Navigating Litigation with Business Valuation: Key Considerations

This article will help you understand the key elements of business valuation in litigation scenarios.

Business valuations are necessary in many lawsuits, including divorce cases, minority shareholder lawsuits, sales disputes, tax appeals, and inheritance conflicts. The fundamental question in each of these situations is the same: how much is the firm or an ownership stake in it worth, and how do you assess it? This helps you ask thoughtful questions to your valuation associate and be ready for all kinds of challenging scenarios.

This article will help you understand the key elements of business valuation in litigation scenarios, such as types of cases where business valuation is commonly used, key considerations in business valuation litigation, and common obstacles to valuation.

Business Valuation and Litigation

There are a number of contexts in which a valuation could be useful. The first step in understanding an appraisal is to understand its foundation. It could be a disagreement between shareholders, a partnership, an estate, a group, a contract, a tax, or a marriage, an action that caused damage, or a claim of professional negligence.

Given the wide variety of conflicts that might need a valuation, it’s important to be very clear on whether the valuation is for the whole business, a specific class of shares, or a shareholding. The following section will give you a better sense of business valuation litigation.

What is Litigation?

Litigation is the official procedure through which a disagreement is settled in a court of law. A broad range of legal matters, including claims for personal injury, divorce, and contract disputes, may be brought before a civil court.

Both state and federal courts have jurisdiction over lawsuits. In any case, the procedure is governed by a set of regulations known as the norms of civil procedure. Whether you are the plaintiff or the defendant in a lawsuit, it is in your best interest to retain the services of a lawyer with relevant expertise.

Understand Business Valuation Litigation

When a company is part of a legal dispute, it needs to determine the value of the business. This information is vital whether it’s a divorce case involving a corporation or a shareholder disagreement, a claim for breach of contract or intellectual property, or a dispute over who owns the firm.

Accurate company valuation is essential for fair settlements, estimating damages, and ensuring justice in legal decisions and disputes. The business valuation expert may be asked to create a full appraisal or economic damages report with a detailed narrative and financial analysis. As an example, we were involved in a dispute between a business and a shareholder who was leaving and whose share the business was supposed to buy under a buy-sell agreement.

- The governing agreement called for an evaluation by a certain business valuation firm. Before we were hired, they had already made a report and given their opinion of value.

- The purchase price was to be paid for with two parts: (1) a cash payment at the start, and (2) a note with annual payments spread out over three years.

- The company, through its remaining shareholders, said the interest of the departing shareholder was overvalued.

- The buyout would require the company to take on a lot of debt, which could eventually hurt the business’s ability to keep running.

