Top 100 Y Combinator Companies

Y Combinator (YC) is a startup accelerator and fund. YC has made over 5,000 investments since 2005, including Airbnb, DoorDash, Stripe, Instacart, Dropbox, and Coinbase. The total value of YC companies exceeds $600 billion. YC offers training and services to help founders succeed throughout the life of their businesses. The fundamentals of launching a business are taught at Startup School. The YC batch program assists founders in developing their idea, communicating with clients, and raising funds. Working in a startup makes it simple for entrepreneurs to hire their first engineers. YC Series A assists founders with the launch of their Series A fundraising. The YC Growth Program helps founders scale their businesses and hire an executive team, while YC Continuity invests in later-stage rounds.

Y Combinator companies

Y Combinator is a venture capital firm that specializes in seed investments in early-stage enterprises. It provides finance, business consultancy, and other services to 2-4 person businesses wanting to turn a concept into a product. Y Combinator prioritizes companies with “excellent” concepts over those with expertise and a business model. In the summer of 2005, the business made its first investments. Y Combinator chooses companies to invest in and consult with twice a year. They’re based in Mountain View, California. Companies that they choose to invest typically receive $5,000 plus an additional $5,000 per founder, as well as a three-month commitment to relocate to Y Combinator’s location.

About Y Combinator?

Y Combinator is a venture capital firm that invests in businesses. Seed money is the first round of venture capital. While you’re getting started, it covers your expenses. Some businesses may only require an initial investment. Y Combinator (YC) is a technology startup accelerator in the United States that was founded in March 2005. Y Combinator is a business accelerator that invests twice a year in a diverse variety of startups. Stripe, Airbnb, Cruise, PagerDuty, DoorDash, Coinbase, Instacart, Dropbox, Twitch, Flightfox, and Reddit are just a few of the firms that have utilized it to launch.

Why do startups need a Y combinator/accelerator?

It takes more than a bright idea to start a successful business. From the beginning, you must have a complete, skilled, and experienced staff supporting your enterprise. On the other hand, most young entrepreneurs benefit from being mentored by an industry veteran who can assist them avoid hurdles that they may not perceive but which might stifle their business growth and reduce the time it takes to market products and services.

These individuals provide accelerator programs that assist companies in collaborating with sponsors in order to launch in the real world. Seed accelerators all across the world have helped to create some of today’s most successful businesses, like Airbnb and Dropbox. Here are five ways that accelerators may help entrepreneurs establish a route to success and overcome their business obstacles.

- Access to all the structural building blocks under one roof, such as mentorship, finances, technology, and legal and financial services, is one of the most valuable offerings of a seed accelerator to a startup.

- In terms of fit and quality, hiring, sales, marketing, competition, and funding, an accelerator tailors a program to the business in order to uncover the inherent dangers to its growth in the product market. It proposes to limit them, effectively de-risking startup growth and paving the way to success.

- Clients and investors are typically difficult to come by for startups at the start of their journey when they are most required. An accelerator can step in to offer its network to such critical persons in such situations. This enables companies to better understand their clients’ and consumers’ needs, work on real-world business cases in accelerator programs, and raise funding through developed connections in the investment community.

- The accelerator organizes relevant community involvement activities for young entrepreneurs that assist them with hiring, branding and enhancing their whole environment. Other companies can learn about the accelerator and its network by attending events organized by the accelerator. Working in a co-working environment has several advantages, the most important is that it provides a forum for like-minded entrepreneurs to discuss their ideas, issues, and requirements.

- An accelerator can also assist businesses to go global by leveraging their worldwide community of peers, who are known for their expertise, experience, contribution, strategic support, human and financial capital, and unrivaled networking. They will have a strong foothold in the actual world and will be well connected.

