Issuing Company Shares in India: Regulations and Best Practices for Public and Private Companies

This article explains the regulatory framework for issuing shares in India and the steps involved in issuing shares in India.

Issuing company shares in India involves complying with regulations set by the Securities and Exchange Board of India (SEBI) and following best practices for public and private companies. Both public and private corporations in India must abide by specific rules and best practices while issuing company shares.

The rules and procedures guarantee openness, investor safety, and adherence to the law. This article explains the regulatory framework for issuing shares in India, the Steps involved in issuing shares in India, and the Risks and Challenges in Issuing Shares in India.

Issuing Company Shares In India

A limited company or a private limited company may issue shares of a firm that is registered in India to the general public (with SEBI clearance) or to friends, family members, business partners, etc. Private limited businesses are forbidden from soliciting public subscriptions for their shares.

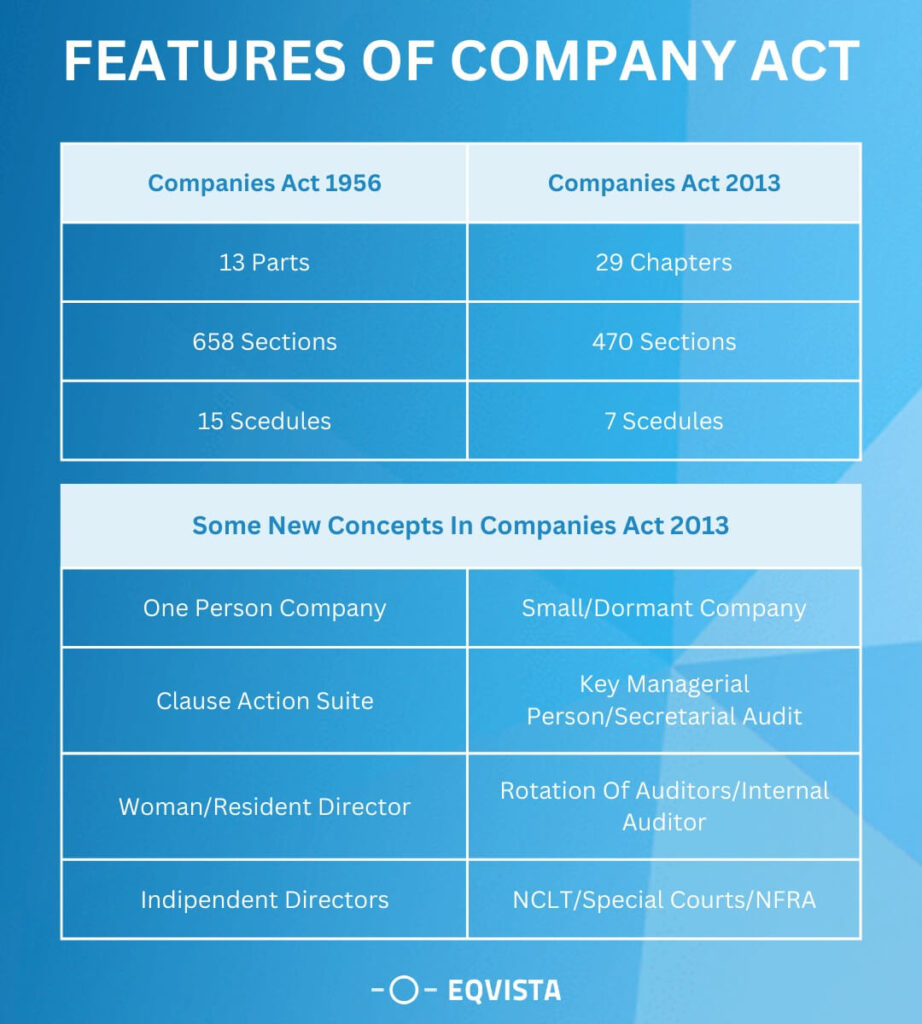

According to the Companies Act of 2013, shares of a private limited company may not be issued to more than 200 shareholders. The Companies Act of 2013 was passed on August 30, 2013. Although some provisions of the Act were implemented on September 12, 2013, others have yet to be notified. It’s worth noting that certain provisions of the Companies Act of 1956 are still in effect.

Regulatory Framework For Issuing Shares In India

SEBI (Securities and Exchange Board of India), MCA (Ministry of Corporate Affairs), and RBI (Reserve Bank Of India) oversee India’s regulatory framework for issuing firm shares. While the Companies Act of 2013 regulates incorporation, business operations, and management, the SEBI Regulations of 1992 and 2018 set forth standards for stockbrokers and sub-brokers.

