How do venture capital fund metrics help in the funding process?

The specifics of key VC fund metrics can be difficult to recall, especially when there are so many of them.

Venture capital (VC) has been a critical source of funding for innovative businesses. To determine the worthiness of a particular deal, venture capital firms employ a variety of financial metrics and figures. These include current revenue, revenue growth rate, revenue type, burn rate/runway, free cash flow, product margins, cost of sales, and a slew of others. There are numerous valid reasons why venture capitalists are conservative with their investment funds.

Venture capital fund metrics

Venture capital is a type of private equity financing provided by venture capital firms or funds to startups, early-stage, and emerging companies with high growth potential or that have demonstrated high growth. The process of determining value and investability in mature companies is relatively simple. Established businesses generate sales, profits, and cash flow that can be used to calculate a reasonably reliable measure of value. However, VCs must put in much more effort to understand the business and the opportunity for early-stage ventures.

Understand venture capital fund metrics

Many businesses use venture capital (VC) as a type of private equity financing to scale and grow. It necessitates that investors take educated risks and make calculations on companies with high growth potential. Because of the risk involved, learning how to do important calculations to determine the state of your VC fund is required if you want to delve deeper into the world of VC.

How does VCs investment strategy work?

Venture capitalists (VCs) are well-known for placing large bets in new start-up companies in the hopes of hitting a home run on a future billion-dollar company. With so many investment opportunities and start-up pitches to choose from, venture capitalists (VCs) often have a set of criteria that they look for and evaluate before investing. The management team influences a VC’s decision, business concept and plan, market opportunity, and risk judgment.

Why is it important to report fund performance?

Measuring business performance is critical because it helps you identify improvement areas and improve business operations over time. Successful investors understand the importance of measuring venture capital fund performance in order to get the most out of their investment. Fortunately, there are numerous VC fund performance metrics available to assist you in measuring your success.

How to calculate fund performance with venture capital fund metrics?

Every day, venture capitalists assess the performance of startups. Many of the metrics used to evaluate companies are fairly well understood and publicly available. VC performance at a high level is typically measured using three metrics: TVPI, DPI, and IRR.

Understand the difference between IRR and multiple calculations

Because they are typically reported to investors side by side, it is easy to confuse the internal rate of return (IRR) with the equity multiple. Because one calculation provides information that the other does not, equity multiple and IRR are shown together.

Another way to think about the difference between IRR and equity multiple is that IRR reports the percentage rate earned on each invested dollar throughout the investment period. The equity multiple indicates how much cash an investor will receive for each dollar of equity invested over the life of the investment.

