Guide to Making a 50/50 Partnership Agreement

In a 50/50 partnership agreement, two or more partner companies enter into a contract where each partner receives an equal share of any profit or losses generated by the business.

For a company to grow, it is important to build connections, form partnerships and collaborate. Companies who have exceptional growth in terms of revenue, reputation and network are able to do so due to long-lasting partnerships. One such partnership is a 50/50 partnership. In this guide, we explain what a 50/50 partnership is, its importance, examples, possible disputes and benefits.

50/50 partnership agreement

In a 50/50 partnership agreement, two or more partner companies enter into a contract where each partner receives an equal share of any profit or losses generated by the business. The contract specifies each partner’s responsibilities and the general partnership’s regulations, as well as profit and loss distribution. In this type of partnership, both the business owners are responsible for their actions, and one cannot make an independent decision without concerning the other.

What is a 50/50 partnership agreement?

A 50/50 partnership agreement is a contract between the two business owners who are willing to work together to build a new business or work on the existing business. This is an equal partnership in which one partner may have the business skills required to manage the business while the other has the financial money needed to finance it. In usual cases, the parties in a 50/50 partnership agreement contribute different resources to the company. These parties form a 50/50 partnership based on their contributions; however, the partners do not have to be monetarily equal.

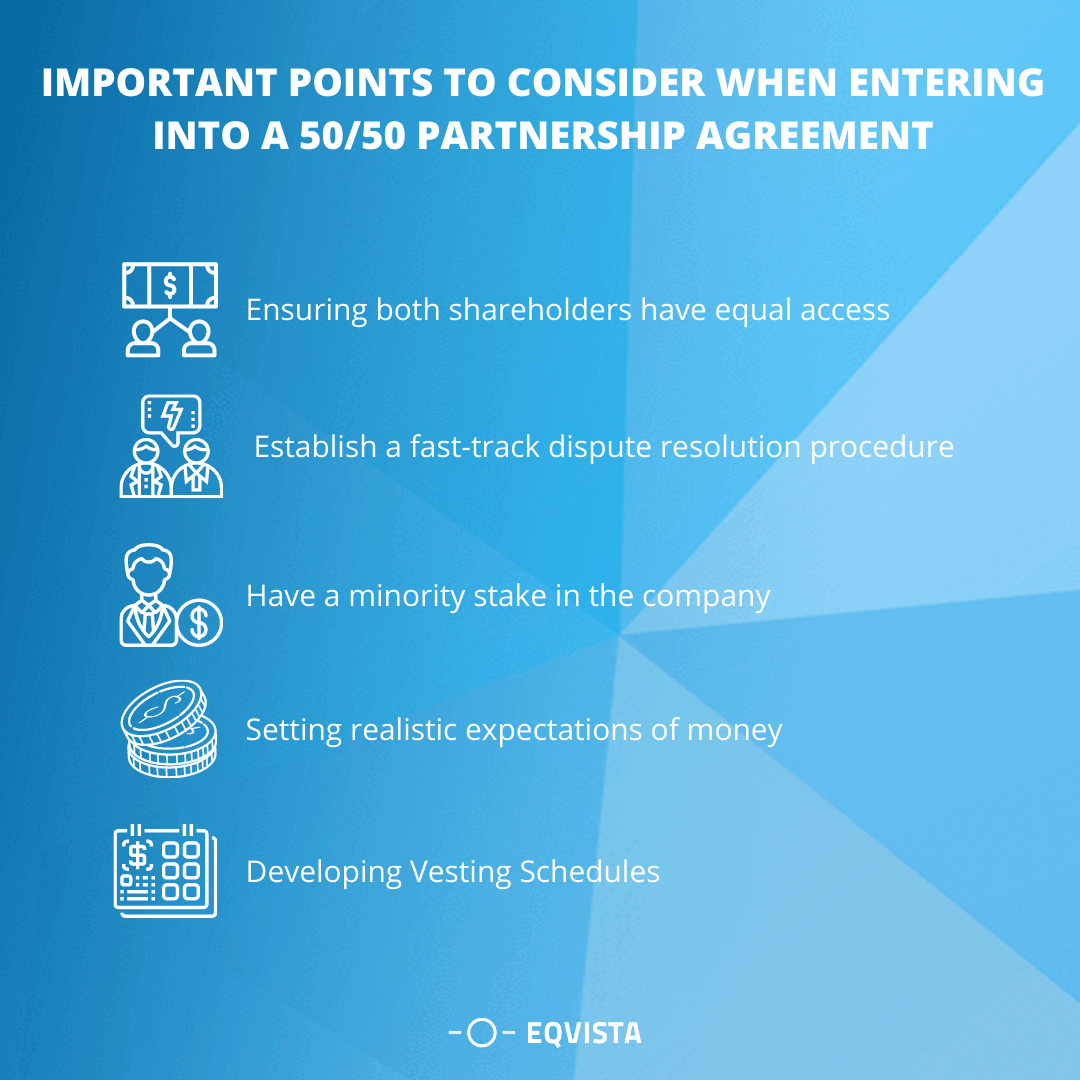

Important points to consider when entering into a 50/50 partnership agreement

Before entering into a 50/50 partnership contract, building trust between both partners is important. If there is no trust between both partners, there might be high chances of risks and disputes in the future.

It’s essential that before actually signing the contract, both partners must be aware of each other’s work, engagement levels, salary, and investment made. If there is miscommunication between the two partners, there are high chances that the business will fail. It is important to consider these aspects to avoid future conflict:

- Ensure both shareholders have equal access to the property – While partners might be in charge of their responsibilities and duties, it is also imperative that they have firm access to all the fixed assets. This is to ensure that there is transparency between the two parties.

