Form 8594 – Everything you need to know

Here’s everything you need to know about Form 8594.

Many businesses have different types of assets, and these assets are taxed differently. When a business is for sale, not only does the ownership of the assets change, but both the buyer and seller have to face tax consequences. Both parties must file Form 8594 (Asset Acquisition Statement), which is a form the Internal Revenue Service (IRS) uses to allocate the entire purchase/sale price of the business into different classes of assets. Both the seller and buyer of the business must file the form with their tax returns.

We give you a guide on Form 8594: what it is, who must file it, when to file it, and what can happen if you don’t file the form. Here’s everything you need to know about Form 8594.

Instructions for Form 8594

The IRS instructs that both the buyer and seller must file the form and attach their income tax returns. The form must be filed when a group of assets were transferred (in a trade or business), and if the buyer’s basis in such assets is determined by the amount paid for the assets. This applies when the group of assets make up a trade, or business in the hands of the seller, the buyer, or both.

What is Form 8594?

Form 8594 is a compliance made by the IRS for reporting the sale of a business. Both the buyer and seller have to file Form 8594 with their own individual income tax return. On Form 8594, the total selling price of the business is allocated to asset classes using the residual method. By filing Form 8594, you provide the IRS with the following information:

- The buyers depreciable basis in the assets transferred

- How the seller determined gain or loss

Purpose of Form 8594

If goodwill or going concern value attaches, or may attach, to a group of assets that makes up a trade or business, both the seller and the buyer must use Form 8594 to report the transaction, and the buyer’s basis in the assets is determined solely by the price paid for the purchases. If the buyer or seller is updating an original or previously filed supplemental Form 8594 due to an increase or decrease in the buyer’s cost of the assets or the amount realized by the seller, Form 8594 must be filed as well.

Who Must File Form 8594

When a group of assets that make up a trade or business is transferred, both the buyer and seller must file Form 8594 and attach it to their income tax returns (Forms 1040, 1041, 1065, 1120, 1120S, and so on) and the buyer’s basis in the assets is determined entirely by the amount paid for the assets, both the buyer and seller must file Form 8594. This rule applies whether the bundle of assets is a trade or business in the hands of the seller, the buyer, or both. Each U.S. shareholder should attach Form 8594 to its Form 5471 if the buyer or seller is a controlled foreign corporation (CFC).

When to File Form 8594

In most cases, you should include Form 8594 with your income tax return for the year in which the sale took place. If goodwill or going concern value attaches, or could attach, to such assets, use Form 8594 to report the sale. The price paid for the assets determines the buyer’s basis in the assets. When a group of assets that make up a trade or business is transferred, both the buyer and seller must submit Form 8594 and attach it to their income tax returns.

Penalties when you don’t file Form 8594

You may face fines if you do not file a correct Form 8594 by the due date of your return and cannot prove justifiable cause. Failure to file complete and accurate information returns with the IRS can result in severe penalties under the Internal Revenue Code. The numerous forms of Form 1099 (used to report things like payments to independent contractors and interest income) and Form W-2 are the most well-known information returns (used to report employee wages). There are, however, a slew of additional less-familiar information returns – check the long list at the bottom of this column for a complete list.

