RSA vs RSU: All You Need to Know

There are two popular stock bonus structures in the market – restricted stock units (RSUs) and restricted stock awards (RSAs).

Over the past 10 years, firms have been changing the way they structure their corporate stock options and how these are used in the market. The reason behind this is the ever-changing rules and regulations that have impacted these companies. Currently, there are two popular stock bonus structures in the market – restricted stock units (RSUs) and restricted stock awards (RSAs).

By the end of this article, you will have a better understanding of these two stock options and the difference between them. It is very important for you, either as a founder or employee of a firm, to know how a RSA vs RSU function as incentives for employees in the company.

Understanding Restricted Stocks

Restricted stock options are very different from normal stock options. Regular stock options offer you the right to purchase a limited number of shares at a predefined price. But in this case, you do not become the owner of the shares until you have bought them. On the other hand, with restricted stocks, you own the shares from the first day they are issued.

The stocks are “restricted” as you will still have to earn them after they have been issued. A common restriction on these restricted stock include a vesting schedule, where the shares are earned over time. This type of plan incentivizes employees to stay with the company longer. And if an employee leaves the company early, the company can repurchase the stock back.

There are two main kinds of restricted stocks – Restricted Stock Units (RSUs) and Restricted Stock Awards (RSAs). Let’s first cover RSAs.

Explaining Restricted Stock Awards or RSA

As mentioned above, a restricted stock award (RSA) is a type of restricted stock. It is a grant of the company stock where the rights of the recipient are restricted until the shares are completely vested or there is a lapse in the restrictions.

To help you understand the concept better, let us take an example. Tony works in a company and receives RSAs. He is one of the first five employees in a startup company. And since the company does not have enough capital to pay high salaries, they offer Tony RSAs as a part of his employment package.

These RSAs are also given to Tony on the grant date. Normally, RSAs are issued to the early employees before the company enters its first equity financing round, where the FMV of the common stock is low. The RSAs offer the individual rights to purchase shares at FMV, at no cost on the grant date, or at a discount.

On the grant date, the employee “owns” the stocks associated with the RSA. But it all depends on the nature of the offer, and the conditions of the restrictions. So, the employee might end up purchasing them even after they are granted the shares. The purchase condition is why the RSAs are considered as “restricted.”

Explaining Restricted Stock Units or RSU

A restricted stock unit (RSU) on the other hand is compensation offered to an employee as company stock, and received later when the vesting is complete, unlike RSAs given on the grant date. The restricted stock units are issued to an employee through a vesting plan and distribution schedule. The employees then get the shares when they meet the requirements in the plan. The requirements can include achieving performance milestones or staying with the company for a particular length of time.

When an RSU is granted to an employee, it does give them an interest in the company’s stock, but it does not have any tangible value until the vesting is complete.

To help you understand this better, let us take another example. Larry is another employee in the same firm as Tony, but joins seven years later. At this point, the company has become very successful and the share price has increased. Along with a great salary, the company decides to offer Larry with RSUs as a part of their offer.

The RSU is common stock and would be delivered at a future date, based on the performance conditions and vesting schedule in the plan. So, Larry would not get the shares until the conditions are met. Unlike RSAs, when an employee is granted an RSU, it is a promise to the employee from the company to give the shares at a later date.

Exactly when Larry would receive the RSU shares can be a specified date in the future, a liquidation event, a vesting date or a combination of these. The future date is set when the RSUs are granted. Additionally, unlike an RSA, the RSU holder does not have to pay anything to own the shares, apart from any relevant taxes.

