Do I need a transfer agent to manage my company cap table?

In this article, we look into the concepts of cap tables and transfer agents and explore the need for transfer agents in cap table management.

If you are an entrepreneur ‘transfer agents’ is a concept you must be familiar with. Be it a new startup, a growing private company with a few hundred shareholders, or a massive public enterprise with thousands of investors, transfer agents are an inevitable part of equity management. However, there is always a debate on whether all companies, especially private ones, require transfer agent services.

Cap Table

The primary role of a transfer agent is cap table management of a company. Every other service they offer is an extension of this responsibility. By entrusting transfer agents with such sensitive data, the client company places immense trust in their operations. So what exactly is a cap table?

What is a cap table?

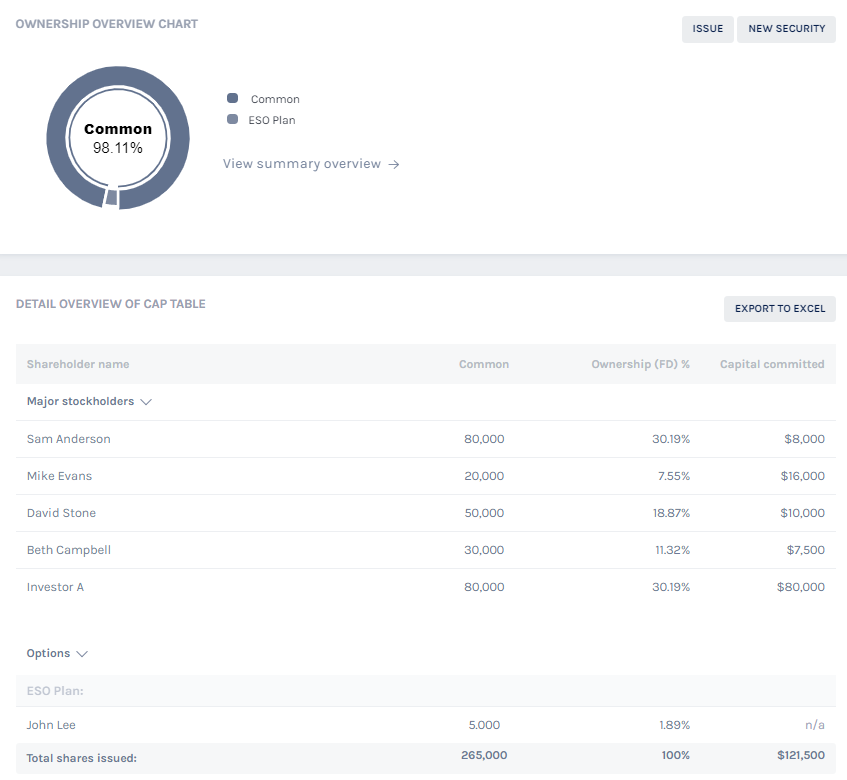

A cap table is a consolidated datasheet of a company’s shareholder information. In the simplest format, this data is maintained by the company manually on spreadsheets. This works for startups with a limited number of shareholders. But as the company grows and more stocks are granted in a bid to raise funds, the number of shareholders and their customized requirements becomes too much to handle. This is when companies need to streamline their cap table management.

| Shareholder | Common Shares | Preference Shares | Options | Total | Ownership |

|---|---|---|---|---|---|

| Mike Evans | 2,000 | - | 200 | 2,200 | 35.77% |

| Blake White | 1,500 | 500 | 200 | 2,200 | 35.77% |

| Sam Thompson | 500 | 250 | 100 | 850 | 13.82% |

| Lindsey Smith | 200 | 250 | 100 | 550 | 8.94% |

| John Williamson | 300 | - | 50 | 350 | 5.69% |

| Total | 4,500 | 1,000 | 650 | 6,150 | 100% |

A basic cap table lists founders first, followed by company executives, key employees, and investors who hold shares in the company. All data related to the various security classes, individual share prices, and their corresponding owners are included in this spreadsheet. In practice, the names of shareowners are listed on the Y-axis while the types of shares are listed on the X-axis. Updating this information periodically is crucial to efficient cap table management.

