RSUs vs PSUs: Comparing Equity Compensation

This article will guide you on the comparison and provide important factors to consider when choosing between RSUs and PSUs.

To attract and retain talented workers, several startups now include shares of ownership in their remuneration packages. Stock ownership in a firm may be lucrative, but before accepting an equity offer, you should do your research. The value of the stock in question as of the date of vesting is the amount that must be reported as taxable income.

In the continued effort to recruit and retain important personnel and reward excellent performance in the workplace, firms have increasingly resorted to different types of stock awards in recent years. When it comes to executive pay schemes, many people find RSUs and PSUs to be more desirable than real stock because of their unique properties.

But to make an informed decision about the compensation structure of your company you must know the key differences between RSUs and PSUs. This article will guide you on the comparison and provide important factors to consider when choosing between RSUs and PSUs.

Equity compensation and its importance in employee compensation packages

Most people consider a job offer’s wage and benefits package before making a final decision. In the IT and biotech industries, particularly at startups, “equity compensation” is sometimes included in employment offers, in addition to base salary and other benefits. Supplementing your pay with stock remuneration is an option at public as well as private firms. Startups often include equity pay as a component of their salary packages as a means of enticing new workers to commit to the firm.

Equity compensation is a common tool used by startups to attract and retain high-caliber workers. Many new businesses lack sufficient capital yet can issue shares at whim to compensate investors. The firm benefits greatly from this arrangement since it avoids the expense of wage payments, which might hurt its cash flow in the beginning.

What is RSU?

A Restricted Stock Unit (RSU) is a promise by an organization to a worker that the employee will be awarded shares at a future date (the vesting date) if specific requirements are met, such as the employee remains employed by the company for a certain minimum time frame or attaining objectives for performance.

The vesting of shares is sometimes contingent on certain events, such as an initial public offering (IPO) or a formal takeover of the firm by another entity. Let’s understand more about it in this section.

Advantages and Disadvantages of RSUs for Employees

The following are some of the benefits of RSUs, as seen from the point of view of an employee.

- RSUs are a very simple equity compensation structure. Awardees will have no trouble understanding the vesting process or determining what their award is worth.

- The recipients will get free shares. It means there will be no need for them to purchase any kind.

- Even if the FMV of the shares decreases between the time of award and the time of vesting, the recipient will always have retained value since they did not pay for the shares.

The disadvantages of an RSU for an employee include the following aspects:

- The tax implications of vesting for employees of private companies can be complex.

- If an employee departs before their RSUs have fully vested, they will often lose out on the unvested portion.

- The stock’s worth may turn out to be less than expected if the FMV upon vesting is lower than expected.

Advantages and Disadvantages of RSUs for Employers

From the perspective of an employer, the following are some of the advantages of RSUs.

- Most employees won’t want to quit the firm while retaining their RSUs, forfeiting the share that hasn’t vested, thus these incentives incentivize workers to stick around for the company’s mid-term goals.

- The administrative burden of tracking and documenting RSUs is lower than that of real stock. Keep in mind that a Restricted Stock Unit (RSU) is nothing more than a promise. You are promising payment with no initial outlay on your part.

For an organization, RSUs have the following drawbacks:

- Employers don’t know the eventual value of RSUs at the time of issuance since the stock is only valued at the time it vests.

- If the value of the stock does not rise much over time or even falls, workers may feel less inspired than they did before.

What is PSU?

To better align executives’ and managers’ interests with those of shareholders, performance shares are often offered to them. As they provide management with a clear incentive to concentrate their efforts on generating shareholder value, performance shares have objectives comparable to those of employee stock option plans (ESOPs).

Performance shares, unlike standard stock-option schemes, provide managers with company equity or stock options in exchange for fulfilling goals.

