What are the most common mistakes startups make when forecasting cash flow?

In this article, we will explore certain cash flow forecasting mistakes that can lead to inaccurate valuations and misguided insights.

Forecasting cash flows is a key step in estimating startup valuations and establishing long-term strategies. These forecasts can impact operational planning and funding agreements. However, many startups and venture capitalists fall prey to forecasting errors, which can have severe consequences.

For instance, in 2019, SoftBank reported that its loss from investments in WeWork amounted to $8.2 billion. Such a massive setback could have been avoided through prudent cash flow projections based on realistic outlooks of commercial real estate.

A similar case unfolded when frontloading revenue figures misguided Katerra investors into extending at least $865 million as Series D funding. Due to ill-planned inorganic growth and business model flaws, when the startup eventually failed, the investors were blindsided.

In this article, we will explore certain cash flow forecasting mistakes that can lead to inaccurate valuations and misguided insights, resulting in suboptimal strategic and financial decisions.

9 Critical Cash Flow Forecasting Mistakes

Some of the common cash flow forecasting mistakes made by startup founders, which can lead to inaccurate valuations and subpar decision-making, are as follows.

Overlooking maintenance capital expenditure

Over time, your assets will depreciate in value and usefulness, to maintain productivity levels, you must periodically make capital expenditure. Many entrepreneurs make the mistake of assuming no capital expenditure in their forecast period. If your assets are fully depreciated in a forecast period, your capital expenditure should be equal to your total depreciation.

Inaccurate terminal value

Beyond a certain point in time, the accuracy of financial projections declines because of the possible variance in key assumptions. To tackle this, we assume that the free cash flow would continue growing at a constant rate for the rest of the expected life. Then, we discount these cash flows to arrive at the terminal value.

Two common errors relating to terminal value are failing to estimate terminal value at all and discounting post-forecast period cash flows incorrectly. Firstly, even a company that is expected to dissolve by the end of the forecast period will have a terminal value equal to the expected net assets.

Secondly, entrepreneurs often mistakenly calculate the present value of cash flows as of the end of the forecast period.

Growth without capital expenditure

Unless your business was operating below capacity, its production cannot increase without capital expenditure. However, entrepreneurs assume that once the product gains traction, the sales growth rate will spontaneously spike. In reality, you must invest in property leases, key machinery, equipment, and other technology to scale production.

So, leading up to the point where your sales scale up, your cash flow projections must reflect capital expenditures. After all, if an industry is expected to grow fast, the capital goods producers are likely to price their products accordingly.

Overlooking working capital needs

Effective working capital management makes sure cash inflows and reserves can meet short-term obligations. Essentially, it involves maintaining a healthy surplus of current assets that can be relied upon in challenging situations.

In periods of stability, you may be excused for not making any additions to this surplus but when you are scaling operations or when business cycles lead to unpredictable cash inflows, you must make additions to your working capital.

As your scale of operations increases, accounts receivable and payable are likely to grow, alongside rising employee compensation costs. To support this increase in operational activity and cash flow volume, you must increase your working capital.

During recessions and seasonal downturns, you must increase your reserves as cash inflow would be less reliable to meet short-term obligations.This should reflect in your cash flow projections as increases in net working capital leading up to the scaling of operations or in expected downturns.

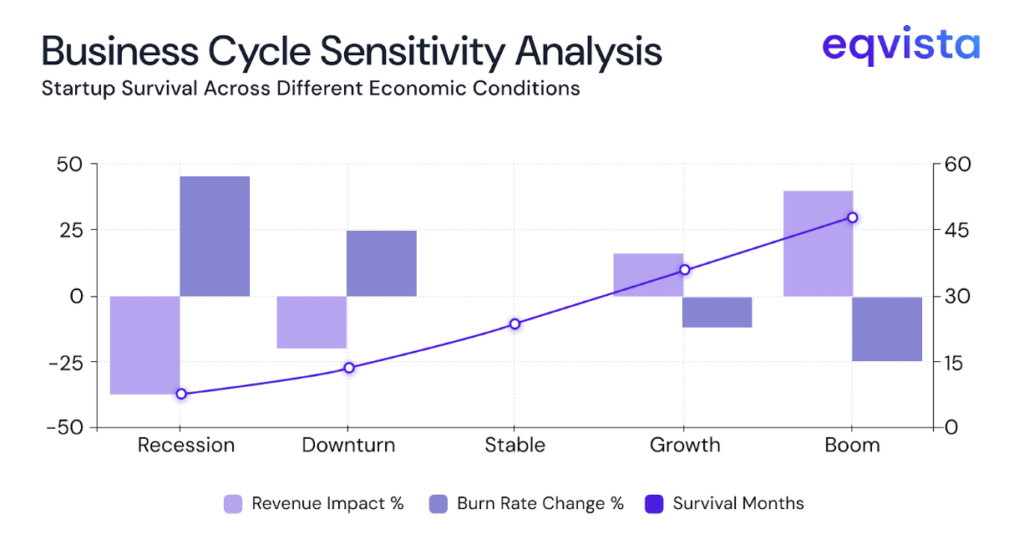

Not accounting for business cycles

It is unlikely that your business is unaffected by upturns and downturns in industry when economic conditions are favorable. However, supply chain disruptions, shifts in consumer preferences, and varying health of financial and banking systems can cause the market to contract.