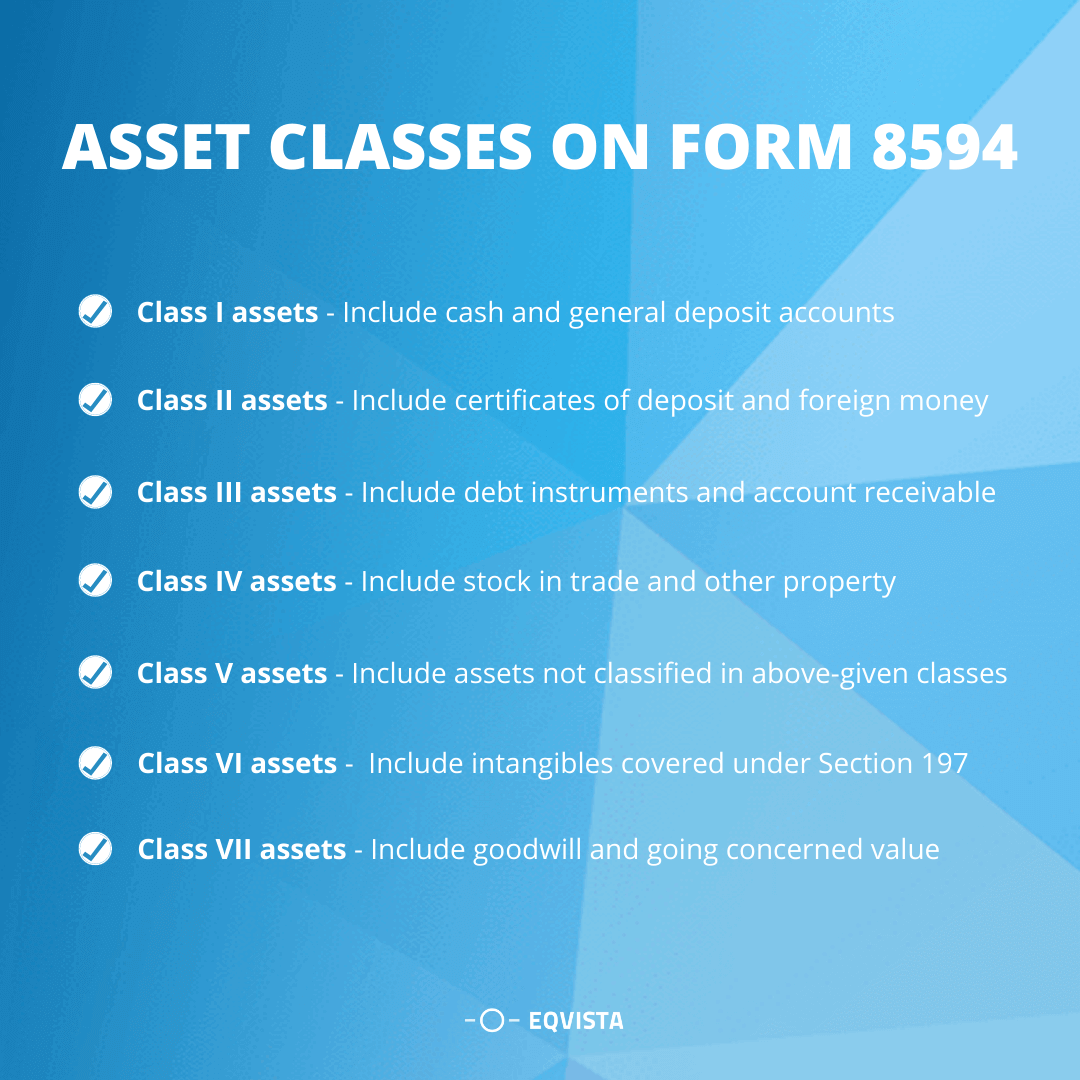

Assets Classes on Form 8594

Form 8594 allocates a business’s assets to different classes, and both the buyer and seller must file the form with their tax returns. It’s also critical that allocations are clearly out in the sale/purchase agreement and that the buyer and seller are treated equally.

Assets are generally split into the following seven groups or classes, which are briefly discussed below:

The classifications for presumed and actual asset acquisitions are listed below.

- Class I Assets – Cash and general deposit accounts (including savings and checking accounts) held in banks, savings and loan associations, and other depository institutions are classified as Class I Assets.

- Class II Assets – Class II Assets as actively traded personal property. In addition, even if they are not frequently traded personal property, Class II assets include certificates of deposit and foreign money. Other than actively traded stock indicated in section 1504(a), Class II assets do not include stock of seller’s affiliates, whether or not actively traded (4). U.S. government securities and publicly traded stock are examples of Class II Assets.

- Class III Assets – Class III Assets and debt instruments are assets that the taxpayer marks to-market at least once a year for federal income tax reasons (including accounts receivable).

- Class IV Assets – Stock in trade or other property of a kind that would properly be included in the taxpayer’s inventory if on hand at the end of the taxable year, or property held by the taxpayer principally for sale to customers in the ordinary course of its trade or business, are classified as Class IV Assets.

- Class V Assets – All assets that are not classified as Class I, II, III, IV, VI, or VII are classified as Class V assets. Class V assets generally include furniture and fixtures, buildings, land, vehicles, and equipment that make up all or part of a trade or company (as defined earlier).

