Stripe IPO and what it means for the fintech industry

With the rise in fintech companies and the disruption of traditional financial systems, online payments are shaping the future of the financial industry. According to statistics, the global fintech market size was valued at $110.57 billion back in 2020, while it is projected to reach $698.48 billion by 2030, thus growing at a CAGR of 20.3% from 2021 to 2030.

In this regard, Stripe is one of the leading online payment solutions that is building a global fintech ecosystem through its platform. They provide software as a service (SaaS) solutions that enable e-commerce websites and mobile applications to build immediate and seamless integrations with Stripe. In this article, we will take a look at Stripe, its history, funding rounds, IPO, and what this move means for the fintech industry.

About Stripe

The Irish-American fintech company Stripe was founded in 2009 by John Collison and Patrick Collison to provide an easy solution for accepting payments over the internet. It is headquartered in San Francisco and Dublin, with 24 other locations worldwide and over 7,000 employees.

With their SaaS solutions, Stripe enables its clients to accept credit and debit cards, PayPal, Apple Pay, and other digital payment methods at their businesses. In recent years, Stripe has been able to implement various technology breakthroughs into its payment processing. As a result, they have focused on automating processes and developing advanced features that help software developers integrate without complexity.

History of Stripe

Founded in 2009 by Patrick Collison and John Collison, Stripe came out of beta and was launched publicly in the United States on September 29, 2011. During the initial stages, the company was focused on building technical solutions for accepting payments over the web. The concept behind online payments was based on the belief that the web has become an integral part of businesses, and the financial industry should adapt accordingly by developing efficient payment methods.

In this regard, the internet has leveled up the playing field for the financial industry and enabled businesses to access global markets. Despite facing competition from other companies, Stripe has achieved significant success and was valued at $95 billion in March 2021, becoming one of the rising stars in the fintech industry.

What are Stripe’s services?

Stripe provides SaaS solutions to help businesses process payments through its platform. It offers various services such as mobile payments, customer authentication, international payment processing, processing payouts, e-commerce payments, and card management. With the integration of application programming interface (API) technology, businesses are able to use Stripe with their existing applications and websites.

Streamlining the mechanism of processing payments is a key factor that has helped Stripe secure large financial transactions. In fact, Stripe has reinforced the digital payment ecosystem and increased merchant services and marketplaces. The company has gained significant market share among other fintech companies and is considered an industry leader.

Stripe’s main competitors

As far as Stripe is concerned, they are mainly facing fierce competition from companies that provide SaaS solutions for online payments. Companies such as Paypal, Square, Adyen, 2Checkout, Authorize.Net, Braintree, and Payline Data are some of the prominent competitors that have strategically positioned themselves in the digital payment ecosystem. However, Stripe has continued to expand and increase its market share because of its automation technology, ease of use and extensive financial resources.

Stripe investments

In the efforts to expand its market share, Stripe has made investments in various companies and startups. This strategy has helped the company gain access to new markets, innovation, and talents. Following are the most recent investments made by Stripe:

- On July 13, 2022, Stripe announced its investment in the cap table management software company named Pulley. While the type of funding was Series B, wherein the company raised $40,000,000. This investment helps Pulley to support its product and expand its platform to other countries.

- June 3, 2022, Stripe invested in an early-stage startup providing training in the field of digital marketing and e-learning called Dream Business System. The company raised an estimated $512,910 in its Seed round of funding. As part of the deal, Stripe will provide mentorship and strategic guidance to the company.

- On May 9, 2022, Stripe invested in the company that identifies and vets undiscovered talent, Manara. The funding amount was $3,000,000 and was part of a Pre-Seed funding round.