To ensure a reasonable cash flow forecast, you must gather expert opinions about industry and incorporate these insights into your growth assumptions. Business cycles will also impact your working capital needs and these changes must also be incorporated into your cash flow projections.

If significant variability is expected in market and economic conditions, you may also need to perform scenario analysis. Furthermore, performing a sensitivity analysis would help you understand the impact of changes in valuation.

Unrealistic growth expectations

If you expect your company to maintain its competitiveness, its growth should mirror the market growth. The company is expected to outdo its competition, the room for growth will depend on the gap between the serviceable available market (SAM) and the serviceable obtainable market (SOM).

SAM is the portion of the market that you can potentially capture given your business model’s characteristics and limitations. SOM is the portion of the SAM that you can capture given your competitiveness in the market. As your competitiveness increases, the gap between SAM and SOM will reduce.

Thus, the growth rate and room for growth will depend on the gap between SAM and SOM.

Finally, if you plan to introduce new product segments or to overhaul your business model to serve more customers, the growth rate would depend on the gap between the total addressable market (TAM) and the SAM.

Not projecting debt requirements

Since raising funds through equity is not always possible, at some point in your journey, you may need to rely on debt financing. Particularly, in times of working capital crises due to economic downturns.

When you must scale operations with agility, you are likely to finance your capital expenditure through long-term debt ,as a result, your interest payments would increase. It is essential to consider for interest as well as principal repayments in your projections.Furthermore, a lender may provide loans to startups only under stringent debt covenants, which may restrict your operations or limit further borrowing.

It’s also important to recognize that access to debt financing is not guaranteed. Availability can be affected by broader market conditions as well as your company’s financial health and creditworthiness.

Constant employee compensation costs

Your human resource requirements will increase when you scale operations unless you heavily rely on outsourcing. At the same time, you cannot always reduce your workforce in downturns.

To recover from such periods, you must retain your workforce to be in a position to take advantage of the business cycle upturn. Only in extended downturns, such as recessions, can reduce your workforce without compromising on post-recession recovery.

So, in your cash flow projections, the employee compensation costs must increase in line with production, and fall only in recessions. To improve accuracy, consider incorporating factors such as deferred stock-based compensation as a cash conservation strategy and potential hiring lags that delay cost increases.

Unreasonable discount rate

You must choose the discount rate based on the purpose of the cash flow projections. If the projections are meant to determine the current value of future cash flows and aid decision-making, expected inflation could serve as the discount rate. In certain cases, the risk-free rate could be used as the discount rate.

To offset the risk, investors require a risk premium to be incorporated into the returns. So, when an investor assesses the valuation using the discounted cash flow (DCF) method, they will set the required rate of return as the discount rate.

When the enterprise value is being estimated, you should apply the weighted average cost of capital (WACC) as the discount rate. WACC is the average return expected by all capital providers, including debt as well as equity. This approach is used when an operational business is being valued and when new projects with similar risk profiles are being valued.

Predictive Analysis: Cash Flow Forecasting Error Cascades

Cash flow forecasting errors create predictable cascade failures that compound exponentially across business systems. These interconnected mistakes follow three primary patterns that account for the majority of startup and growth company collapses.

- Primary Cascade (73% of failed startups): Unrealistic growth projections lead companies to underinvest, creating operational bottlenecks. This mismatch results in a 150-300% increase in burn rate, ultimately pushing companies into expensive debt dependency spirals that become unsustainable within 12-18 months.

- Valuation Cascade (65% of Series B+ companies): Terminal value miscalculations create systematic overvaluations 300-500% above sustainable levels. Companies face down-round scenarios, demotivated employees with underwater equity, and limited strategic options over 18-36 month timeframes.

- Operational Cascade (58% during downturns): Companies that ignore business cycles trapped when economic conditions shift. With 60-80% of expenses locked in employee costs, these businesses experience a burn rate acceleration of 50-150%, creating a 3-6 month runway collapse and tighter funding markets.

Early intervention requires monitoring automated cascade indicators, maintaining conservative assumptions, and implementing flexible cost structures before crisis points emerge.

Eqvista – Accurate valuations for actionable insights!

In financial modelling, accuracy comes from deliberate choices. Cash flow projections are grounded in data and expert opinions. When you follow a financial modelling template thoughtlessly, you are unknowingly making numerous assumptions.

An alternative which improves accuracy would be thoroughly reviewing your startup’s business model and incorporating these insights into realistic assumptions about revenue growth, cost structure, capital expenditure, working capital, and funding strategy.

At Eqvista, we can help you navigate these complexities with confidence. Each month, we value up to $3 billion in client assets. These services enable clients to stay compliant with 409A regulations, negotiate valuations with confidence, and effectively manage venture capital portfolios. Contact us to learn more about our services!

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!