- Establish a fast-track dispute resolution procedure – For most startups, legal conflicts can be costly and there are limited resources to resolve disputes. When a dispute does arise, it is important to keep the resources to a minimum to avoid impacting the company. Both parties will save time and money by agreeing to rapid and economical methods. Mediation is an excellent strategy. If everything else fails, a walkaway clause with a waiver may allow the parties to move forward without being obligated by the original shareholder agreement.

- Have a minority stake in the company – The problem with a 50/50 partnership is that if both partners cannot agree, an impasse will occur. Both partners can agree on giving someone minority ownership in the company. Giving someone a minority ownership might help smooth things over and help the partners reach a decision.

- Set realistic expectations regarding money – The amount you want to be paid is one of the most challenging negotiations with potential investors. It can be a deal breaker, and disagreement is a foregone conclusion without a clear grasp of your and your partner’s pay requirements. Each founder must set reasonable wage expectations, and the other must be fine with them.

- Developing Vesting Schedules – When equity is on the table, each partner should agree on a vesting plan. Vesting schedules (a mechanism in which persons acquire options in increments rather than in full) prohibit a partner from leaving a company and still owning half of it. The normal vesting period is four years.

Solutions to 50/50 partnership conflicts

Deadlock occurs when there are disagreements on important matters in a 50/50 partnership agreement. When this happens, it’s hard to proceed unless the disagreements are resolved. In many 50/50 partnership agreements, the most common solution in any disagreements is to compromise on certain matters and move forward.

Here are some ways you can resolve disagreements in a 50/50 partnership agreement:

- Negotiation/Mediation – When preparing your documents for the agreement, you can include a statement where any deadlock that occurs can be negotiated through a defined process. This can include mediation, where the two parties would discuss while a mediator facilitates the discussion. The mediator can lead the two parties into an agreement once the discussion is done.

- MAD (Mutually Assured Destruction) – For this solution, it is important to remember that both parties will suffer major consequences if a deadlock occurs. By having built-in mechanisms that are so bad for everyone, both parties have no choice but to avoid deadlocks at all costs.

- Buy-Sell Options – In this solution, one party can sell their portion while the other party buys it. There are different approaches in doing this and in any scenario, make sure to be considerate about the mechanics for purchase. This is to make sure that the process can work in practice.

Pros and Cons of 50/50 partnership

It is important to note that there are pros and cons to a 50/50 partnership. Before entering into one, consider these factors and see if a partnership is the right move for your company.