Types Of Shares Available For Public And Private Companies In India

Ordinary equity shares and preference shares are the two types of shares available in India. In India, issuing shares entails several phases, including the initial public offering (IPO), follow-on public offering, rights issue, preferential issue, private placement, and qualified institutional placement (QIP).

- Ordinary equity shares – Provide voting rights and a portion of the company’s surplus profits, are the most frequent type of shares issued by public and private limited corporations. They do not receive preferential treatment in the event of the liquidation of the company concerning dividends or capital return. Ordinary shares can be divided into voting shares and non-voting shares as well as authorized share capital, issued share capital, subscribed capital, paid-up capital, and authorized share capital.

- Preference shares – Preference shares have additional rights or preferential treatments, such as the entitlement to dividend payments and capital reimbursement during a company’s liquidation. They get dividend payments first and have a greater claim to the company’s assets in the case of a liquidation. Preference shares come in a variety of forms depending on the dividend payout, convertibility, and redeemability.

Process for Issuing Shares in India

The first step is an IPO (Initial Public Offering), and the next is a follow-on public offering to fulfill listing requirements or raise money. Rights offerings enable publicly traded corporations to raise money without diluting interests by issuing securities to current owners in a predetermined ratio. Subject to adherence to the Firms Act and SEBI regulations, preferential offerings enable firms to issue shares to specific groups.

Private placements supply shares to potential investors, whereas QIPs (Qualified Institutional Placement) allow listed corporations to place equity shares or convertible shares with Qualified Institutional Buyers.

To explain the concept of share allocation, let’s take an example.

The company has a total capital of Rs. 6 lakhs. The money has been divided into 6000 units of shares, costing Rs. 100. Therefore, each share costs Rs. 100, and anyone can buy these shares at this price.

When you have a share in a company, you have partial ownership of that organization. This is why anyone who holds a share is called a shareholder.

Steps Involved In Issuing Shares In India

Preferential offerings generate money rapidly, subject to compliance with the Companies Act and SEBI regulations, while rights issues provide securities to existing shareholders in a defined ratio. While QIPs are private placements of equity shares or convertible shares to qualified institutional buyers, private placements offer shares to a limited number of investors.

Pre-Issue Activities

A client company and a merchant banker sign an MoU. They get an appraisal note, optimize the capital structure, and call a board meeting. Financial intermediaries are appointed, and various documents are prepared, including stock exchange submissions, MoUs with registrars, underwriters, co-managers, and agreements with expert advisors. These actions are essential to the successful execution of the capital market issuance process.

Preparing the company for share issuance

Establish the face value of the shares, issue certificates following set deadlines, and include information about the company, such as its name, CIN (Corporate Identification Number), registered office, shareholders, and dividend number.

Certificates must follow the requirements of the Companies Act and be submitted to the Registrar of Companies within the allotted time frames after being approved by the board.

Conducting due diligence

In India, due diligence examines important factors such as employees, financial records, services, assets, and business processes to help investors make wise investment decisions. For foreign investors, this comprehensive study guarantees well-informed investments.

Appointing merchant bankers, underwriters, and other advisors

The issuer should adhere to the rules and processes specified by the regulatory authorities when selecting merchant bankers, underwriters, and other consultants in India. It’s vital to remember that the specific procedure and requirements may change depending on the rules and specifications established by the regulatory authority in India, such as SEBI.

The issuer should review the pertinent rules and get expert counsel to ensure compliance. The procedure for the appointment is as follows:

- Indian commercial banks must abide by SEBI regulations regarding openness, investor protection, and documentation needs.

- The Indian government appointed 10 merchant bankers to supervise the Life Insurance Corporation’s first public offering (IPO) to ensure its success.

- Bids are required by September 16 for the stake sale of LIC, for which DIPAM (Department of Investment and Public Asset Management) has appointed a legal advisor.

Shareholders’ Approval

According to the company’s bylaws, Indian shareholders have the power to choose directors and make decisions regarding business activities. SEBI has made changes to enhance transparency, corporate governance, and stakeholder interests.

Filing necessary documents with regulatory bodies

In India, the context and purpose must be considered when filing paperwork with regulatory organizations. Clinical trial filings are regulated by CDSCO (Central Drugs Standard Control Organization), and businesses must abide by the Insurance Regulatory and Development Authority of India (IRDAI). Compliance with diverse industry-specific legislative frameworks is a part of risk and compliance management.