Stripe funding from 2010 to 2021

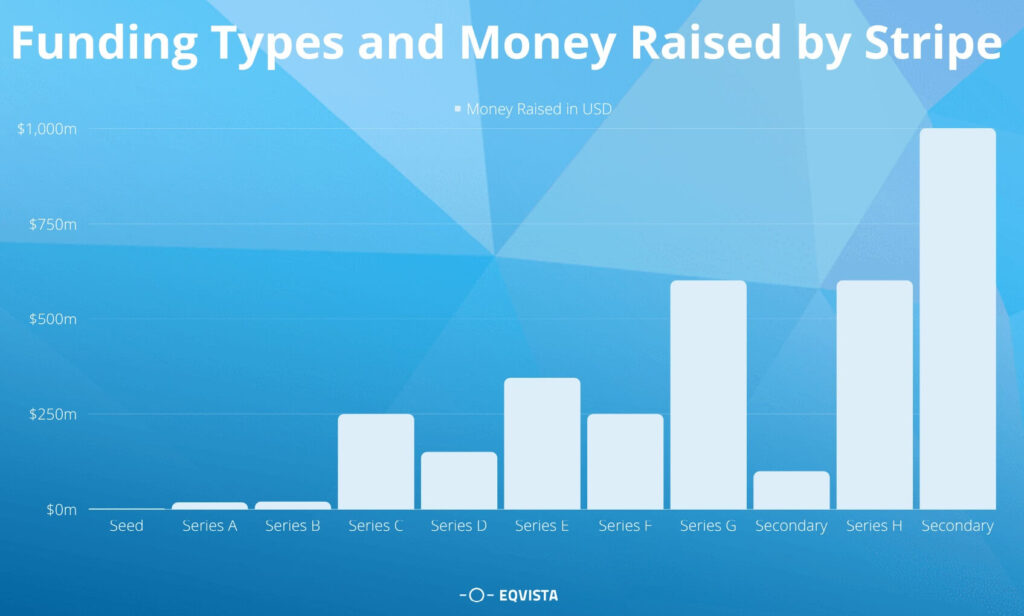

In the initial days, Stripe raised funding from various investors, and venture capitalists are known for their recognized expertise in the financial industry. From 2010 to 2021, the company raised an estimated total of $2.3 billion in funding over 20 rounds from 39 investors. This shows a consistent growth trend in funding and indicates the company’s strength in the financial sector.

Growth history

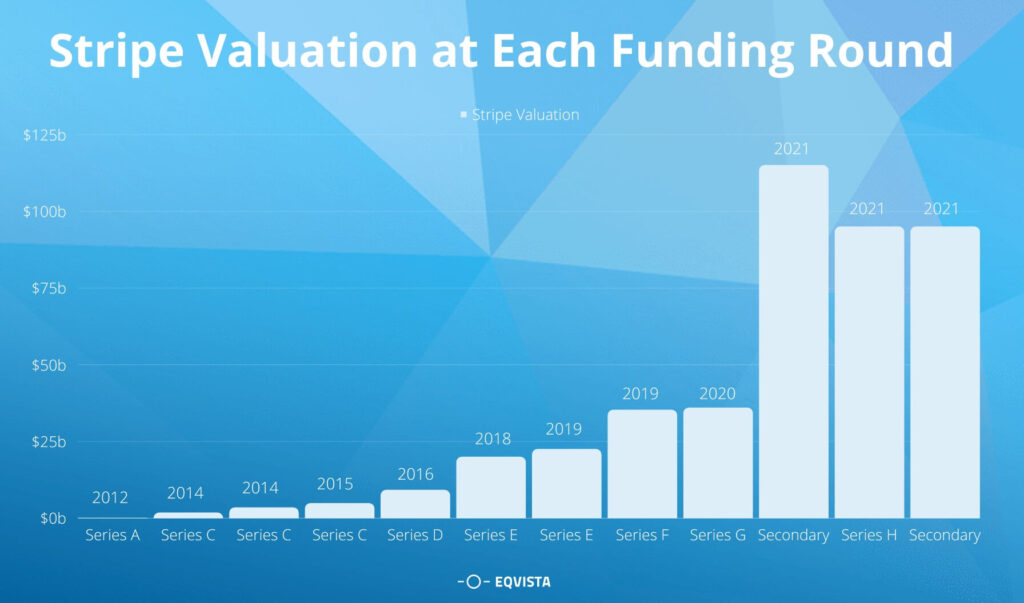

The positive track record of financial growth shows that the company has been able to secure funding from a variety of investors, making it one of the most competitive fintech companies. It has been able to raise significant sums of funding in order to grow and expand its operations.

Founded in 2009, with the first Stripe funding round in 2010, Stripe has grown in leaps and bounds to become one of the most preferred fintech companies in the industry. When the latest Stripe funding round took place, Stripe was valued at $95 billion. Hence, the overall funding history has helped the company build and scale its innovative business model.

Funding round table

The first funding round took place in January 2010, where Stripe received between $20,000 and $30,000 in seed funding from Y Combinator. The traction the company saw during its early years was enough to attract more investors, and in the same year, Stripe closed second funding rounds that were led by Sequoia Capital and Andreessen Horowitz, with a total Stripe funding round of $2 million.

As a result, the latest funding round (Series H) was held in March 2021, raising $600 million from Fidelity Management & Research Company, Sequoia Capital and Ireland’s National Treasury Management Agency (NTMA) and more. Overall, the total funding Stripe has received over the years is approximately $2.3 billion, which clearly shows its competitive edge in the fintech industry.