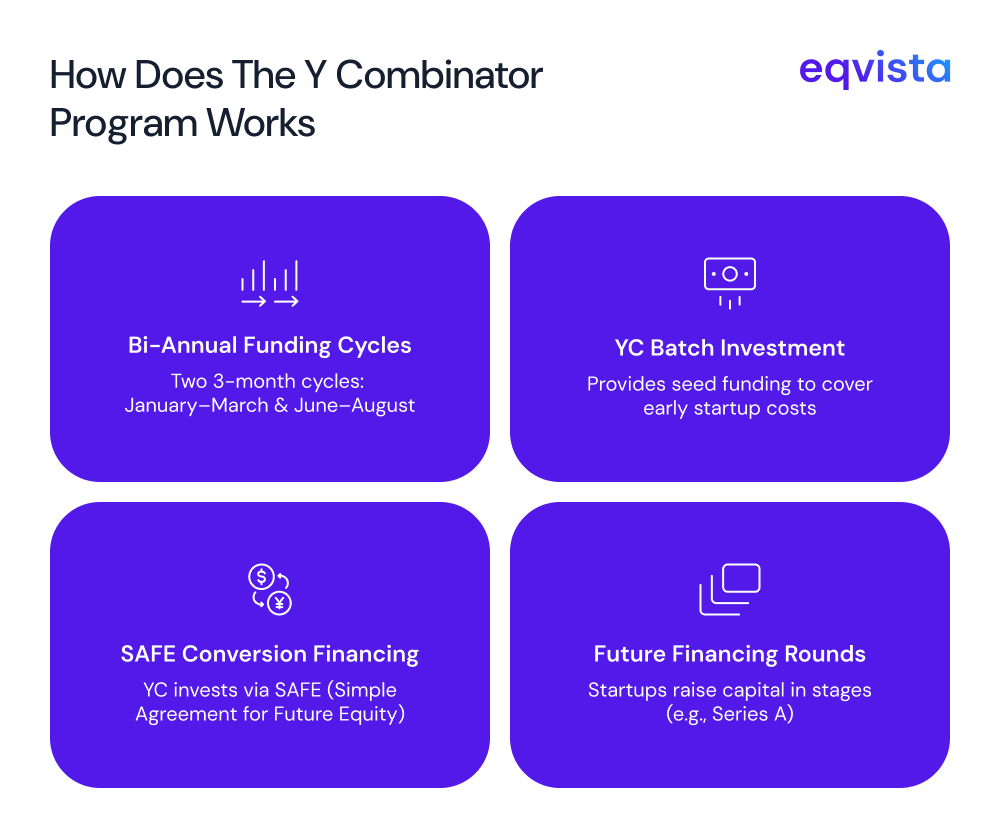

How does the Y combinator funding program work?

Y Combinator has two three-month funding cycles each year, one from January to March and the other from June to August.

- YC batch investment – Y Combinator is a venture capital firm that invests in businesses. Seed money is the first round of venture capital. It covers your expenses when you’re getting started. Some enterprises may simply necessitate a small start-up investment. Others will need to go through several rounds. There is no one-size-fits-all solution; the quantity of capital needed depends on the type of business you start. Each startup goes through a round of batches in the beginning, and subsequent funding is based on the procurement and type of business.

- Safe conversion financing – Every venture investor contributes money and assistance in some form. In their case, money is by far the least important factor. In fact, many of the startups they support do not require funding. They conceive of the money invest as being akin to financial aid in college: it’s there to help folks who really need it pay their bills while Y Combinator is going on.

- Additional future financing round – Financing is the money given to a startup or other young private company by private equity or venture capital investors. New businesses must raise cash in phases. The Series A round is often a company’s second round of fundraising, as well as the first substantial funding round in the venture capital stage. Investors who supply A round financing are frequently given convertible preferred shares.

