Venture Debt Evolution, Current Landscape, and Future Trends

Venture debt is extended to venture-backed startups and typically amounts to about 20-40% of the funds raised in previous funding rounds. It is meant to extend a startup’s runway and has the added benefit of mitigating equity dilution.

As venture debt deal value almost doubled to $53.3 billion in 2024 and VC investments remained muted, we are witnessing another chapter in the rise of venture debt in startup financing. This trend is truly astonishing considering the fact that it only strengthened after the collapse of Silicon Valley Bank, a name synonymous with venture debt.

In this article, we shall recount the history of venture debt and try to make sense of its rise in startup financing. Read on to learn more!

History of venture debt

Venture debt originated in the equipment financing offered to California’s tech companies in the 1960s and 1970s. At that time, technological transformation was driven by upgrading computer hardware and military equipment.

Due to the kind of risk appetite and liquidity needs of traditional banks in the 1970s, they simply did not feel comfortable lending to startups. Individual borrowers faced similar challenges. To meet this excess demand, in the 1970s, Fannie Mae and Freddie Mac began securitizing mortgages in the form of mortgage-backed securities (MBS).

Sometime later, in the 1980s, Equitec Financial Group started offering what seems to be the earliest record of modern venture debt. The company offered 100% equipment financing secured by equity kickers or warrants.

The risk-averse nature of investors and lack of financing alternatives meant that venture debt became a crucial source of funding for emerging tech companies. As the number of startups grew, so did the demand for venture debt. Thus, a mutual growth cycle was formed where venture debt enabled startup success while the rising number of startups made venture debt more lucrative. As a result, venture debt reached a peak of $5 billion in 2000.

However, as the Dot Com bubble burst in 2001, venture debt funding dropped, and many venture debt providers transitioned to more conservative products.

Stock market history

The roots of stock trading can be traced back to the Dutch East India Company becoming the first publicly traded company in 1602. This event also resulted in the formation of the Amsterdam Stock Exchange which is widely recognized as the oldest stock exchange in the world.

Stock markets were introduced to the US only about two centuries later in 1790 with the establishment of the Philadelphia Stock Exchange.It took almost another century for the first American stock index, the Dow Jones Railroad Average, to get published. Twelve years later, in 1896, the Dow Jones Industrial Average was first published.

While stocks have existed for about four centuries, they are not a reliable way to raise funds for startups in modern times. According to BCG research, tech startups require at least five funding rounds and 6.4 years to reach the initial public offering (IPO) stage.

Silicon Valley Bank (SVB): Innovator and key provider of financing to startups

Founded in 1983, Silicon Valley Bank (SVB) was a pioneer of venture debt. Equitec Financial Group was the first entity to offer venture debt, while Bank of America (BoA) was the first bank to do so. However, after BoA and Wells Fargo exited the venture debt market, SVB emerged as the primary venture debt provider and even became synonymous with the term in the USA.

When the bank was founded, its total assets were $18 million. Over the next 36 years, SVB’s balance sheet grew at a stupendous CAGR of 25.86%, reaching $71 billion by 2019. However, the bank achieved truly unbelievable growth in its final three years when it almost tripled its total assets to $212 billion.

SVB had served half the venture-backed US startups and 44% of tech and health companies in 2022, the year prior to its shutdown. By the end of 2022, SVB was the 16th largest bank in the USA, larger than Morgan Stanley, and less than 3 months later, it collapsed.This success achieved by SVB in its final days makes its collapse all the more anticlimactic.

So, why did SVB fail?

