Why you don’t need a transfer agent for your Startup

In this article, we discuss the role of transfer agents in detail and explore how cap-table software is trending as a suitable alternative.

Transfer agents are an integral part of a company’s equity management system. Traditionally, all private and public companies dealing with shareholders work closely with transfer agents for their equity needs. However, with the advent of automated equity management software, this trend is changing. Especially, in the case of startups and other private companies, transfer agents may no longer be a mandatory requirement.

Transfer Agent

In the initial stages, all startups have a hands-on approach to their business. With limited resources, the tendency is to manage as much work as possible in-house. This is true for equity management as well. Most startup shareholders are the company founders, employees, and investors. This list is a small number that is easily managed using a simple cap table on an excel sheet. However, as the company grows equity management becomes layered with the inclusion of multiple stakeholders, customized vesting schedules, and payout terms. This is when transfer agents are considered.

What is a transfer agent?

A transfer agent is a financial institution that handles the equity-related activities of all registered shareholders of a company. To track and manage shareholders is quite a cumbersome task when the numbers run in thousands as is the case with most public companies. This is why such a massive responsibility is outsourced to transfer agents. Transfer agent firms handle hundreds of companies and thousands of shareholders annually.

Transfer agent services among other things include bookkeeping, liaison between company and shareholders, timely payouts to shareholders (dividends and interests), and a crucial partnership with the company during important events such as an IPO. Transfer agents are the face of a company in the share market. Thus care must be taken to choose the right fit. Most often, once partnered, transfer agents are on board for the long haul. Unless there are any unfavorable incidents, transfer agents are not changed during a company’s lifetime. Here are some pointers to note before partnering with a transfer agent:

- A transfer agent must be hand-in-hand with the client company. Client and shareholder ratings are a good way to determine the transfer agent’s long-lasting commitment towards their partnerships.

- Years of experience in the business, innovative technology, updated data security measures, and responsiveness are some important features to note in a transfer agent.

- Value for money is another aspect. Most transfer agent services are bundled offers. Clients must do a thorough check to understand the nuances of the contract.

- Another big part of transfer agent responsibilities is to keep up with the regulatory environment. Accuracy and reliability in these matters can make or break a business.

- Finally, a transfer agent is an integral part of any business. They are truly company representatives to shareholders. They must know to treat your shareholders the way you would.

What are the responsibilities of a transfer agent?

Transfer agent services are outsourced. Thus a good mutual working relationship with the client is crucial. It is not an overreach to expect transfer agents to be proactive in communicating with their clients and shareholders. Let us take a closer look at some of the important responsibilities of a transfer agent:

- Recordkeeping & payments – Transfer agent responsibilities pertain to the registered shareholders of a company. Registered shareholders are those investors who purchase or are issued stocks directly by the company. To maintain updated records of thousands of shareholders is a huge responsibility. To ensure timely communications, track ownership transfers, and payouts to the right contact are key to build and maintain the trust of the company shareholders.

- Expertise in regulations – Trade-related SEC rulings and state regulations is a complicated affair. The dynamic nature of the regulatory environment makes it difficult to keep track of amendments. However, this is an important function of transfer agents. To keep clients and shareholders updated about regulatory changes, to ensure accurate, timely submissions of paperwork, and active client advocacy during new regulatory planning is what differentiates an expert transfer agent from an average one.

- IPO services – If a private company has not hired a transfer agent in its initial stages of operation, it will need one during an IPO. Transfer agents partnering with a client during an IPO are entrusted with the crucial responsibility of issuing shares. It is the start of a long and trustworthy relationship. This requires years of experience and in-depth industry knowledge on the part of transfer agents to successfully implement an IPO and then on liaison between the client and their shareholders.

- Voting procedures – Post IPO, shareholders are entitled to the right to vote on company matters. Voting rights vary with the type of shares held by the stockholders. Transfer agents play an important role in facilitating a smooth voting process based on the different entitlements of investors.

Transfer Agent for Companies

Transfer agent services are bound by confidentiality clauses. Except for the details mandatory for public documentation, most shareholder data is heavily guarded by every business. Thus transfer agents must have a well-organized company structure that understands and respects the particular need of clients. Let’s explore this.

Why are transfer agents important for companies?

As discussed in the previous sections, transfer agent responsibilities are quite time consuming, cumbersome, and require the highest precision. For large public companies, in addition to their business goals, shareholder management is a big burden. Thus it is a good business policy to engage an experienced transfer agent company to partner with them in this aspect. Transfer agents allow the Direct Registration System (DRS) to investors who want to buy shares directly from the company without going through a bank or brokerage firm.

