File Form 8594

Want to report the sale of a business on Form 8594? Eqvista can help you!

Both the seller and purchaser of a group of assets that constitutes a trade or business must file Form 8594 to report asset purchase and sale, if such assets have or may have goodwill or going concern value, and the purchaser’s basis in the assets is solely determined by the purchase price.

Form 8594

The IRS has established Form 8594 for the purpose of reporting the sale of a business. Both the buyer and seller are required to file Form 8594 together with their respective individual income tax returns. The residual technique is used to assign the whole selling price of the firm to asset classes on Form 8594. By submitting Form 8594, you transmit the following information to the IRS:

- The purchasers’ depreciable basis in the transferred assets

- How the seller determined whether there was a gain or loss

When do you need to file Form 8594?

In most cases, you should include Form 8594 with your income tax return for the year in which the sale happened. If the value of an asset is increased or lowered after the year of the sale, the seller and/or purchaser (as applicable) must complete Parts I and III of Form 8594 and attach the form to the income tax return for the year in which the increase or decrease is reflected.

Filing Form 8594

When a business is sold, both the buyer and seller have to file Form 8594 together with their tax returns. This is used by the IRS to allocate the sale of the business into different asset classes.

What information is required to file Form 8594?

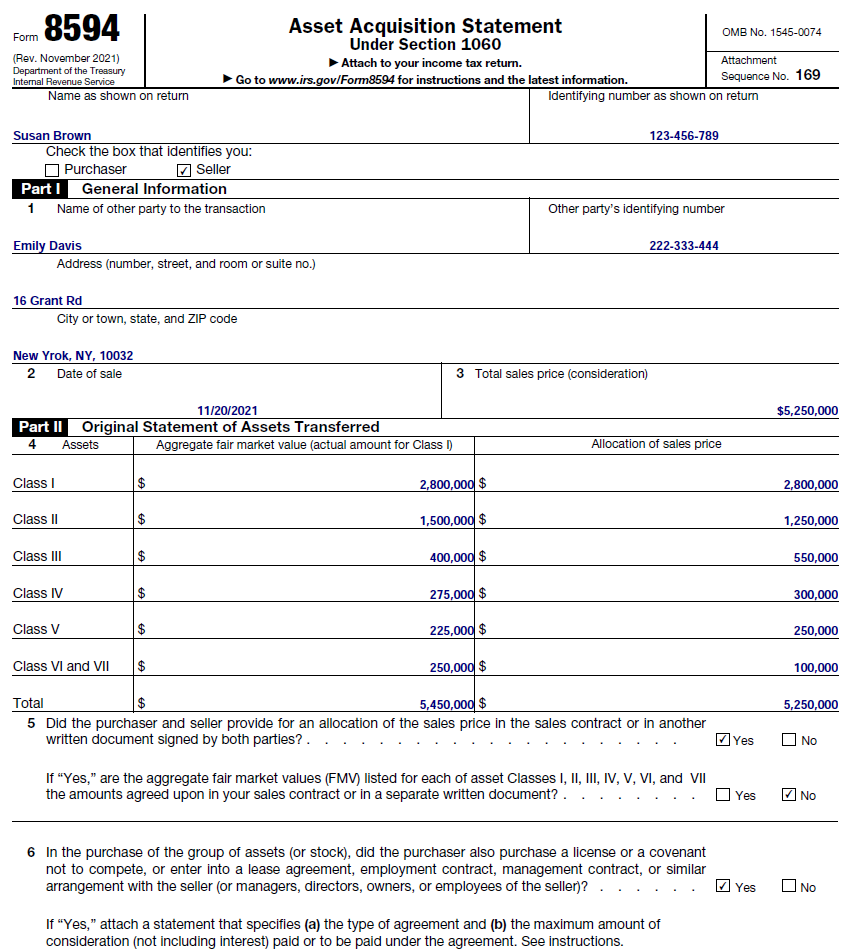

There are three parts in Form 8594. Completing Parts I and II create an original statement. Parts I and III are of a Supplemental Statement. At the top of the form, enter your name and Taxpayer identification number (TIN). Then select Buyer or Seller. Here are the other form 8594 instructions:

- Part I: General Information

- Line 1: The opposite party’s name, address, and TIN (purchaser or seller). You must input the other party’s TIN. If the other party is an individual, enter their Social Security Number (SSN). If the other party is a corporation, partnership, or other legal entity, enter its EIN (Employer identification number).

- Line 2: Enter the date of the asset sale.

- Line 3: Total consideration paid for the assets

- Part II: Original Asset Transfer Statement

- Line 4: Enter the total fair market value of all assets in a class and the total sales price allocation. Enter the combined fair market value of Classes VI and VII and the percentage of the sales price given to each.

- Line 6: Both parties must sign this line. Assume that all contingencies stipulated in the agreement are met and that the consideration paid is the greatest amount possible. If the maximum consideration cannot be determined, state the computation method and payment duration.

- Part III: Supplemental Statement – Part III must be completed and filed for each year of increased or decreased consideration. See also When To File and Reallocation after a change in consideration. Explain the increase or decrease in allocation. Indicate the tax year(s) and form(s) used to file the original and any Supplemental Statements. Enter “2021 Form 1040”.

Asset classes on Form 8594 (seven classes)

The overall selling price of a business is allocated among these seven asset groups, with each asset class receiving its fair market value. The first column is fair market value, and the next column is the sales price for each asset class.

- Class I – Cash and General Deposit (checking and savings)

- Class II – Personal Property That Is Actively Traded & Certificates of Deposit

- Class III – Debt Instruments

- Class IV – Inventory

- Class V – Fixtures, Vehicles, Real Estate, and Equipment

- Class VI – Section 197 Intangibles

- Class VII – Value of Goodwill and Continuity of Business

These include the company’s reputation and its assets’ capacity to create a return on investment.

Sample of Form 8594

Note: Information is for presentation purposes only.

Consequences if For 8594 is not filed correctly

You may be subject to penalties if you fail to file a correct Form 8594 by the return’s due date and cannot demonstrate sufficient cause. Incomplete and inaccurate information returns filed with the IRS may result in significant fines under the Internal Revenue Code. The most well-known information returns are the multiple variants of Form 1099 (used to record payments to independent contractors and interest income) and Form W-2 (used to report employee wages).

Easily File Your Form 8594 With Eqvista

It is essential to keep track of your assets when filing Form 8594. Asset management can be time-consuming, which is why Eqvista is the ideal solution for managing your assets and shares.

Eqvista is a recognized expert in providing defensible services for associations of all sizes, industries, and stages. In addition to being NACVA-accredited, we have a staff of highly qualified specialists who devote themselves to each case. To provide you with the most accurate and reliable valuation report, our team is equipped with the necessary credentials, training, and expertise.

Pricing starts at $390

Eqvista’s File Form 8594 service starts at $390, which includes full customer service support from NACVA certified analysts. The filing is a seamless process and is conducted professionally and timely. Contact us now for more information.

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!