How can eCommerce Companies manage a 409a valuation?

Here is a summary of the 409a valuations for eCommerce companies performed by Eqvista.

The eCommerce industry has been booming since the start of COVID, rising by over 30% in 2020, according to the U.S Department of Commerce. And because of this boom in business, many ecommerce companies have experienced a rise in their firms’ valuations. With a focus on company valuations, share price, and how equity is divided, the importance of a 409a valuation for the e-commerce industry becomes all the more prevalent. This article will teach you all about e-commerce business 409a valuation and you can manage it. Keep on reading to learn more.

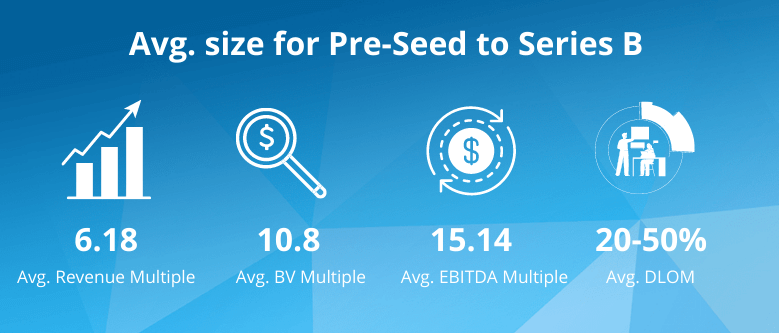

eCommerce Company 409a valuations by the numbers

Here is a summary of the 409a valuations for eCommerce companies performed by Eqvista. These average figures were obtained from public markets, private markets, and our 409a valuations.

409a Valuation for eCommerce Companies

One can determine the value of an e-commerce business in many ways. Various factors and methodologies can evaluate the worth. There will be specific methodologies that are better suited than others, and the type of methodology you choose will largely depend on the business in question.

eCommerce industry introduction

Talk about making money online, and e-commerce business is the first thing that comes up. It has grown into one of the most attractive ways of making money online for both company founders and investors. The E-commerce business industry is not just limited to online shopping, but both terms are used interchangeably. Understand that the e-commerce industry integrates the concept of doing business online, incorporating many different services such as booking flights, online payment, etc.

Why Do eCommerce Companies Need 409a Valuation?

A business valuation assists in establishing a baseline value, enabling you to create more informed financial goals, business strategies, and marketing objectives. One can understand their business valuation for potential growth and innovation. A business valuation is a process to determine the financial value of a company. As explained above, the business valuation is used for finding out the fair market value of an organization, which is the price at which one would sell the company. The purpose of a valuation includes getting the sale value, employee compensation packages, and establishing partner ownership.

But what does the 409A business valuation have to do with an e-commerce business? It is essential to get a proper 409A valuation for your online business. This can be the most challenging part for any website. Many complications may arise when it comes to evaluating online companies for sale or otherwise. This is due to a lack of physical assets. If you are experiencing the same problem, it is best to gather the correct data on the relevant valuation drivers and apply it correctly. You will almost always arrive at a website valuation that makes sense. Given below are a few of the 409A valuation and the steps to get one done.

Valuation Metrics to Consider in eCommerce Business

Now that you have an idea of an eCommerce business valuation, let us know about various valuation metrics when defining a company’s value.

Website traffic

Website traffic is the backbone of any e-commerce business. As website traffic leads to company sales. Ecommerce stores completely rely on the number of people visiting your site. Ensure that you answer the following question to have an accurate valuation for this metric:

- What percentage of traffic comes from search?

- Is the traffic sustainable?

- How secure are the search rankings?

- How has traffic been for the last year or few months?

- How much has the site been influenced by any Google algorithm changes or manual penalties?

- What is the industry trend (Google Trends)?

- Where does the referral traffic come from?

You can clearly understand your website traffic and deliver the best value possible by answering all the questions above.

Customer conversion rate

Next on the list is the customer conversion rate. Once you have visitors on your website, the next mission is to convert them into customers. If they aren’t paying for your product or service, at least ensure that they sign up. This will fetch you some contact information, where you can follow up with the client. Different ways are used by various companies to measure the conversion. It may be measured by signing up, placing an order, or simply by clicking on a link.

In addition to this a simple formula that can help find the conversion rate is:

By evaluating the Customer Conversion Rate percentage, you can value your eCommerce business accurately.

Average order value

The moment a site has valuable customers placing orders for products or services, measuring the Average Order Value (AOV) is essential. This e-commerce business valuation would reference the cumulative revenue divided by the total number of paid orders. For example, a website has $20 million in revenue and 50,000 orders in a particular year. The average order value is equal to $400.

Customer acquisition costs

To calculate Customer Acquisition Cost (CAC), we require the type of marketing programs the organization uses to earn customers. There are three main types of marketing spend:

- CPM – It is the Cost per 1,000 impressions

- CPC – CPC defines Cost per Click

- CPA – It is Cost per Acquisition

The formula that can help find the Customer Acquisition Cost is:

A straightforward illustration of CAC is as per the following. An organization burns through $20 million on advertising and earns 2 million new clients. The CAC, in this way, is $10.

