Issuing Company Stock to US Contractors or Consultants

There are different rules when it comes to issuing shares and company stocks to US contractors and US consultants. They are both third parties but they play big roles in a company’s development. For most companies, especially startups, they offer stocks to contractors and consultants to give them some ownership of the company. By doing this, the company can motivate them to be more proactive and have them committed to the company for a long time.

In this article, we discuss the different types of stock options that can be given to US contractors and US consultants, and how to determine the price or value of shares in order to avoid any discrepancies.

Issuing company stock to US contractors or consultants

Companies may choose to compensate independent contractors with company stock in the form of stock options, restricted shares, or outright stock grants in certain circumstances. This is especially common among startups that do not have a lot of cash on hand and private companies that plan to go public in the future. Shares can be issued by companies to any independent contractor.

Why do companies offer stocks to contractors/consultants?

The companies offer stock to contractors and consultants so that they can get ownership over the shares in the organization itself. This enables them to be more proactive towards the companies. The US consultants or contractors are both third parties for them but still play a major role in the company’s growth. The rationale behind the offer is evident.

As a means of financing the business, companies may offer bonds or stocks to investors. Companies should evaluate two important strategic factors when evaluating if it is a smart idea to pay an independent contractor with company stock:

- Contractor stock ownership (whether through a limited or outright stock grant or stock options) does not create a conflict between the contractor’s interests and the company’s or other shareholders’ interests.

- The sums of stock involved never amount to a significant enough percentage of the company to raise a question about who controls it.

When creating a stock-based compensation agreement with a contractor, there are various factors to consider. Whatever the case, businesses should engage with tax and legal advice to ensure that these arrangements comply with applicable rules and regulations and fully comprehend the tax implications for all parties involved.

Employee Stock Options For US Consultants or Contractors

As a form of compensation, some companies choose to issue stock options to independent contractors. In some instances, the contractor has the option of becoming a shareholder in the company. Contractors might be given stock options for a variety of reasons. They might do so as a bonus on top of an already appealing wage, or as a form of compensation because the firm doesn’t have that much money (yet), to entice the contractor to stay with them, because owning stock means they have a personal stake in the company’s success, or simply as a reward. The number of shares received, the type of stock, the strike price, and the vesting schedule will all be included in stock option grants. Vesting is the process by which a person gains the right to buy their stock options, and it means that firms can impose conditions on contractors before they can vest their stock options, i.e. buy the company’s stock.

What are employee stock options?

Employee Stock Option Plans are the plans in which employees are given the option to purchase a set number of shares (determined by the employer) in the firm at a reduced price in place of a salary (less than the market price). The employee has a right, but not an obligation, to use the option given under this scheme. Employees must wait a set amount of time – known as the vesting period – before exercising their right to purchase a particular number of shares. Employees can exercise their options to obtain shares after they have vested by paying the predetermined exercise price.