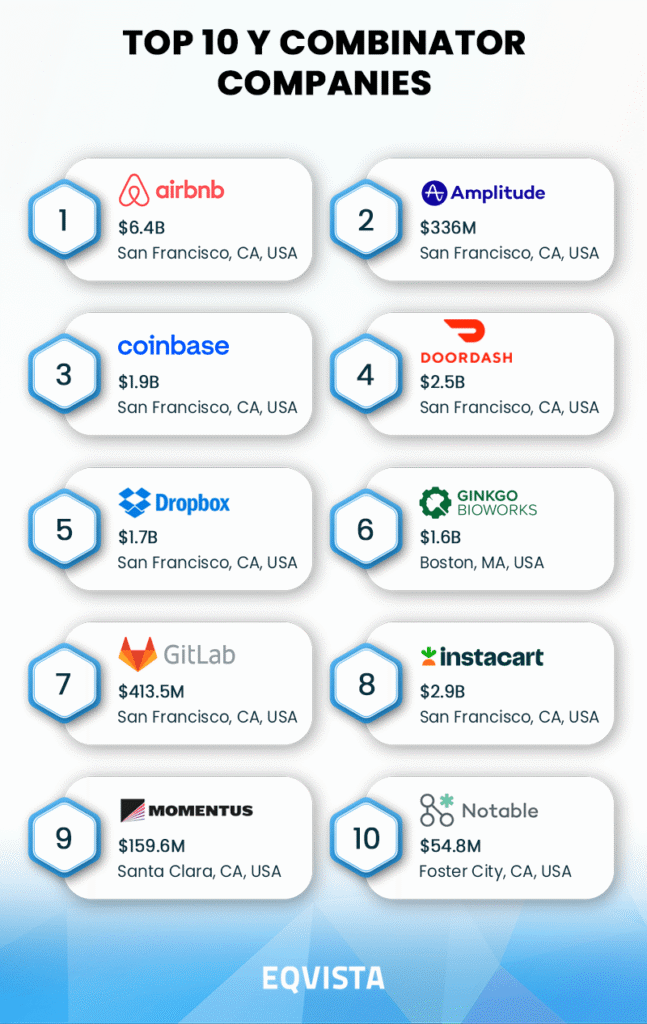

Top 10 Y Combinator Companies

Y Combinator is a venture capital firm that acts as an accelerator program for startups. The top Y Combinator graduates are as follows:

Airbnb

- Batch: Winter 2009

- Industry: Consumer, travel, leisure and tourism

- Total funding: $6.4 billion

- Current valuation: $93.95 billion

Airbnb is considered one of the most well-known companies to come out of Y Combinator. The company functions as a marketplace that connects travelers with accommodations of various types including hotels, apartments, villas, and even castles. Airbnb can provide accommodation at virtually any price point.

The marketplace spreads across more than 220 countries and has over 8 million active listings worldwide. So far, Airbnb hosts have earned more than $250 billion. Thus, to no one’s surprise, Airbnb is seen as a viable revenue stream by landlords until they can secure long-term rental income.

Over the past few years, the company has shown significant improvements in financial performance with its diluted earnings per share (EPS) improving from -$0.57 in 2021 to $7.52 in 2023.

Amplitude

- Batch: Winter 2012

- Industry: B2B, analytics

- Total funding: $336 million

- Current valuation: $961.32 million

In 2011, Spenser Skates and Curtis Liu applied to Y Combinator with the idea of a site for crowdsourcing tasks, but they were rejected by Y Combinator reviewers. However, this did not break their spirit. A year later, they came up with a text-to-speech solution, Sonalight, and joined Y Combinator’s program. However, since the market potential was limited, they pivoted to mobile analytics.

They brought on Jeffrey Wang as a co-founder to strengthen their technical team and within a few months, they launched Amplitude. Despite industry skepticism, right from the first year, Amplitude was generating revenue and tracking billions of events every month.

Currently, Amplitude is ranked number 1 in product analytics by G2 and provides digital analytics solutions to 26 of the Fortune 100 companies.

Coinbase

- Batch: Summer 2012

- Industry: Fintech, banking, and exchange

- Total funding: $1.9 billion

- Current valuation: $63.34 billion

Coinbase, the largest American cryptocurrency brokerage, was founded in 2012 by Brian Armstrong and Fred Ehrsam. Despite the initial skepticism regarding cryptocurrencies, the company grew into a Fortune 500 company in 2022.

The company reports a whopping $185 billion in quarterly volume traded and $273 billion in safeguarded assets. The crypto exchange supports over 245,000 customers in more than 100 countries. Its mission is to increase the economic freedom for more than 1 billion people.

Currently, on this platform, you can buy, sell, and store more than 240 cryptocurrencies. Here, trading is enabled for more than 300 cryptocurrency trading pairs and wallets can be funded using more than 60 fiat currencies.

DoorDash

- Batch: Summer 2013

- Industry: Consumer, food and beverage

- Total funding: $2.5 billion

- Current valuation: $43.39 billion

DoorDash is a restaurant delivery service provider that boasted a 67% market share in the United States as of March 2024. The manager of a macaron shop sparked their quest in 2012 by venting her frustration over the high volume of delivery orders and the shortage of drivers to keep up. To verify the market potential, the DoorDash team interviewed more than 200 small business owners in the Bay Area over the next few weeks.