- Class VI Assets – Except for goodwill and going concern value, all section 197 intangibles (as defined in section 197 of the Internal Revenue Code) are classified as Class VI assets. Intangibles covered under Section 197 include:

- The workforce is already in place

- Business records, operating systems, or any other type of database, method, design, pattern, know-how, formula, or similar thing

- Any intangible that is reliant on a consumer

- Any intangible reliant on a supplier

- A government unit’s issue of a license, permit, or other rights

- Any non-competition agreement entered into in connection with the purchase of a stake in a trade or business

- Any trademark, trade name, or franchise (however, see exception below for certain professional sports franchises)

- Class VII Assets – Goodwill and going concern value are classified as Class VII assets (whether or not the goodwill or going concern value qualifies as a section 197 intangible) Goodwill is the difference between the purchase price of a business and its net asset value (also called book value). It could have the following features:

- It could be linked to a company’s strong reputation regarding the items it sells, the services it provides, and its community standing.

- It may be linked to a company’s capacity to continue doing business with existing customers while also attracting new ones.

- It’s an intangible asset that can only be purchased as part of a business purchase.

The worth assigned to a company entity as an ongoing enterprise is known as going concern value. Going-concern value emphasizes the ability of the company’s assets to make a profit rather than just goodwill. If an asset specified in (I) through (VI) is listed in more than one category, put it in the category with the lowest number (for example, if an asset can be included in both Class II and IV, choose Class II).