Advantages and Disadvantages of PSUs for Employees

Most of the benefits and drawbacks discussed for RSUs are equally applicable to PSUs due to their similarities. Concerning PSUs, the following are also worth mentioning. Among the benefits for workers is the opportunity to amass personal wealth in tandem with the success of the firm via performance shares.

Advantages and Disadvantages of PSUs for Employers

The following are some of the benefits that PSUs provide to companies:

- PSUs have the potential to serve as an efficient incentive and reward tool.

- By giving employees a stake in the firm, this equity incentive may bring about a closer alignment of employee and company interests.

And the disadvantages of PSUs for an employer are:

- Performance shares may be fairly expensive for the business, depending on the conditions.

- There’s also the possibility that workers would act recklessly if they know they’ll be rewarded soon, even if it’s not in the company’s best interest.

Comparing Equity Compensation: RSUs vs PSUs

When an employee receives an award of restricted stock, they usually agree to stay with the firm for a certain length of time. When an employee receives an award of performance shares, they get their shares depending on the success of the company.

RSUs Vest based on time, employees receive shares after a specified period of continued employment. Vesting is predictable and usually faster, making RSUs attractive for retention. On other hand PSUs vest only if specific company performance goals are met (e.g., revenue, earnings per share, total shareholder return), often over a multi-year period. The number of shares awarded can increase or decrease depending on performance.

RSUs have a lower risk for employees, as they are likely to receive shares as long as they remain employed through the vesting period. They always have value unless the company stock becomes worthless. Regarding PSUs, having higher risk, as employees may receive fewer or no shares if performance targets are not achieved. However, there is potential for higher rewards if targets are exceeded.

When it comes to primarily encouraging retention and loyalty, with less direct linkage to company performance. On the other hand PSUs strongly incentivize employees to achieve key company objectives, directly tying rewards to business outcomes.

Key differences between RSUs and PSUs

| Feature | RSUs | PSUs |

|---|---|---|

| Vesting Condition | Time based | Performance based |

| Motivation | Retention | Performance |

| Complexity | Simpler to understand and administer | More complex,requires defining and tracking metrics |

| Reward certainty | Guaranteed value if employed at vesting | Variable payout;may be zero if targets not met |

| Payout | Fixed number shares upon vesting | Number of shares depends on performance level |

| Taxation | Taxed as ordinary income at vesting | Taxed as ordinary income when shares are delivered |

| Common recipients | Broad employee base,including managers | Typically executives and senior leaders. |

RSUs and PSUs are taxed as ordinary income when shares are delivered or vested, based on the fair market value at that time. Any kind of gains or losses will be subject to capital gains tax.

How to Choose Between RSUs and PSUs

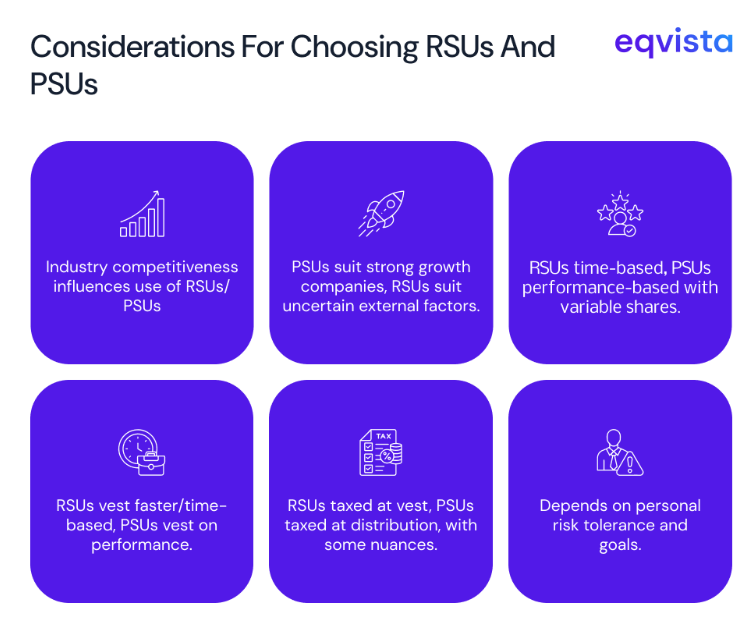

The following are a few key considerations to take into account when deciding between Restricted Stock Units (RSUs) and Performance Stock Units (PSUs).