Stripe key investors

Some of the most prominent investors in the fintech industry have led the Stripe funding rounds. In fact, Stripe has over 35 investors in its cap table who have invested $2.3 billion in the company so far. Allianz X, Axa, Baillie Gifford, Fidelity Management & Research Company, Sequoia Capital, and Ireland’s National Treasury Management Agency (NTMA) are some of Stripe key investors that have contributed to Stripe’s growth and dominance in the fintech industry.

Stripe IPO

The company is yet to go public, but it has been speculated that Stripe is considering an IPO. This news is highly anticipated among the fintech community, and investors are eagerly waiting for it to happen. As such, Stripe filed its intentions to IPO with the Securities and Exchange Commission (SEC) in July 2021. In this regard, it is expected that the company will go public in 2022. However, the company is yet to disclose any proper information about this.

Recent Stripe valuation

As of March 2021, Stripe was valued at $95 billion. This Stripe valuation shows how dominant the company is among other fintech companies and is expected to grow further. While this valuation was over 160% from its previous valuation in 2020. This increase in valuation is mainly due to the latest round of funding and investments in the company.

It is projected that the Stripe valuation will continue its upward trend in the near future. Furthermore, Stripe is planning to invest more in European operations and expand the Global Payments and Treasury Network process in Brazil, UAE and India. As a result, the company is expected to continue receiving funding and investments, making it one of the largest fintech companies in the industry.

Favors and challenges in Stripe IPO

Stripe has received favorable reception during its business operations, and this has helped the company gain a significant edge in the market. Stripe has an extensive customer base and is among the most visible fintech companies in the industry.

While this success may seem like a cakewalk, it has not always been easy for Stripe to maintain its position as one of the leading companies in the industry. In the case of IPOs, Stripe IPOs can be a volatile process as it is predicted to be oversubscribed or overvalued. Valued at $95 billion, Stripe needs to be careful while taking the IPO route.

When is the Stripe IPO?

It has been speculated that Stripe is planning to go public in 2022. This can be verified by the fact that the company filed its intentions with the SEC in July 2021. However, the exact date is unknown and remains to be unidentified. It is advised to wait for more information about the Stripe IPO date.

Why does Stripe have a lower internal valuation this year?

It is said that Stripe’s internal valuation is falling. As Stripe is a privately held corporation and the disclosure of the information is limited, it has been tough to verify this claim. However, Wall Street Journal states that the 409A valuation was conducted around July 2021, wherein the Stripe valuation was estimated to be around $74 billion from $95 billion, a 28% drop. That being said, the reason and the accuracy of the claimed Stripe internal lower valuation are still unclear.

Stripe expansion to new market

Accelerating the growth of Stripe is one of the goals set by the company. With such strong traction in selected markets, it has become a priority for Stripe expansion in the new market. So far, Stripe has initiated expansion in Brazil and UAE, and it is expected that the company will expand its network to other emerging markets as well. Moreover, the plan to cover the European operations is expected to be initiated by the year 2022. Alongside this, Stripe is also strengthening its ties with existing partners and banks.

Crypto market

Stripe being in the fintech industry, it is not surprising that the company has plans to dive into the cryptocurrency market. Facilitating the payment gateways in the crypto market can be a huge boost for Stripe, so the company is said to be considering this option. If Stripe moves in accordance with its plans for the crypto market, the business may experience a huge change in terms of growth. In fact, this strategy can be beneficial for both Stripe and the crypto market as a whole.

Fintech Growth

The boom in the fintech industry is believed to be driven by the rapid advancements in the financial services industry and the increasing use of technology. As the traditional financial services remain slow and ineffective, the new fintech companies bring in a fresh breeze of change and growth.

Future fintech companies getting ready for IPO

Here are some of the upcoming fintech companies expected to go public.

- Klarna – Swedish fintech company Klarna has been operating since 2005 and is expected to go public soon. With the current valuation of $45.6 billion, the company is making plans to go public in 2022.

- Revolut – London-based Revolut has been operating since mid-2015 and is expected to initiate its IPO soon. As a fintech company that specializes in banking services, Revolut may file an intention to IPO soon with the current valuation of $33 billion.

- Chime – Chime specializes in digital banking services and was founded in 2013. The company is expected to go public early in 2022 with a current valuation of $25 billion.

- Plaid – Plaid is a financial technology company that provides financial services for the digital generation, including banks, credit unions, and other institutions that provide similar services. The company has been operating since 2013 and is expected to go public by 2022 with a current valuation of $13 billion.

Conclusion

Stripe, with its fintech services and huge success in the industry, is a potential company that can go IPO in the near future. With a strong customer base and extensive network, Stripe has the upper hand and is expected to continue thriving. Eqvista offers financial services ranging from business valuations to setting up an IPO, which gives the company an edge in the market. Get in touch with Eqvista to know more about the services.