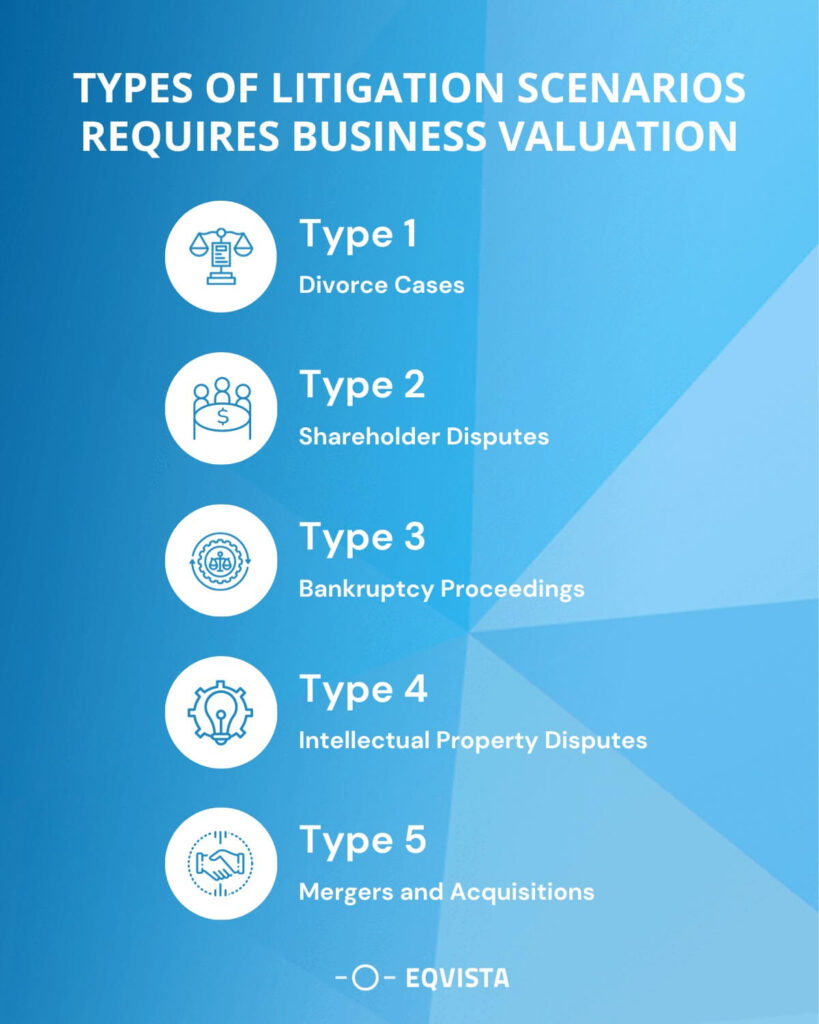

Types of Litigation cases where Business valuation is commonly used

“Business litigation” refers to the process by which a company or other party defends itself or seeks a resolution to a legal issue, often one in which the company is the defendant. Here are the types of cases where business valuation is commonly used.

- Divorce Cases – When a couple’s assets include a company or a share in a firm, a business appraisal becomes a crucial part of the divorce process. The valuation is vital to equitable distribution since it allows for the rightful division of company assets between spouses. Establishing a neutral company valuation facilitates a fair distribution of marital assets and may be used in negotiations or business valuation litigation.

- Shareholder Disputes – Disputes between shareholders and partners may happen for many reasons, including disagreements over management, breach of agreement, planning for succession, breaches of corporate regulations, or executive remuneration.

- Bankruptcy Proceedings – During bankruptcy proceedings, an organization must determine the value of its assets and debts, and this is where a business valuation comes into play. An accurate assessment may shed light on whether or not a company is solven. Experts in business valuation litigation examine the company’s financials and market circumstances, value its assets (both tangible and intangible), and forecast its cash flows.

- Intellectual Property Disputes – Copyright violations, trademark infringements, patent infringements, and trade secret disputes are all examples of intellectual property disputes. Businesses can protect their innovations by keeping good records, using Digital Rights Management, signing confidentiality contracts, and taking other steps to prevent unauthorized access to their secrets.

- Mergers and Acquisitions – Business valuation is essential in merger and acquisition deals. It establishes a fair exchange ratio or purchase price when merging two firms. Professionals who do valuations look into the target company’s past financial results, current assets, debts, and projected growth.

Key Considerations in Business Valuation Litigation

A thorough cost-benefit analysis is necessary to solve many company issues. That evaluation must be based on tried and true criteria, procedures, and information. This section is a compilation of key considerations in business valuation litigation.

Gathering and analyzing financial data

Gathering and evaluating financial data is the first stage in business valuation litigation. The process includes collecting financial documents such as financial statements, tax filings, and bank records to provide a full picture of the company’s financial position. The information has to be checked for errors and omissions, and any discrepancies or outliers must be explained and fixed. In these cases, experts in business valuation litigation can examine past patterns, spot unusual transactions, and make educated guesses about a company’s financial health by analyzing financial data.

Accounting for intangible assets

When determining a company’s worth, intangible assets such as intellectual property, value of brands, and customer connections are particularly important considerations. Professionals in the field of valuation need to identify and quantify these intangible assets correctly. To do so, you may analyze their potential future economic rewards, competitive advantages, legal safeguards, market demand, and other factors.

Selecting appropriate valuation methods

In business valuation litigation, picking the right methodology is critical and challenging. Each valuation approach has its advantages and disadvantages, and choosing one relies on several aspects, such as the asset’s value, the information at hand, the business’s nature, and the case’s specifics.

When predicting how much money will arrive, employing income-based approaches like the discounted cash flow (DCF) analysis is common practice. The comparable methods focused on the market, such as the comparable company analysis, evaluate a firm by comparing it to others in the same industry. The net asset value (NAV) technique is an asset-based method that estimates a company’s worth based on its actual assets.