Clauses to fill in the form 8594

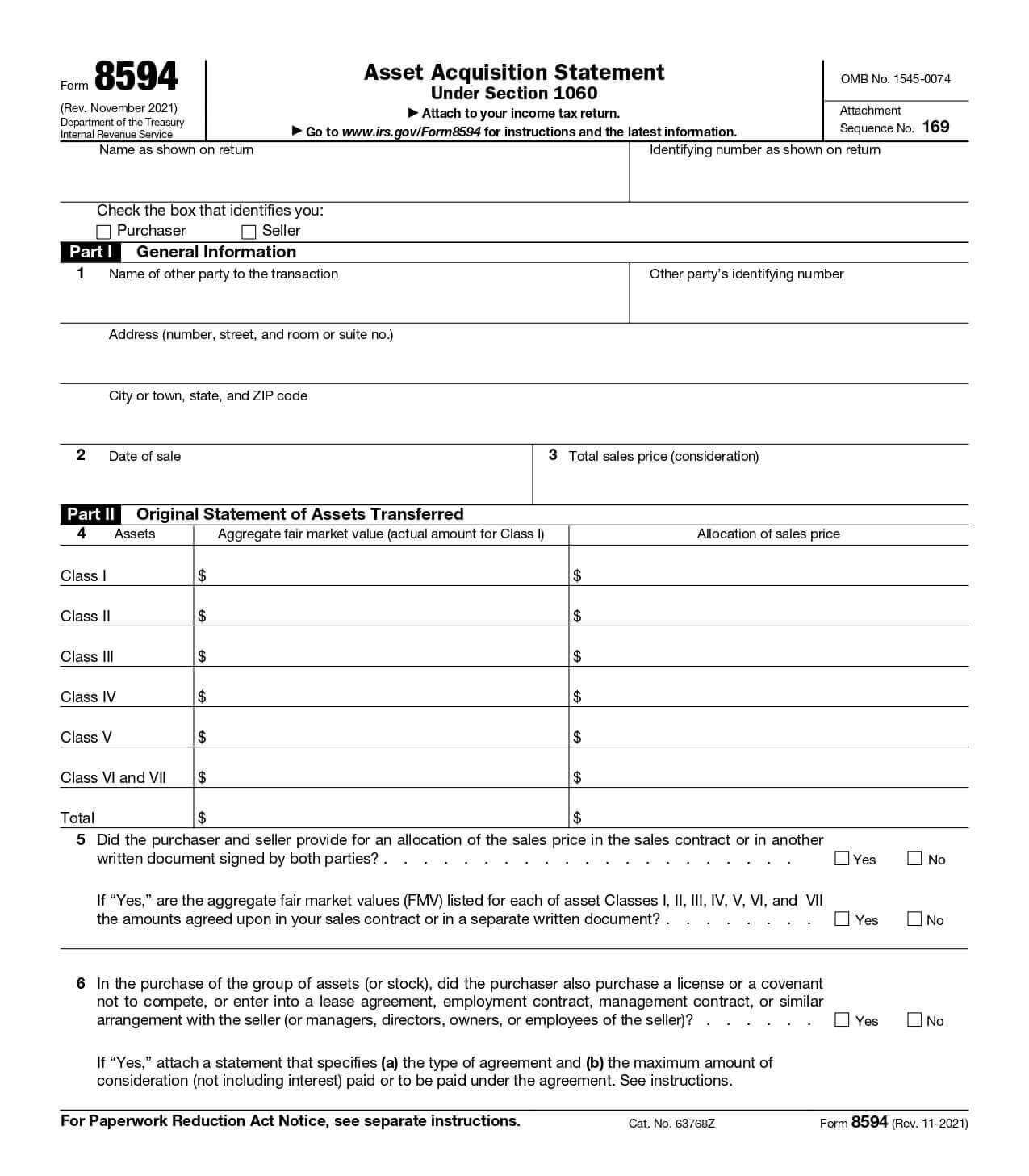

Part 1: General Information

- Line 1: Fill in the name, address and TIN of the other party of the transaction (either the purchaser or seller). The TIN of the other party is required in the form. If the other party is an individual or sole proprietor, enter the social security number. If the other party is a corporation, partnership or any other entity, then enter the employer identification number.

- Line 2: Indicate the date on which the sale of the assets happened.

- Line 3: Enter the total value of the assets exchanged.

Part 2: Original Statement of Assets Transferred

- Line 4: Enter the total fair market value of all assets in a given asset class, as well as the overall allocation of the sales price for that asset class. For Classes VI and VII, enter the total fair market value of the both classes combined. Also, include the total portion of the sales price allotted to Class VI and VII combined.

- Line 6: To find out the maximum consideration to be paid, assume that any contingencies indicated in the agreement are met and that the consideration paid is the highest amount possible. If the maximum consideration cannot be determined, state how the consideration will be calculated and specify the payment period.

