Startup Valuation Model in Excel

Valuation models in excel are some of the commonly used formats, and give the company founders and investors a general idea of how much the company is worth.

Business valuation is the basis of any future sale or acquisition of a company. Investors and analysts use various startup valuation models to estimate a company’s worth, which can vary drastically based on the figures and assumptions involved.

Startup Valuation Methods

Startup valuations can be tricky, especially in their pre-revenue stages. Startup valuation models used at this stage have to rely on assumptions. Despite this limitation, the importance of valuation can’t be overlooked. Every startup requires funds to grow and expand their business and a reliable valuation is the only way of estimating the business worth. It is only based on this calculation that investors evaluate funding proposals. In this section, we discuss some of the common valuation methods used for startups.

Market Capitalization

This is one of the simplest startup valuation models. Market capitalization determines the total dollar market value of a company’s outstanding shares. It is a far more dependable measure in comparison to the total asset or revenue figures. Investors use the market cap as a quick measure of the company size and a reliable indicator of possible risks.

Companies are categorized based on their market cap. Here is a suggested range:

- $10 billion or more – Large cap

- $2 billion – $10 billion – Mid cap

- $300 million – $2 billion – Small cap

Let’s take an example of two companies A & B worth $2 billion each. Company A has 20 million shares in the market selling at $100 while Company B has 200,000 shares selling at $10,000 each. From an investor’s point of view Company A is much more stable and functional in the industry.

Market cap is established only after a company goes public through an IPO. Before this stage, a startup must engage a professional valuation firm to get a realistic value of the business using various startup valuation models. Based on this information, the startup determines how many shares to issue and at what value. A $10 million company may want to issue 1 million shares at $10 per share or 2 million shares at $5 per share.

Once a startup goes public, their share prices are determined by market forces. The supply and demand of its products and services impact the price of shares. A higher demand increases share price while a falling demand crashes stock prices. Once a company starts trading in the stock market, the market cap becomes a real-time estimate of the company’s value.

Times Revenue Method

This startup valuation method is used to understand the range of a company’s revenue potential. The idea is to determine the ‘max-value’ or ‘ceiling’ for a particular business. To calculate this, the actual revenue data over a period is considered (for eg. one fiscal year). A ‘multiplier’ is applied to this value. Thus a company valuation using Times Revenue Method can be 1x, 2x, 3x, or less than 1. Multiplier value depends on the industry and its economic growth. A hot industry such as AI may have 3x revenue while a service industry may qualify for 0.5x.

Earnings Multiplier

This startup valuation model is used as a comparative study with similar companies. Investors use this method to check if the target company’s stock price is more expensive than it should be relative to its contemporaries in the market. Historical stock price data is also taken into consideration.

In this method, the target company’s current stock price is measured against its earnings per share (EPS). For eg, if a company’s current stock price is $100 and earnings per share are $10, the earnings multiplier will be $100/$10 = 10 years. Put simply, this is expressed as: This Company is trading at 10 times its earnings.

As we see, earnings multiplier methods do not provide an exact valuation. They rather give relative information about companies trading in the stock exchange. Investors use these metrics to invest in the most economical stocks that promise future profit potential.

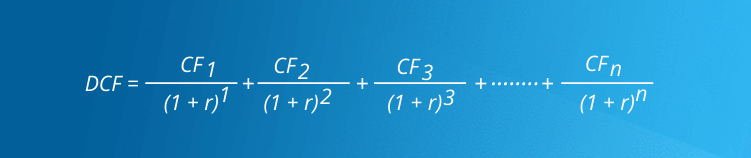

Discounted Cash Flow (DCF) Method

This startup valuation model is used to estimate the present value of an investment based on the company’s future cash flows. This is one of the more commonly used valuation models used.

This again is a comparative metric and not an absolute one as a lot of its findings are based on assumptions. Analysts apply discount rates to neutralize any risks related to the business and its industry of operation.

Where:

- CF – Cash flow for a given year. Yr1, yr2, yr3…and so on.

- r – Discount rate

If the DCF value is higher than the present investment, it indicates a positive outcome and potential good cash flow in the future years. However be sure to go through the details on how the discount rate was arrived at and what factors of the company were considered.

