Gift & Estate Tax Valuation – Everything you should know

This article will provide you with a brief overview of the concept behind Gift & Estate Tax Valuation.

You may have heard the terms gift and estate tax before, as they are often part of discussions about taxation and the transfer of assets. Gift and estate tax valuation in this regard refers to a process of assessing the worth of an asset for taxation purposes. Are you wondering what, exactly, gift and estate tax are? The gift and estate taxes are being initiated by governments to ensure that the transfer of assets is being taxed as it takes place. Since these taxes are being treated as a form of tax on the property rather than a tax on its transfer, they are usually known as estate and gift taxes. Well, this article will provide you with a brief overview of the concept behind each.

Gift and estate tax valuation

In essence, the gift and estate tax valuation means the identification of the fair market value of assets that can be subject to taxation by the government. Usually, there is a provision of a certain tax levied based on valuation. In order to file gift and estate tax returns, the valuation of the property should be computed. Since valuation involves the concept of determining the fair market value of an asset, it is often equated with the price of an asset for sale.

In other words, it is the theoretical amount at which the property could be sold on the open market, factoring in all the costs related to selling the asset. Thus, gift and estate tax valuation is the process of determining the value of an asset and deciding on the taxes to be levied on that value.

What are gift and estate taxes?

Gift and estate taxes are taxes levied on the transfer of property. Though they are two separate taxes, they often get lumped together under the term estate taxes. Both are concerned with the transfer of assets, with gift tax being levied on transfers that occur during a lifetime, and estate tax is levied on transfers resulting from the death.

In the USA, the gift and estate tax rates currently range from 18% – 40%, regardless of whether you are a US citizen, US domiciliary, or non-US domiciliary. However, be sure to check out the gift and estate tax laws in your country of residence and citizenship.

Understand gift and estate tax valuation

Valuation is the process of assigning a value to certain assets based on various factors, including the basis of the asset, market trends, economic trends, and other factors. The reason why the process of valuation gets labeled as gift and estate tax valuation is that the government levies taxes on the asset based on the value of the asset.

Though the fundamental process of valuation is the same, it is important to understand that it is used in different scenarios. As such, gift and estate tax valuation is concerned with the valuation of assets in relation to gift and estate taxes.

General consideration for gift and estate tax valuation

Some general considerations need to be taken into account before you start your valuation. These include the following:

- Undervaluation – It is important for you to ascertain the actual worth of the asset before you start your valuation process. Undervaluation can lead to penalties and hefty taxes. Thus, it is important to ensure that the value you have assigned to the asset is correct.

- Complying with IRS – The gift and estate tax valuation carried out should comply with IRS regulations in order to avoid penalties. Be sure to check the rules and regulations of the IRS before you initiate the valuation process.

- Consider Various Approaches – With various standardized approaches to valuation, you need to consider which one is suited for your purpose. These approaches have been designed to serve different purposes, and you must decide which is best for your situation.

Important consideration for gift and estate tax

Now that you are aware of the general considerations that need to be taken into account while computing the fair market value, you can move ahead and understand some of the important considerations that need to be taken into account while conducting gift and estate tax valuation. Here are some of the important considerations:

- Future interest – If the property is held by you and will be transferred to your heirs later, then you need to consider this future interest. As such, future interest is generally considered as the future interest accrued as a result of a series of future events. The amount of future interest that is to be taken into account will depend on the nature of the events associated with the property.

- Life insurance – If you are the policyholder who has purchased life insurance in the name of your asset, then you need to take this into account. This is because, in the case of gift and estate tax valuation, there is a provision for using the insurance amount as a part of the valuation process.

- Undivided interest in property and discount for minorities – When the property is owned by two or more persons, then you need to take into account the undivided interest and the discount for minorities in order to calculate the value which will be taxed.

- Expert deposition – If you are faced with a situation where you may need to hire an expert to evaluate your property, then you should make sure that you consider expert deposition in the gift and estate tax valuation process. An expert deposition is an expert declaration of the value of your property.