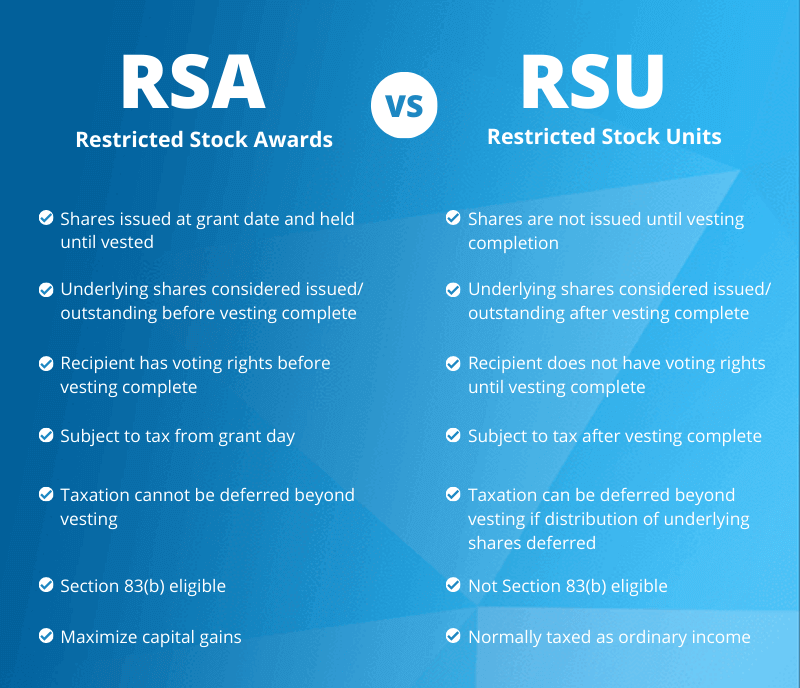

Key difference between RSA and RSU

Even though both an RSA and RSU are types of restricted stocks, they have many significant differences. First off, an RSA is a grant which gives the employee the right to buy shares at the FMV, at no cost, or at a discount. On the other hand, an RSU is a grant valued in terms of company stock, but you do not actually get the shares until the restrictions lapse or vest. As soon as these conditions are met, the shares are given to the employee in the form of stock or cash as outlined in the plan.

But that is not all. There are a lot of tax compliance and legal differences between the two, as below:

- Since RSAs are bought on the grant date, they are subjected to tax from the grant day. RSUs on the other hand, are not purchased. Due to this, the tax is delayed until the shares are granted after the vesting schedule.

- RSUs have a lot of vesting conditions until the employee becomes the owner of the shares, while RSAs have time-based vesting conditions.

- RSUs are not eligible for the 83(b) elections and are taxed when they vest, while the RSAs are eligible for a 83(b) election.

- The unvested RSU shares are forfeited back to the company instantly upon termination, while unvested RSA shares are subjected to repurchase upon termination.

Finally, the RSU shares release can be deferred until a later date which is not the case for RSA shares. Moreover, the employee of the company has to pay the minimum taxes as determined by the employer upon vesting. But the complete payment of all the other taxes can be deferred until the time of the distribution or when you actually get the shares or its cash equivalent which is all based on the company’s plan rules.

In short, there are a lot of differences between an RSA vs RSU, which is why it’s good to research more about these restricted stocks before issuing them in your company.

Vesting: RSA & RSU

Both RSA vesting and RSU vesting are different to a great extent. Vesting means that the person getting the shares will have to earn the shares over a period of time. To help you understand the difference between RSA vs RSU vesting, each has been explained below in detail:

RSA vesting

The person who gets RSA shares owns them, but the vesting for RSAs affects whether the company can repurchase the shares if the person leaves the company. A lot of companies have vesting schedules in place to avoid a case where an employee joins the company, gets their RSA award, and then leaves the company instantly after getting the award.

RSU vesting

RSU shares aren’t issued to the recipient until they vest. The moment the company grants the RSUs, they are promising to issue those shares later on as per the vesting schedule. These might also be subject to other conditions in the company in order for the RSUs to vest.

For example, a liquidation condition states that the company has to be acquired or undergo an IPO before the shares would vest. The employees would need to satisfy the time-based vesting schedule and the liquidation condition before their shares would be vested. In short, RSU vesting has many more conditions as compared to RSA vesting.

How does termination affects RSUs and RSAs?

To understand how a RSA vs RSU works, let us also understand what happens when there is a termination event using the same example of Larry (who was offered RSUs) and Tony (who was offered RSAs). Each has been explained below. Just note that both Tony and Larry are partially vested upon termination.

Termination and RSAs

Tony keeps all of his vested shares during a termination event. Nonetheless, the unvested shares are subject to a company repurchase, where the company can purchase the shares back from Tony. And in such a case, companies usually repurchase the shares at the same price at which the employee paid for them.

Note that the company has the right, but not the obligation, to repurchase the shares from the employee. So, if the company decides not to repurchase the shares back, they can offer it to the employee instead.

Termination and RSUs

Larry would also get to keep his vested shares, but there is one thing to keep in mind. The restricted stock units are usually subjected to additional vesting conditions such as a liquidation event. It is also possible for the time-vested shares of Larry to expire before both the conditions are met. In case the shares expire before the company is acquired or it gets IPOs, Larry would not be allowed to keep the time-vested shares.