Transfer agent services also inevitably include legal counsel dedicated to client and shareholder needs. The importance of this addition to any business process cannot be undermined. This legal team closely monitors regulatory changes in the market and ensures their clients adhere to all the reporting requirements. Transfer agents also function as election inspectors, corporate auction supervisors during mergers and acquisitions, DSPP (Direct stock purchase plan) administration, and DRIP (Dividend reinvestment plan) administration.

Cost of transfer agents

Transfer agents offer a world of premium confidential services. The best in the business hire top-notch professionals to handle different verticals of operations. With the best of human resources and a wide network of legal and industry advisors, running a transfer agent company is quite an expensive affair. Likewise, hiring a transfer agent is expensive as well. Most firms offer flat rates, usually bundled offers. But companies must do a cost analysis and justify transfer agent hiring charges based on their stage of growth.

Transfer agent services are usually signed up for the long term. Big companies seldom shift their transfer agents. But in a worst-case scenario, when transfer agents need to be terminated, the cost incurred could be massive. Termination charges could range anywhere between $500 and $15,000. Time of engagement is also another matter of consideration. Termination charges are generally applied if the contract is withdrawn before 7 to 10 years.

Possible options to get transfer agent services

Transfer agent services are not limited to transfer agent firms alone. Based on the company’s stage of growth, budget, and shareholder requirements, transfer agent roles and responsibilities can be managed in various ways. Here are some options:

- Transfer agent companies – This is the most obvious go-to option for transfer agent services. They are well-organized institutions with an array of finance and legal professionals. With years of experience in handling clients, transfer agent companies are the most reliable option. However, their services are expensive and companies need to evaluate the cost of hiring them. Else, transfer agent services could prove to become a huge financial burden.

- Self Administration – This is the most basic form of equity management. It is common with startups that begin by managing their cap tables in-house on a simple spreadsheet. In the initial stages, the number of startup shareholders is limited and mostly include founders, investors, employees, and consultants. Startups enjoy a close personal relationship with their shareholders and regulatory requirements, equity management, and regular shareholder communication are simpler. In this scenario, third party transfer agent services are not required.

- Law firms – Legal counsel is a large and crucial part of transfer agent services. To keep track of changes in SEC and other government regulations is important to maintain business paperwork. Wrong filing or lapse in deadlines and process can cost a company dearly. A typical transfer agent company employs a strong legal team as well. Thus some law firms can also function as transfer agents.

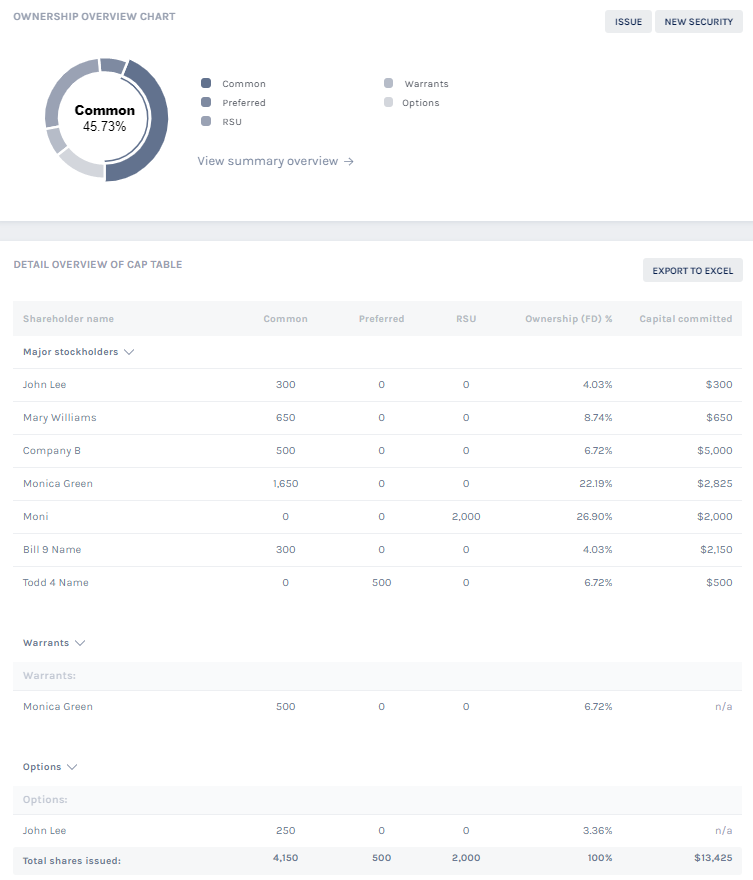

- Cap table software – This is an exciting breakthrough in the world of equity management. Cap table software allows the user the benefits of self-administration as well as professional transfer agent services. Sophisticated cap table software such as Eqvista is designed to handle not only cap tables but a gamut of other services that encompass the whole spectrum of the equity management process. Besides, owing to cloud computing shareholders are provided customized access to their equity accounts. Also, at the company end, cap table software companies provide sufficient training and support services to ease the learning curve.