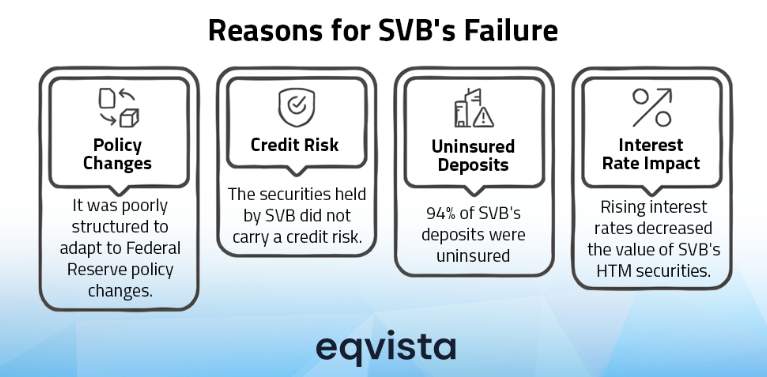

The venture debt pioneer failed because it was ill-structured to deal with the Federal Reserve’s policy changes. While held-to-maturity (HTM) securities, such as government securities, made up 10.5% of the total assets of large banking organizations, such securities accounted for 42.9% of SVB’s parent company’s total assets.

These securities do not carry a credit risk. However, if their market value declined, SVB would not have been able to deal with deposit withdrawal requests. Another fact is that 94% of SVB’s deposits were uninsured. In comparison, for large banking organizations, this figure stood at 41%.

As the Federal Reserve increased interest rates from 0.25% to 5% from March 2022 to March 2023, it significantly reduced the value of SVB’s HTM securities. As a result, SVB’s depositors panicked and attempted to withdraw $42 billion, 19.81% of SVB’s total assets, and one of the largest bank runs in history. Unable to navigate this crisis, the bank’s parent company filed for bankruptcy shortly after the bank run.

Current landscape and future outlook of venture debt

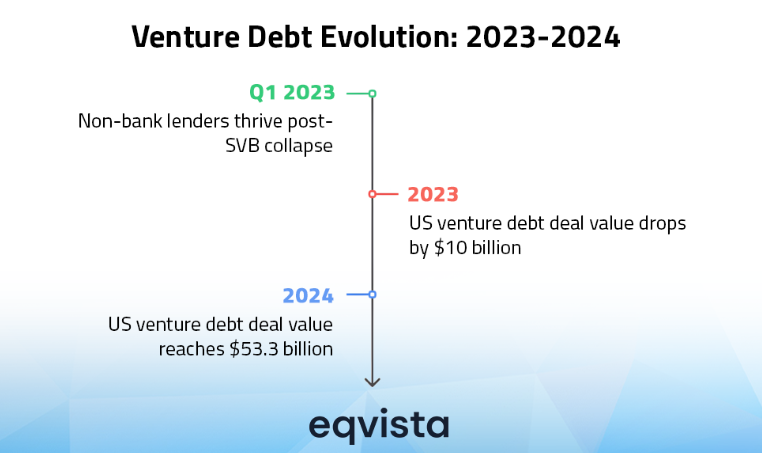

In Q1 2023, non-bank lenders prospered by extending debt to startups in the wake of Silicon Valley Bank’s collapse. For instance, in this quarter, by taking this approach, Hercules Capital increased its net interest income by 82.96% and Horizon Technology more than doubled its own.

However, startups soon grew wary of the risks associated with borrowing from non-bank lenders. Simultaneously, as the stock market rebounded and banks anticipated an end to the Fed’s interest rate hikes, they re-entered the venture debt market.

Despite new entries, the US venture debt deal value dropped by more than $10 billion in 2023.In 2024, while the number of venture debt deals declined, the total US deal value soared to a record $53.3 billion, nearly twice the amount recorded in 2023.

A key reason for this trend would be the fact that venture capital investments have stayed well below the peak achieved in 2021. As a result, startups had to turn to alternatives such as venture debt.

Industry experts note that startups that do not meet the growth requirements of VCs in 2024 may still meet the growth requirements of venture debt providers. Hence, venture debt appears to be a natural alternative in this situation.

Venture debt: A historical lens on modern startup financing

Venture debt now stands at about 1/4th of VC investments in the USA, and if these trends continue, it may become just as important as equity investments for startups. However, we must note that venture debt lenders and VCs have entirely different priorities, survival conditions, and risk appetites. As a result, their criteria for shortlisting startups can be wildly different.

To secure venture debt, in addition to displaying growth potential, you must validate your ability to generate cash flow. This would mean greater scrutiny of your financial records. Eqvista, through its partnership with Cheqly, enables startups to confidently clear such hurdles to securing venture debt. Contact us to know more!