Taxation: RSA & RSU

As RSAs and RSUs have a lot of differences when it comes to the vesting conditions and the termination events, the same is true when it comes to how they are taxed. To begin with, there are two kinds of taxes to consider when talking about equity compensation. This includes the capital gains tax and the ordinary income tax. The main thing that we need to remember is that the capital gains tax rate is much lower than the income tax rate.

RSA taxation and RSU taxation can be confusing and complicated. It is important for both the owners and employees to know all about the taxation rules of these forms of equity compensation. It would help the employees save a lot of money for taxes, as whenever the company pays their employees in salary, benefits, or equity, the employee would owe tax to the IRS.

RSA taxation

Taking the example of Tony again; when Tony was offered RSAs by his company, he had to pay for this RSA shares to own them outright. And since Tony paid for the shares on the vesting date, he is not receiving any additional value from the company shares. Therefore, he does not have to pay taxes on the RSAs when they vest.

As time passes, the value of these shares would eventually increase. Once they do, Tony will have to pay taxes on the gain. Let us say that Tony gets the share at $1 per share and by the time they vest, the value of it is $5 per share. In this case, the taxable gain would be $4 ($5-$1). Any taxable gain between the grant date and vesting is subject to ordinary income tax.

The moment the shares vest, Tony would own them, and any subsequent gains between the ultimate sale date and the vesting date is subject to capital gains tax. The basic point to keep in mind is that the employee would pay taxes on the shares they get when they vest. However if the shares become worthless, you will bear all the losses on this. If you’ve already paid the taxes for the RSAs, the IRS will not refund your payment.

But fortunately, there is a solution for such a case, and it is through the section 83(b) election. It has been explained in detail below.

Section 83(b) Election

As per the 83(b) election, an employee can choose to pay all the ordinary income tax upfront to the government for the RSA obtained.

But it is important to note that there is a 30-day deadline from the grant date to file an 83(b) election. After this time passes by, the employee will not be able to file the election. Let us get back to Tony, and assume he decides to file the election and pays tax at the grant date. In this case, his taxable gain would be zero at grant since the FMV of the share is the same as what he paid (which is $1).

By filing the 83(b) election, Tony will choose to recognize ordinary income tax upfront. And since the taxable gain is $0, Tony pays no ordinary income tax for the shares he obtained. Even when the shares vest later on, Tony would not have to pay ordinary income tax, even if they increase to $10 per share. Instead, he will have to pay capital gains tax on the full $9 gain ($10-$1) when he sells the shares. This is good for Tony (or any other employee in such a situation) for two reasons:

- He would not be in the risk of paying taxes on illiquid shares that cannot be sold later on

- The capital gains tax has a much lower rate than the standard income tax

So, in the end, Tony would pay a lot less for the RSA taxation by choosing the section 83(b) election. Now let’s take a look at how RSUs are taxed.

RSU taxation

The main thing to know about RSU taxation is that you will have to pay standard income tax when your shares vest. This is the same as the RSA taxation if the section 83(b) election isn’t made.

Now using the example again, Larry was granted with RSUs and the FMV was at $10. Since he does not get any shares on the RSU grant date, he is not responsible for paying taxes on that $10. So, the taxable gain is $0 on the grant date.

Instead, Larry will pay ordinary income tax on the full FMV when his RSUs vest, say at the FMV of $20. But why does Larry have to pay ordinary income tax on the full FMV of $20 when Tony only paid taxes on the $4 gain for his RSA? This is because Tony paid $1 upfront when he was given his RSA. But similar to Tony’s RSAs, Larry would pay capital gains tax on the difference between the $20 FMV, and the ultimate sale of the stock, say at $25.

Keep in mind that restricted stock units usually have multiple vesting conditions. In the example shared here about Larry, we assumed that there is only one condition, a time-based one. But if there is a condition of the liquidation of the company in the vesting schedule, things would change. Let us assume that there is a liquidation requirement as well and Larry sells his RSUs at the same time it vests. In this case, he will have to pay the standard income tax on the complete value of his RSU ($25) when it sells, as the liquidation requirement isn’t fulfilled until the time of sale.

Issue and manage your shares with Eqvista!

In the end, you need to know that timing is the key for both RSAs and RSUs. Hopefully by now you have a better idea and understanding about the differences between the two, and how to make a plan for their vesting schedules and taxation.

To learn more about them or to find out how Eqvista can help you, contact us here and our representative will reach out to you soon!

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!