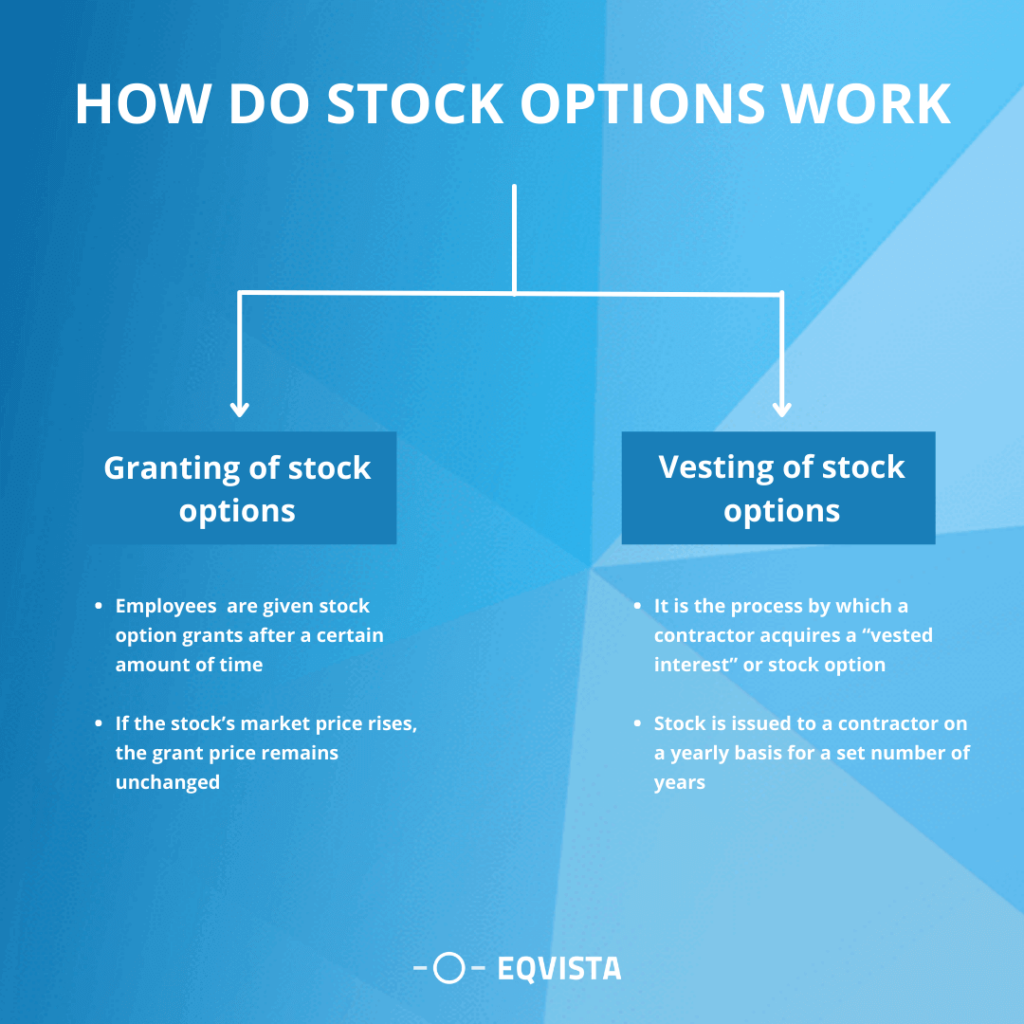

How do stock options work (Granting and Vesting)?

Depending on the firm, the amount of options available to its employees varies. It will also be determined by the employee’s seniority and specific skills. Before any employee may get stock options, investors and other stakeholders must approve of it first. The grant date, or the day your options begin to vest, will be specified in the contract. When a stock option vests, it becomes accessible for you to exercise or purchase. Unfortunately, you will not receive all of your options when you first start working for a company; instead, the options will vest over time, known as the vesting period.

- Granting of stock options – Employees are frequently given stock option grants after they have worked for the company for a certain amount of time. If the stock’s market price rises, the grant price remains unchanged, and the employee purchases a stock at a lower price than market value while exercising the option. An option grant is a right to purchase a specific number of shares of a company’s stock at a specific price. Stock options are a common benefit associated with startups, which may issue them with rewarding early employees if and when the firm goes public. Some fast-growing corporations give them out as a way to motivate employees to strive toward increasing the value of the company’s stock.

- Vesting of stock options – When you adopt a vesting schedule, a portion of the stock is issued to an employee on a yearly basis for a set number of years, and the stock must be purchased within four years with a one-year cliff. The term “one-year cliff” refers to the fact that an employee does not vest (earn shares) during their first year of work. Some corporations provide stock options that can be exercised right away, but you must wait for the shares to vest before you can own them completely. If your employment terminates before vesting, the stock is still subject to a repurchase right until then.

How are stock options taxed?

The issuance of an incentive stock option (ISO) or other statutory stock option does not result in any immediate taxable income. Similarly, exercising the option to purchase the stock does not result in instant profit as long as the stock is held in the year it is purchased. When you sell the stock you bought by exercising the option, you earn money. When you exercise your options, you pay ordinary income taxes, and when you sell the shares, you pay capital gains taxes. You only pay taxes on ordinary income or capital gains when you sell ISOs, depending on how long you owned the shares before selling them.

Incentive stock options

An incentive stock option (ISO) is a corporate perk that allows employees to purchase shares of company stock at a discounted price with the possibility of profit tax savings. Profits from eligible ISOs are normally taxed at lower capital gain rather than higher ordinary income rates.

- Employees are eligible to choose ISOs.

- Tax treatment at exercise date – not normally taxable, although the difference between the exercise price and the fair market value is subject to the Alternative Minimum Tax (AMT).

- The difference between the sale price and the initial exercise price (if held for more than one year) is taxed at the long-term capital gains rate at the time of sale.

- Transferability – not transferable except in the event of death of the recipient.

