How Patent Valuation Secured Funding for Innovative Startups?

Investors are always looking for innovative startups that could disrupt their respective industry segments. Such startups can potentially capture a significant portion of value creation in a particular industry. However, more often than not, innovative startups will not have financial performance or market-tested solutions to bolster their claims. Instead, they would rely on their patent portfolio to demonstrate their potential.

Without patent valuations, innovative startups cannot establish their patent portfolio’s financial value, their innovative potential, and the competitive edge and market viability of their product. According to a study by the European Patent Office (EPO) and the European Union Intellectual Property Office (EUIPO), the odds of an early-stage startup raising funds rise by more than 10 times when they hold patents and trademarks.

In this article, we will go over the role of patent valuations in startup funding and how patents have secured startup funding in the past.

Patent valuation and startup funding

Startups, especially early-stage startups, cannot raise money solely based on their financial performance. Mature companies would easily provide better margins and stable stock prices. However, startups offer investors exceptional returns. Instead of focusing on marketing their product and earning revenue, early-stage startups are focused on building a valuable product. At later stages, startups raise money based on their ability to scale operations.

To ensure that their product is not imitated by competitors, startups can get patents for the technology and the products they develop. In fundraising rounds, potential investors would want to verify the validity of the patents held by a startup.

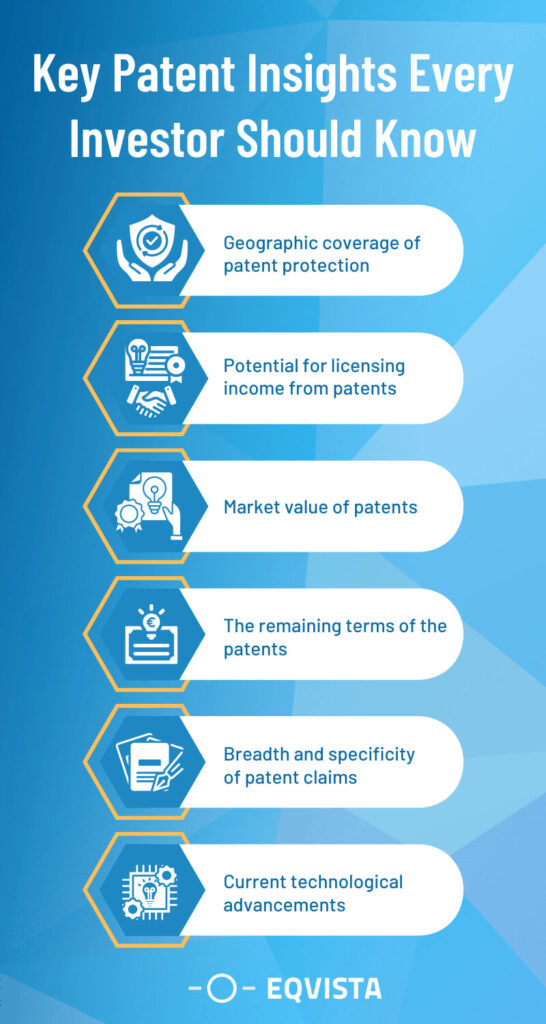

Some important facts an investor will want to check with respect to patents are given in below infographics:

Such facts are verified, analyzed, and summarized in a patent valuation.

How does patent valuation secure funding for innovative startups?

Patent valuations can bolster your claims regarding your innovative solutions and products, and help you gain an advantage in fundraising rounds. Some of the benefits of patent valuation for innovative startups are as follows:

- Demonstrates Unique Value: You can demonstrate the unique and innovative aspects of your startup’s technology and its potential to revolutionize the market through a patent valuation. This would make your startup more attractive to investors seeking novel solutions.

- Reduces Competition Risk: Patent valuations involve measuring the amount of protection against imitation and copycat products gained through patents. It also measures the amount of competitive advantage gained. Such evaluations play a key role in establishing your startup’s value in fundraising rounds.

