409a valuation in South Korea

In this article, we explain what a 409A valuation is, and whether or not you need a 409A valuation in South Korea.

South Korea is one of the top 10 business-friendly economies in the world. It’s no surprise that both foreign and local companies will want to set up their business in the country. In 2011, the UK was the 9th largest foreign direct investor in South Korea with a total investment of $4.32 billion. With the rise of K-Pop and K-Dramas, it’s no surprise that many businesses want to enter the South Korean market. If you want to have your business in South Korea, it’s important to get the paperwork done (correctly!). One such document to take note of is: a 409A valuation.

South Korean Companies in the US

South Korea is an East Asian sovereign state that occupies the southern half of the Korean Peninsula. Companies from South Korea are growing their investments in the US. For example, SK Innovation, which began construction of a factory in Commerce, Georgia last year, has already invested ₩1.9 trillion ($1.5 billion) in the region and plans to invest another one trillion won to better fulfill rising battery demand in the US.

Overview of Korean companies and business with the US

South Korea is a key strategic and economic partner for the United States in Asia. Bilateral trade and investment activity have grown throughout time, with the implementation of the first US-Korea Free Trade Agreement in 2012 providing a significant boost. Despite these tremendous advances, much more may be accomplished through creative approaches that take advantage of both countries’ common capabilities. Both the United States and South Korea, for example, have innovative and technologically advanced manufacturing industries. This sparks a shared interest in figuring out how technological advancements, ranging from robotics to artificial intelligence, will affect their prosperity and security in the twenty-first century.

Important US tax issues to know

There are several US tax terminologies to understand in order to fully grasp the importance of a 409A valuation for a South Korean company. We will discuss the following: 83(b) Election, ASC 718, ISO 100k, Form 3921 & 3922, and Internal revenue Code (IRC) Section 409A.

- 83(b) Election – According to the IRC, 83(b) Election is for equities that have a vesting period, and lets employees and company owners pay taxes on the complete fair market value (FMV) of restricted shares at the time of grant. This means, the IRS will be instructed to tax the elector for stock ownership at the time of gift rather than when the stock vests.

- ASC 718 – ASC means Accounting Standards Codification, which was developed by the Financial Accounting Standard Board (FASB) in 2009. Under ASC 718, compensation such as employee stock-based compensation and equity awards are subject to a set of accounting regulations that companies must comply with.

- ISO 100k – Under ISO 100k, employees are not allowed to treat more than $100k worth of exercisable options as incentive stock options (ISOs) in a year. ISO 100k is also known as the $100k ISO Limit or $100k Rule.

- Form 3921 & 3922 – These forms were issued by the IRS for reporting ISO exercises (Form 3921) and ESPP share purchases (Form 3922). Each time an exercise or purchase is made during the calendar year, a new form must be completed.

409a Valuation & South Korean Companies

There are various forms by the South Korean companies that exist along with the 409a valuation. The 409a valuation for the South Korean companies is based on the taxation and fair market value of the stock. Although the taxation system in South Korea is quite complex, it still offers some favorable conditions.

What is a 409a valuation?

A 409A valuation in South Korea determines the value of your company’s common stock that is necessary when issuing stock options to employees. A 409A valuation in South Korea is required for any corporation issuing stock options. The striking price for options granted to employees, contractors, advisors, and anyone else who receives common stock is determined by 409As.