However, things get more complicated as one may have directed some of this marketing towards existing clients that are simply returning to the site. It is suggested to strip that part of the marketing spending out, if possible.

Monthly recurring revenue (MRR)

Monthly Recurring Revenue (MRR) is equivalent to the value of month-to-month income that is repeating, which means the clients are on a membership or plan. So, their sales will proceed until they drop their membership. A typical example of such an internet business valuation is Netflix.

To calculate Monthly Recurring Revenue:

Churn rate

The Churn Rate is the percent of customers who “churn” out of the business. In short, they are no longer customers in a specific period. This time period is calculated often annually.

Use the formula given below to calculate the Churn rate:

For instance, an organization had 20,000 customers last year, added 2,000 new customers in the year, but at the end of this year, has 17,000 customers. The Churn rate would be equal to (20,000 – 17,000 + 2,000) / 20,000 that results in Churn rate = 25%

Burn rate

Burn Rate, as the name indicates, is the amount of money a startup loses per month. One can use the cash burn rate to decide the organization’s runway. It is the total cash balance divided by the monthly cash burn rate. This figure tells investors and administration how many more months the organization can make due at its current burn rate. Use the following formula to calculate the burn rate.

Contribution margin per order/Customer

In the eCommerce business, a Contribution Margin (CM) is a significant part of unit economics. This metric is estimated by taking the revenue per order and deducing any variable costs per order. The formula for which is

Operating costs

Before buying a business, whether online or offline, you need to know what it will cost to keep it up and running. Also, how profitable it will be once the overhead costs are met. Like other types of businesses, eCommerce organizations also need some insurance to keep their doors open. Some of the factors include:

- Scalability – How can the company evolve to match market demand and the room for the industry to expand into new markets?

- Underlying cost structure – How will the underlying expenses be transferred to the new owner? How can underlying costs be cut?

- Product concentration – How much revenue of the company are reliant on certain products? Do too many products make up for too few sales?

Financial history

Financial history can help a lot to calculate the accurate value of the business. An analyst is appointed to analyze the financial statements, such as:

- The age of the business.

- The gross and net income for the last 1-3 years or the last few months

- Chances of a new owner recreate the cost structure. Are they able to make any savings?

- Check the stability of the earning power.

- Is the owner dominating the earnings power i.e owner-specific earning relationships?

How do we do the 409A Valuation for eCommerce Companies?

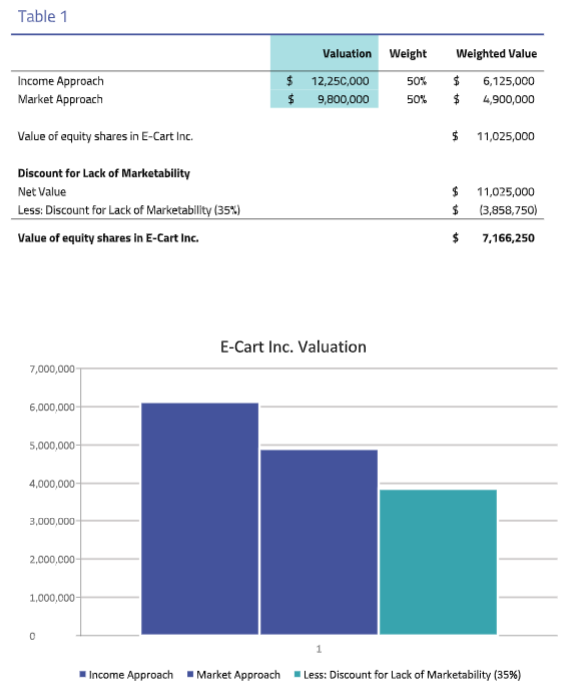

Let us see how the valuation for eCommerce companies is performed. Out of the many methods available, three main strategies are used the most. One can choose either income, market or both. The main strategies used are:

- Market Approach – The market approach utilizes multiple financial information from publicly traded companies from the same industry and situation, including revenue, net income, EBITDA, etc. These are then used to contrast with for estimating the company’s equity value.

- Income Approach – The income approach is very simple and is used for companies with a positive cash flow and sufficient revenue. They would normally use the Discounted Cash Flow (DCF) method based on past financial records and future forecasts.

- Asset Approach – The asset approach is the least supported 409A business valuation approach and is mainly for the very early-stage businesses that have not raised any funding and do not have any revenue yet. Therefore, this method defines the net asset value to figure out the right deal for the business. However for Ecommerce businesses, the other valuations methods are more suitable for a 409a.

Why choose Eqvista for eCommerce Company 409a Valuation?

Now that you know all about eCommerce Company 409a Valuation, it is best to choose a firm that can offer safe harbour with accurate valuations. Our team at Eqvista is certified to perform 409a valuations for your Ecommerce business. Contact us to discuss your case today!

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!