred shares. Along with the purchase price of the shares that each investor paid, the shareholder register also includes the unpaid amount, if the shares are not fully paid for.

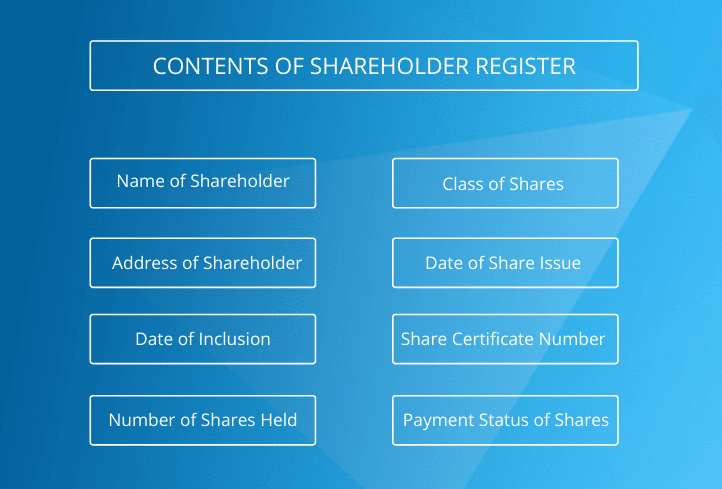

What information is included in a shareholder register?

The information recorded in the shareholder register is about the beneficial owners of the shares. A beneficial owner of shares is a shareholder that has the right to vote through the shares he owns. Also, if any shareholder is entitled to any benefits that are directly related to the shares, they will come under the term beneficiary held. Shares that a trustee holds comes under the non-beneficiary category as it is held by a third party. A company must provide the shareholder register to its current shareholders for free and can choose to charge a fee for non-shareholders. The U.S. SEC (Securities and Exchange Commission) states that if needed, the company must provide a shareholder register to other shareholders. This need may arise due to a proxy solicitation or a tender offer.

Here is a list of all the information that needs to be included in the shareholder register:

- Name and address of the shareholder

- The date on which he became a member

- Number of shares held

- Folio number or share certificate of held shares

- The number of shares publicly issued

- Date of issuance

- Class of public issued shares

- Status of the shares (paid or not)

Who all can access the shareholder register?

A shareholder register is not accessible for free to everyone. The only people who can access it for free are the current company shareholders. Non-shareholders can access the shareholder register but at a fee. If required, a company shareholder can ask for the register and inspect the information freely. Non-shareholders will have to provide details regarding the purpose of access to the register and how the data will be used.

The business may provide access to a request of a non-shareholder if the reason for access is genuine but may also charge a fee. However, the company can choose to decline the request for access if the non-shareholder wants to use the data for an unlawful purpose.

Shareholder Register Requirements

A shareholder register purpose is to show all the current information of the beneficial owners of shares in the company. Beneficial owners have direct benefits from the ownership of the shares, such as voting power, receive dividends, and other rights. All of this information is part of the shareholder register requirements. The SEC states that a company is required to provide a shareholder with other shareholders’ information in two instances, for tender and proxy solicitations.

A proxy solicitation is a form of request that authorizes another shareholder to give a vote on behalf of a shareholder at a meeting. For this to be valid, a proxy statement should be included within which essential information regarding the specific topic that permits the shareholder to vote on should be provided. On the other side, a tender offer is an offer a shareholder makes to buy a part or all of the shares held by another shareholder. When making this offer, the shareholder will need to contact the other shareholder from which he wants to buy the shares. They might also want to send a bid at a specific price after calculating the amount by using the details of the shareholder. This information is provided in the shareholder register. The company is required to follow the state laws and internal charter & bylaws while giving access to the shareholder register.

Consequences for not maintaining a shareholders register

If in any case, the company fails to maintain a shareholders’ register in an orderly manner, they may be fined up to $10,000. If the fine is above a certain amount, the company will be included in the criminal register for ten years. This can affect the funding of the company as investors check the criminal register to see if the company is mentioned before investing. Additionally, if there are incorrect or omissions in the register it is also punishable.

If any shareholder is entered in the register, and the board of directors does not have any proof of the acquisition of such shares, and the mentioned shareholder is not a legal owner of the company shares. Then they will be in violation of the law. This is why it is essential that the shareholders’ register is not only made but also regularly maintained and checked.