Why is a cap table important for a company?

Since cap tables contain consolidated shareholder information, it is an important reference both for the company as well as investors. Financial strategies are developed based on the data reflecting in cap tables. One look at a cap table reveals a lot of information about the company’s actual value in the share market. It is easy to determine the number of existing shareholders and the extent to which a company can stretch dilution. Cap table management thus is the cornerstone for a company’s funding efforts. The most important functions of a cap table are:

- Internal stakeholders (employees and founders) can see their equity information in real-time. This acts as a constant motivation as the share prices fluctuate with company growth and a quick reference to a cap table provides a clear idea of the present valuation of the shares.

- During funding rounds, referencing past data from the cap tables provides a strong foundation to showcase company growth.

- Interested investors can gauge the extent of ownership in the company and evaluate their share upon dilution. This determines their potential control and leverage in the company decisions if they decide to come on board.

- Efficient cap table management helps in the audit process. The legal team can count on solid data from the cap tables to back up timely regulatory requirements.

With a limited number of shareholders, as is the case with private companies, cap table management can be handled by the finance team of a company. However, in the case of large publicly trading companies where the number of shareholders runs in thousands, to maintain that volume of data manually on spreadsheets is a recipe for disaster. If cap table data goes wrong, so would equity distribution and regulatory filings. The company will end up paying dearly for such losses. This is why transfer agents are considered.

Transfer Agent

A transfer agent acts as a bridge between a company and its shareholders. It is always advised to hire a transfer agent for cap table management as these responsibilities are better outsourced. It minimizes error and frees up company time to focus on other growth strategies. So what exactly is a transfer agent?

What is a transfer agent?

A transfer agent is an SEC-registered finance company that handles all shareholder related activities for a company, primarily cap table management. They are an extension of the company and are the face of a business for the shareholders. Transfer agent companies thrive on trust and long-lasting relationships with clients and are seldom changed during the lifetime of a business. Thus, care must be taken to sign-up with an experienced transfer agent.

Apart from cap table management, another crucial role of transfer agents is to keep up with SEC and other government regulations and ensure that clients file the necessary reports on time. Thus transfer agents also play an important advisory role in educating and guiding their client companies about regulatory requirements in their business. This skill is only acquired after years of experience in handling clients from varied industries. Thus it is important to choose a transfer agent after careful background checks. Some pointers to determine a good transfer agent are:

- Years of experience

- Diversity of clients based on industries and markets

- Satisfaction ratings of clients and shareholders

- Responsiveness

- Data security measures

- Technical expertise

- Accuracy and reliability

- Reliable legal counsel

What are the responsibilities of a transfer agent?

Transfer agent services are quite expensive. But the cost is justified if the company does have that many functions to outsource. For example, transfer agents for startups may not be a good idea. Startups have limited shareholders and the volume of work surrounding shareholder management is low as well. Here are some important responsibilities of a transfer agent:

- Record keeping – Once a company starts to issue shares, every piece of information regarding these share transactions have to be recorded. The name of each shareholder, their security class, contact information, shareholder agreements, share certificates, dividend, and interest information, vesting schedules, etc, every bit of data is important from a regulatory perspective.

- Payments – Depending on the type of shares held by investors, they are eligible for timely dividend and interest payouts. Transfer agents are responsible to ensure these payments reach the right person on time. In the case of stock splits or dilution, the necessary information needs to be communicated to shareholders on time.

- IRS reporting – Periodic regulatory reporting of the business forms a big part of transfer agent responsibilities. Meanwhile, sharing important company documents such as annual reports, audited financial statements, and others with the shareholders is another aspect of this process.

- Corporate events – To ensure smooth conduct of important corporate events that have a direct impact on the company shareholding is another important responsibility of transfer agents. Mergers and acquisitions, IPO, and annual meetings are situations where the expertise of an experienced transfer agent is valuable to a company.