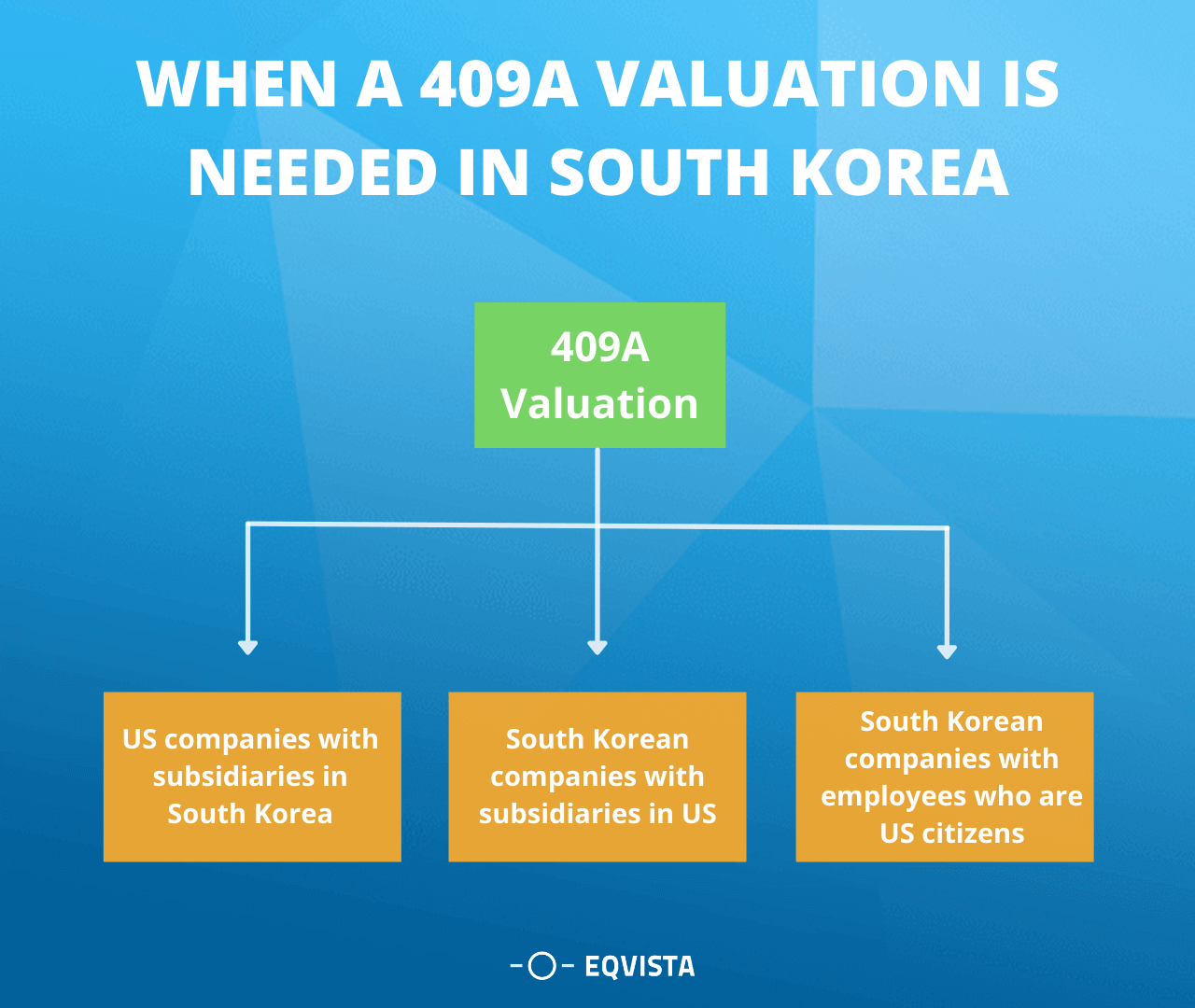

When is a 409a valuation required for a South Korean company?

A 409A valuation is needed if you don’t know the value of your company’s stock. It’s impossible to sell your company’s stock and shares if you don’t know how much they are worth. Also, a 409A valuation becomes important if a company intends to offer equity. Here’s when a 409A valuation is needed for your company:

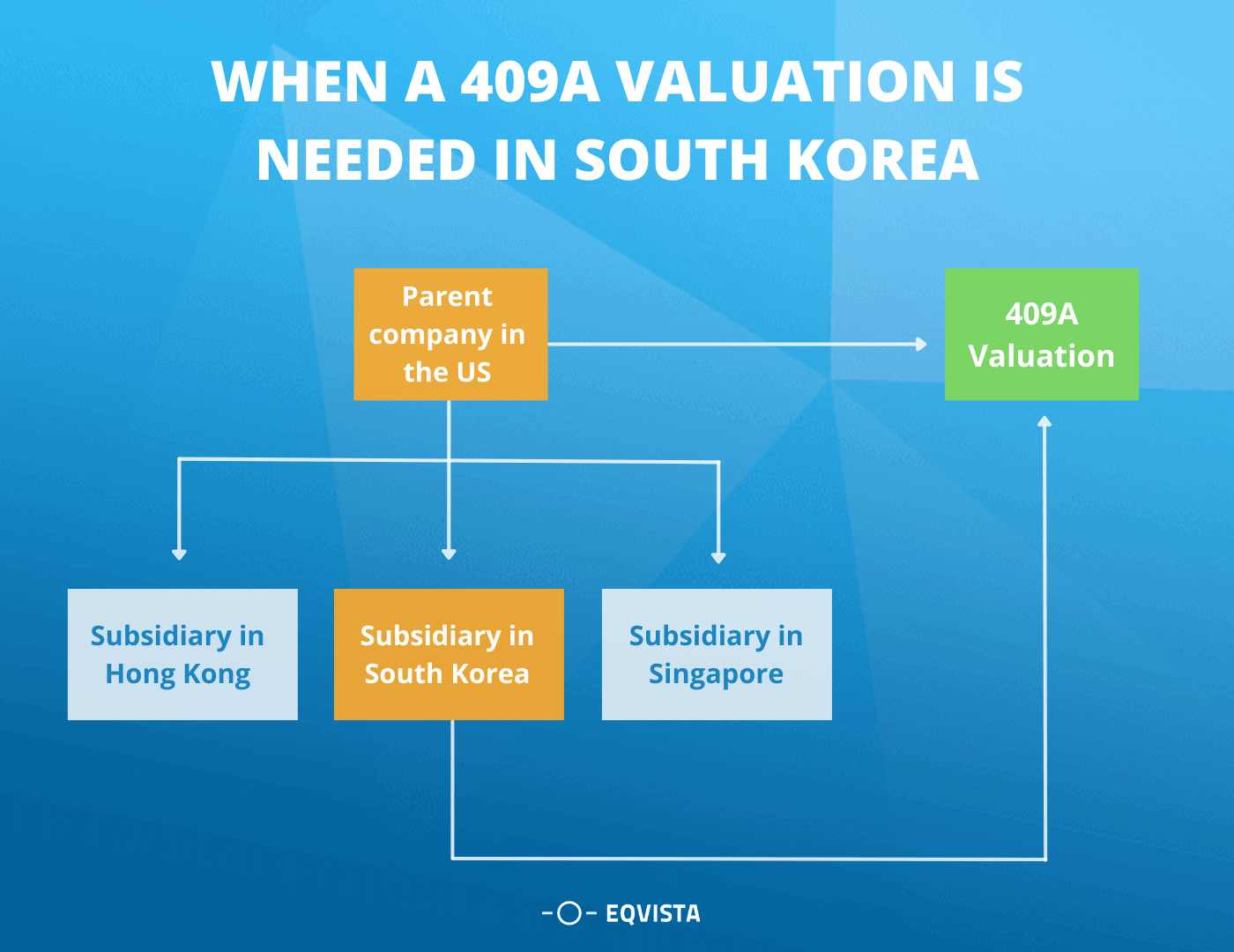

US Holding company with South Korean subsidiaries

Since South Korea is one of the top business-friendly economies in the world, many US companies have set up subsidiaries in South Korea. Also, The US and South Korea entered into a trade agreement (United States-Korea Free Trade Agreement) in 2007, which allows US business to export more, create more jobs and grow their businesses. According to the United States Trade Representative, South Korea is currently the 6th largest goods trading partner with $134 billion in total (two way) goods trade during 2019.