In a short period, the team developed Palo Alto Delivery and started delivering food to students on the Stanford campus.

Since its inception, DoorDash has scaled its operations many times over. Currently, the company offers its service in more than 30 countries through 7 million active couriers.

Dropbox

- Batch: Summer 2007

- Industry: B2B, productivity

- Total funding: $1.7 billion

- Current valuation: $7.43 billion

Dropbox, the cloud storage giant, was conceived in 2006 when its founder, Drew Houston, repeatedly forgot his USB flash drive as an MIT student. A few months later, on the insistence of Y Combinator’s founder, Paul Graham, Houston teamed up with Arash Ferdowsi. After securing funding from Y Combinator, these two perfectionists spent the next year pulling all-nighters out of a small apartment, trying to build a viable cloud storage solution.

At the time, the functionality of accessing files across devices without physically transferring them was valuable from a productivity standpoint. Hence, the company attracted attention from various venture capital firms and finally, secured $1.2 million from Sequoia Capital.

On the back of this funding, in 2008, Dropbox was serving 200,000 customers with just nine employees. Fast forward to 2024, Dropbox has over 700 million users spread across 180 countries.

Ginkgo Bioworks

- Batch: Summer 2014

- Industry: Healthcare, industrial biotech

- Total funding: $1.6 billion

- Current valuation: $623.95 million

Ginkgo Bioworks, the genetic engineering pioneer, was the first biotech company funded by Y Combinator. This company differentiated itself from other synthetic biology companies by engineering organisms and licensing them over to other manufacturers instead of building massive fermentation facilities to produce the chemicals in-house.

While this was a cost-effective and asset-light business model, during their time at Y Combinator, the founders still had to work day and night to secure $1.2 million in milestone contracts to prove that customers would actually pay for this service.

Over the last decade, Ginkgo Bioworks reached many milestones such as going public, and the creation of natural food color alternatives to synthetic dyes.

GitLab

- Batch: Winter 2015

- Industry: B2B, engineering, product and design

- Total funding: $413.5 million

- Current valuation: $8.51 billion

GitLab was founded in 2011 by Dmitriy Zaporozhets as an open-source collaboration tool for developers but it didn’t join Y Combinator until 2015. This was the turning point for the company. Next year, GitLab had millions of users, its team grew from just 9 people to more than 140, and in September, it successfully raised $20 million in its Series B funding round.

By 2020, it became the world’s largest all-remote company with more than 1,200 team members. Another three years later, Gartner named GitLab a Leader in the Magic Quadrant for DevOps Platforms. In Q3 2024, GitLab achieved non-GAAP operating profitability for the first time.

Instacart

- Batch: Summer 2012

- Industry: Consumer, food and beverage

- Total funding: $2.9 billion

- Current valuation: $9.3 billion

In 2012, Apoorva Mehta conceived the idea for Instacart after his empty refrigerator prompted him to think that he could buy anything online except groceries. The Instacart story is important since the company managed to enter the coveted startup accelerator program two months late and with a single founder. After facing rejection from almost all Y Combinator partners, Mehta made his way in by sending a six-pack of beer to Garry Tan at Y Combinator headquarters via Instacart.

At inception, the company was helping local grocers from the Bay Area to deliver food. In just two years, in 2014, the company expanded to 10 additional major metropolitan cities, and in another three years, it expanded nationwide and also expanded to Canada.

Momentus

- Batch: Summer 2018

- Industry: industrials, aviation and space

- Total funding: $159.6 million

- Current valuation: $9.8 million

Momentus, the first mover in space infrastructure services space, offers point-to-point delivery of payload and a hosted payload platform. Momentus was one of the three companies selected to provide launch services for future NASA missions through a Venture-Class Acquisition of Dedicated and Rideshare (VADR) contract. The VADR contracts have a maximum total value of $300 million.

Momentus is also one of the pioneers of the Microwave Electrothermal Thruster (MET) technology that generates plasma and thrust using solar power and distilled water propellant. This technology can make propulsion significantly cost-effective, efficient, safe, and environmentally friendly.