Accounting for market conditions and industry trends

Business valuation experts need to consider how market circumstances and industry changes could affect the company’s worth. This necessitates looking at things like the state of the market, how it is predicted to develop in the future and the impact of new technologies and regulations.

The value of a company may be affected by changes in market circumstances and industry trends that modify its prospects for development, level of risk, or projected cash flows. After considering these external variables, experts can offer a more reliable estimate of the company’s value.

Consideration of potential damages

The prospective losses incurred by the plaintiff and the defendant in a case involving damages claims must be considered by valuation specialists. One way to accomplish this is to estimate how much money was lost because of the claimed crime, breach of agreement, or other occurrence that set off the chain of events.

Business valuation calculates the monetary loss sustained by a company as a result of an unexpected incident by comparing the company’s pre- and post-event values. To aid the court or arbitrators in finding a fair decision, the expert’s report should provide a realistic assessment of the damages backed up by key financial and market data.

Common Challenges in Business Valuation Litigation

Litigation involving business valuation is a highly nuanced and often challenging area of law. Experts’ credentials, disagreements over valuation methodologies, problems with financial data, and other factors might all play a role in determining the case’s conclusion.

- Conflicting expert opinions – Disagreements may emerge when there are discrepancies in starting assumptions, interpretation of data, choice of valuation methodologies, or expert opinion. To find a solution to these disputes, it is necessary to examine the methods utilized, the data collected, and the professional knowledge of the experts involved.

- Issues with financial data – There is a possibility of incompleteness, inconsistency, or manipulation of financial records. Open accounting disputes, unknown liabilities, or unreported related-party activities might further complicate the business valuation litigation procedure. Valuation experts must address these challenges carefully by conducting thorough research, exploring additional data sources, and making necessary adjustments to the financial information used in their analyses.

- Disputes over valuation methods – Valuation litigation may include disagreements about the valuation method used since various valuation approaches will produce different outcomes. Disputes may arise if the two sides cannot agree on the best system to prove their respective points. Depending on the unique legal and factual concerns, a court or arbitrator may have a say in deciding which valuation methodologies are most suitable.

- Challenging expert qualifications – In cases involving the appraisal of a firm, the credentials of the experts may also be disputed. Each party may doubt the credentials of the other side’s expert witness. Possible problems include the expert’s lack of grasp of legal requirements, inability to explain their reasoning, or incorrect application of valuation concepts.

The Role of the Expert Witness in Business Valuation Litigation

In business valuation litigation, an expert witness plays a vital role by providing specialized knowledge and professional opinions to help the court or arbitrator panel make informed decisions about a company’s value or assets.

To help courts and arbitration panels comprehend complicated valuation problems, they assess financial data, use suitable valuation procedures, and deliver their judgments and suggestions.

Examples of Expert Witness Testimony

During valuation litigations, an expert witness’s testimony frequently includes clarifying the valuation methods employed, emphasizing pertinent financial aspects, and providing expert opinions grounded in their knowledge. To illustrate, an expert witness might provide testimony regarding the suitable discount rate for application, the assessment of fair market value, or the influence of industry trends on the valuation.

There are required skills and knowledge that an expert witness should have in order to do their job well. These include considerable company valuation expertise, applicable professional qualifications (such as the CVA or ASA), and a strong grasp of valuation concepts, processes, and industry-specific concerns.

The expert witness must foresee problems, prepare hypothetical replies, and be familiar with the norms and procedures regulating expert testimony. Effective preparation allows the expert witness to confidently convey their findings, endure cross-examination, and communicate their judgments in a way that persuades the trier of fact.

Get your Business Valuation for Litigation Done!

Business valuation is important for reaching fair agreements in legal conflicts. It involves providing unbiased assessments of a company’s value. It calls for in-depth research, knowledgeable judgment, and compliance with all applicable laws and regulations. To avoid high legal costs, it’s wise to hire a business valuation expert who can act as a neutral mediator. Both parties in a dispute can appoint this expert together. They’ll give an unbiased evaluation, helping parties settle their differences without costly legal proceedings.

Eqvista is a specialist platform that provides extensive tools and resources for maintaining and managing firm equity, capitalization tables, and financial data, which might be useful in business valuation litigation. The platform streamlines everything, ensuring precise records and making it easier to value things during proceedings.

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!