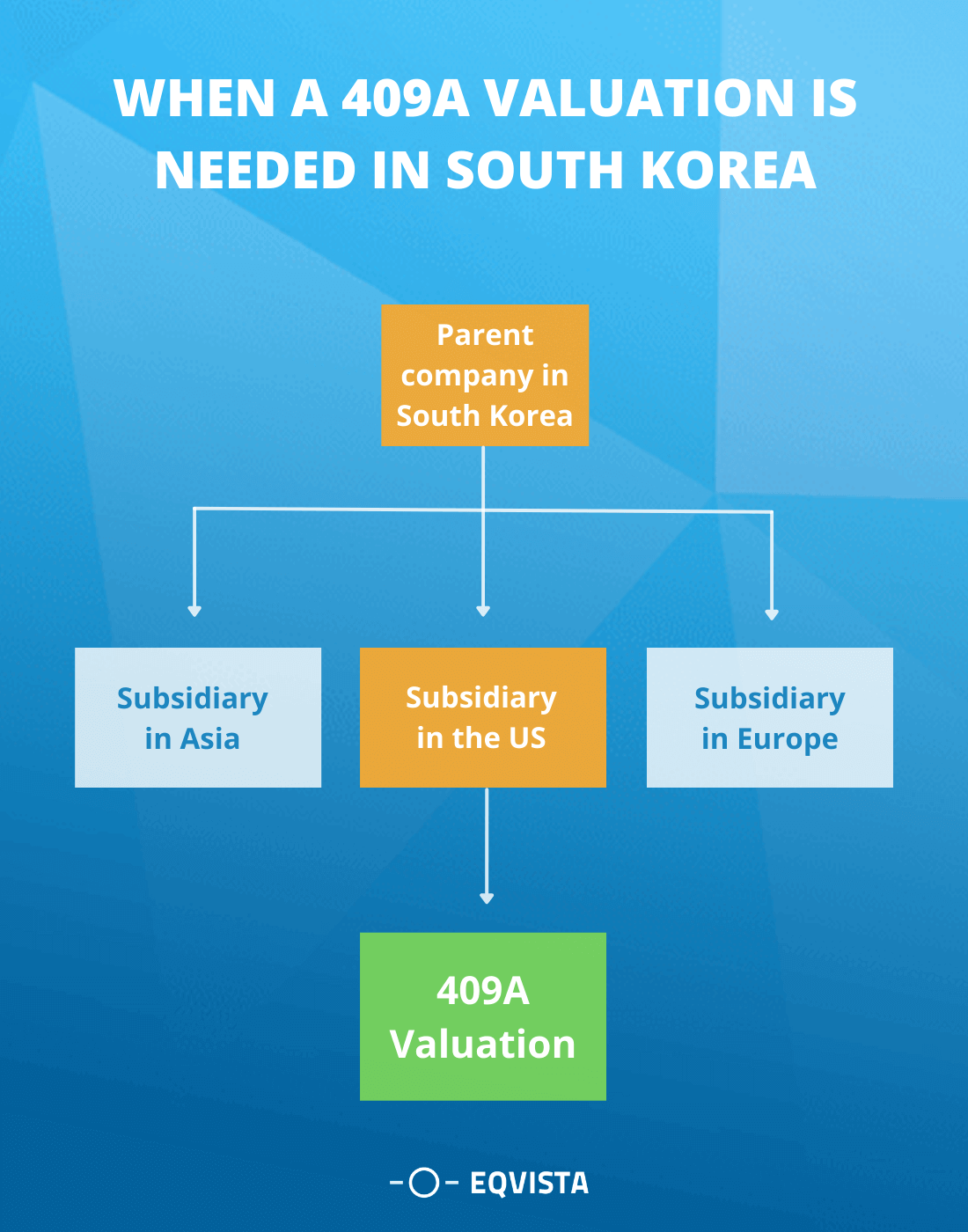

South Korean Holding company with US subsidiaries

In recent years, South Korea has seen a surge in mergers and acquisitions (M&A) opportunities. To compete in the global economy, expand operations, and achieve synergistic benefits, a growing number of organizations are turning to M&A. As the number of mergers and acquisitions grows in South Korea, the government continues to provide tax and other incentives to encourage them. This paper focuses on the following concerns in relation to cross-border M&A taxation: asset purchase or share purchase choice of acquisition vehicle choice of acquisition funding. The trade deal between the United States and South Korea gives AGI more chances in this fast rising market. Although AGI already exports duty-free to Korea, the US-South Korea trade agreement nevertheless provides intangible benefits to AGI and other technology companies.