Notable Labs

- Batch: Winter 2015

- Industry: Healthcare, diagnostics

- Total funding: $54.8 million

- Current valuation: $6.97 million

Notable Labs is working on personalized cancer treatment through a drug discovery platform focused on relapsed and refractory cancers. Their innovative approach tests combinations of FDA-approved drugs on patient-specific cancer cells to identify those that kill cancer cells while sparing healthy cells.

Notable Labs’ predictive medicine platform is powered by a vast biological response database that enables better accuracy in patient response prediction.

Through partnerships with top institutions like the University of California San Francisco (UCSF) Benioff Children’s Hospital, and MD Anderson Cancer Center, Notable Labs aims to bring new, targeted treatments to those with critical, unmet medical needs.

Complete list of top 100 Y Combinator companies

While we have covered some of the biggest companies to have graduated from Y Combinator, the program has been so instrumental that companies like Twitch, Algolia, Bellabeat, and Cruise could not make the top 10 list. If you are curious as to which other companies made the top 100 list of Y Combinator companies, check below.

| Rank | Name | Batch | Total Funding | Valuation |

|---|---|---|---|---|

| 1 | Airbnb | W09 | $6.4B | $93.95B |

| 2 | Amplitude | W12 | $336M | $961.32M |

| 3 | Coinbase | S12 | $1.9B | $63.34B |

| 4 | DoorDash | S13 | $2.5B | $43.39B |

| 5 | Dropbox | S07 | $1.7B | $7.43B |

| 6 | Ginkgo Bioworks | S14 | $1.6B | $623.95M |

| 7 | GitLab | W15 | $413.5M | $8.51B |

| 8 | Instacart | S12 | $2.9B | $9.3B |

| 9 | Momentus | S18 | $159.6M | $9.8M |

| 10 | Notable Labs | W15 | $54.8M | $6.97M |

| 11 | PagerDuty | S10 | $523.6M | $1.93B |

| 12 | Pardes Biosciences | S20 | $126.6M | $0.13B |

| 13 | Presto | S10 | $175.5M | $10.61M |

| 14 | Rigetti Computing | S14 | $298.5M | $178.80M |

| 15 | Weave | W14 | $168M | $698.43M |

| 16 | Oklo | S14 | $1.9B | $1.05B |

| 17 | Matterport | W12 | $409M | $1.35B |

| 18 | Embark Trucks | W16 | $317.1M | $70.2M |

| 19 | Lucira Health | W15 | $147.3M | $18.14M |

| 20 | Segment | S11 | $283.7M | $3.2B |

| 21 | Algolia | W14 | $334.2M | $2.25B |

| 22 | Truebill | W16 | $85M | $500M |

| 23 | Twitch | W07 | $35M | $3.79B |

| 24 | PlanGrid | W12 | $69.1M | $875M |

| 25 | Bellabeat | W14 | $18.8M | $47B |

| 26 | Cruise | W14 | $16B | $30B |

| 27 | Benchling | S12 | $411.9M | $6.1B |

| 28 | Casetext | S13 | $64.3M | $650M |

| 29 | Bird | S16 | $1B | $3.8B |

| 30 | Brex | W17 | $1.5B | $12.3B |

| 31 | The Athletic | S16 | $140M | $550M |

| 32 | Codecademy | S11 | $87.5M | $525M |

| 33 | Checkr | S14 | $679M | $5.7B |

| 34 | Lever | S12 | $123M | $98M |

| 35 | Clipboard Health | W17 | $94.1M | $1.3B |

| 36 | Heap | W13 | $218.1M | $960M |

| 37 | Sendwave | W12 | $200M | $500M |

| 38 | Deel | W19 | $679M | $12B |

| 39 | Clever | S12 | $43.3M | $500M |

| 40 | Caper | W16 | $13M | $350M |

| 41 | EquipmentShare | W15 | $3.5B | $3.8B |

| 42 | S05 | $1.3B | $10.57B | |

| 43 | Fivestars | W11 | $144.2M | $317M |

| 44 | Machine Zone | W08 | $263.3M | $500M |

| 45 | Faire | W17 | $1.7B | $12.6B |