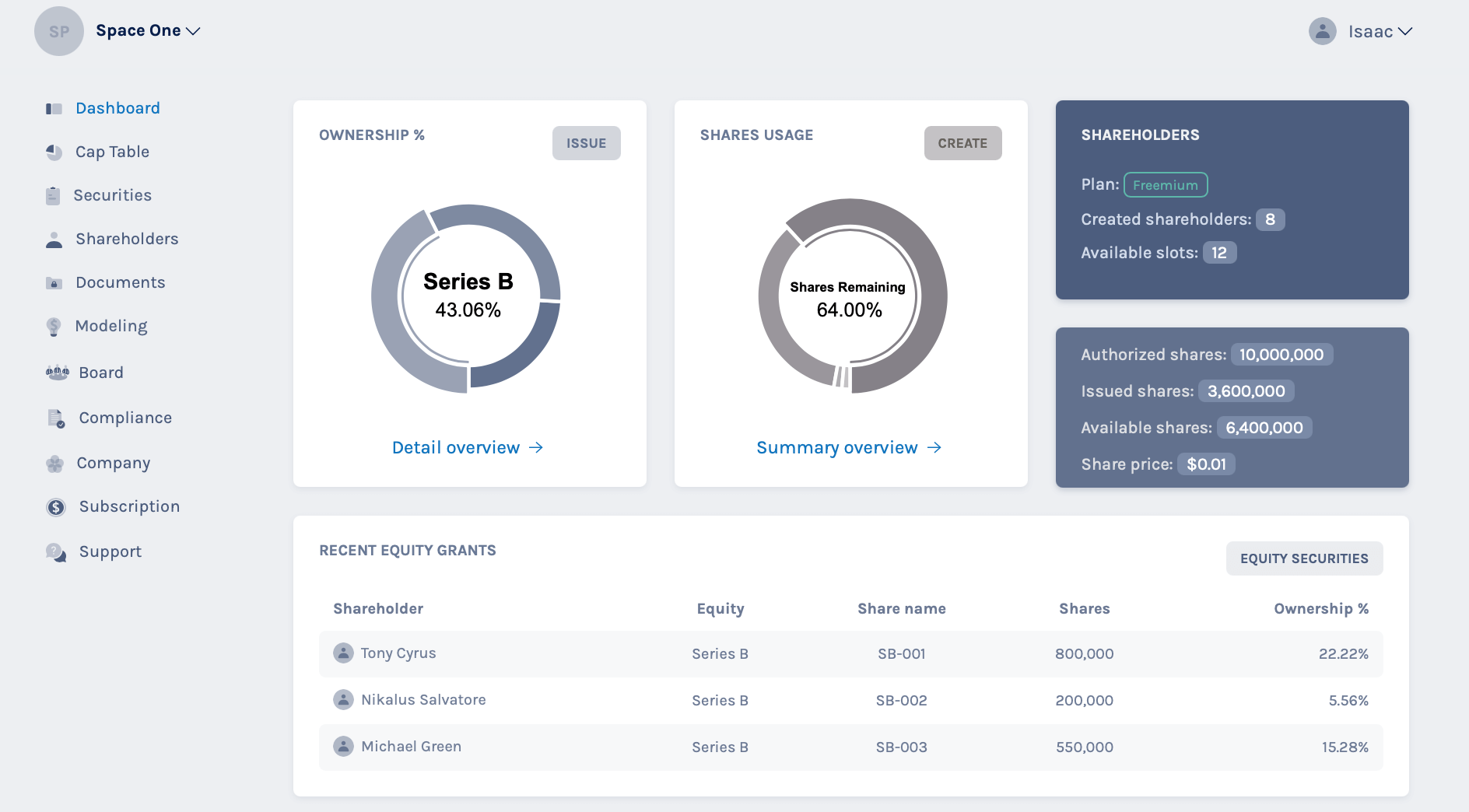

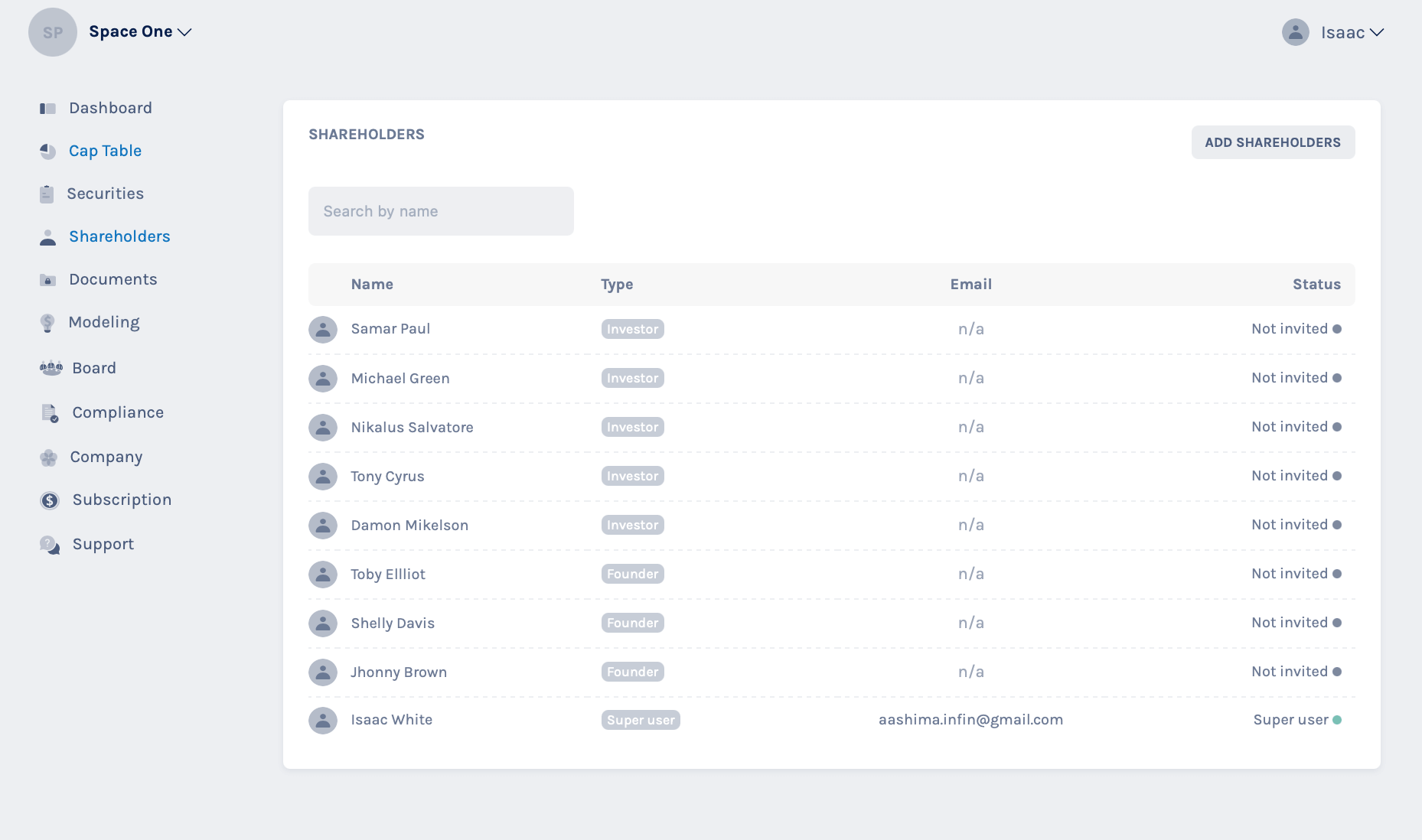

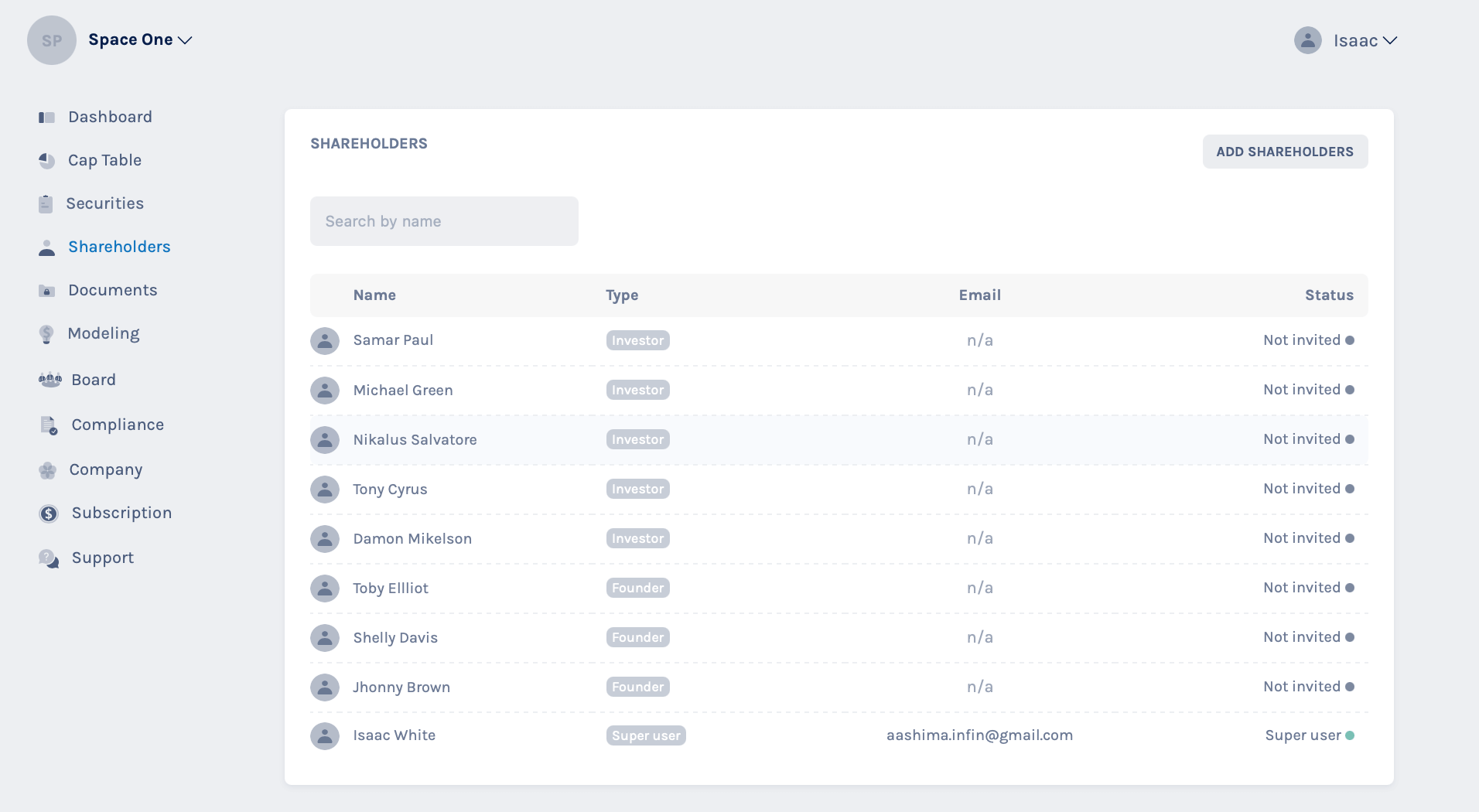

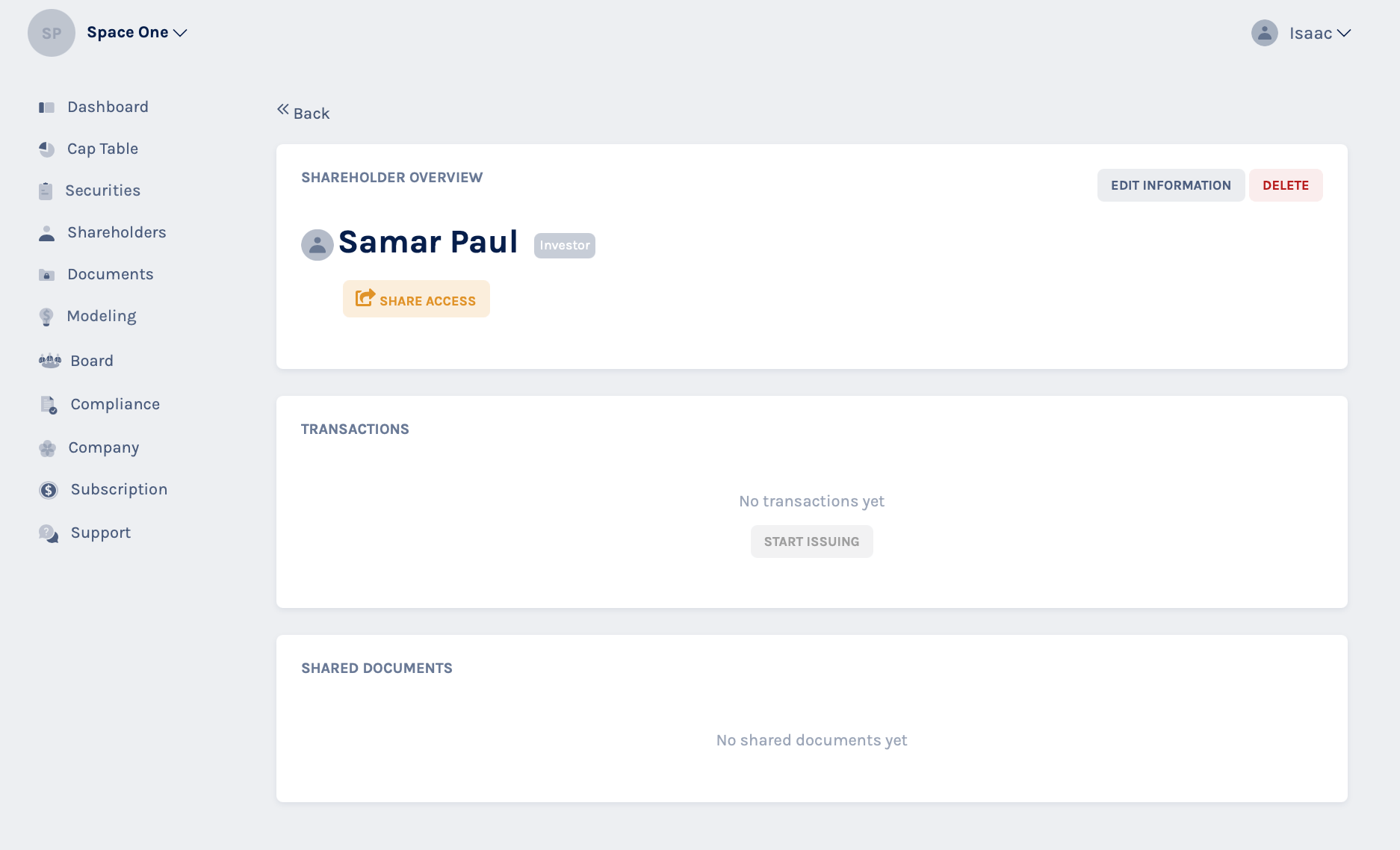

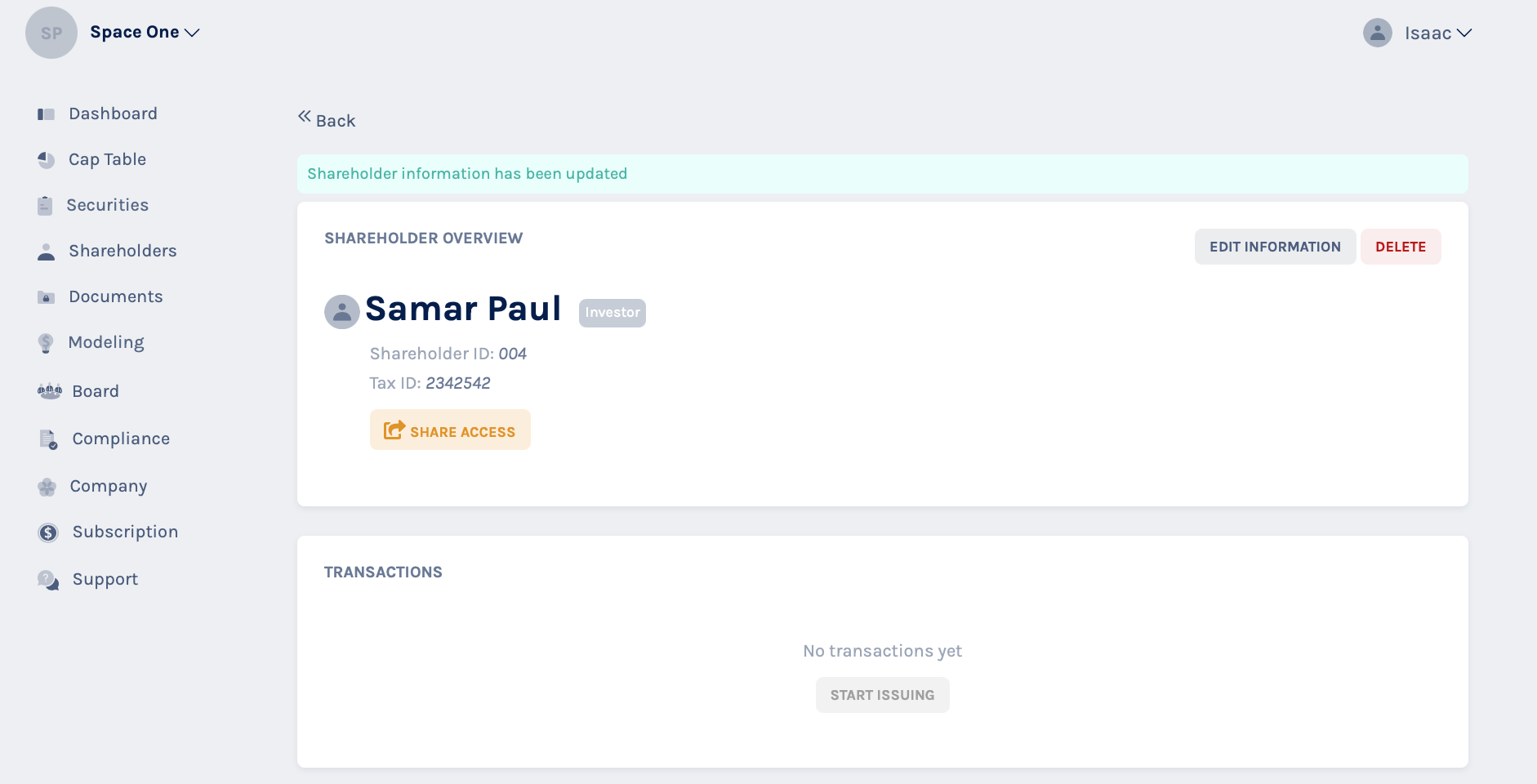

Shareholder Register Example on Eqvista

Here is a shareholder register example, you can see all the information of the current shareholder in the company on one page. If you click on the company shareholder name in the shareholder register example, you will see the entire information of the shareholder.

Record and Manage Your Company Shareholders on Eqvista

Managing and recording your shareholders can be a hassle if you do not use the right tools. Eqvista provides a platform where this can be done easily and be free from mistakes.

How do you add shareholders on Eqvista?