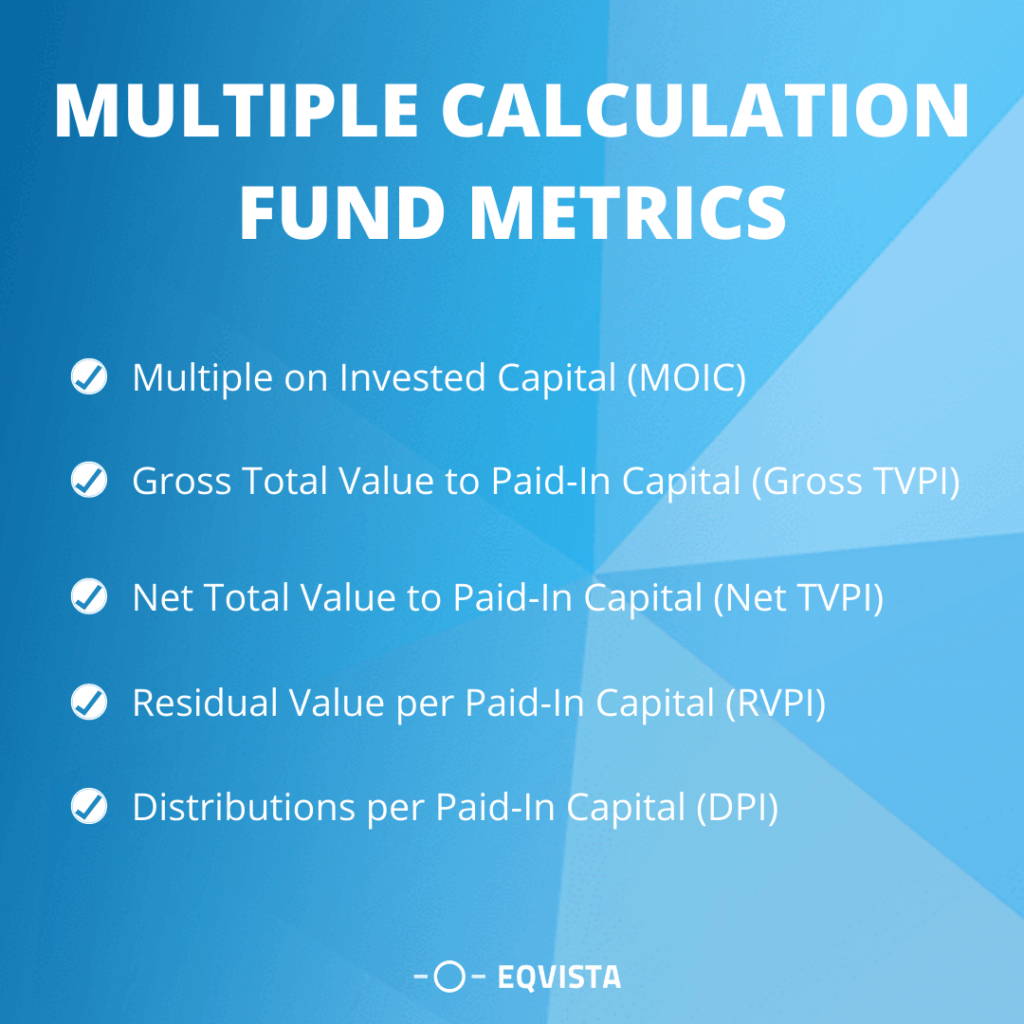

Multiple calculation fund metrics

There are so many formulations of the fund metrics; they function differently and are highly essential for determining the venture capital and its aspects. The multiple calculations include:

- Multiple on Invested Capital (MOIC) – MOIC is an investment return metric that compares the current value of an investment to the amount of money an investor initially put into it. For example, if you invest $1 million and the asset you bought is now worth $1.5 million, your return on the investment is 1.5 times. Invest $1,000,000 and receive a return of $10,000,000 in ten years; your MOIC is ten times. If you invest $1,000,000 and earn $10,000,000 in three years, your MOIC remains ten times.

- Gross Total Value to Paid-In Capital (Gross TVPI) – A simple formula attempts to calculate the total value of a fund’s realized and unrealized future profits for investors in relation to the amount of money contributed. Total Value (Distributions + Net Asset Value) is divided by Paid-In Capital (TVPI). This metric calculates the total gain. A TVPI ratio of 1.30x indicates that the investment generated a total gain of 30 cents for every dollar invested.

- Net Total Value to Paid-In Capital (Net TVPI) – Also known as Net Multiple, Net TVPi is the second most important metric for LPs. Make sure you’re making reasonable comparisons between similar categories before calculating Net TVPI. Using the following formula, compute Net TVPI: Distributed Capital and Fund Book Value/NAV are the numerators. Paid-In Capital is the denominator. When you add up expenses, fees, and carry.

- Residual Value per Paid-In Capital (RVPI) – Residual Value (also known as Net Asset Value or NAV) divided by Paid-In Capital This ratio calculates how much-unrealized value is still in the investment. An RVPI ratio of 0.70x indicates that the remaining investments are worth 70 cents on the dollar. The current value of all remaining investments within a fund is divided by the total contributions made by Limited Partners to date.