| 46 | Fivetran | W13 | $853.1M | $5.6B |

| 47 | Optimizely | W10 | $251.2M | $1.1B |

| 48 | Flexport | W14 | $2.7B | $8B |

| 49 | WePay | S09 | $74.2M | $400M |

| 50 | Weebly | W07 | $35.7M | $365M |

| 51 | Flock Safety | S17 | $380.6M | $3.5B |

| 52 | Sqreen | W18 | $18M | $220M |

| 53 | NURX | W16 | $115.9M | $110M |

| 54 | Go1 | S15 | $413.7M | $3B |

| 55 | CoreOS | S13 | $48.1M | $250M |

| 56 | Bear Flag Robotics | W18 | $11.4M | $250M |

| 57 | GOAT Group | W11 | $492.6M | $3.7B |

| 58 | Heroku | W08 | $13M | $212M |

| 59 | Groww | W18 | $393.3M | $3B |

| 60 | GrubMarket | W15 | $499.1M | $3.5B |

| 61 | HelloSign | W11 | $16M | $230M |

| 62 | Zenefits | W13 | $584.1M | $4.5B |

| 63 | Gusto | W12 | $746.1M | $9.5B |

| 64 | Honeylove | S18 | $16M | $2.3B |

| 65 | Modern Fertility | S17 | $22M | $225M |

| 66 | Cognito | S14 | $2.1M | $250M |

| 67 | OpenInvest | S15 | $24.3M | $50M |

| 68 | Meesho | S16 | $1.4B | $3.9B |

| 69 | Mixpanel | S09 | $277M | $1B |

| 70 | Paystack | W16 | $11.7M | $200M |

| 71 | Moxion Power Co. | W21 | $124.1M | $1.5B |

| 72 | DrChrono | W11 | $60.7M | $182.5M |

| 73 | OMGPop | S06 | $16.6M | $210M |

| 74 | Newfront | W18 | $310M | $2.2B |

| 75 | North | W13 | $199.6M | $180M |

| 76 | Nowports | W19 | $242.6M | $1.1B |

| 77 | Odeko | S19 | $227M | $200M |

| 78 | GitPrime | W16 | $12.5M | $170M |

| 79 | Proxy | S16 | $58.8M | $165M |

| 80 | FutureAdvisor | S10 | $21.5M | $150M |

| 81 | Podium | W16 | $419.1M | $3B |

| 82 | Rappi | W16 | $2.3B | $5.2B |

| 83 | Razorpay | W15 | $816.3M | $7B |

| 84 | Rippling | W17 | $2B | $13.5B |

| 85 | Scale AI | S16 | $1.6B | $14B |

| 86 | Scentbird | S15 | $29.6M | $93M |

| 87 | Scribd | S06 | $106.8M | $450M |

| 88 | ShipBob | S14 | $330.5M | $1B |

| 89 | SmartAsset | S12 | $161.4M | $1B |

| 90 | Stripe | S09 | $9.4B | $70B |

| 91 | Wave | W12 | $301.7M | $1.7B |

| 92 | Webflow | S13 | $334.9M | $4B |

| 93 | Whatnot | W20 | $484.7M | $3.7B |

| 94 | Zapier | S12 | $1.4M | $5B |

| 95 | Zepto | W21 | $1.26B | $3.6B |

| 96 | Focal Systems | W16 | $41.9M | $155M |

| 97 | Mio | W16 | $17M | $1.1B |

| 98 | Daily | W16 | $11M | $66M |

| 99 | Petcube | W16 | $14.1M | $60M |

| 100 | Outschool | W16 | $240.2M | $1B |

Choose Eqvista’s precise valuations to fuel startup growth!

No one can deny Y Combinator’s legacy as one of the world’s premier startup accelerators. Over its 19-year history, it has launched and supported numerous innovative companies across industries.

Y Combinator graduates have made a significant impact on how we live, how we do business, and the technological landscape as a whole.

The program’s unparalleled ability to identify transformative startups and its adventurous and generous spirit made it excruciatingly difficult to choose just 100 out of the thousands. We are confident that Y Combinator will continue to support countless startups in the future.However, securing funding from Y Combinator can be challenging due to the high volume of applications. A valuation report from Eqvista can strengthen your application by providing a clear, data-backed assessment of your company’s worth. Contact us to know more!