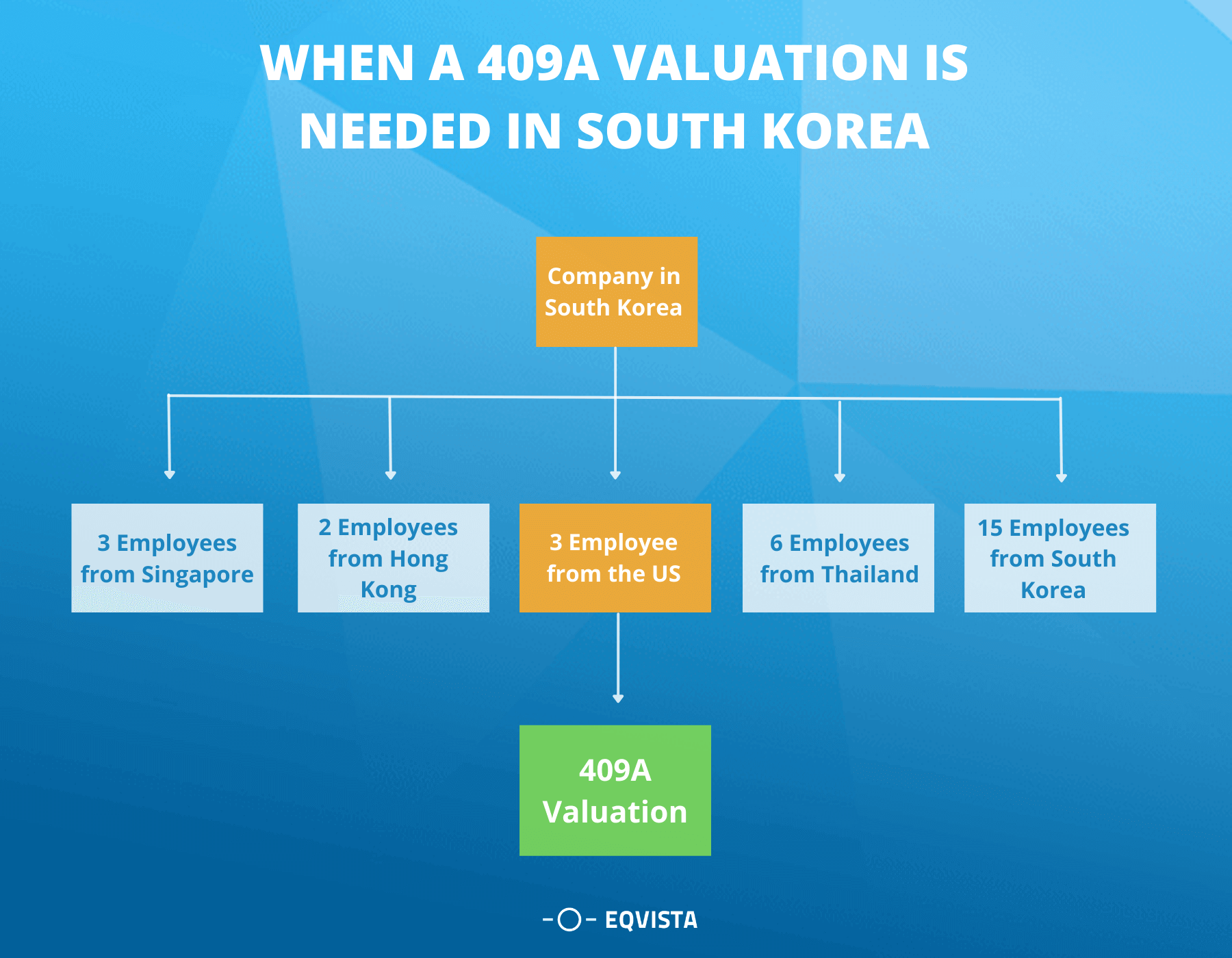

South Korean companies with US employees (Offering ESOPs/Other Incentive Programs)

Purchasing stock outright, receiving stock as a bonus, earning stock options or participating in a profit-sharing agreement are ways employee ownership can be achieved. For many South Korean companies, employee stock ownership plans (ESOPs) are the most frequent type of employee ownership for US employees. As appealing as these tax benefits are, they have their own limitations and consequences. ESOPs are not allowed in partnerships and most professional corporations under the law. ESOPs can be used in South Korean companies but they are not eligible for the rollover approach and have lower contribution limitations. Private corporations have to repurchase the shares of retiring employees, which can be costly.

Other situations for 409a valuation

Aside from the above situations, a 409A valuation is required for a company in South Korea for the following reasons:

- South Korean employee share option plans: A company can grant share options to directors, officers, and employees who have contributed or have the potential of contributing to the company’s incorporation, management of technological innovation, under a share option plan (which is primarily regulated by the KCC).

- Offering share options: A company must be a joint-stock company (jusik hoesa), which is similar to a corporation in the US.

ESOA Share Option Plan

Employees of a joint-stock firm (with employees of certain associated companies) can form an ESOA under the Workers Welfare Basic Law (Welfare Law). The articles of incorporation of a company must expressly authorize the issue of share options to members of the ESOA, just as they do for a stock option plan. Furthermore, the grant must be approved by a resolution passed at a general shareholders’ meeting in general. The corporation must issue new shares or distribute treasury shares if an option is exercised during the exercise period. Unlike a share option plan, cash settlement is not permitted under an ESOA share option plan.

Importance of 409A Valuation

- Defining the fair market value of shares – A 409A valuation helps to determine the fair market value (FMV) of your company’s shares. The FMV is needed for you to sell your company’s shares. Aside from the FMV, it also determines the striking price for options granted to employees, advisors, and anyone else who receives common stock.