Non-qualified stock options

Non-qualified stock options (NSOs) are a type of stock option for which the employee does not receive favorable tax treatment. Unlike incentive stock options (ISOs), which do not require taxes upon exercise, NSOs require taxes both when the option is exercised (purchased shares) and when the shares are sold.

- Employees, advisors, consultants, contractors, directors, and officials are all eligible for NSOs.

- The difference between the fair market value and the exercise price of the shares is subject to ordinary income tax at the time of exercise.

- The difference between the sale price and the fair market value on the exercise date is taxed at the capital gains rate.

- NSOs are typically transferable to family members, charities, or trusts for the person’s benefit during their lifetime.

Sample stock option agreement for consultants

Employee stock options (ESOs) are a type of equity remuneration that firms give to employees and executives. Rather than issuing shares of stock, the corporation instead offers derivative options on the equity. These options are similar to conventional call options in that they give the employee the right to purchase the company’s stock at a certain price for a set length of time. Employee stock option terms will be spelled out in detail in an employee stock option agreement.

Restricted Stocks For US Consultants Or Contractors

Restricted Stocks for US Consultants and Contractors are based on vesting stock plans. Employers award them to full-time employees and independent contractors who meet particular goals or stay with the organization for a set amount of time. RSUs have a fair market value and are treated as income once they have vested: a portion of the shares is withheld to pay income taxes. The remaining shares are kept by the stockholders and can be used as they see fit. RSUs provide their owners with interest in company equity once their equities have entirely vested. RSAs are similar to regular stocks, with the distinction that you must buy the shares on the day they are issued.

What are restricted stocks?

Under Restricted Share Plans and Deferred Share Plans, plan members are issued shares by the corporation at no cost. As the shares are conditionally awarded, participants can only receive the shares after the conditions are met. The conditions could be time-based, performance-based, or both. To show the commitment of a company to pay shares depending on a vesting schedule, restricted stock units are used. This has advantages for the company, but it does not provide employees ownership rights until the shares are earned and issued.

RSA and RSU

Restricted Share Units (RSU) are notional units given to participants in an RSU plan. In this scenario, participants are not given actual shares. As the awarding company’s common shares market value fluctuates, so does the RSU value. Plan members receive their shares after meeting specific requirements (including staying with the company for a certain period). When it comes to equity compensation plans, restricted stocks have an important role to play. Restricted stocks have less risk, and can help in making better decisions in stock. They help in lowering any potential tax, taking ownership of the company and reducing deferred tax.

How restricted stocks are taxed?

Restricted Stocks taxation is based on this table:

| Situation | Tax Liabilities |

|---|---|

| RSU after vesting | Pay income tax after adding such shares to taxable income |

| Acquiring RSU | No tax liability |

| Selling RSU within 2 years of acquisition | Sale value added to income tax amount and taxed as per applicable slab |

| Selling RSU later than 2 years after the acquisition | Taxes applicable as per long term capital gain norms, along with an indexation facility |

Sample restricted stock agreement for consultants

A restricted stock unit (RSU) is a type of compensation that an employer provides to an employee in the form of company stock. Employees receive restricted stock units through a vesting plan and distribution schedule after meeting certain performance milestones or staying with their employer for a certain period of time. RSUs provide employees a stake in the company but no cash value until the stock vests. When RSUs vest, they are given a fair market value (FMV). Once they’ve vested, they’re deemed income, and a portion of the shares is withheld to pay taxes. The remaining shares are given to the employee, who can sell them at their leisure.

Determine the price or value of shares

It is extremely important to know the value of the shares and in order to determine the value of shares and its price. One has to understand the valuation and market scenario such as demand and supply. To determine the price and value of shares, following are the important considerations.

409a valuation help to set the price/value of shares

The 409A valuation is the sole mechanism that a privately owned corporation can utilize to offer tax-free options to its employees. A 409A valuation consists of three steps: The first stage is to figure out how much a company is worth (also known as “enterprise value“). The enterprise value is then divided across the various equity classes to arrive at the common stock’s fair market value (FMV). Finally, a discount is applied to the FMV to account for the fact that the stock is not publicly traded.

Efficiently manage your company’s equity with Eqvista!

Managing a company’s equity can be difficult for most people. It’s a complicated process to understand. We at Eqvista make the process easier for you. By using Eqvista, you can record your whole company’s equity plans. Our easy and convenient platform can help you plan your equity compensation for your employees, trustees, directors and shareholders. Interested to learn more? Sign up now or contact us for a demo!