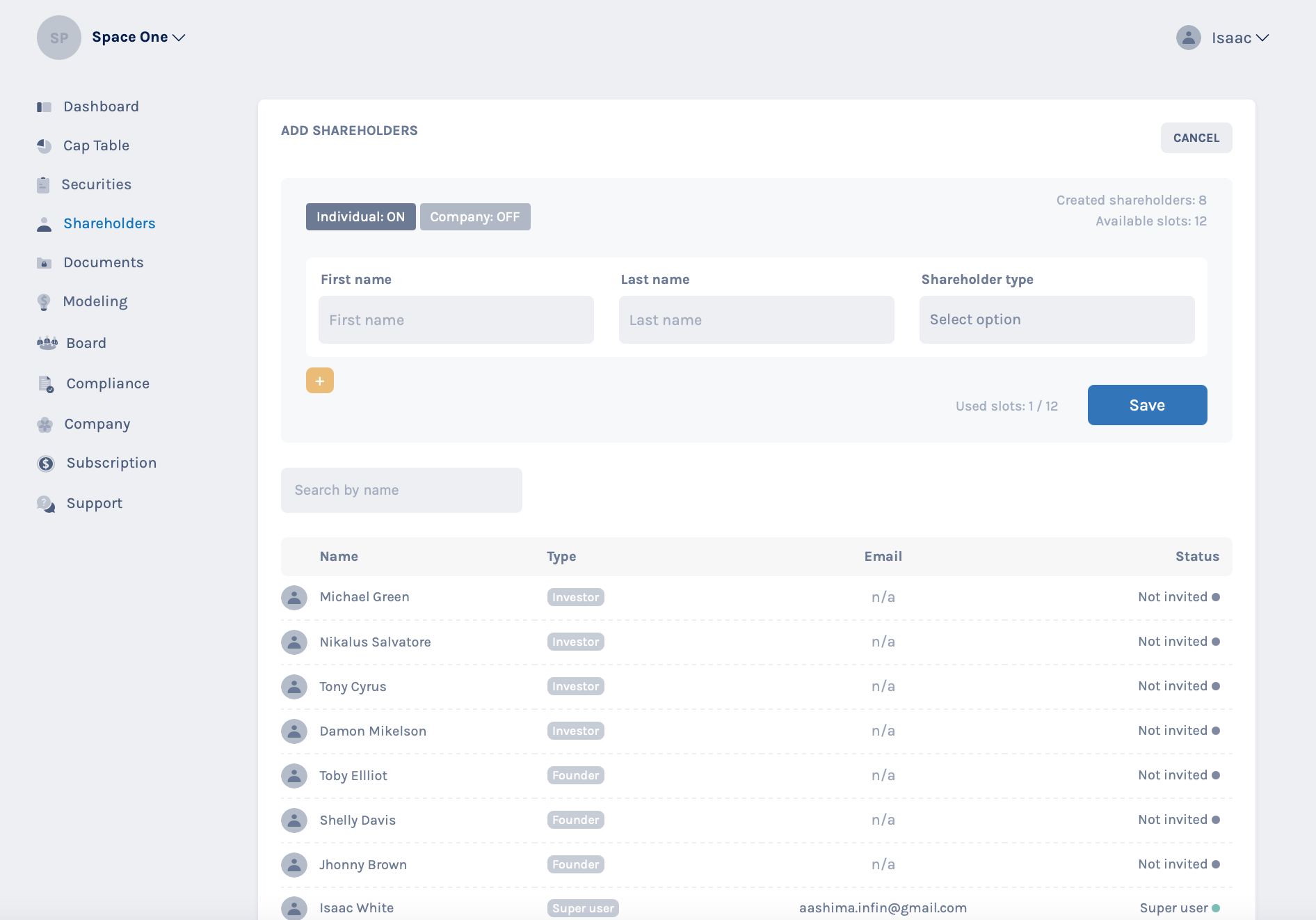

On Eqvista, its easy to add new shareholders right on the platform.

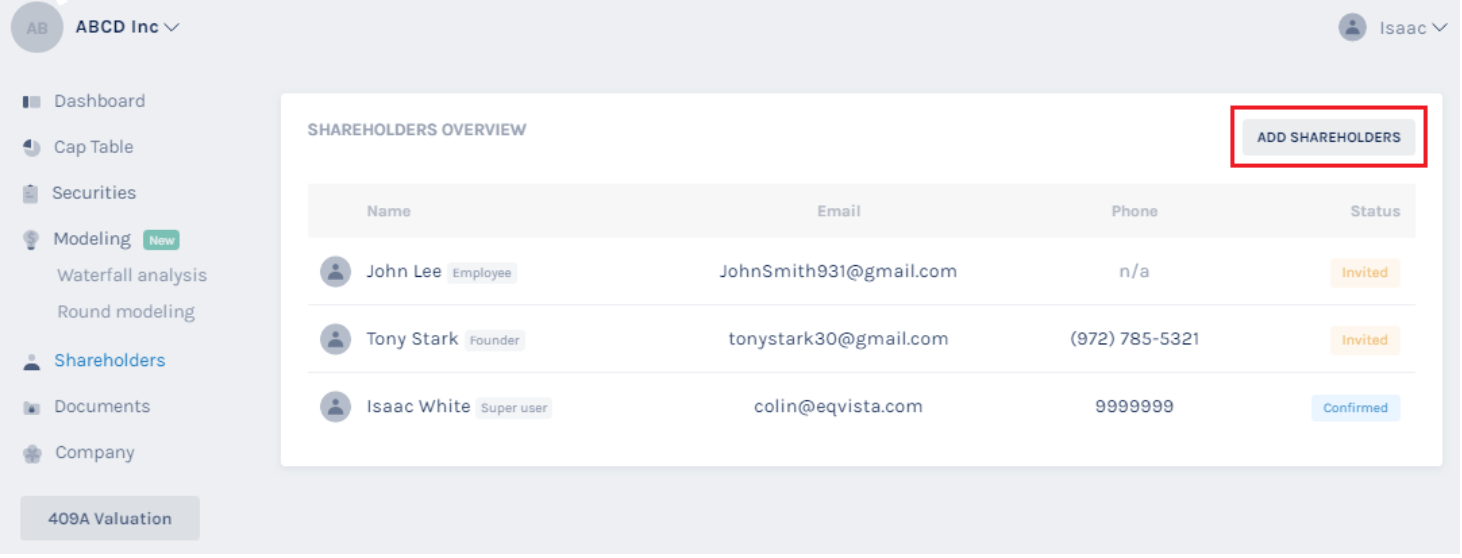

Step 1: Select the company that you want to add the shareholder. Once done, you will be on the profile page of the company. On the left side, there will be an option “shareholder”, click on it.