- Strengthens Market Position: Patents can potentially give your startup exclusive rights to certain innovations. If these innovations catch on in the market, they can be an important source of product differentiation. Accurate assessment of such benefits can be effective in fundraising negotiations.

- Higher Valuation: While startups are not judged on their financial performance, they are expected to create innovative solutions. Without patent valuations, it is challenging to ascertain the value of the solutions a startup provides. Hence, startups that get favorable patent valuations secure higher fundraising valuations than others.

- Attracts Specialized Investors: You can focus on developing a concrete solution rather than bringing in revenue only if your investors have the same goals. A good way to attract investors who support product development is by demonstrating the value of your research and development (R&D) results via independent patent valuations.

- Mitigates Legal Risks: Accurate patent valuation helps identify and mitigate potential legal risks associated with intellectual property disputes. This assurance of legal safety can be a decisive factor for investors considering funding a startup.

- Reduces Bankruptcy Risk: Patents are assets that can generate revenue without incurring further costs and in times of financial distress, they can be sold for millions to keep the boat afloat. Since investors would like to know the exact potential of a patent to reduce bankruptcy risk, patent valuations are necessary.

Patent Valuation: Startup success stories

Some notable cases where startups were able to raise funds based on their patent portfolio are as follows:

Theranos

- In 2003, Elizabeth Holmes, a Stanford University dropout, founded Theranos, a healthcare startup offering blood-testing technology that could perform numerous medical tests quickly, cheaply, and with just a few drops of blood.

- Holmes was listed as an inventor for 544 of Theranos’ patents, possibly to capitalize on her popularity.

- Theranos’ extensive patent portfolio and charismatic leader helped the company raise over $700 million, reaching a $9 billion valuation with investors like Rupert Murdoch and Larry Ellison.

- Theranos’ downfall began with a Wall Street Journal article exposing that Theranos had not achieved the necessary technological advancements to meet its vision.

- Subsequent publications and government investigations further revealed Theranos’ exaggerated claims.

- The founders faced federal charges, and Theranos ceased operations in 2018.

Conclusion

From the Theranos story, we can learn that misvaluing intellectual property rights can have grave consequences, especially for investors. Another lesson is that a company’s patent portfolio has a huge sway over its valuation.

Magic Leap

- Magic Leap is an augmented reality (AR) startup catering to both industry professionals and casual users.

- The company markets solutions for professionals in manufacturing, architecture, engineering, construction (AEC), and healthcare.

- Magic Leap’s solutions enhance the ability to visualize complex scenarios and 3D data and prepare for complex surgical maneuvers.

- Before launching a full-fledged product in June 2020, they had raised almost $3 billion.

- The untapped potential of the AR market, lack of significant competitors, and a huge portfolio of patents contributed heavily to Magic Leap’s fundraising success.

- According to GreyB, Magic Leap has filed over 8,000 patents globally, with more than 4,000 granted.

Top 10 technologies for which they hold patents

Source: GreyB

- Despite low sales of its first product, the company raised additional funding from Saudi Arabia’s Public Investment Fund in late 2021.

- Magic Leap is currently exploring the possibility of licensing its patented technology to earn royalties.

Conclusion

Magic Leap is a 14-year-old startup that has yet to commercialize its product in a significant way. They have been able to raise funding even after their products did not do well in the market. This would not be if their patent portfolio was not highly valued by the investors.

Boost your fundraising effort with Eqvista’s patent valuation!

The importance of patent valuation for startup funding cannot be underestimated. They play a key role in establishing the growth potential of a startup and the level of protection it has against competition. They also demonstrate how efficient a startup is at utilizing investments made for research and development (R&D) and how close it might be to commercializing.

Companies like Theranos, Magic Leap, and Nantero were able to secure funding mainly because of their extensive patent portfolio. If you would like to follow in their footsteps and need a patent valuation for startup funding, contact Eqvista, a valuation expert, on this page!