- Company’s financial standing – Getting a 409A valuation can help management and investors to gauge the company’s financial standing. It’s good to know where your company stands in order to make sound decisions on what to do with finances and funding.

- Safe harbor status – The valuation will protect your employees from any tax issues with the IRS. Also, it will protect the company and owners from any lawsuits or tax liabilities.

What are the consequences if the company does not comply with 409a while equity issuance?

An independent company valuation is necessary for nonqualified deferred compensation (NQDC) plans that contain stock options and stock appreciation rights (SARs). The valuation determines the special price at which the opportunities and SARs can be exercised.

Tax penalties

The following tax penalties could be imposed on employees if your company does not comply with section 409A of the IRC:

- Income tax and a 20% penalty will be imposed on any deferred vested amounts under the NQDC plan as of the last day of the vesting year.

- Premium interest tax of 1% above the federal underpayment rate on failed compensation from the vesting date forward.

Aside from these penalties, employees could be required to pay additional penalties as a result of understating their income, and they could be subject to penalties imposed by the state.

Common Valuation Methods

There are many ways to calculate the value of a business. Of the many approaches, there are three common valuation methods that valuation analysts use to conduct a 409A valuation for your company: asset approach, market approach, and income approach.

- Asset approach – This approach stands out because it examines the total value of the assets in your company. These assets include tangible items such as real estates and vehicles, and intangible assets like intellectual property (i.e. copyrights and trademarks). Often, the value of the assets minus the liabilities can differ from the values reported on the balance sheet. This can be due to timing and other factors. By using the asset approach, the valuation can offer latitude for using market values instead of balance sheet values.

- Market approach – Financial executives play a critical role in determining and maintaining a company’s value. Stakeholder and investor returns rise in tandem with a company’s value and vice versa. There are various approaches for calculating the value of a firm. Two of the most frequent valuations are equity value and enterprise value. The asset-based strategy can be used in conjunction with these two techniques or on its own. Both equity value and enterprise value necessitate the use of equity in the calculation. If a corporation does not have any shares, analysts can use asset-based valuation as an alternative.

- Income approach – The income approach, also known as the income capitalization technique, is a real estate assessment method that allows investors to estimate a property’s value based on its income. It’s calculated by dividing the rent collected net operating income (NOI) by the capitalization rate. The income approach is one of three general approaches to assessing real estate and is primarily utilized for income-producing properties.

Calculation for 409A Valuation in South Korea

In this example, we will look into how a 409A valuation is calculated for a pretend company called “Dalshim Incorporated”. The company is based in Busan, South Korea and manufactures automobiles all around the world, specializing in motorcycles. Some of the company’s senior managers and executives are expats and US citizens, and they need to declare tax back in the US for their stock options they plan to exercise in the future.

To determine the strike price on these options, Dalshim Incorporated decides to undergo a 409A valuation to find the value and exercise price for their ESOPs.

Here is a basic look at their cap table:

| Security Name | Shares | FD% |

|---|---|---|

| Common Stock | 3,500,000 | 15.56% |

| Preferred Stock | 15,500,000 | 68.89% |

| ESOP | 3,500,000 | 15.56% |

| Total | 22,500,000 | - |

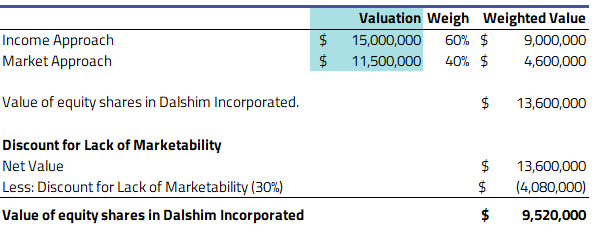

After having their 409A valuation processed, the resulting value was calculated as:

With the total valuation of the company at $9,520,000 after the DLOM, and capital structure with 22,500,000 shares, after processing the value through a waterfall analysis, the final share price was calculated as:

$0.30 price per share

Get Accurate 409a Valuation Report for Your Company?

If you are a US company with a South Korean subsidiary, or a South Korean company with subsidiaries in the US, it’s important to get a 409A valuation. Eqvista provides you with a valuation report and offers various services to get to know the fair price of your stock. We also offer consultations to manage your shares, accounts, and growth of the business strategies. If you are unsure where you can get your 409a valuation, we are here to help you. Contact us now and one of our experts will guide you.

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!