Pros

In a 50/50 business partnership (two equal co-founders), the partners benefit from:

- gaining a diversity of talents, manpower, and ideas that benefits both parties

- greater stability in business vitality (partners feed off each other’s energy)

- operational flexibility afforded by another team player (complementary skills to round out the management/leadership team)

- shared start-up costs

- shared work responsibilities and risks,

- mutual support and motivation

Cons

The reasons to not engage in a 50/50 business partnership include:

- having to share the profit (again, this applies whenever you have a co-founder regardless of the exact ownership split)

- confusion among employees and vendors about who is in charge

- deadlocks and disputes when the founders can’t agree on a decision, and

- constant work and talking things through are necessary to keep the equal balance working well

A business with equal 50/50 partners is a one-of-a-kind connection. Unless they establish clear, separate areas of duty, neither partner can accomplish anything without the approval of the other. However, many people are concerned over the power struggles that would arise in 50/50 business relationships.

Agreement terms of a 50/50 partnership

Before accepting and agreeing to the contract of a 50/50 partnership agreement, both business owners should put forward their ideas and suggestions, and discuss the financial assets, the percentage, and future plans to avoid conflicts.

The main terms in a 50/50 partnership include the following:

- Name of the partnership

- Each partner’s contributions

- Each partner’s authority to make binding contracts or debts

- Each partner’s specific duties

- How disputes will be resolved

- How decisions will be made

How does a 50/50 partnership work?

A 50/50 partnership agreement is made between two or more business partners. Under the agreement, each partner has equal share in any profits or losses. The agreement also specifies each partner’s responsibilities, rules about the partnership, and how profit and loss is distributed among the partners.

Steps to implement a 50/50 partnership

It’s important to consider the fundamental steps and the necessary points that must be included in the 50/50 partnership contract. While implementing this form of partnership, the companies must be aware of each partner’s rights.

Following are the steps to be considered before signing the 50/50 partnership contract:

- Principal Place of Business

- Business and Purpose

- Capital Contribution

- Profit and Loss

- Distribution of Profits

- Management of the Partnership Business

- Legal Title to partnership property

- Buy and Sell Agreement

- Special Allocations

Example of a 50/50 partnership agreement

A 50/50 partnership is based on the amount of money invested by two partners, and what one partner is offering is extremely important.

For example, Neil and Mike are two partners investing in a clothing company. Mike will be taking care of the management part and Neil will be taking care of the operations. Both of them are investing the same amount of capital and thus they will receive half the total amount earned. Mike will get 50-percent revenue and Neil will also get the same.

Possible disputes in 50/50 partnership agreement

The difficulty with a 50/50 partnership is that it does not appear to be balanced. It may appear to be 50/50 on the surface, but in reality, a task cannot be split equally between two people. For example, if there are two of you pushing a cart, how much energy is used by each of you? Is it a 50/50 split or a 49/51 split?

Here are some possible disputes in a 50/50 partnership agreement:

- Share – There are times when the partners are not satisfied with the amount of money they share. For example, one partner may have put more effort and worked harder in the business than the other partner, but both partners receive equal profit. Disagreements on how much each partner should receive occurs because of this.

- Deadlocks – A deadlock is a common problem in a partnership. With a sole proprietorship, this is impossible. In a 50/50 partnership, a deadlock occurs when none of the partners are willing to compromise or can’t agree on a decision.

- Change of Heart – Perhaps you’ve made a decision today and reached an agreement with no problems. However, sometimes people can have a change of heart and go back on their word. For this reason, it’s important to keep yourself updated and see whether you can avoid changing your partner’s mind.

50/50 Partnership Agreement Template

In the sample template below, it outlines the agreement between two partners. Under the agreement, the partners agree on the establishment and terms of the partnership. The terms and conditions can be changed before signing the agreement. Once approval is received from both partners, the agreement can be amended, but the terms and conditions cannot be changed.

Manage Your 50/50 Partnership Agreement With Eqvista

Preparing a 50/50 partnership agreement can be confusing and time-consuming. It is also much more difficult to enter a partnership if there is no trust between the partners. With Eqvista, the process becomes easier and more streamlined. How? You can upload and manage/share access to equity plan documents, and manage all our accounts in one place on our equity management system. Want to learn more? Get a free consultation now!

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!