Fund valuation methods in the venture capital industry

In this article, we’ll break down the venture capital world and look into the types of fund valuation methods in venture capital.

According to Grant Thornton’s survey, 87.2% of investors use the multiples method for investment valuations. Startup valuations often involve a fair amount of guesswork and estimation due to the uncertainties surrounding the business and its future. So, how does fund valuation work in venture capital?

Unlike other industries, there isn’t a one-size-fits-all approach to analyzing these ventures. Instead, Venture Capital use a mix of methods to determine a startup’s value, depending on its stage and available data. VC firms value their funds accurately by creating a consistent valuation framework, establishing a valuation policy, and complying with regulatory and accounting standards, such as GAAP and ASC 820.

What is Fund Valuation in venture capital?

Fund valuation in venture capital refers to determining the financial worth of an investment fund, particularly those dedicated to supporting startups and emerging businesses. It involves assessing the overall value of the fund’s portfolio, which typically comprises various investments in early-stage companies.

How Does Fund Valuation Work in Venture Capital?

Venture capital fund valuation operates on the premise that the fund’s total value depends on the performance and potential of the individual companies it has invested. As these portfolio companies grow and succeed, the overall value of the fund increases. Conversely, if some companies face challenges or fail to meet expectations, it can negatively impact the fund’s valuation.

Venture capitalists regularly evaluate the progress and performance of the startups in their portfolios. The valuation is not only based on current financial metrics but also on the perceived future potential of these companies. This approach is essential, especially in a dynamic and high-risk environment for early-stage investments.

How to Calculate Fund Valuation In Venture Capital?

Calculating fund valuation in venture capital is a nuanced process. It often involves a combination of quantitative and qualitative assessments. One common method is the Net Asset Value (NAV) calculation. It entails subtracting the fund’s liabilities from its assets, giving you a snapshot of its net worth.

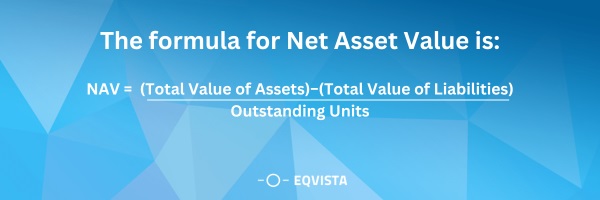

The formula for Net Asset Value is:

NAV= (Total Value of Assets – Total Value of Liabilities)/Outstanding Units

Net Asset Value (NAV) is determined by dividing the Net Asset of the Scheme by the total Outstanding Units. The Net Asset of the Scheme estimates the market value of investments, receivables, other accrued income, and the scheme’s additional assets.

Another method frequently used is the multiples approach. It involves comparing the fund’s performance to industry benchmarks and similar funds to derive a valuation based on multiples of earnings or other financial metrics.

Best Practices for Venture Capital Fund Valuation

Successful venture capital fund valuation requires a strategic and thoughtful approach. Here are key best practices to enhance the effectiveness of the valuation process:

Frame a Comprehensive Valuation Policy

Establishing a comprehensive valuation policy provides clear guidelines for assessing fund valuations. Define criteria, methodologies, and key performance indicators that align with the fund’s objectives. To develop a reliable and thorough valuation policy:

- Clearly outline what will be covered

- Select the best valuation method

- Gather and study the necessary data for valuation

- Determine the value of the subject using the chosen method

- Compare findings and come to a final valuation conclusion

Make the Best Use of Technology

You must learn to utilize technological tools and venture capital fund valuation platforms. Specialized valuation software can streamline data analysis, enhance accuracy, and reduce the time required for valuation processes. Some ways you can use technology to smoothen the valuation process are:

- Using blockchain technology can confirm the legitimacy of financial information and verify ownership records accurately.

- Big data analytics proves valuable when evaluating companies with vast financial and operational data.

- Machine learning algorithms enhance the accuracy of valuation models by considering various factors and adapting to changing market trends.

- Online platforms enable businesses to securely exchange data and view valuation reports from anywhere.

- Cloud computing guarantees the safety of historical valuation records and allows for easy access when necessary, simplifying data sharing among involved parties.

Balance Precision with Practicality in Valuations

While precision is essential, basing valuations on realistic assumptions is equally crucial. Here are a few ways to achieve that.

- Define Clear Objectives – Clearly outline the valuation’s purpose and scope to avoid unnecessary complexity.