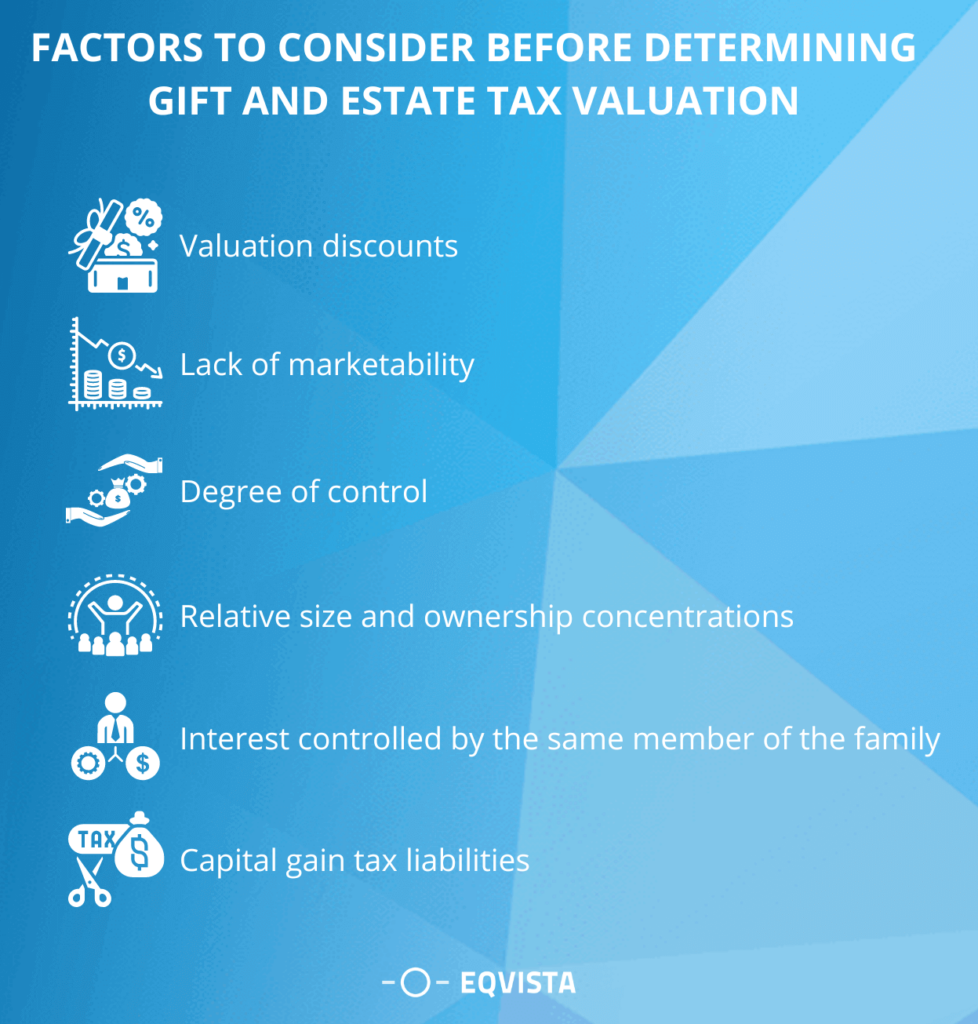

Factors to consider before determining gift and estate tax valuation

Gift and estate tax valuation is meant to determine the value of an asset, which will then be taxed according to the rules and regulations. It is important to know the various factors that play an important role in determining the value of your property. Here are some of these factors:

- Valuation discounts – These discounts pertain to the value of your property as lower than the actual worth of the asset. The valuation discounts are applicable as a result of deductions that are allowed to you under certain circumstances. It is important that you understand these circumstances so that you can properly account for them in the gift and estate tax valuation process.

- Lack of marketability – In the case where the investible worth of a property is substantially below its actual worth, then you need to take into account the lack of marketability in the gift and estate tax valuation process. The lack of marketability refers to the fact that there is a lack of active buying and selling in the market for your property.

- Degree of control – It is important to consider the degree of control you have over the property you are trying to value. This means that to properly determine the value of your property, you need to consider all the rights you have over it. This could include the right to sell, transfer or lease your property, as well as the right to market it in order to determine its value.

- Relative size and ownership concentrations – The relative size is the extent of ownership that you have over a particular property. Similarly, ownership concentrations refer to the number of other owners who own a share of interest in the said property. As such, it is important to consider these factors before determining your property’s value.

- Interest controlled by the same member of the family – When the property is held by members of a family, then you need to consider this aspect while determining the value. As such, it is important to keep in mind that the value of your property may be influenced by the fact that it is controlled by a certain member of the family.

- Capital gain tax liabilities – The capital gain tax liabilities that may be associated with your property are an important factor that you need to consider in order to determine its value. In most cases, there is an additional capital gain tax that is levied when you sell or transfer your property. Thus, it is important that you consider capital gain tax liabilities in your valuation process.

Some of the main valuation discounts for gift and estate tax valuation

There are several situations that may require you to use discounts for gift and estate tax valuation. These are the situations where you will be able to claim a direct deduction from the actual value of your property in order to arrive at the reduced value that will be taxed. Following are some of the main valuation discounts that you need to understand and keep in mind when conducting the gift and estate tax valuation:

- Trends in valuation discounts – There are usually trends in valuation discounts. These trends are based on the fact that there are situations and conditions that may be exceptional. This means that these trends may affect your property’s value.

- Discount for lack of control – When there is a lack of actual control over certain property, then you need to consider this aspect while conducting the gift and estate tax valuation. As such, when noncontrolling interests are part of the value of your property, then you will be able to take advantage of the discount for lack of control.

- Discount for lack of marketability – The discount for lack of marketability refers to the fact that certain properties may not be readily available on the open market or the marketplace is small. The lack of marketability is one of the major considerations in gift and estate tax valuation.

- Discount for lack of built-in gain taxes – The fact that a property is subject to built-in gain taxes has implications on its value. In order to get a discount for lack of built-in gain taxes, you will need to make sure that you have considered this aspect before proceeding with your gift and estate tax valuation.

Gift and estate tax valuation approaches

There are several approaches that you can use to conduct the valuation for gift and estate tax purposes. These include the following:

- Market approach – In market value approach, the value of the property is determined by taking into account the selling price of similar assets in the open market. While the relevant facts and circumstances are accounted for, the value of the property is determined by considering recent comparable sales.

- Cost Approach – Another approach that you can use is the cost approach. This approach involves you determining the value of your property based on the value of the land as compared to the current replacement cost of a new building. However, adjustments must be made, such as deducting the estimated depreciation and obsolescence

- Income approach – If the property generates a stream of income, then you need to consider this aspect while determining its value. The valuation will be done by dividing the net operating income by the capitalization rate.

Need help determining your gift and estate tax valuation?

In this article, we have given you an overview of the basic concept of gift and estate tax valuation. While it is important for you to understand and follow the various valuation discounts, it is equally important to know and understand the available valuation approaches. This way, you can choose a method that suits your personal needs and preferences. Eqvista is here to help you with your valuation needs. Our professional tax consultants will be able to assist you in business valuation for gift and estate tax purposes.

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!