Book Value

Otherwise known as the ‘net book value’, this startup valuation model simply indicates the carrying value of company assets on its balance sheet. While this method is not the most accurate valuation method for your company, it is quick and easy to calculate and give you a ballpark estimate of the value of your company. It is calculated as follows:

Book value serves two purposes:

- It reflects the worth of company assets that shareholders are entitled to in case of company liquidation

- This value when compared to the company’s market value indicates if their stocks are legitimately priced.

Be sure though to identify which assets may be subject to fair market adjustments (fixed assets, intangible assets, etc), and what other assets or liabilities are already at FV (cash and cash equivalents, accounts receivable and accounts payable, etc).

Liquidation Value

This startup valuation model is similar to the book value model but considers only the tangible assets like equipment, inventory, real estate, etc. Intangible assets are not considered in this calculation. Hence in value, liquidation value is always less than the book value but higher than the salvage value.

In the event of liquidation, most assets are sold at a loss. Hence investors use the liquidation value to asset a potential investment so that they have a fair estimation of how much they can expect in returns in case the company falls out of business.

Startup Valuation Model in Excel (DCF Method)

We have created a very simple startup valuation model in excel using the discounted cash flow method, one of the more common methods for company valuations.

As the startup may not have many company assets in the beginning, and being too early to have enough financial figures for comparing to other companies in the market, this income based approach may be the easiest way to determine your startup valuation.

We included a template for a 5 year and 3 year weighted moving average, as some companies may not be able to determine their growth rate just yet. Also we believe a weighted average may be more applicable than a simple average, especially with early stage companies with fluctuating income levels.

Get your 100% reliable startup valuation in minutes with Eqvista!

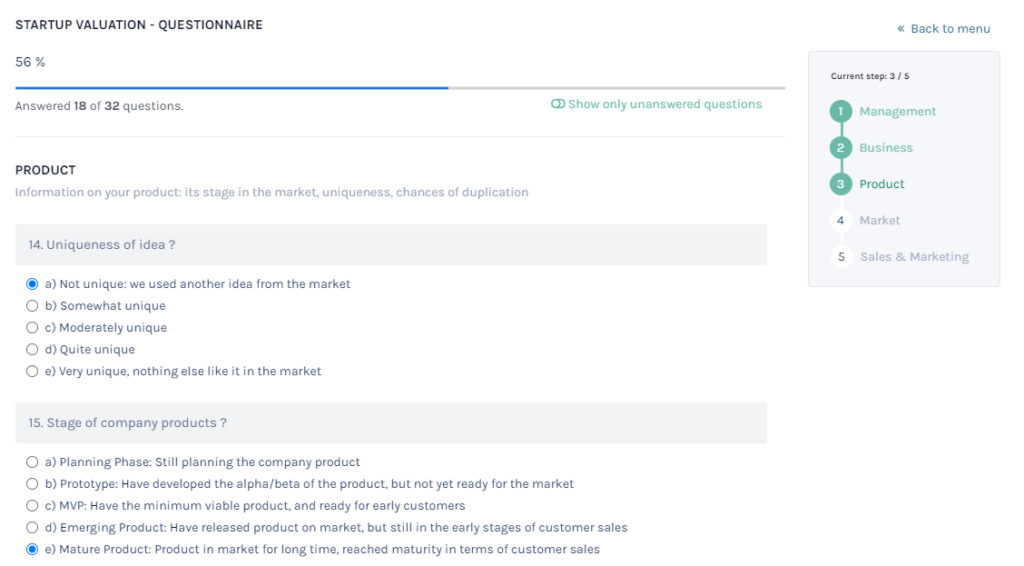

It’s now easier and more convenient to get a valuation for your startup with Eqvista’s startup valuation software. We incorporate trusted valuation methodologies into the software to calculate the most accurate valuation for your startup. Also, the 30 multiple-choice questions covers 5 areas of your business: team/management, business, product, market, as well as sales and marketing. A summarized report will be made available for you in 20 minutes.

Why should you choose Eqvista for your startup valuation?

There are many startup valuation models and none of them are used standalone. It is best left to the professional evaluators to choose the right mix of these methods to arrive at a justifiable value for the company.

Our team of valuation experts at Eqvista can help you in the valuation of your startup and get an audit ready 409a valuation report. Our online captable also helps you easily manage your company shareholders, equity transactions, valuation reports, and more.

Interested in issuing & managing shares?

If you want to start issuing and managing shares, Try out our Eqvista App, it is free and all online!