- Voting – An efficient cap table management ensures up to date information about company shares and their respective shareholders. Based on the type of shareholding, they are eligible for voting rights in company decisions. Transfer agents facilitate these voting procedures, including proxy voting.

A transfer agent is indeed an invaluable resource for every business. However, their utility always comes under the microscope, especially for startups and other private companies. The importance of transfer agents for cap table management cannot be denied, however, are there any other alternatives? Let’s explore.

Do I need a transfer agent to manage my company cap table?

In practice, it is observed that except for publicly traded companies, transfer agents are not required for cap table management. With the advent of sophisticated cap table software such as Eqvista, the requirement of hiring a transfer agent for a company’s equity management needs is on the decline. This type of software is easy to learn and use, and minimizes manual error in data management. All information related to shareholders is available with the click of a button.

Traditionally, startups manage their cap tables on a simple spreadsheet with a team of finance professionals within the company. With startup shareholders, mostly being founders, employees, and investors, everyone knows each other up close and all personalized communication can be handled easily within the team. It is only when the number of registered shareholders crosses the 2,000 mark (alternatively 500 non-registered shareholders), as per regulatory requirements, companies are required to hire a transfer agent.

Meanwhile, transfer agents for startups are mandatory when they are going public. An IPO is an ideal event to engage a transfer agent since they are experienced in handling the process and accurately issue shares. A public company eventually holds thousands of shareholders and transfer agents play an important role to liaison between them and the company.

Lastly, an important point to note about transfer agent companies is their cost-effectiveness. Most transfer agent services are bundled offers which although being highly efficient, companies must analyze if their business is at a stage where they will require services to that extent. Also, companies must check if their industry has a regulatory environment complicated enough to need a transfer agent to monitor it. Can it be handled by the company’s legal team? And finally, transfer agent termination clauses must be checked thoroughly. Usually, this attracts an expensive termination fee.

In the next section, we explore a rising alternative to transfer agents – cap table management software. Leaving public companies aside, cap table software seems to increasingly become a go-to option for startups and other private companies.

Cap Table Management Software

Cap table management is a dynamic task. On one hand, new funding rounds attract buying and selling of existing shares and alterations to the common options pool. While on the other hand, employees leaving a company, investors exercising their options, and other such activities dilute shareholdings. All of this information needs to be constantly updated and available in real-time for use. What other best way to do this than using an automated system!

Why use a cap table management software to manage your equity operations?

A state of the art, user-friendly cap table management software like Eqvista is a rising trend and sensible alternative for the varied equity needs of a private company. The ease of onboarding, quick learning curve, support services, and customized access are what make such software an attractive option for equity management. Here are some undeniable benefits of using a cap table management software:

- It is a lot cheaper than hiring transfer agent services

- Saves time and money for growing businesses

- Protects companies from lapses in shareholder management and timely regulatory filings

- Single source data management system allows access to all data in real-time

- Helps to keep data updated during new 409a valuations, issue options, and liquidity offers

Create Your Company Cap Table with Eqvista

Eqvista is one of the leading providers of cap table management software. The tools are so extensive that all the services can be easily bundled under equity management. It is a very simple procedure to create a cap table using Eqvista.

Simply visit our website, sign-up on the platform, and complete your company profile while logging in. On your first login, you will be directly taken to the dashboard that will display all the company details you have just provided. You can now start issuing shares from this platform. It’s that simple. The key features of Eqvista are:

- It manages all forms of equity accounting

- It supports you to maintain equity ledgers

- Issuing electronic stocks has never been easier

- Cloud computing allows easy cap table management and sharing with relevant users

- Facilitates Round modeling and Waterfall analysis

- Helps create, manage, and convert stocks to options and warrants

- Helps create, manage, and immediately apply vesting plans on shareholders

- Supports convertible note, KISS, SAFE, and all other convertible instruments

- Easily create ESOP

- Shareholder portals are easily personalized

Here is some additional reference material that speaks about our range of services. To know more, contact us today!

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!