- Industry – Industry competition should influence employee decisions. Companies may employ RSUs or PSUs in highly competitive sectors as a means of attracting and retaining top personnel. For this reason, workers in this situation may wish to compare the prospective worth of RSUs and PSUs to the pay packages given by competitors in the same sector.

- Growth prospects – New product lines, market expansion, and technological or process innovation are major growth drivers. PSUs may be a smart option if the firm has a strong growth track record. RSUs may be advantageous if the company’s development depends on unexpected external variables like regulatory policy or customer preferences.

- Performance Metrics – The value of RSUs is determined purely by the stock price of the firm, and there are often no performance criteria associated with them. But the value of PSUs relies on whether or not certain targets are attained, such as growth in sales, profits per stock, or return on equity.

- Vesting Schedules – RSUs vest gradually, whereas PSUs vest depending on performance. RSUs vest faster than PSUs. The shorter vesting term may benefit individuals who want shares sooner.

- Tax Implications – RSUs and PSUs are subject to a variety of tax repercussions when they are cashed in. PSUs are not subject to taxation until they are distributed, but RSUs are subject to taxation when they become vested based on their value in the open market.

- Employee Preferences – When deciding between RSUs and PSUs, it’s crucial to take employees’ preferences into account. Employees’ compensation choices may vary widely based on their financial situations, risk aversions, and long-term objectives.

Note:

- RSUs: Best for retention, guaranteed value, simpler structure.

- PSUs: Best for performance alignment, variable reward, more complexity.

How to negotiate equity compensation packages that include RSUs or PSUs

To negotiate equity compensation packages that effectively, consider the following expert strategies:

Build a Strong Case for Your Value

One of the keys to successfully negotiating equity is developing a compelling case for your worth to the firm. You might highlight your unique set of abilities and professional experience to set yourself out from the competition. You might also share your expectations for your time here and why you’re looking forward to working for this specific organization.

Research Market Standards

Include any pertinent research findings, such as average salary or benefits packages, in your presentation and discussion. Your stake in a corporation might be represented in the form of a percentage or a fixed number of shares. Check to see whether the vesting schedule works with your anticipated time commitment to the organization.

Understand the Equity Structure and Vesting

Regardless of whether or when more investors buy the stock at a later date if the corporation records your intended equity as a fixed number of shares, you will possess exactly that many shares. It is important to remember while all aspects of the pay package may be up for negotiation, you may choose to focus on only the equity portion of this discussion.

Counteroffer Confidently but Fairly

Always make a counteroffer if the initial equity offer seems low. Approach negotiations in good faith, avoiding unreasonable demands or ultimatums, as this can harm your relationship with the employer.

Use Polite, Clear Language, and Be Prepared

Ask for RSUs or PSUs politely and clearly, making your case based on your contributions and market data. Reading negotiation guides like Getting to Yes or Never Split the Difference can improve your approach and confidence.

Don’t Trade Away Salary for Equity

Ensure your equity compensation is in addition to a fair base salary. Equity should supplement your pay, not replace it, especially since RSUs and PSUs vest over time and come with some risk.

Get expert help to manage your stock compensation!

Employees of private companies may receive a portion of their compensation in the form of stocks, RSUs, stock options, or additional securities issued by the company. The utilization of equity compensation is a potent strategy that companies can employ to incentivize and retain their workforce.

Looking for reliable equity management software? Eqvista is here to help you. As one of the top market leaders, our software makes it a breeze to issue, track, and manage any kind of employee equity plan. To elevate your equity compensation and financial reporting, contact us now!

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!