Step 2: On the page, you are directed to click on “Add Shareholder” on the top right side.

Step 3: A pop-up window will appear where you will have to fill in all the new company shareholder information. Once done click on “Save”.

Step 4: Once you click on save you will be directed to a page where you will be able to see the shareholder information that you added and other previously entered shareholder’s information. Then you can add the information of shares for the shareholder. ‘

How to update shareholder information on Eqvista?

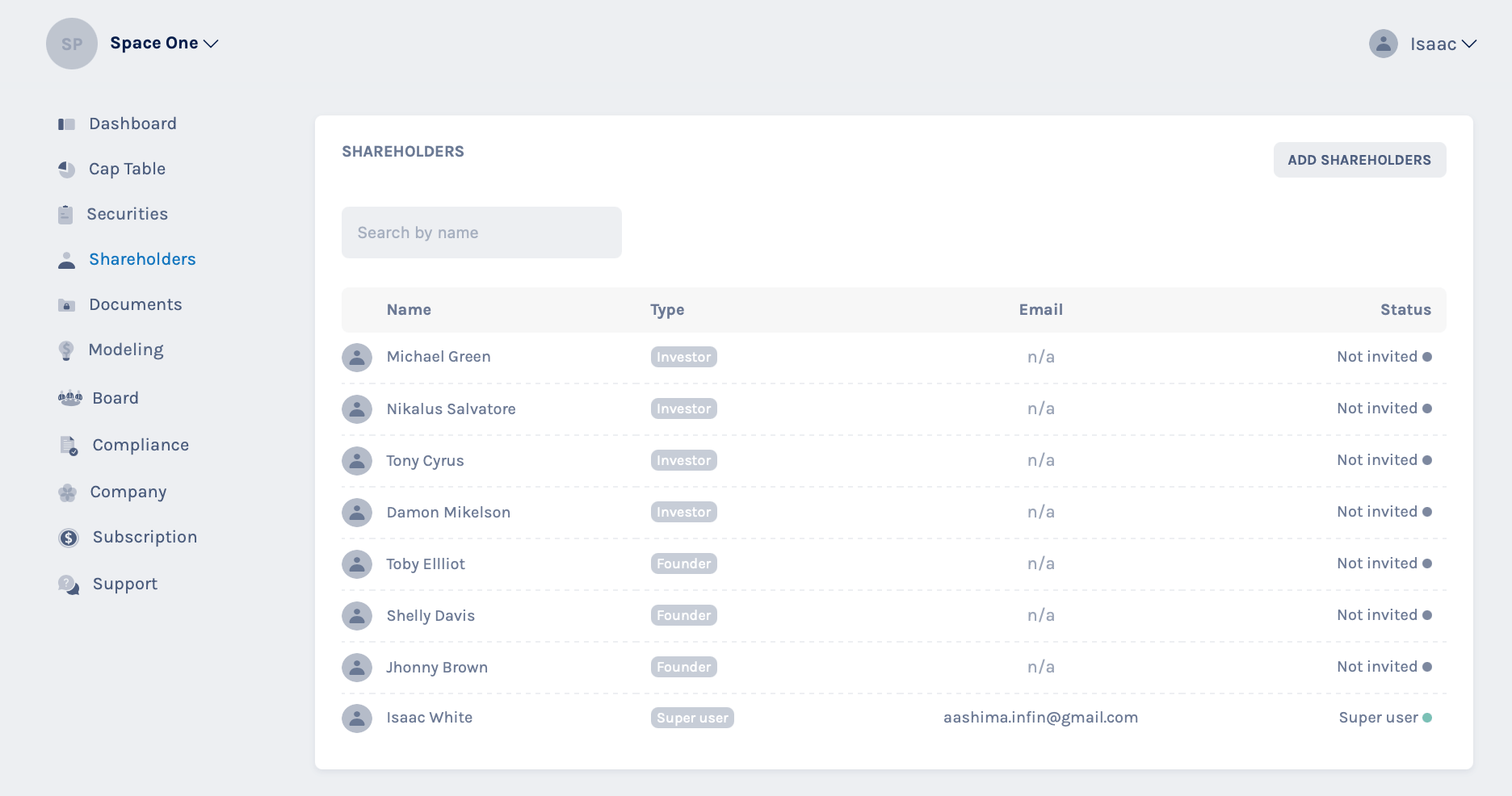

To add shareholders on Eqvista, you will need to login into your account and click on shareholders. Once done, you will be on a page where all the shareholders’ information will be seen.