SEBI Compliance

The SEBI (Securities and Exchange Board of India) compliance process entails listed firms adhering to rules and disclosure specifications for the Indian commodities and securities markets.

To promote transparency, investor safety, and ethical business practices, companies must abide by SEBI requirements while issuing shares in India. India-based offerings must provide SEBI paperwork for investor information, and transparency, stay updated with regulations, and engage with experts.

Pricing and Valuation

Pricing and valuation in India are critical to business and finance, and EY (Ernst & Young Private Limited) India offers transparent services and encourages ethical behavior.

Utilize renowned financial websites like NSE (National Stock Exchange), BSE (Bombay Stock Exchange), and Moneycontrol for real-time market data, live updates, and analysis to establish India’s share price and value. These resources assist in gathering pertinent data and tracking specific stock prices.

Factors Affecting Share Pricing

India’s share pricing is influenced by economic, financial, and market factors, including demand, supply, climate, monetary policy, union budget, news, sentiment, and liquidity.

- Documentation and Disclosures – The paperwork for India includes the UNDP’s (United Nations Development Programme) strategic plan and NBFC (Non-Banking financial companies) disclosure for transparency and investor confidence, as well as country programs, NBFC disclosure standards, and accounting principles.

- Disclosing information to shareholders and regulatory bodies – India’s securities markets are governed by SEBI, which promotes transparency and safeguards the interests of shareholders. The Companies Act and MCA, among other corporate governance regulations, address disclosure requirements.

- Complying with disclosure requirements – Following the rules established by regulatory agencies, accounting standards, and corporate governance commitments are all necessary to comply with disclosure requirements in India. The Indian Accounting Standards (Ind AS), which are compliant with International Financial Reporting Standards (IFRS), must be followed while creating financial statements for businesses.

- Share Allotment and Listing – PK Ventures Limited, Cyient DLM Limited, IdeaForge Technology Limited, and HMA Agro Industries Limited are among the companies listed as part of India’s IPO allotment and listing information.

- Listing shares on stock exchanges – Companies can list their shares on reputable stock markets in India through an initial public offering (IPO), which enables investors to buy and sell them. The National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE), which offer a venue for businesses to list their shares and facilitate trading activities, are the two major stock exchanges in India.

- Maintaining records and registers – In accordance with the Companies Act of 2013, the National Archives, and labor regulations, companies and employers in India are required to maintain statutory records. In 2017, the Central Government implemented Ease of Compliance, bringing the number of registers down to five. Legal professionals can advise you on compliance obligations.

Risks and Challenges in Issuing Shares in India

Risks, difficulties, and legal concerns are present in India’s stock market, including capital structuring, compliance with regulations, and skill shortage. Overcoming these challenges might be aided by consulting with legal and financial authorities

- Regulatory and Compliance Risks – Businesses must implement anti-corruption measures because cultural traditions, corruption, and bureaucratic red tape pose regulatory difficulties in India.

- Market Risks – Market risk refers to the possibility of losing money as a result of changes in stock prices brought on by variables such as supply, demand, earnings, investor sentiment, and prevailing economic conditions.

- Pricing and Valuation Risks – Pricing and valuation risks in India are influenced by factors like regulatory framework, quoted shares, unquoted shares, and corporate actions. Depending on their goals and circumstances, investors should seek the advice of experts for valuation approaches.

- Legal Risks – The heterogeneous business environment and legal system of India are impacted by the mixed economy, the state of the economy at the time, and COVID-19, demanding legal risk management for compliance and operations.

- Reputation Risks – Local market variables, such as legal compliance, corporate governance, financial performance, client satisfaction, and social responsibility programs, have an impact on India’s reputation risk. Companies must recognize and handle these variables to effectively manage risks and safeguard share value.

Issue company shares with Eqvista!

Issuing firm shares in India entails adhering to SEBI rules, following corporate governance norms, and applying best practices to promote transparency, investor protection, and fair practices. Private businesses should take into account compliance exemptions and sector-specific standards whereas public corporations must abide by SEBI regulations. Companies can complete the share issuing process and preserve a positive market reputation by adhering to certain rules and best practices.

Eqvista is a corporate platform for managing cap tables and equity that includes tools for financial research, electronic share issuance, and valuations. Easily incorporate your business and manage your equity in one location. Utilize the Eqvista platform to distribute stock and maintain contact with your shareholders.

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!