Does your company require a transfer agent company?

Transfer agent services generally make sense for publicly traded companies. The extent of their operations and the corresponding family of shareholders demand the highest form of recordkeeping, liaison, and transparent communication. Transfer agents do this the best. If to be handled in-house, this could be a cumbersome task. However, this is not the case with most private companies or startups with limited shareholders.

For instance, a private company or a startup does not have to pay dividends. Neither are they required to host massive shareholder meetings or engage in proxy voting. Unlike public companies, private firms do not have to file SEC reports either. But all of these activities are part of the bundle offered by transfer agents. Thus hiring transfer agent services becomes highly expensive for startups.

Cap table software for private companies

The newest innovation in cap table management is cap table software. Though its primary function is to automate cap tables, it is designed to handle a wide spectrum of functions that together can be grouped as equity management. This software has built-in checks that protect the clients from computation errors and are programmed in a way that common events such as vesting schedules are automated.

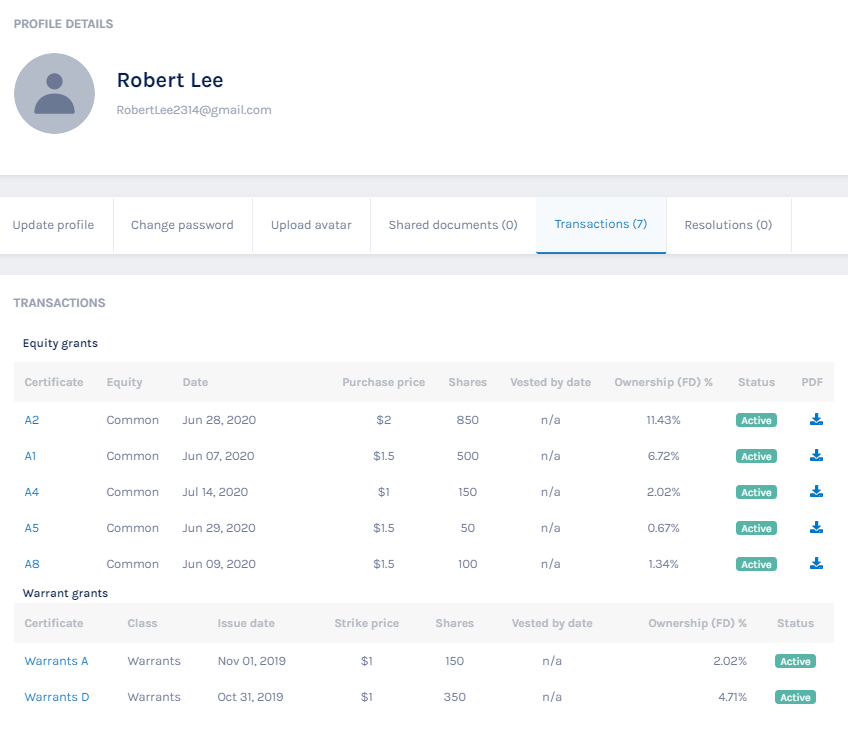

Cap table software almost functions as transfer agent software and enables electronic issuance of shares, share cancellation, a comprehensive mailing list for streamlined shareholder communications, and includes almost all functionalities required by a private company for their equity and shareholder transactions. Besides, cap table software providers also extend training and support to help users make optimum use of all the software features. The best advantages of using cap table software for private companies are:

- A cap table software is much cheaper than contractual transfer agents. This has a massive impact on a private company’s monthly expenses. A team of in-house well-trained staff adept in handling the software is sufficient.

- Investor relationships and shareholder information are sensitive data. More the company’s control over this information, the better the chances of privacy. Thus, in a private company with few hundreds shareholders and most of whom are closely associated with the business (employees, founders, investors, consultants), with a simple cap table software, all shareholder related queries and communications can be handled in-house.

- One of the best features of cap table software is its ability to provide individual account access to all shareholders. Being hosted on the cloud, shareholders can readily access their equity information at any point in time from anywhere in the world. This is a much easier method as compared to request based access provided by transfer agent services.

Using Eqvista as a transfer agent service

Eqvista is one of the market leaders in cap table management software. Our advanced equity management tool enables companies and their shareholders to interact and exchange information with the utmost ease. Issuing shares, tracking them, timely payouts, and the necessary documentation are all available with a single click. Our services mirror the most efficient transfer agent services in the market.

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!