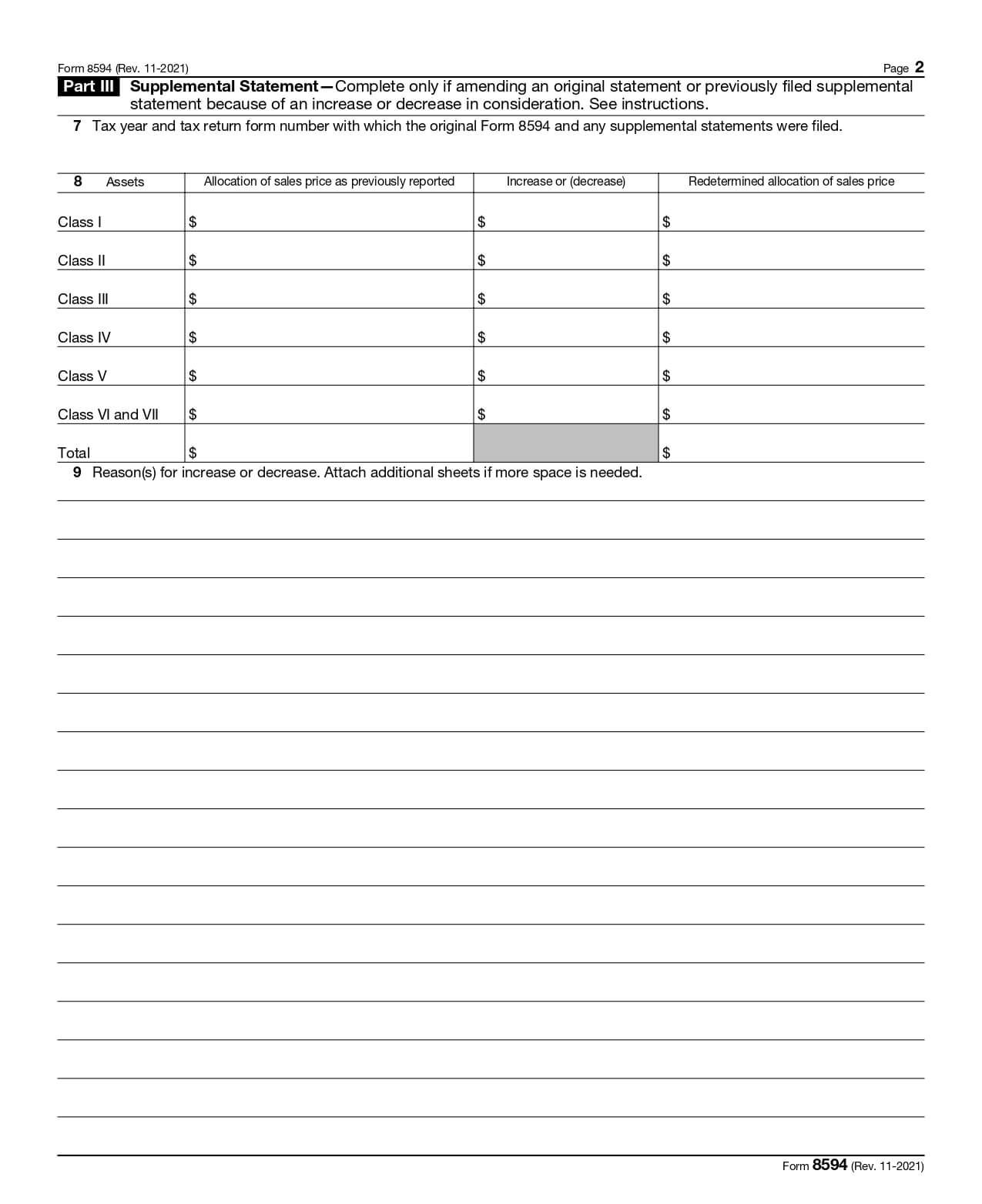

Part 3: Supplemental Statement

A new form 8594, together with Part 3 of the form, must be completed for each year that an increase or decrease in consideration occurs. Reasons for the increase or decrease in allocation must also be stated. Additionally, enter the tax year(s) and form number with which the original and any Supplemental Statements were filled (e.g. 2021 Form 1040).

How Are Applicable Asset Acquisitions Reported on Form 8594?

When a small business is sold or purchased, not only does the ownership of the assets change, but both parties are subject to tax consequences. Both entities must file Form 8594, Asset Acquisition Statement, with their individual income tax returns when a group of assets constituting a company is sold or purchased. Both entities must declare the business’s total sale price and agree on the wholesale price allocated among seven different asset classes. The values are assigned using this allocation approach based on the fair market value of the assets at the time of sale.

Example of Form 8594

You can find Form 8594 online on the IRS website. It’s a downloadable form that you can either print and fill out, or just fill up digitally. Here is a sample of how the form looks like:

Want assistance in filing Form 8594?

Eqvista provides clients with an objective valuation report that details the effort and cost criteria for particular intangible assets. These are some of the most essential value drivers to consider throughout the valuation:

- Technology – A value may include determining the level of innovation, ease of modification and upgrading, replacement cost, and remaining usable life or obsolescence. Is the software’s language, for example, up to date and simple to comprehend? Is the software less functional than a comparable alternative? The extent to which the intellectual property is legally protected is also taken into account when valuing software.

- The richness of functionality – This criterion considers how easy the software is to use, as well as whether it is maintained, efficient, and adaptable to a variety of platforms. It determines if the software is compatible with the most recent version of other programs.

- Adaptability — Software that can be quickly scaled to handle larger business structures and that can easily integrate with other software programs will command higher prices. More and more organizations are turning to technology and software to help them manage their operations more efficiently and successfully these days.

Given their intangible and one-of-a-kind nature, the question of how to value intangible assets boils down to selecting the appropriate valuation method—and exercising sound judgment. Apart from these, there are a few other ways in which we can assist in filling form 8594 and intangible assets valuation. Contact us with your specific case, and we will follow up with an email, quotation and document request, and work to fill out the form.

Effectively Manage Your Assets on Eqvista

When filing Form 8594, it’s important to keep track of your assets. Asset management can be a hassle, which is why Eqvista is the best tool to help you with your assets and shares. Our sophisticated equity management software allows you to track, manage and make smart decisions about your company’s equity. Contact us to know more!

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!