- Distributions per Paid-In Capital (DPI) – The amount of capital returned to investors divided by a fund’s capital calls at the valuation date is referred to as the distribution to paid-in (DPI). DPI reflects the realized, cash-on-cash returns generated by its investments at the valuation date. This is also known as the realization multiple. It is a measure of how much money has been paid out to investors. It is calculated by dividing total distributions by total paid-in capital. This multiple is popular among investors because it tells them how much money they received in return.

IRR calculation fund metrics

There are a few methods in which the internal rate of return is calculated, which is explained below:

- Gross IRR – This is the rate of return that can be used to assess a general partner’s raw investment capability. It assesses the GP’s ability to generate returns on invested capital. You calculate Gross IRR outflows by dividing Investment Cost/Basis by Paid-In Capital. Look at Investment Proceeds/Returns and Investment Book Value/NAV to calculate Gross IRR inflows.

- Gross Realized IRR – This is comparable to the Gross IRR in that it is the best rate of return when assessing a GP’s ability to make raw investments. It assesses the actual cash return on all investments, including securities, corporations, and funds. Before calculating Gross IRR, you should determine whether invested or paid-in capital was used. Make certain you understand because this can significantly impact your Gross IRR calculation. You calculate Gross Realized IRR outflows by examining investment Cost/Basis and Paid-In Capital.

- Net IRR Net IRR – It assesses a general partner’s ability to generate returns on an LP’s capital contributions. While GPs frequently mention this metric, it is only the LPs’ second most important measurement. A net IRR, like net multiples, should only be used at the fund level. There are numerous methods for allocating fees and expenses and carrying IRR calculations‘ unrealized value. Paid-In Capital is used to calculate Net IRR outflows. Look at Distributed Capital and Fund Book Value/NAV to determine Net IRR inflows.

- Net Realized IRR – A Net Realized IRR could be used to generate a J-curve. This is the most important metric for LPs at the end of the fund because it shows the overall yield or quality of an investment. Unlike the other measures, Net Realized IRR takes into account the effect of costs, fees, carried interests, and other factors that IRR does not. Net Realized IRR outflows are determined by looking at Paid-In Capital, and Net Realized IRR inflows are determined by looking at Distributed Capital.

Cons of IRR fund metrics calculation

- In general, IRR is best suited for analyzing capital budgeting projects. When used outside of appropriate scenarios, it can be misconstrued or misinterpreted.

- The IRR may have multiple values if positive cash flows are followed by negative ones and then by positive ones.

- Furthermore, if all cash flows have the same sign (i.e., the project never makes a profit), no discount rate will result in a zero NPV.

- IRR is a popular metric for estimating a project’s annual return within its range of applications. It is not, however, intended to be used in isolation. Because IRR is typically relatively high, it is possible to arrive at an NPV of zero. The IRR is merely a single estimated figure.

- Most businesses do not rely solely on IRR and NPV analysis. These calculations are frequently studied in conjunction with a company’s WACC and an RRR, which allows for additional consideration.

- Companies frequently contrast IRR analysis with other tradeoffs. If another project has a similar IRR with less up-front capital or simpler extraneous considerations, despite IRRs, a simpler investment may be chosen.

How to choose the right fund metrics?

The complex world of venture capital is not always easy to understand or enter. The specifics of key VC fund metrics can be difficult to recall, especially when there are so many of them. This is where the cheat sheet comes in. These nine venture capital fund metrics, as well as the formulas for multiple and IRR calculations, are excellent places to begin learning how to assess the potential and health of your funds.

Get high-quality valuation reports for VC funding like with Eqvista!

Many corporations have established investment arms in the last decade to try to capitalize on the potential of entrepreneurial activity, and they can learn from the VC industry’s practices. The management team and deal sourcing play a critical role in determining investment success should influence who they fund—and where and when. Are you feeling stuck when it comes to getting high-quality valuation reports? Don’t worry, Eqvista is there to help you. Our expert team helps the clients to get the desired reports according to the market scenario. Just fill up the sign up form and get started.

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!