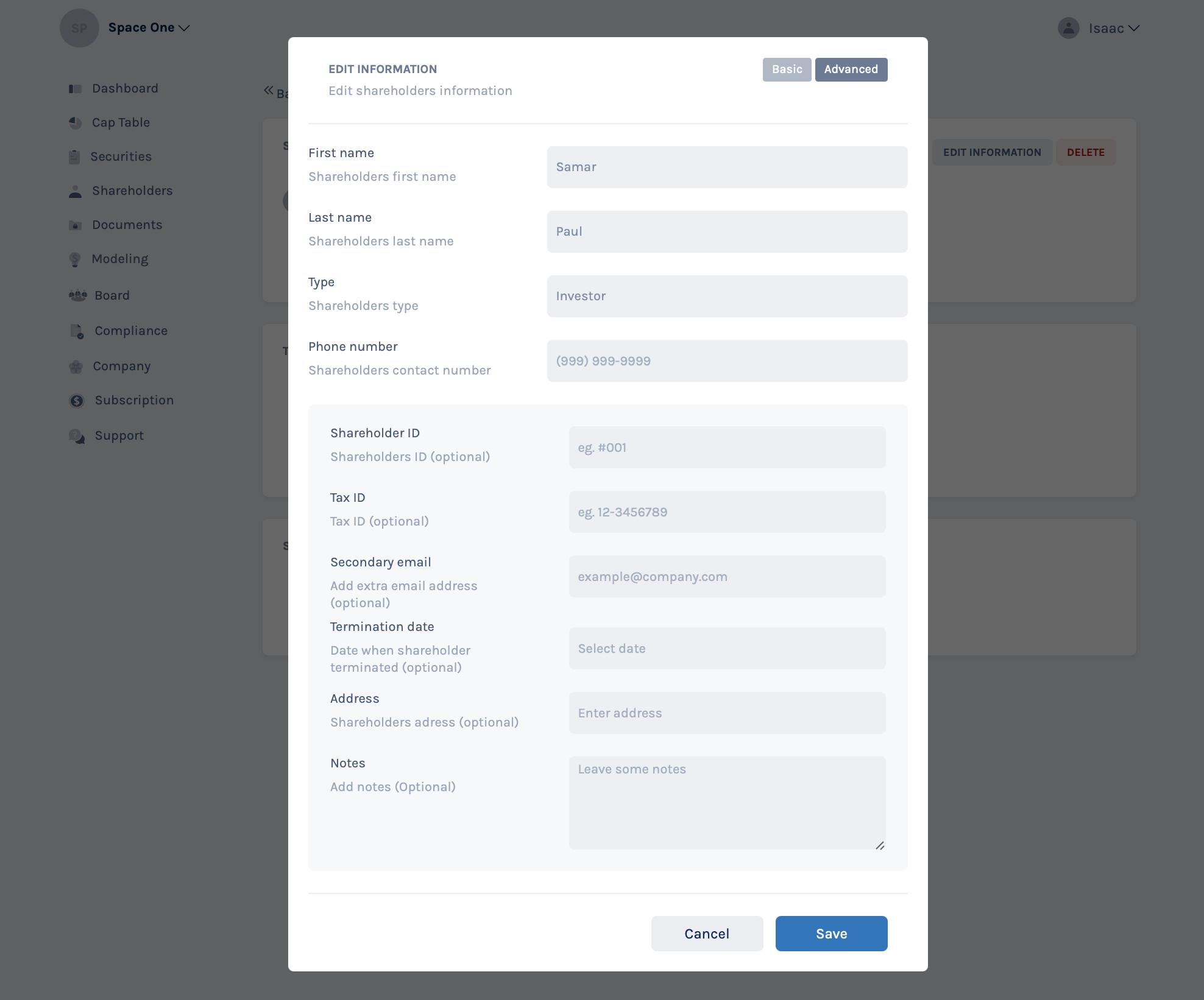

Step 1: To start, select the shareholder and then click on edit information. Here you can fill in the name and the type of shareholder.

Step 2: Click add information, and fill in the required information about the shareholder.

Step 3: Once all the information is filled, click save, and the company shareholders’ information will be added to the list.

If you want to delete or edit shareholder information from the list then click on the shareholder and you will be directed to a page with two options, edit information and delete. You can choose the required and click on the cap table to see the updated information.

Keep your Shareholder Register on Eqvista!

In order to keep everything organized and avoid headaches down the line, you should maintain a shareholders register. It is essential that the company or the board of directors not only creates one but also maintains it by regularly updating it at intervals or when shares are sold. One way to keep track without keeping paper registers which could cause omissions and loss of data is by using tools.

Eqvista is a software that provides you with the necessary tools that help you maintain a shareholders register easily. It is a platform backed by a team of professionals that help make such tasks easier for you. You can also maintain a cap table, 409a valuation, and conduct waterfall analysis for your company. Contact us for more information today!

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!