- Select Appropriate Methods – Use valuation methods based on data availability, time constraints, and required precision.

- Consider Trade-offs – Recognize that achieving absolute precision may require significant resources. Prioritize efficiency while maintaining accuracy.

- Use Sensitivity Analysis – Assess the impact of uncertainties and assumptions on valuation results for a realistic assessment.

- Communicate Assumptions and Limitations – Transparently communicate underlying assumptions to manage expectations.

- Iterate and Refine – Continuously improve the valuation process based on feedback and experience for enhanced precision and practicality.

Types of fund valuation methods in venture capital

Fund valuation methods are used depending on the stage of the business and the available data points in the market or industry in which the startup operates.

- Venture Capital Valuation Method – This method involves estimating the necessary investment, forecasting startup finances, determining exit timing, and calculating the terminal value.

- Cost-to-Duplicate Method – This valuation method determines a startup’s worth based on the cost of replicating its assets and operations.

- Scorecard Valuation Method – It evaluates the startup against a set of predetermined criteria and assigns a score based on the evaluation.

- Dave Berkus Valuation Method – This approach involves allocating values to various aspects of the startup, such as the concept, prototype, and management group.

- Risk-Factor Summation Method – It evaluates the startup’s risk factors and assigns a numerical value based on the assessment.

- Discounted Cash Flow (DCF) Method – This approach computes the current worth of anticipated future cash receipts.

- Valuation by Multiples Method – The startup’s valuation is determined by comparing it with similar companies in the market. This is done by using multiples.

Challenges in VC Fund Valuation Methods

Venture Capital (VC) fund valuation comes with challenges and considerations shaped by the dynamic nature of startup ecosystems and market conditions. Here are key aspects to consider. Startup valuation poses significant challenges due to the nature of the industry and the limited data available.

Here are the main challenges faced:

- Insufficient Historical Financial Data – Early-stage startups often have minimal financial history, making it difficult to forecast future performance accurately. This complicates valuation based on financial data and also hampers approaches that rely on past market performance.

- High Level of Uncertainty and Risk – Startups operate in an environment characterized by uncertainty and risk. Factors such as conflicting information, subjective interpretations, and measurement errors contribute to this uncertainty, making valuation challenging.

- Difficulty in Predicting Future Performance – Most startups take longer than expected to reach significant milestones, often between 5 to 10 years. This makes it challenging to make accurate predictions . As a result, traditional startup valuation methods may struggle to provide precise forecasts.

- Impact of Market Volatility on Valuation – Sudden changes in market conditions can affect the demand for startup investments, leading to variations in valuation multiples and discount rates used in valuation models. When volatility is high, prices can swing significantly, offering chances for greater profits, but also raising the possibility of losses.

- Keeping up with Valuation Methods – The venture capital landscape is dynamic, characterized by rapid technological advancements, shifting consumer preferences, and evolving regulatory environments. Traditional valuation approaches may not capture the full value potential of startups operating in emerging sectors or leveraging disruptive technologies.

FAQ’s

What is the Market Approach, and how is it applied in venture capital fund valuation?

Fund valuation in venture capital employs the Market Approach by comparing the target investment with comparable companies. This analysis of similar entities in the market helps determine the investment’s value.

How do venture capital funds communicate valuation changes to their investors?

Venture capital funds employ regular updates and reports to communicate changes in fund valuation to investors. These communications include explanations of factors influencing the fund’s valuation and adherence to best practices of venture capital fund valuation.

Are there industry standards or guidelines for venture capital fund valuation methods?

Venture capital funds communicate changes in valuation methods to investors through regular updates and reports. Best practices of venture capital fund valuation include incorporating clear guidelines, leveraging technology for efficiency, and maintaining a practical approach in valuations.

Get Professional Funding Valuation From Eqvista!

Securing funding for your startup can be tough, as many investors doubt your business idea. That’s why getting a valuation is crucial to convince them of your business’s potential success. It not only assigns value to your business but also highlights its strengths in the industry.

A well-crafted pitch deck is essential to grab investors’ attention, showcasing what your business does. With Eqvista’s investment valuation starting at $1,890, you can enhance your pitch deck by revealing your company’s value and competitive advantages. Our professional NACVA-certified analysts ensure a timely and seamless valuation process. Contact us now for more information!

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!